This material is not intended for viewers from EEA countries. Binary options are not promoted or sold to retail EEA traders

Welcome to the largest expert guide to binary options and binary trading online. Korea-option.com has been educating traders worldwide since 2011, and all articles are written by experts working in the financial industry. We have thousands of articles and reviews to help you become a profitable trader in 2020, regardless of your current experience level. If you want to discuss trading or brokers with other traders, we also have the world’s largest forum with over 20,000 members and lots of daily activity. Start trading today! EU Traders – Despite the ESMA ban, binary options trading is still possible. For example, brands regulated in Australia still accept EU traders and offer binary options. Our list of brokers is tailored to your region – the ones on this list accept traders from your region. EU traders can also trade as ‘experts’. ESMA rules only apply to non-professional retail investors. A trader must meet 2 out of 3 criteria to be classified as an expert:

- Trade size and volume. 10 trades of ‘significant size’ per quarter (brokers’ views of ‘significant’ vary)

- portfolio size. A total investment portfolio of more than 500 million euros. Holdings can be across brokers.

- experience. You have worked or worked in the financial industry and gained experience with complex financial products.

Brokers may require proof. Switching to jargon means losing certain regulatory consumer protections, but ESMA changes (including reduced leverage and access to binary options) should be avoided entirely. Another alternative for EU traders is the new products brands have introduced to combat the ban.

Popular Korea Broker

What are binary options and how do you make money?

Binary options are a fast and very simple financial instrument that allows investors to speculate whether the price of an asset will rise in the future, whether it be Google’s share price, Bitcoin price, USD/GBP exchange, etc. interest rate or price. The turnaround time is only 60 seconds, so you can trade hundreds of times a day on markets around the world. If your predictions are correct before you place a trade, usually 70-95%, if you invest exactly $70 you will receive a credit of $170 – $195 on a successful trade. This makes risk management and trading decisions much simpler. The result is always a yes or no answer. You can win all or lose all. Hence the “binary” option. The risks and rewards are known in advance and this structured reward is one of the attractions. Binaries traded on exchanges are also available. In other words, traders do not trade with brokers. To start trading, you first need a regulated broker account (or you need a license). Choose one from our list of recommended brokers, which includes only brokers marked as trustworthy. The top brokers are ranked as the top choice for most traders. If you are completely new to binary options, you can open a demo account with most brokers and try out the platform to see what you are trading before depositing real money.

Introductory Video – How to Trade Binary Options

This video introduces you to the concept of binary options and how trading works. If you want to know more, read this entire page and follow the links to more detailed articles. Binary trading doesn’t have to be complicated, but like any other subject, you can become an expert and perfect your skills.

Option type

The most common type of binary option is a simple “Up/Down” trade. However, there are other types of options. One common factor is that the results have a “binary” outcome (yes or no). Some of the available types are:

