This amazing harmonic pattern trading strategy gives you a whole new understanding of price action. The Trading Strategy Guides team knows the geometric patterns you can find in nature. The same anomalies can be found in financial markets such as harmonic patterns. This ability to repeat and create such complex patterns is what makes Forex harmonic patterns so amazing. We also provide training on fractal trading strategies.

Harmonic patterns are complex patterns in the forex market. To start with a simpler price action pattern, we recommend the Head and Shoulders price pattern strategy.

Six fundamental Forex harmonic patterns can be distinguished.

- Gartley Pattern – Developed by HM Gartley, this pattern is most used in the harmonic trading community. Gartley patterns use Fibonacci ratios to find breakout, resistance and support cases. This pattern is completed with an uptrend, a small reversal, a small uptrend, and a large reversal (forming an asymmetric “M” or “W” shape).

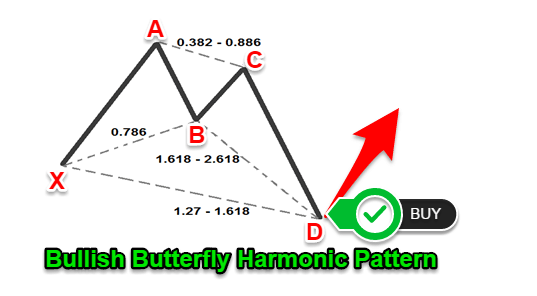

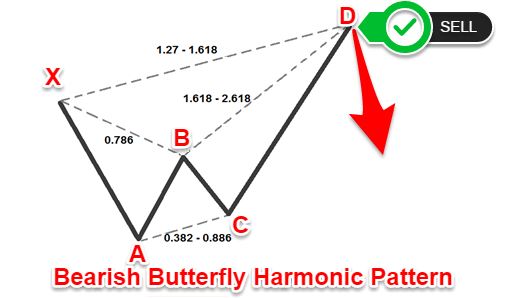

- Butterfly patterns – There are two types of butterfly patterns. A bearish butterfly and a bullish butterfly. Like the Gartley patterns, these patterns are designed to indicate when a trend reversal is stronger than the original trend. Using the triangle created within the butterfly, traders can determine whether holding a short or long position is most profitable.

- Crab Patterns – Crab patterns are ideal for traders who want to catch accurate price movements. Traders can maximize returns on securities with low volatility. The crab shape is similar to the butterfly shape, but more condensed. Small movements can be captured.

- Bat Pattern – Compared to the other patterns, the bat pattern is still trapezoidal but more symmetrical. The heights of the right and left sides of both the bullish and bullish patterns are approximately the same.

- Shark Pattern – Shark pattern is one of the newer harmonic trading patterns and has been around since 2011. It uses a similar 5-leg reversal sequence. A steep outer line and shallow dip in the middle create a chart similar to that of the dorsal fin. This is how you get the name of your shark pattern.

- Cypher Pattern – Cypher pattern is an advanced trading pattern that combines Fibonacci trading with other indicators (e.g. RSI). Cypher uses tighter Fibonacci ratios (usually less than 1) to create a “sticky” visual appearance.

Each of these patterns will help you issue stop losses and stop limits effectively. It is useful to monitor multiple harmonic trading patterns at once to get a more comprehensive view of the market.

Harmonic trading has many advantages. For example, when you become an expert in one of the Forex harmonic patterns, you will know how to trade on a particular pair. You will know when is the best time to trade and when the market will react in a certain way.

You will become an expert in forex harmonic patterns. A useful tool for trading this strategy is a harmonic pattern scanner or a dashboard that shows all patterns from various instruments. However, it is a good idea to familiarize yourself with the patterns before using the scanner or dashboard.

Our favorite timeframes for our amazing harmonic pattern trading strategy are the 1 hour, 4 hour or daily charts. For simplicity, we refer to the Amazing Harmonic Pattern Trading Strategy as the AHPT Trading Strategy. I don’t want to go with a lower time frame because after extensive backtesting I have found that the Amazing Harmonic Pattern Trading Strategy works best on a higher time frame.

If you want quick profits, check out our favorite daily trading strategy, the Best Stochastic Trading Strategy – Easy 6 Step Strategy. It may suit your needs better. This strategy performs identically and is suitable for trading other asset classes such as stocks, futures, options and more.

