Nadex is a fully regulated exchange regulated by the Commodity Futures Trading Commission (CFTC) and is legally permitted to accept US residents as customers. Nadex operates in the US but forms part of the London-based IG Group. They offer a real exchange with buy and sell positions that are fully open to traders and traders.

Offering state-of-the-art trading tools and advanced features, Nadex provides a high-quality trading experience. Documented exchange fees highlight the transparency Nadex provides to its services. They describe their business as:

” Provides the ability to match contract buyers and sellers in a convenient way (Nadex does not profit from the P&L of the trade, it simply receives a fully disclosed exchange fee) ”

Review summary

- Nadex demo account – yes (open a free demo account)

- Minimum deposit – $250

- Minimum transaction – $1

- Bonus Information – There is currently no active bonus scheme.

- Mobile App – NadexGo.

- Signal service – no

Nadex offers its customers the following features and benefits:

- Transparent transaction costs – Nadex is clear about how it is funded.

- Advanced Charting – Charting and technical analysis tools are the best in binary options.

- Education – This company takes trader education to the next level. There are regular free webinars on how to use the platform as well as how to make consistent money.

How to use the trading platform

Nadex provides a real-world trading experience. This means traders have the option to buy and sell on both sides of the asset. Traders can also request their own strike price. If another client wants to trade the other side of the option, it will open at that price.

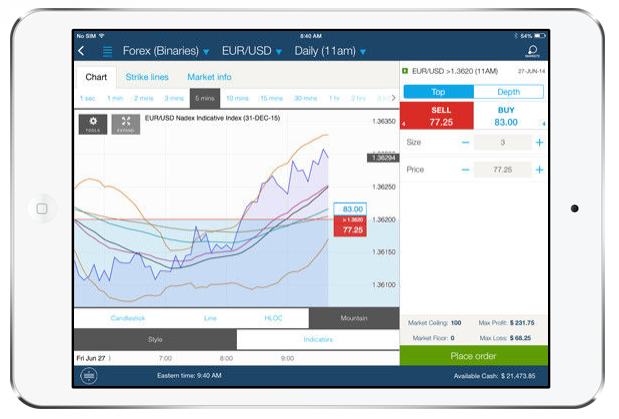

The first thing to choose is which asset to trade. This can be found through the ‘Finder’ window on the left side of the trading platform. Selecting a market opens the offer time for option expiration (times are shown in Eastern Time).

The market window refreshes when expiry and assets are selected. The current tradeable price level is displayed. There are usually about 10 different price levels. For example, Nasdaq trading offers 10 different levels. Each level trades depending on whether the closing price (expiration price) is higher or lower than the indicated level. Nadex binary options have a settlement price of 0 or 100, so the exchange price fluctuates between 0 and 100. 100 indicates a positive outcome (thus the asset finishes above or below a certain price) and the option settles to zero. For example, if the price of an asset is above the target price did not end, the option has had a negative outcome. Remember that traders can buy and sell both positive and negative outcomes.

Clicking on an asset in the market list, or clicking on a ‘bid’ or ‘offer’ figure will open the trade ticket screen. Clicking the Bid or Offer button opens the ticket with the ‘Sell’ or ‘Buy’ option pre-selected.

The trade ticket checks the expiration time, price level, bid size, and current bid and offer prices. The user then has to click the sell or buy button (if not already selected) and confirm the size of the trade (investment amount). The figures at the bottom of the ticket highlight the maximum loss and maximum payout based on the trade size entered. ‘Maximum loss’ can be intimidating, but you can close the trade at any time if the price moves against them. Traders can also change prices – this is the exchange element of Nadex trading. Traders wait to see if their position ‘matches’ by requesting a price above or below the current price.

As each option is publicly tradable, clients can close open trades at any time, allowing them to take profits or cut their losses. If the option expires without further trading, the maximum and minimum figures on the ticket represent two outcomes.