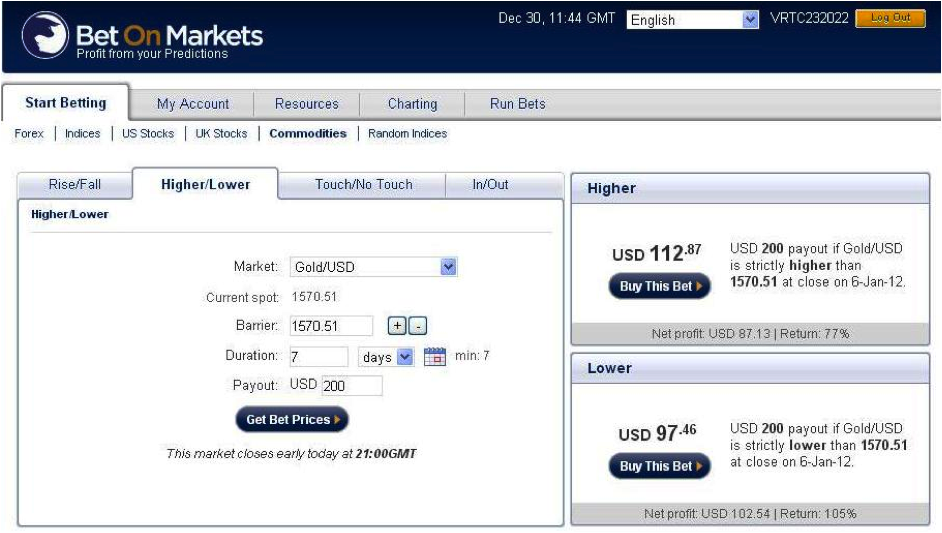

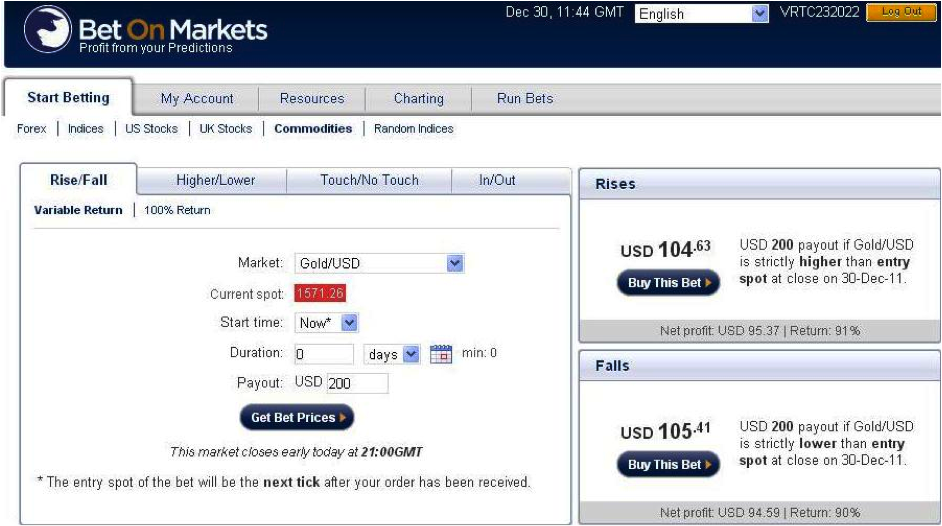

- Up/Down or High/Low – These are the basic and most common binary options. Will the price finish above or below the current price at expiration?

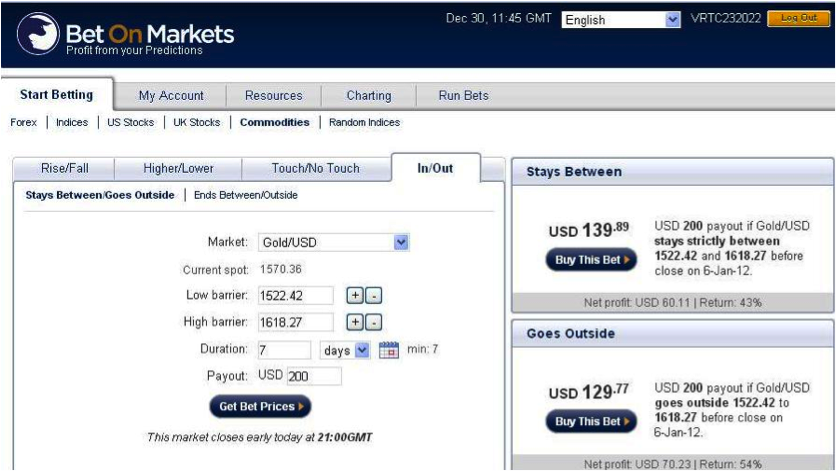

- In/Out, Range or Bounds – These options set the “higher” number and the “lower” number. Traders predict if the price will finish inside or outside this level (or ‘boundary’).