Throughout this article, you will learn the strengths and weaknesses of this pattern’s effectiveness. You will also learn how to trade Forex harmonic patterns efficiently. This ability to repeat over and over again makes Forex harmonic patterns attractive to our trading strategy guide team. We also received training on how to trade with the Gartley pattern.

Before we get started, let’s look at the indicators you need to successfully trade harmonic pattern trading strategies.

If you’re not good with geometry, most standard Forex trading platforms have harmonic pattern indicators. This allows you to identify and measure forex harmonic patterns. Forex harmonic patterns use Fibonacci numbers to define precise trading points.

TradingView Platform: Harmonic Pattern Indicator

The harmonic pattern indicator allows you to call market turning points with a high degree of accuracy. If you have no prior knowledge of what a reversal trading strategy looks like, check out our price action pin bar trading strategy.

Now let’s move on to the rules of the AHPT trading strategy.

Note: I will focus on the butterfly harmonic pattern going forward. This is one of the most common forex harmonic patterns.

What is a Butterfly Harmonic Pattern?

In technical analysis, a butterfly harmonic pattern is a four-legged reversal pattern. The bridge is a swing wave movement consisting of swing swing and swing swing. Here’s how to identify the right swings to increase your profits.

Summary of Butterfly Harmonic Pattern Rules:

- AB of XA swing leg = 0.786 or 78.6% return;

- BC = min 38.2% – AB max 88.6% of swing leg;

- CD = Min 1.618 – Max 2.618 of AB Swing Leg;

- CD = min 1.272% – max 1.618% of XA swing leg;

Butterfly harmonic pattern definition.

The butterfly harmonic pattern depends on point B. You define a trading opportunity by defining a structure and setting different measures within the pattern. The B pattern’s butterfly pattern should have an exact 78.6% retracement of the XA swing. Other rules for redefining structures include BC projections, which must be at least 1.618 measurements.

Also, the Butterfly pattern must contain an equivalent AB = CD pattern. These are the minimum requirements. However, the alternative 1.27AB = CD is more common in this structure.

The 1.27XA projection is the most significant number in the potential reversal region. Finally, point C should fall within the 0.382-0.886 regression range.

You can start drawing the butterfly pattern as soon as you have the first two legs of the pattern. Once you have points X, A and B you can start monitoring price action. You can check that wave C obeys the Butterfly Pattern rules.

Amazing Harmonic Pattern Trading Strategy Rules

Now is the time to reveal the amazing Harmonic Pattern Trading Strategy Rules. Let’s start with the most interesting part. This is always the entry point, follow the rules for stop loss and take a profit order.

In fact, there are important things you need to know to define your harmonic pattern trading strategy rules. Provides information on how to apply harmonic pattern indicators.

How to apply the 1st stage harmonic pattern indicator

We will guide you through this process step by step. Just follow this simple guide. See the picture below to better understand the process.

- First click on the harmonic pattern indicator on the right toolbar of the TradingView platform. You can find harmonic pattern indicators in the indicator library of your MT4 terminal.

- Identify starting point X on the chart. It can be a swing high or low on the chart.

- Once you have found the first swing high/low point you should simply follow the market swing wave movement.

- You need 4 points or 4 swing high/low points that combine with each other to form a forex harmonic pattern. All swing legs must check and adhere to the harmonic pattern strategy rules as presented above.

Now, we will give you the input rules for the bullish butterfly harmonic pattern.