Once the trade is set as required, the trader clicks the ‘Place Order’ button. If they match, they will appear in the ‘Open Locations’ window. If the transaction is ‘unmatched’ (all or partially), it will take you to the ‘Work Orders’ screen. When orders are matched, both ‘Open Positions’ and ‘Work Orders’ are updated. Nadex will send you an email confirmation in addition to this window. Another email will be sent once your order is confirmed.

Trading choice

Nadex offers binary trading on forex pairs, commodities (gold, silver, etc.) and stock indices. Each asset has a range of price points, so if traders are looking for fast price movement in a particular stock index or long-term trading of a currency pair, Nadex offers it.

Nadex offers over 5000 contracts at a time.

Touch Bracket™ Agreement

The Nadex Touch Bracket™ contract is a new type of contract introduced by Nadex. Contracts operate between two ‘brackets’ (a floor price and a ceiling price). Prices move with the real asset price between these price levels. This level of attractiveness ensures that they work as built-in risk management tools and there is no slippage. The transaction opening cost is the maximum capital at risk.

Flexible ‘micro lot’ trade sizes allow novice investors to secure these contracts with low capital requirements, but extend to professional trades to get the most out of leveraged trading.

mobile app

Nadex offers the best and most complete mobile trading app on the market. The application is free and has been written and optimized for various mobile platforms. The app is called NadexGo

Quick and important application actions include all the features available on the entire website. Account maintenance, charting, trading apps have it all for traders.

Its clear layout makes trading extremely simple while displaying all the data a trader needs. The deal ticket deal area is already optimized for ease of use, displaying the same as the full website platform.

The NadexGo mobile app includes all the features of the full site and is a leader in binary options.

Call spread payment

Payouts on Nadex are not easy to compare with other brokers – other brokers do not offer genuine exchange transactions. Binary options pay out based on the strike level at which the trader was able to open the option.

For example, if a trader brings in 50 and the makeup is 100, the payout is effectively 100% (e.g. you could risk $100 and got $200 when the trade settled). 100 then the payout dropped to about 50% (more risk amount and less profit).

There is a trading fee of $1 per contract per side incurred when opening a trading position and closing a position before expiry. Otherwise, contracts held until expiry will be charged a $1 per contract settlement fee when you finish in the money. These rates are transparent (with each trade you know exactly what happens) and represent a ‘better value’ trade than traditional options. More information about Nadex pricing can be found on their site.

Complaints

Nadex doesn’t have many complaints. Traders sometimes struggle with the platform because it is very different from the ‘over the counter’ brokers that are more widely known than the platform. Demo accounts give traders a chance to familiarize themselves with the platform before trying out new strategies, but users can become frustrated if they lose or miss trades due to confusion with the platform.

The training materials provided by the company are very good. This platform is unique and requires specific training materials. Tools range from videos to handbooks, and the website regularly runs a series of webinars for traders to take lessons in a live trading setup. Once traded, the exchange platform does so in a simple way similar to more familiar platforms. The fees charged on transactions are clear and transparent, never complain again.

This brand is definitely not a scam. It is owned and operated by London-based IG Group and regulated by the UK’s FCA. The CFTC oversees and regulates US exchanges to provide trading to US residents.

The company’s regulations couldn’t be more stringent, and users can log in, deposit, and transact with absolute confidence.

Withdrawal and deposit methods

Nadex allows US residents to fund their accounts via debit card, ACH wire transfer. Non-US residents can only use debit cards or landlines.

For bank transfers of $5000 or more, Nadex will refund a $20 bank fee to your trading account.

Withdrawals can only be made via ACH or wire transfer. Non-US residents can only use wire transfer. The withdrawal option can be found in the ‘Account Funding’ menu under ‘My Account’. ACH transfers are free and take about 3 to 5 days, while wire transfers require a $25 fee but are usually processed the next day.