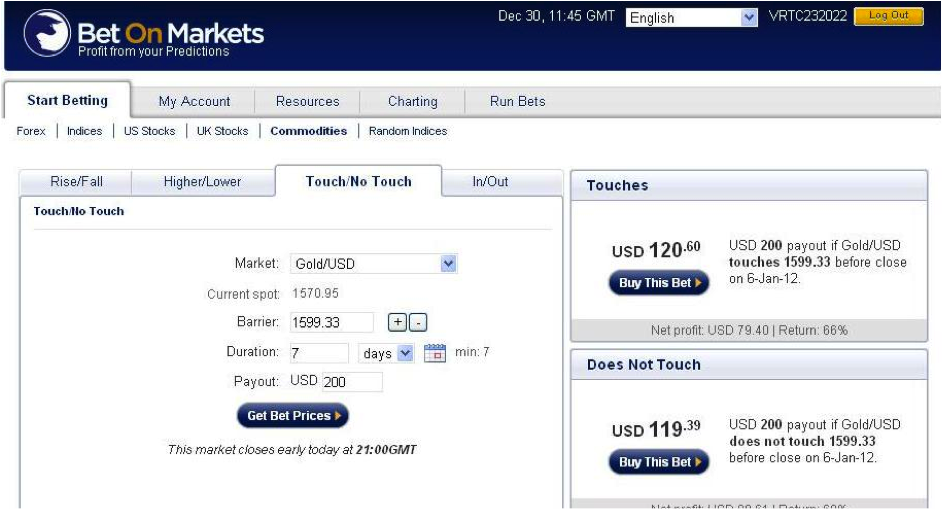

- Touch/No Touch – Set at a level above or below the current price. Traders need to predict whether the actual price will ‘touch’ that level at any point between trading hours. Touch options allow you to close trades before expiry time. If the option touches the price level before expiration, the “touch” option pays immediately, regardless of whether the price moves away from the touch level.

- Ladder – This option behaves like a normal rise/fall trade, but instead of using the current strike price, the ladder has a preset price level (a ‘ladder’ is a gradual rise or fall). Because these options typically require significant price movement, payouts often exceed 100%, but both sides of the trade are not available.

How To Trade – A Step-by-Step Guide

Below is a step-by-step guide to placing binary trades.

- Broker Selection – Use our broker reviews and comparison tool to find the best binary trading sites.

- Choose an asset or market to trade – The list of assets is large and includes commodities, stocks, cryptocurrencies, forex or indices. For example, the price of oil or Apple stock price.

- Choose an expiration time – Options can expire anywhere from 30 seconds up to 1 year.

- Set your trade size – remember that 100% of your investment is at risk. So consider your transaction amount carefully.

- Click Calls/Orders or Buy/Sell – Does the asset value rise or fall? Some broker label buttons are different.

- Trade Verification and Confirmation – Many brokers offer traders the opportunity to verify that the details are correct before confirming a trade.

Choose a Broker

Option fraud has been a major problem in the past. Fraudulent and unlicensed operators have exploited binary options as a new exotic derivative. These companies are thankfully disappearing as regulators finally start to act, but traders still need to look out for regulated brokers. note! Do not trade with the broker or use the services listed on the blacklist and scam pages, but use the services the site recommends here. Here is a shortcut to a page to help you decide which broker is right for you.

- Compare All Brokers to compare features and offers of all recommended brokers.

- Bonuses and Offers – If you want to get extra money to trade or other promotions and offers.

- Low minimum deposit brokers – if you want to trade real money without depositing large sums.

- Demo account – if you want to use the “real” trading platform without depositing any money.

- Halal Broker – If you are one of the growing number of Muslim traders.

Asset list

The number and variety of assets that can be traded varies from broker to broker. Most brokers offer options on popular assets such as major forex pairs including EUR/USD, USD/JPY and GBP/USD, as well as major stock indices such as FTSE, S&P 500 or Dow Jones Industrial. Commodities including gold, silver and oil are also commonly offered. Individual stocks and stocks can also be traded through many binary brokers. Not all stocks are available, but you can usually choose between 25 and 100 popular stocks like Google and Apple. This list is growing all the time as demand dictates. Asset listings are always clearly listed on all trading platforms, and most brokers provide full asset listings on their websites. Full asset listing information is also available within the review.