See below…

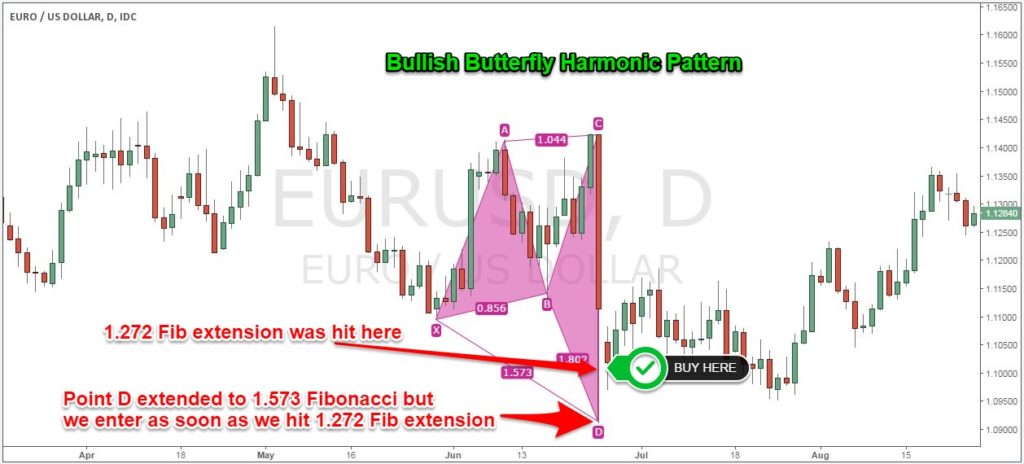

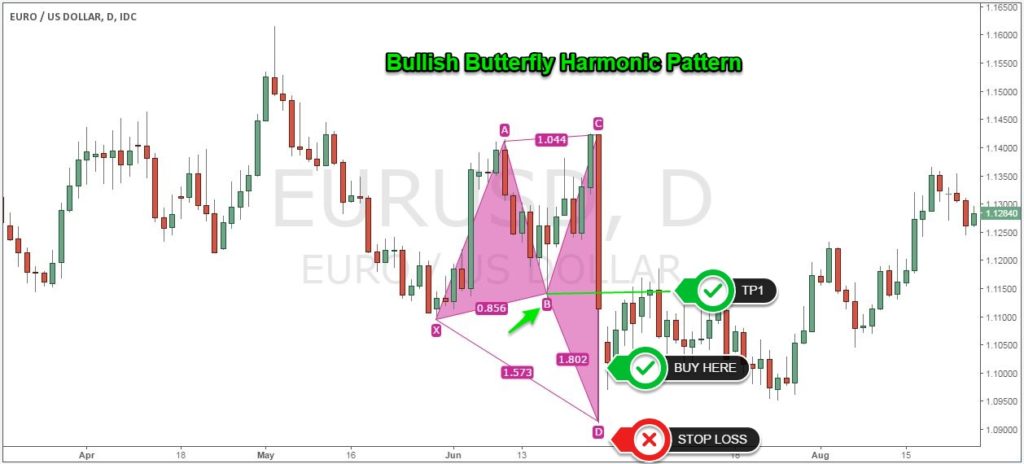

Bullish Butterfly Harmonic Pattern – What to Buy

Ideally, as a trader you want to enter the completion of point D. As set out earlier, point D of the Butterfly Forex harmonic pattern can occur between the extension lines of the 1.27 – 1.618 Fibonacci A leg. The market is not a perfect place, so when the market reaches the 1.27 Fibonacci extension, you initiate a buy order.

In the example above, we entered at the 1.272 Fibonacci extension, but we can see that point D already extends to the 1.573 Fibonacci extension. This is still within the 1.272 – 1.618 range validating a bullish butterfly harmonic pattern.

It’s still a great entry level.

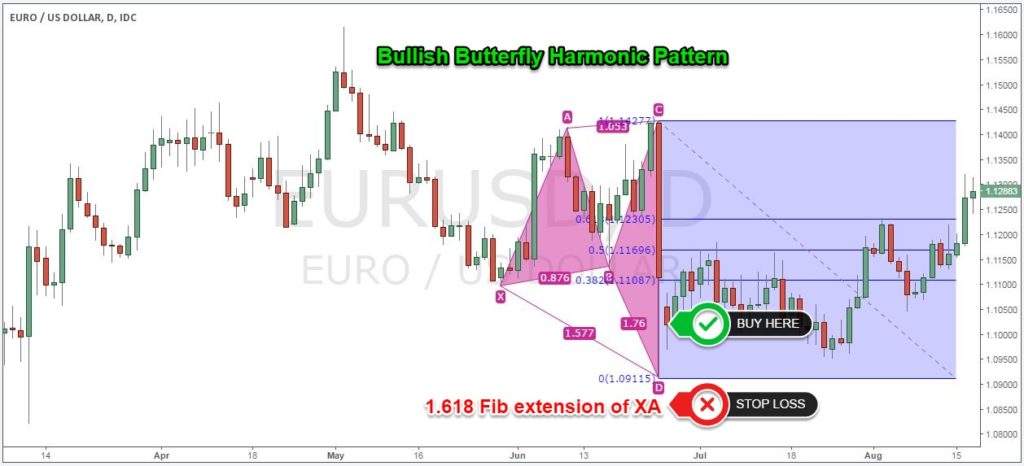

You can avoid logical stop losses with the following steps:

Bullish Butterfly Harmonic Pattern – Stop Loss

For the Bullish Butterfly Harmonic Pattern, you typically want to place your protective stop loss below the 1.618 Fibonacci extension line of the XA leg. That’s the logical place to hide your stop loss. Because the brakes below automatically nullify the butterfly harmonic pattern.

So far we have defined proper entry points and stop loss positions for harmonic pattern trading strategies. Now is the time to shift our focus and define where we will benefit.

Bullish Butterfly Harmonic Pattern – Take Profit

Adding multiple profits with the AHPT trading strategy further enhances your trading experience. It affects expected profitability because it will almost guarantee a bank of revenue. Forex harmonic patterns are reliable patterns, but you want to be very active on profit targets.

As the saying goes, “no one has benefited”

So where do you get the first part profit?

See picture below.

The Amazing Harmonic Pattern Trading Strategy has a more conservative first part profit target at point B. Usually this is where you can expect some resistance on the way back up as this is a critical swing point.

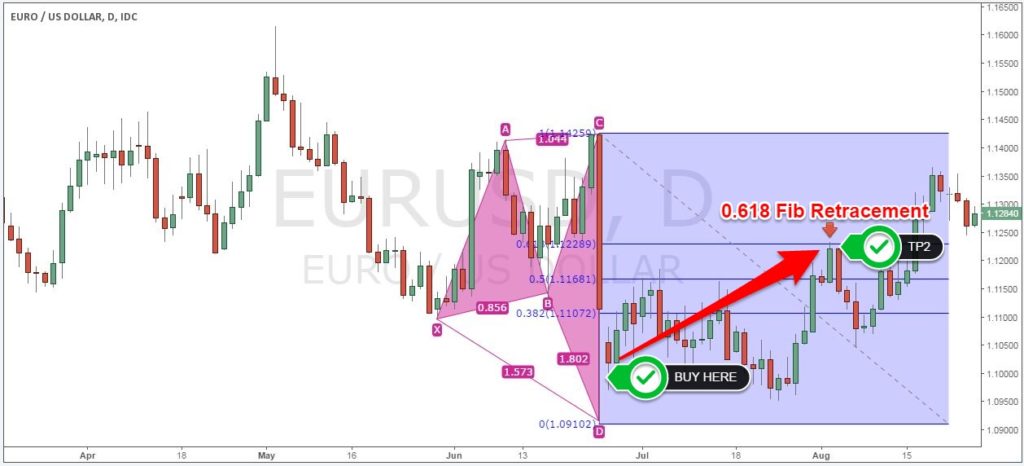

I would like to close the second part of the trade once the 0.618 Fibonacci retracement of the CD leg is reached. You can also aim for a retest of point A. Once you’re familiar with the harmonic pattern indicator, it could be your next goal.

Take a look at the chart below.

Note ** The above is an example of a BUY trade using the Bullish Butterfly Forex Harmonic Pattern. Use the same rules for the Bearish Butterfly Forex Harmonic Pattern for SELL trades. In the picture below you can see an example of a SELL transaction in action. You can do this using the Bearish Butterfly Forex Harmonic Pattern.

watch:

Don’t be discouraged as this chart may seem confusing at first. If you study the rules above, you will find that this trading example follows the strategy rules perfectly.

conclusion:

For all forex harmonic patterns and trading in general, precision is key. Because when you’re as accurate as possible, you eliminate mistakes. The harmonic pattern trading strategy has the best chance of success for us. The great thing about forex harmonic patterns is that they recognize areas where supply and demand are concentrated. If you are a fan of supply and demand trading, learn about Supply and Demand Trading – Market Movements. Supply and demand trades are great prefaces.