Withdrawal details are not straightforward on Nadex, so it’s worth clarifying before requesting payment. While many of these steps are required due to CFTC regulations, delays are a regular issue among traders and brokers, an area that should be thoroughly researched prior to funding this account. This ensures there are no shocks and traders know exactly what to expect when requesting a withdrawal.

Frequently Asked Questions

Who regulates Nadex?

Nadex is regulated by the CFTC (Commodity Futures Trading Commission). This is one of the strongest levels of regulation in the sector.

Who owns Nadex?

Nadex is owned by UK-based IG Group. They have offices in London and are listed on the London Stock Exchange. The IG Group also operates the UK brokerage IG Index.

Trading hours?

The Nadex website is available 24 hours a day, but many assets are only available for trading based on their own local trading hours. Like London-based stocks for example, they can only be traded during UK trading hours, but S& Some products, such as the P500, are traded electronically around the clock. Some forex trades are traded all over the world, so they are open 24/7 on weekdays, but volumes may vary from time to time.

Is Nadex a broker?

NADEX is not a binary options broker in the “traditional” sense. NADEX is an exchange, and an exchange is a place where traders meet to conduct business. Nadex provides a platform to ensure that everything is CFTC compliant, and is the clearing house for Nadex trades, handling all necessary money and other obligations.

An exchange fee of $1 per contract is charged for each transaction. Remember that exchanges make money by facilitating trades, not when they lose.

This is important as it eliminates the potential conflict of interest when dealing with EU style brokers. NADEX doesn’t care if you win or lose, they charge a small fee per contract (more on the site) and that’s where the profits come from.

Offshore style brokers make money when they lose money, not win. “Account managers”, signals and auto trading offered by some brokers are often scams.

What makes NADEX better and where the real fun comes from is the person facilitating the trades. You are trading with other traders, like yourself and market makers, who only function as a liquidity provider, not a platform that functions only as a liquidity provider.

How to make money on NADEX

The way to make money on NADEX is to buy and sell binary options. These options work like EU-style binaries in some ways, but not in others. On the one hand they can be held until expiry, in which case you will either lose them all or get the maximum payout. On the other hand, they are based on strike price and can be bought and sold continuously until expiration.

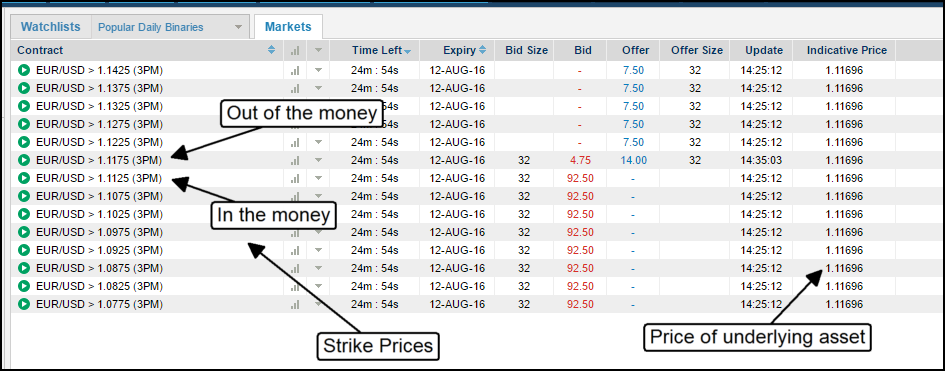

The biggest difference between them and why they trade differently is how they function. EU-style binary options use the price of the asset as the strike price when purchasing. If the price goes up or down, you either lose money or make money depending on the type of option you buy. NADEX binary options are based on a strike price selected from a list of possible strikes and can be withdrawn or withdrawn.