Expiration time

Expiration time is the point at which a trade is closed and settled. The only exception is if the ‘Touch’ option reaches a preset level before expiring. Certain transactions have expiry periods ranging from 30 seconds up to 1 year. Binaries initially launched with very short expiry periods, but demand now warrants a range of expiry times. Some brokers offer traders the flexibility to set their own expiry times. Maturity generally falls into three categories.

- Short/Turbo – These are generally categorized as expiring less than 5 minutes.

- Normal – from 5 minutes to the ‘final’ expiry that expires when the local market for that asset closes.

- Long term – Any expiry that ends in a day is considered a long term. The longest expiration period is 12 months.

Regulation

Although slow to react to binary options in the early days, regulators around the world are now regulating the industry and starting to make a presence out of it. Currently, the main regulators are:

- Financial Conduct Authority (FCA) – UK regulator

- Cyprus Securities and Exchange Commission (CySec) – Cyprus Regulator (‘passed’ across the EU under MiFID)

- Commodity Futures Trading Commission (CFTC) – US regulator

- Australian Securities and Investments Commission ( ASIC )

Malta and the Isle of Man also have regulators. Many other authorities are interested in binaries, especially in Europe, where domestic regulators are working to tighten CySec regulation. Unregulated brokers still operate and some are reliable, but the lack of regulation is a clear warning sign for potential new clients.

ESMA

Recently, the European Securities and Markets Authority (ESMA) banned the sale and marketing of binary options in the EU. However, this ban only applies to brokers regulated in the EU. This leaves the trader with two choices for holding the trade. First, you can trade with unregulated companies – this is very risky and undesirable. Some unregulated companies are responsible and honest, but many are not. The second option is to use a company regulated by an authority outside the EU. ASIC in Australia is a strong regulator, but does not enforce bans. This means ASIC regulated companies can still accept EU traders. For regulated or trusted brokers in your area, see our broker list. There is also a third option. Traders registered as ‘experts’ are exempt from the new ban. The ban is meant to protect ‘retail’ investors. Professional traders can continue to trade at EU regulated brokers. To be classified as a professional, account holders must meet two of the following three criteria:

- Open at least 10 trades per quarter with over €150.

- Have assets over €500,000

- I have worked in a financial company for 2 years and have experience in financial products.

How to set up a trade

You can trade different types of binary options if you understand certain concepts such as strike types or price barriers, settlements and expiration dates. Every transaction has an expiry date. When a trade expires, the action of the price action depending on the type selected determines whether it is in a profit (in the money) or a loss position (in the money). Also, a price target is a key level traders set as a benchmark to determine their outcome. You will see pricing targets applied when describing the different types. There are three types of transactions. Each of these has different variations. these are:

- that high

- in/out

- touch / no touch

Let us take them in turn.

That high

Also known as Up/Down binary trading, its essence is to predict whether the market price of an asset will be higher or lower than its strike price (the chosen target price) before expiration. When a trader expects the price to rise (“go up” or “trade high”), they buy a call option. You buy a put option when you expect the price to go down (“lower” or “down”). Expiration times can be as low as 5 minutes.

Note: Some brokers classify Up/Down as different types. A trader buys a call option if he expects the price to rise above the current price, or he buys a put option if he expects the price to fall below the current price. On some trading platforms, this may be displayed as a rise/fall type.

In/out

Also known as “tunnel trades” or “boundary trades,” In/Out types are used to trade price consolidation (“in”) and breakdown (“out”). How does it work? First, traders set two price targets to form a price range. You then buy an option predicting whether the price will stay within the price range/tunnel until expiration (In) or whether the price will break out of the price range in either direction (Out).

The best way to use tunnel binaries is to use the asset’s pivot point. If you are familiar with pivot points in forex, you can trade this type.

