Strategy

A daily trading strategy is essential if you want to take advantage of frequent small movements. A consistent and effective strategy relies on in-depth technical analysis utilizing charts, indicators and patterns to predict future price movement. On this page, beginner trading strategies are thoroughly analyzed, progressing to advanced automation and asset-specific strategies.

We’ll also point you in the direction of the regional differences you need to know about and helpful resources. Ultimately, you need to find a daily trading strategy that suits your specific trading style and needs.

Also, choose a broker for your strategy-based daily trading. You might want something like;

- Excellent transaction execution speed

- Price action data (if available + level 2)

- The ability to trade directly on the graph

- trade automation,

- Stop Loss and Order Profit

- etc

Visit our Brokers page to check if your broker has the right trading partners.

Trading strategies for beginners

Focus on the basics of a simple daily trading strategy before wreaking havoc in the complex world of highly technical indicators. Many people make the mistake of thinking that it takes a very complex strategy to be successful throughout the day, but there are often simpler and more effective ones.

Basics

Incorporate the valuable elements below into your strategy.

- Bankroll Management – Before you start, sit down and decide how much you are willing to risk. Most successful traders never put more than 2% of their capital on the line per trade. If you want to be around when the wins start, be prepared for some losses.

- Time Management – If you allot only an hour or two a day to trading, don’t expect a fortune. You need to constantly monitor the market and look for trading opportunities.

- Start small – stick to up to 3 stocks per day while you find your feet. It’s better to get average without making more money than usual.

- Education – It is not enough to understand the complexities of the market, you must stay informed. Stay up to date with any events that may affect your property, such as changes in market policy and economic policy. You can find a wealth of online financial and business resources to keep you in the know.

- Consistency – It’s harder than holding back your emotions when you’ve had five cups of coffee and been staring at a screen for hours. You must let math, logic and strategy guide you, not nerves, fear or greed.

- Timing – Markets become volatile each day they open and experienced day traders can read patterns and returns, but waste your time. Wait for the first 15 minutes. You’re still hours ahead.

- Demo Account – An essential tool for beginners, but the best place to backtest or experiment with new and sophisticated strategies for advanced traders. Many demo accounts are unlimited, so there is no time limit.

Components required for all strategies

Whether it is an automated weekly trading strategy or a beginner and advanced tactic, there are three essential components to consider. Volatility, liquidity and volume. Choosing the right stock is important if you want to make money on small price fluctuations. These three factors will help you make your decision.

- Liquidity – You can enter and exit trades quickly at attractive and stable prices. For example, the liquid commodities strategy will focus on gold, crude oil and natural gas.

- Volatility – tells you the range of potential profits. The greater the volatility, the greater the profit or loss. The cryptocurrency market is one such example, known for its high volatility.

- Volume – This measure represents the number of times a stock/asset has been traded over a period of time. For day traders, this is better known as ‘Average Daily Volume’. A high volume indicates significant interest in the asset or security. An increase in volume is often an indicator that prices are moving up or down.

5 day trading strategy

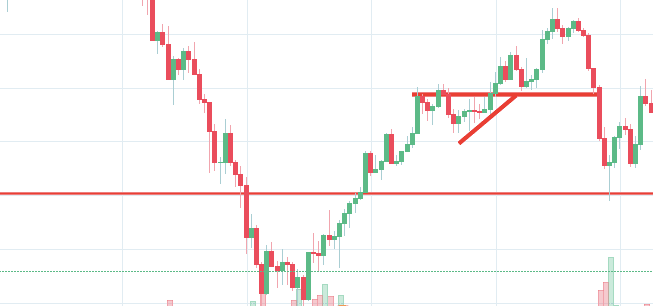

1. escape

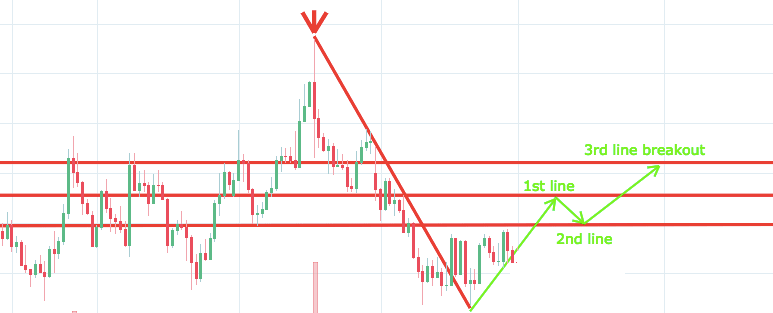

A breakout strategy is central when price clears a specified level from the chart by increasing volume. A breakout trader enters a long position after an asset or security breaks above resistance. Alternatively, enter a short position when the stock moves below support.

When an asset or security trades past a certain price barrier, volatility usually increases and prices often tend towards the breakout.

You need to find the right product to trade. As you do this, keep in mind your asset’s support and resistance levels. The more often the price hits this point, the more verified and significant it becomes.

entry point

This part is nice and simple. A price set above a resistance level is a bearish call. A price set below the support level requires a bullish position.