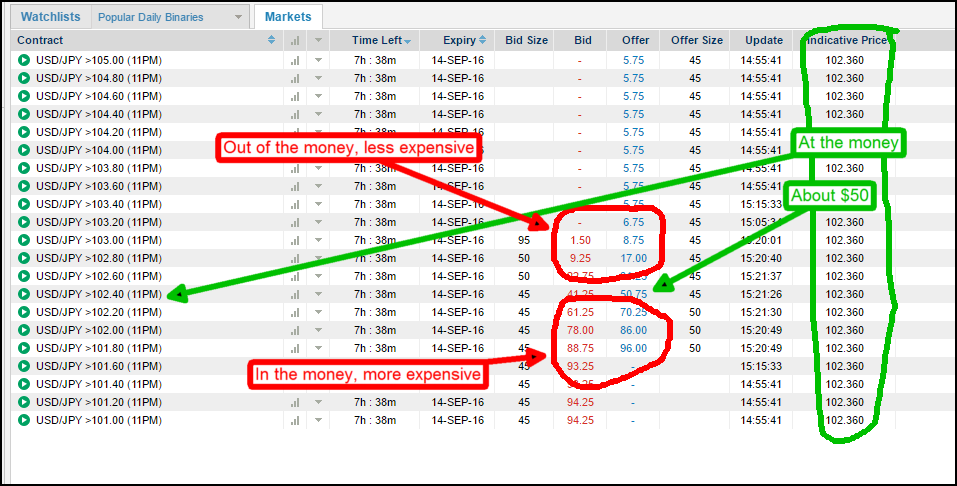

EU style options allow you to trade any amount you want, just enter the numbers on the trading screen. For example, NADEX options are sold in lots, so if you want to buy EUR/USD at 1.0545 for example, you can buy 1 or 2 or 10. The price of each lot depends on whether or not there is a strike, whether there is bankruptcy, and market pressure. Option prices range from $0 to $100, with $0 being the minimum payout and $100 being the maximum. Out of the money options naturally cost more, but out of the money options cost less. You will receive $100 per lot if the option closes at expiration. If the option closes in the money, you receive $0. Before an option expires, its price depends on the price of the underlying asset. The profit you make is the difference between what you pay for and what you get for your money, $100. Typically, a money option costs around $50, which means a trade return of $50 or 100%, which is much better than the 70% to 80% you get with EU-style binaries.

Strategies

To say that NADEX binary options are a bit confusing for new traders is a bit of an understatement. There are several key differences between these US CFTC regulated binary options trades and traditional spot binary trades offered by European and international brokers. However, these differences open up new avenues for trading and profits that are never available in other forms of binary trading.

Before moving into the more complex details of opening and closing NADEX positions, let’s review the specific differences between spot binaries and NADEX. The offshore spot binary options brokers who mentioned standard high/low digital options trading have two types of positions. Call and put in. You buy a call if you are bullish, you buy a put if you are weak, and in both cases you buy from the broker. If you win the broker, you keep your money if you lose the broker. You cannot sell an option outside of an Early Out situation. NADEX only has one type of position, called a lot, which can be bought or sold. If you’re optimistic you buy it, if you’re optimistic you sell it.