Touch / no touch

This type presupposes price action touching a price barrier. A “touch” option is a type of contract in which a trader purchases a contract that will provide a profit if the market price of the purchased asset touches a set target price at least once prior to expiration. If the price action does not touch the price target (strike price) before expiry, the trade ends in a loss. “No Touch” is the exact opposite of touch. Here you bet on the price action of the underlying asset before expiration without touching the strike price.

This type includes double touch and double no touch. Here, a trader can set two price targets and buy a contract betting on a price that either touches both targets before expiry (double touch) or does not touch both targets before expiry (double no touch). Generally, we only use Double Touch trades when the market is volatile and the price is expected to take multiple price levels. Some brokers offer all three types, while others offer both, and there are types that only offer one variety. Also, some brokers place restrictions on how expiration dates are set. To get the most out of the different types, traders are advised to shop for a broker that offers maximum flexibility in terms of types and expiry times.

Mobile app

Trading via mobile has never been easier as all major brokers offer fully developed mobile trading apps. Most trading platforms are designed with mobile device users in mind. So the mobile version is very similar, if not identical to the full web version of a traditional website. The broker accepts both iOS and Android devices and creates versions for each. The download is fast, and traders can sign up through the mobile site as well. Our reviews contain details of each broker mobile app, but most of them are well aware that this is a growing realm of trading. Traders want to react instantly to news events and market updates, so brokers give their clients tools to trade wherever they are.

Transaction FAQ

What are Binary Options?

“Binary options” means trades where the outcome is a yes/no answer that is ‘binary’. These options pay a fixed amount if they win (“in the money”), but lose your entire investment if the binary trade fails. In other words, it is a form of fixed income financing option.

How does stock trading work?

trading stocks through binary options;

- Choose stocks or stocks.

- Identify the desired expiry time (the time the option expires).

- Enter your trade or investment size

- Decide whether the value will rise or fall and place a put or call

The above steps are the same for every single broker. You can add more layers of complexity, but the simple Up/Down trade type is most popular when trading stocks.

Outgoing and calling options

A call and put is simply the terms of buying and selling options. If a trader thinks the underlying price will rise, they can make a call. However, you can place a put trade if you expect the price to decline. Different trading platforms label their trade buttons differently, some toggle between buy/sell and currency/enter. Others drop the phrase and call them all. Almost all trading platforms make it absolutely clear in which direction traders open options.

Are Binary Options a Scam?

Financial investment tools are not scams, but unreliable and dishonest brokers, trading robots and signal providers. The point is not to base the concept of binary options on a handful of dishonest brokers. The image of these financial products has suffered as a result of these operators, but regulators are slowly starting to prosecute and fine the offenders, and the industry is cleaning up. Our forum is a great place to raise awareness of misbehavior. This simple check can help anyone avoid scams.

- Marketing that promises big returns. This is a clear warning sign. Binaries are a high-risk, high-reward tool, they are not “make money online” schemes and should not be sold. Operators making such claims are most likely untrustworthy.

- I know the broker. Some operators ‘funnel’ new clients to the broker they partner with, so they don’t know who the account is. Traders need to know which broker they will be trading with! These funnels often fall under the ‘get rich quick’ marketing discussed earlier.

cold call. - Professional brokers won’t do call calls – they don’t market it that way. Cold calls often come from unregulated brokers who are only interested in depositing an initial deposit. If you sign up for a company that has contacted you in this way, proceed very carefully. This includes e-mail contacts as well. All forms of contact are blue.

- Terms of Use . Please read the full terms and conditions when accepting a bonus or offer. Some involve locking in initial funds (along with bonus funds) until a lot of trades are made. The first deposit is the merchant’s cash. Legitimate brokers do not claim as their own prior to trading. Some brokers also offer the option of canceling the bonus if it does not suit the trader’s needs.

- Don’t let anyone else trade for you. Do not allow “account managers” to transact on your behalf. Although there is an obvious conflict of interest, these guys at the broker will encourage traders to make big deposits and take bigger risks. Traders must not allow anyone to trade on their behalf.