Exit Plan

Use the asset’s recent performance to set reasonable price targets. Chart patterns make this process more precise. You can create a target by calculating the average recent price movement. If the average price move is 3 points compared to the last few price moves, this is a reasonable target. When you reach that target you can exit the trade and enjoy your profits.

2. 스케일링

One of the most popular strategies is scalping. It is particularly popular in the forex market and appears to take advantage of minute price movements. Momentum is quantity. You want to sell as soon as the trade becomes profitable. This is a fast-paced and exciting way to trade, but it can be risky. You need high trading probabilities to even out a low risk-to-reward ratio.

Keep an eye on volatile instruments, attractive liquidity and timing. You can’t wait for the market, so you need to close losing trades as soon as possible.

3. Momentum

Popular among trading strategies for beginners, this strategy focuses on identifying substantial trend changes with action and mass support on news sources. There’s always one stock that moves around 20-30% each day, so there’s plenty of opportunity. You can hold your position until you see signs of a reversal and then exit.

Or it could fade price cuts. This way, when the price target starts to end, the quantity starts to decrease.

This strategy is simple and effective when used correctly. However, you should be aware of upcoming news and earnings announcements. Just seconds on each trade will make all the difference to your ending profit.

4. reverse

Although buzzy and potentially dangerous when used by beginners, reverse trading is used all over the world. Also known as trend trading, trend reversal, and mean reversion strategies.

This strategy defies basic logic by aiming to trade against the trend. You must be able to accurately identify possible fullbacks and predict their strength. Doing this effectively requires in-depth market knowledge and experience.

The ‘Daily Pivot’ strategy is considered a unique case of reverse trading because it focuses on buying and selling low and high pullbacks/reverses on a daily basis.

5. Use Pivot Point

A daily trading pivot strategy can be fantastic for identifying and acting on critical support and/or resistance levels. Especially useful in the Forex market. It can also be used by range-limited traders to identify entry points, while trend and breakout traders can use pivot points to find key levels they should stop at to count as breakouts.

Pivot Point Calculation

A pivot point is defined as a rotation point. The pivot point is calculated using the previous day’s high and low prices and the security’s closing price.

Accuracy is often compromised when pivot points are calculated using relatively short time periods of price information.

So how do you calculate the pivot point?

- Central pivot point (P) = (high + low + close) / 3

The pivot points can then be used to calculate support and resistance levels. To do so, you must use the following formula:

- First resistor (R1) = (2 * P) – low

- First Support (S1) = (2 * P) – High

Then, the second support and resistance levels are calculated as:

- Second resistor (R2) = P + (R1-S1)

- Second support point (S2) = P – (R1-S1)

Apply

For example, when applied to the FX market, you will find that the trading range of a session often occurs between the pivot point and the first support and resistance levels. Because a large number of traders play this range.

It is also one of the systems and methods that can be applied to indexes. For example, it can help you come up with an effective S&P day trading strategy.

Limit your losses

This is especially important if you use margins. Day traders usually have higher requirements. Trading on margin makes you increasingly vulnerable to sudden price movements. That’s right. This means the potential to generate bigger profits, but it can also result in significant losses. Fortunately, stop is available.

Stop-loss controls your risk. In a short position, you can place your stop loss at a level above the recent high, and in a long position, you can place it below the recent low. It may also depend on volatility.

For example, stocks move at £0.05 per minute, so losing £0.15 on an entry order could swing in the expected direction.

One popular strategy is to set up two stop losses. First, you place a physical stop loss order at a specific price level. This will be the most capital you can afford to lose. Second, you create a mental freeze. Place this at the point where the input criteria is violated. So if a trade takes an unexpected turn, you get out of it quickly.

Forex trading strategies

Forex strategies are inherently risky as you need to accumulate profits in a short amount of time. Apply all of the above strategies to the Forex market or see our Forex page for detailed strategy examples.

Cryptocurrency trading strategies

The exciting and unpredictable cryptocurrency market offers many opportunities for switched-on day traders. You don’t need to understand the complex technical makeup of Bitcoin or Ethereum, nor do you need to have a long-term view of their viability. Use a simple strategy to profit from this rapidly changing market.

Stock trading strategies

Daily trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. Below are specific strategies that can be applied to the stock market.

Moving Average Crossover

You need three moving averages.

- One set with 20 cycles – fast moving average

- One Set in 60 Periods – Slow Moving Average

- One Set in 100 Periods – Trend Indicator

This is one of the moving average strategies that generate a buy signal when the fast moving average exceeds the cross moving average. A sell signal is created when the fast moving average crosses below the slow moving average.

Therefore, a position is opened when the moving average crosses in one direction, and a position is closed when it crosses again in the opposite direction.

How do you know if there is a trend for sure? If the price bar stays above or below the 100 line, a trend has begun.

For more information on stock strategies, visit our Stocks and Stocks page.

Spread betting strategies

Spread betting allows you to speculate on numerous global markets without actually owning any assets. Also, the strategy is relatively simple.

See our spread betting page to reveal some of the best daily trading strategies.