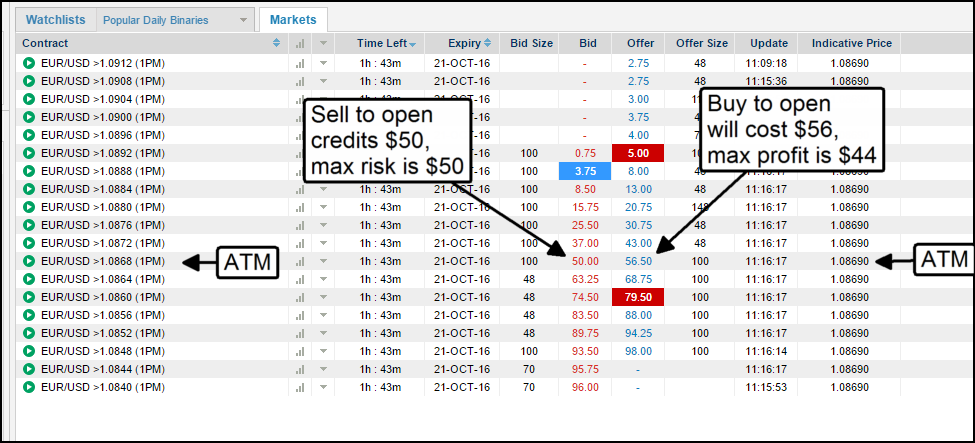

How buying and selling works

This is how it works. NADEX lots are quoted at different strike prices, some in cash, some in cash, and one or two near or in cash. For the purposes of this discussion, I will only focus on the At-The-Money strike for simplicity, as long (buy, sell, bull) and short (sell, sell, bear) positions will be around $50. The thing to remember is that in both cases you are opening an position on either a buy or a sell. So buying a NADEX lot is equivalent to buying an EU style call. Selling a NADEX lot is almost the same as buying an EU style put. The difference is that with NADEX it is OPEN OPEN rather than Open To Open so you can get credit as it is a bearish position.

See example below. In this NADEX warning chart for EUR/USD’s 1PM expiration, the 1.0868 warning is At The Money. If you want to buy a long position, call, the offer is priced. This is the price at which other merchants are offering Sell . If you buy at $56.00 and the asset’s price is above the strike price, your maximum profit from The Money is $44, which is the difference between what you paid and the maximum payout of $100 at maturity. If you want to sell a short position, enter a put and you will receive your bid price. This is the price that other traders are at willing to buyin this case, the option is $50. This means you will get a $50 credit to your account, and you will have the asset price keep it Out Of The Money (if the other trader loses, you win). Your risk is if the asset price closes on The Money, in which case you will have to pay out up to $100, but don’t worry. Since you’ve already paid $50, your risk is $50 because you’re actually only costing $50.

The easiest and best way to make money using NADEX options is to hold the option for maximum return until expiration. However, sometimes you may want to close early to secure a profit or cut losses. This is another area where confusion can arise.

The thing to remember is that you have already opened a position, now you need to close it. If you have purchased a long position, call (buy), then close sell and get your bid price. If that price is higher than the price you paid for the option, you make a profit. If you sell a short position, and sell to open, you must buy the closing price to close the position.

Opening and closing

The key is to remember two things. First, there is only one kind of entry that you can open or buy. The second thing to remember is that in order to make your position stand, you must do the opposite to what you unfolded it. If you open and buy, you close the door, and if you open a sale, you close the door.

NADEX Beginners Guide

My biggest complaint about NADEX is that it’s not easy. Of course, NADEX is not as easy as trading in an offshore, EU or CySEC style digital binary options broker. At one of those places all you need to know is which direction you want to go and how much risk you want to take.

When you enter the price of the underlying asset at the strike price, if the price of the asset moves in the right direction from there you are a winner and you pay the mark percentage when you buy the option. It’s not that simple with NADEX, but trust me when I say it’s far superior to any other form of binary trading I know of.

There are three things you need to know about trading NADEX.

1. Options are priced on a 0-100 scale

Because they are binary in nature, there are only two possible outcomes at expiration: $0 or $100. You get $0 if the option closes out of the money and $100 if it closes out of the money. The specifics of what trades do is that while an option is active, its value fluctuates between $0 and $100 depending on the movement of the underlying asset and market pressures before the option expires. When an option is out of the money it is less in the money and when it is in the money it is more expensive.

Your return at maturity is the difference between what you pay and what you receive. If the option expires in the money, paying $45 and receiving $100, you get $55 or a 122% profit. 122%, a far better return than I could find anywhere else. Importantly, you do not have to hold NADEX options until expiration, you can buy or sell them at any time. If your trade moves in the money and the option shows a profit, you can sell it, but you may not get the maximum return.

2. NADEX binary options are traded in “lots” that are priced in the market.

Factors affecting price include the price of the asset, the strike price of the option and the time until expiration. Offshore brokers have no market pressure affecting the price, and if you want to trade $500, simply enter $500 in the Amount box, click Enter, and your trade is complete. If you trade $500 using the “lot system” and 1 (1) lot costs $50, you must buy 10 (10). If the lot is priced at $65, you can only buy 7 (seven) without going over the limit.