What is the best trading strategy?

Binary trading strategies are unique to each trade. We have a strategy section, with ideas for traders to experiment with. Technical analysis is used by some traders along with the study of charts, indicators, and price action. Money management is essential to ensure risk management is applied to all trades. Different styles suit different traders and strategies will evolve and change too. There is no single “best” strategy. Traders need to ask questions about their investment goals and risk appetite and know what fits them.

Are Binary Options Gambling?

This entirely depends on the trader’s habits. Without strategy or research, short-term investing will win or lose based solely on luck. Conversely, a trader who makes well-researched trades will do everything he can to avoid relying on fortunes. You can gamble using binary options, but you can also place trades based on value and expected profit. Accordingly, the answer to the question will come down to the merchant.

Advantages of Binary Trading

The main advantage of binaries is the risk and reward clarity and trading structure.

Minimal financial risk

If you’ve ever traded forex or its volatile cousins, crude oil or spot metals like gold or silver, you’ve probably noticed one thing. Leverage and margin, news events, cuts and price requotes, etc. can all negatively impact trading. The situation is different in binary options trading. Indisputable, phenomena such as slippage and price takeover do not affect the outcome of binary options trading. This reduces the risk of binary options trading to a minimum.

Adaptability

Binary options markets allow traders to trade financial instruments across currency and commodity markets, as well as indices and bonds. This flexibility is unmatched and provides traders with the knowledge of how to trade these markets, a one-stop shop for trading all these markets.

Simple

Binary trading results are based on one parameter, the direction. Traders essentially bet whether a financial asset will end up in a certain direction. Additionally, traders have the freedom to determine when a trade is to close by setting an expiry date. This gives you an opportunity to start trading well in the first place. Not so in other markets. For example, loss control can only be achieved through stop losses. Otherwise, traders will have to endure bearishness if reverse rotations are made to give them room to take profits. The simple thing here is that in binary options traders have less to worry about than trading other markets.

Greater transaction control

Traders have more control over binary trading. For example, if a trader wants to buy a contract, they know in advance what they will gain and what they will lose if the trade is out-of-the-money. Not so in other markets. For example, if a trader sets a pending order in the forex market to trade an influential news event, there is no guarantee that his trade will be filled at the opening price or that a losing trade will be closed at the exit point at a loss.

High payout

The payout per trade is usually higher for binary than other forms of trade. Some brokers offer payouts of up to 80% on trades. This can be achieved without compromising your account. In other markets, such a payout can only happen if a trader ignores all money management rules and exposes a lot of trading capital to the market, expecting one big payout (which in most cases will never happen).

Accessibility

To trade the volatile forex or commodity markets, traders must have a reasonable amount of money as trading capital. For example, trading gold, a commodity with a maximum daily volatility of 10,000 during high volatility timeframes, requires trading capital in the tens of thousands of dollars. However, binary options have lower entry requirements as some brokers allow people to start trading at as low as $10.

Disadvantages of Binary Trading

Decreased trade probability for sure banker trades

The payoff on binary options trades is significantly reduced when those trades have very high odds. It is true that some trades offer dividends as high as 85% per trade, but such high dividends are only possible if the trade is made with an expiry date far from the trade date. Of course, trading in such circumstances is more unpredictable.

Lack of good trading tools

Some brokers do not provide their clients with useful trading tools such as charts and functions for technical analysis. Experienced traders can get around this by sourcing these tools elsewhere. Inexperienced traders who are new to the market are out of luck. This is changing for the better as operators mature and traders recognize the need for these tools to attract.

Limitations on Risk Management

Unlike forex where traders can get an account to trade mini and micro slots with a small account size, many binary options brokers set trading floors. The minimum amount a trader can trade on the market. This makes it easier to lose too much capital when trading binaries. For example, a forex broker can open an account with $200 and trade microslots, which allows the trader to expose only an acceptable amount of capital to the market. However, even with a $200 account, you would be hard pressed to find many binary brokers that allow you to trade for less than $50. Four losing trades in this situation will blow your account.