CFD strategies

Developing an effective daily trading strategy can be complicated. However, the task can be somewhat easier if you choose a tool like CFD.

CFDs are concerned with the difference between where a trade enters and exits. Its popularity has skyrocketed in recent years. This is because you can profit when the underlying moves relative to your position, without having to own the underlying.

For CFD specific day trading tips and strategies, see our CFDs page.

Regional differences

Different markets present different opportunities and obstacles. Daily trading strategies for Indian markets may not be effective when applied to Australia. For example, some countries may not trust the news and therefore may not react the same way as they expect the market to return.

Regulation is another factor to consider. Delivery strategies can be tailored to fit specific rules, such as high minimum share balances in margin accounts. So get online and make sure no dubious regulations affect your strategy.

You may also find that different countries have different tax loopholes. Although you live in the West, you should do your homework first if you want to apply your daily trading strategies in the Philippines.

What type of tax do I have to pay? Do I need to pay overseas and/or domestically? Marginal tax differences can have a large impact on a day’s profit margin.

Crisis management

Stop Loss

An effective strategy takes risks into account. If you don’t manage your risk, you’ll lose more than you can handle and be out of the game before you know it. That’s why you should always use stop loss.

The price may appear to be moving in the direction you want it to go, but it can always reverse. Stop-loss controls that risk. You close the trade and incur minimal losses if no assets or securities come through.

Savvy traders typically do not risk more than 1% of their account balance in a single trade. So if you have £27,500 in your account, you can risk up to £275 per trade.

Position size

You can also choose the perfect position size. Position size is the number of shares won in a single trade. Consider the difference between the entry price and the stop loss price. For example, if your entry point is £12 and your stop loss is £11.80, your risk is £0.20 per share.

Divide £275 by £0.20 to find out how many trades you can make in a single trade. You can use up to 1,375 shared location sizes. This is the maximum position you can take to stay within the 1% risk limit.

Also make sure you have enough in your stock/assets to absorb the size of the position you use. Also, if your position size is too large relative to the market, you may lose money on entry and incur losses.

Learning methods

Videos

Everyone learns in a different way. For example, some will find daily trading strategy videos most useful. That’s why many brokers offer different types of daily trading strategies in easy-to-follow educational videos. Go to the Learn & Resources section to see what we have to offer.

Blogs

If you are looking for the most effective daily trading strategies, we recommend visiting our online blog. Often free, you can learn daily strategies and more from experienced traders. Also, blogs are often a source of inspiration.

Forums

Some people will learn best in a forum. Because you can comment and ask questions. Also, you can find daily trading methods to make it easy for anyone to use. However, because space is limited, you usually only get the basics of a daily trading strategy. So if you’re looking for more in-depth skills, you might want to consider alternative learning tools.

If you want a detailed list of the best trading strategies, the PDF is often a fantastic place. Their first advantage is that they are easy to follow. You can open it when you try to follow the instructions of your own candlestick chart.

Another benefit is that they are easy to find. For example, you can use the price action patterns PDF download with a quick Google to find daily trading strategies. They can also be very specific. So finding a specific instrument or forex PDF is relatively simple.

It is also suitable for traders of all experience levels. So, you can find PDFs for beginners and PDFs for advanced users. You can also find country specific options such as Daily Trading Tips and India PDF Strategies.

Books

However, PDFs simply don’t go into the level of detail found in many books. The books below provide detailed examples of daily strategies. Easy to understand and easy to understand, making it ideal for beginners as well.

- Simple Strategies – Powerful Day Trading Strategies for Trading Futures, Stocks, ETFs and Forex, Mark Hodge

- How to Day Trade: A Detailed Guide to Day Trading Strategies, Risk Management and Trader Psychology, by Ross Cameron

- Day Trading Strategy: Proven Steps to Trading Profits, Jeff Cooper

- Day Trading Guide : Practical Manual by Markus Heitkoetter Professional Day Trading Coach

- Stock Trading Wizard: Advanced Short Term Trading Strategies, Tony Oz

Therefore, weekly trading strategy books and e-books can greatly help you improve your trading performance. If you want to get more hits, please visit our Books page.

Online courses

Others will find an interactive and structured course the best way to learn. Fortunately, there are now many places online that offer such services. You can find courses on daily trading strategies for commodities and here you can look at crude oil strategies. Alternatively, you can find daily trading FTSE, gap and hedging strategies.

Trading for a living

If you are ready for a full day job and want to start trading daily for a living, we have a challenging but exciting journey for you. You should look around for advanced strategies as well as effective risk and money management strategies. Discipline and a solid understanding of your emotions are essential.

For more information, please visit our ‘Living Transactions’ page.

final word

Your end profits will be highly dependent on your hiring strategy. So, whether you are interested in gold or NSE, you should keep in mind that this is a simple strategy to be successful.

Additionally, technical analysis should play an important role in validating your strategy. Also, risk management is essential if you want to still have cash in the bank over the weekend, even if you choose an early entry or exit trading strategy. Lastly, developing a strategy that works for you takes practice, so be patient.