3. Strike price

Each asset has a listed maturity with each available strike price. The strike price is the price at which the option goes into money. When it comes to price options, At-the-money options always trade near $50 and there is roughly a 50/50 chance the option will move up or down. When the strike price is in the currency, i.e. when the asset price exceeds the strike price, it is more likely to close profitably and therefore cost more. Strikes get more expensive the deeper you go into the money until they come in price. When the strike price is out of the money, i.e. the asset’s price is below the strike price, the cost is less than $50 and more OTM is available until it becomes completely worthless. In terms of standard, oriented style trading, ITM or ATM options are less risky trades, whereas OTM options are more risky. Of course, if the signal is strong, an OTM option that costs only $30 to $40 will set you back 150% to 230%.

Simple Selling Strategy for NADEX Binary Options

NADEX binary options are different from EU style spot binaries, so you can actually sell them and get paid for them. Read on to find out how to use this simple selling strategy.

First, let’s reiterate that NADEX options are heavily sold, option strikes are preset in the money and money, and all options are worth $0 or $100 at expiration. During the life of an option, the time between when it is first traded and the time it expires, the price fluctuates between $0 and $100 depending on the exercise and exercise of the underlying asset. For a bullish position, the difference between the price you pay for the position and the amount returned at expiration is $0 for a position where you buy a strike in the belief that the price will go up. or $100.

If the option expires out of the money and you receive $0, the position cost is lost. If the option expires in the money, you receive $100, take a profit, and $100 minus the cost of the option. If you bought the option with money, it would cost about $50 and return you about $50 or 100%.

Therefore, for a bear position, you proceed in the same way as a buyer. When you “sell” a strike, you pay the other side of the position from the matching buyer. If a buyer pays $40, they pay $60 to $40 to $40. The most you can lose is that $60. The buyer benefits when the option expires at 0, whereas the buyer benefits when it expires at $100. In this case, if the binaries were worthless, you would pay $100 if you paid the buyer’s $40 back for $60.

ATM money options cost around $50 per lot. If you sell one for $50 and it closes in the money you have to pay $100. $100 is $50 of your money and $50 received as an option premium. When the option closes the desired amount of money, you keep the premium (the owner of the option holds the contract for no value and does not have to pay anything) and takes that amount as a profit.

- Buy in NADEX/Bullish Position – Buy the option exercise exercise, pay the ask price, and make the difference between the cost of the option and $100. Your risk is the price of the option.

- Sell on a NADEX/Bearish position – Sell the option strike price, receive the bid price, and make that amount a profit when the option exits the money. Your risk is the difference between what you receive and $100.

The mechanism for buying and selling options on NADEX opens up several possibilities. The simplest and probably the most effective for directional binary options trading is the hedging strategy. Hedging helps you use one position to offset the cost of another position or maximize your profits before expiry. think about this Take a signal for a bullish trade and buy a $50 option at the ATM. The underlying asset may move up and stall to the next resistance target, but simultaneously sell to the next high strike at $50. This means that the total cost is $0 dollars, so you just have to wait until it expires. If you have assets left between the two strikes, you can make the maximum return if you lose nothing.

Advanced traders can use sell options to target non-directional strategies. These strategies are most effective in markets where asset prices are declining or constrained by resistance. One way is to target strikes that can be sold on credit that are more likely to clear the money. For example S & Take this trade setup for P 500 as an example. Price is trending down in the short term with 2 strikes close enough to the money to come to value but well enough to be fairly safe against price action. The price is already set, so no price fluctuations are required. All you have to do is sell $31.50 of credit for free and keep it for 5 minutes.

Some of the links to third party websites contained on our website are affiliate links. This means that if you click on a link to a third party website or purchase a product from a third party website, we may charge you a fee or commission.