Transaction loss cost

Unlike other markets where the risk/reward ratio is controlled and can give an edge to winning trades, the odds of binary options skew the risk reward ratio for losing trades.

Transaction modification

When trading a market such as the forex or commodities market, if repeated analysis of your trades turns out that your first trade was a mistake, you can close it with minimal losses and open another profitable trade. This is mitigated if the binary is traded on an exchange.

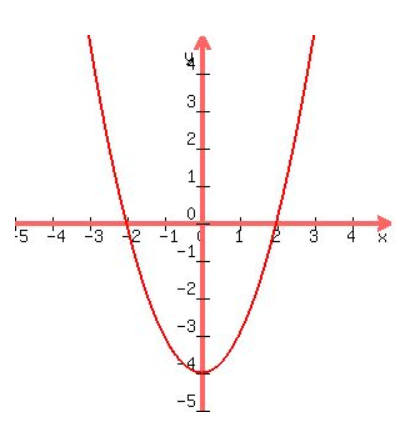

Spot forex and binary trading

These are two alternatives trading with two different psychologies, but both can be understood as investment tools. One is TIME-centric and the other is PRICE-centric. Both work on time/price, but their focus on each other is where it gets interesting. Spot forex traders may overlook time as a factor in their trades, which is a very big mistake. Successful binary traders have a more balanced view of time/price, which makes them simply more balanced traders. Binaries are more focused on discipline and risk management by essentially forcing you to exit winning or losing positions within a given amount of time. In forex trading, this lack of discipline is the number one cause of failure for most traders. Because they simply lose positions over long periods of time and cut winning positions over short periods of time. In the case of binary options, which is impossible due to time expiring, trade exit wins or loses. Below are some examples of how this works.

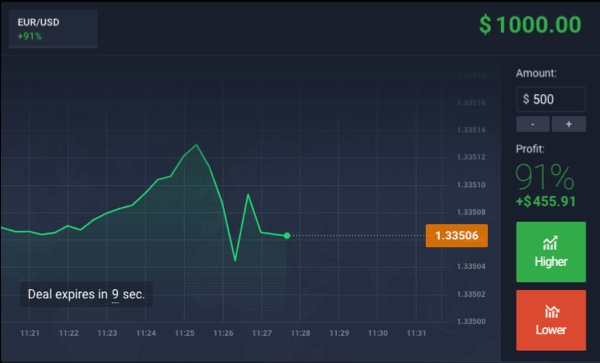

Above is a trade to buy EUR/USD at a price and time of less than 10 minutes. As a binary trader, this focus will naturally outweigh the example below, where spot forex traders who focus on price while ignoring the time factor struggle. The psychology of being able to focus on your limits and dual axes will help you become a better trader overall.

The biggest advantage of spot trading is the same failure as the price expands exponentially from 1 point. In other words, if you enter a price where you expect value to rise, but the price doesn’t move up, but accelerates down, most spot traders usually tend to wait or add a losing position. Will come again. In the opposite direction, when time approaches, most spot traders get stuck in an undesirable position, as most spot traders don’t plan their time on reasoning, which is a complete lack of trading discipline.

Due to the nature of binary options, both Y = price range and X = time range can give you a more complete mindset to trade as you apply limits. They will simply make you a better overall trader in the first place. Conversely, by their very nature they demand greater odds, since each bet means a 70-90% profit vs. a 100% loss. So your win rate should average 54%-58%. This imbalance causes many traders to overtrade or take revenge, which is as bad as losing or adding to a position as a spot forex trader. You need to practice money management and emotional control to be successful in trading. In conclusion, when starting out as a trader, binaries can provide a better foundation for learning to trade. The simple corollary is that focusing on TIME/PRICE is like finding two ways to cross paths. The average spot forex trader is only looking at price. That means you only look in one direction before crossing the street. Learning to trade with both time and price in mind will help you become a holistic trader.