Strategy is a key element of long-term binary options trading. The best binary trading strategy can be defined as: Ways or signals to consistently make a profit. Some strategies may focus on expiry times such as 60 seconds, 1 hour or trade close, others may use specific systems (such as the Martingale) or technical indicators such as moving averages, Bollinger Bands or breakouts .

A trader just wants a strategy that works. Novice investors may be interested in the 3 binary options strategies for beginners presented in the “Strategies for Beginners” section. Advanced traders will find forex strategies, scalping or arbitrage trading tips, and MT4 strategies. Whatever you want to learn about strategy, you can find it here.

This page provides definitive resources for binary trading strategies. No more searching for books, PDFs, videos, software downloads or ebooks! This page lists numerous strategies that work, but remember:

strategy guide

When trading binary options, you need a way to trade more loses and win, crucially in a winning strategy: the dividend payout ratio covers more losses than it covers. Digital trading usually pays less than 100% of your investment. So just winning more trades than you lose may not be enough to make long-term profits.

The art of trading binaries shares some similarities with the world of sports betting. An important characteristic linking the two companies is the characteristic of expectations. Long term profit trading binaries can only be derived if the expectation (theoretical profit within any trade) results in a positive expectation from that trade.

Binary options trading strategies are therefore used to identify repeatable trends and situations where trades can be made with positive and profitable expectations. It can be as simple as:

- If asset ‘X’ is valued for 3 sessions in a row, open call options during the next session.

The above is a very simple example of a trading ‘strategy’. Strategies don’t have to be complex (though they can be), but sometimes the simplest strategies work best.

Types of Trading Strategies

There are various techniques that can be used to identify binary options strategies. New investors may want to explore everything. Each investor is profitable if used correctly.

In addition to the types of basic or traditional trading strategies highlighted above, there are other methods as well.

- Charts and technical analysis charts (analysis of graphs and other technical indicators) come first when discussing strategies. Much has been written about trends and patterns that appear regularly on price charts, many of which can be directly translated into trading strategies. It’s not always easy to keep a simple strategy while trying to drill into technical analysis, but it provides insights you won’t immediately know elsewhere.

- Fundamentals – Fundamental analysis is a prerequisite for almost any type of investment or trading. However, when it comes to binary options trading, the time scale is too short for the fundamentals to move price in the expected direction. Still, there are binary options trading that can come from a study of the basics and is another potential path to a successful strategy. Especially long-term options. Some brokers now offer expiry times of one to two months, making these strategies even more realistic.

See why price action matters.

Advantages of a good trading strategy

A good binary trading strategy simplifies many decisions about where and when to trade. As all the keys to timing deals are around, the less guess work the better the entry and exit points. Especially suitable for less experienced traders.

A repeatable strategy always highlights trading opportunities, otherwise you will miss most openings. The strategy encourages discipline, helps with money management and provides the clearest predictor of positive expectations. While it is possible for traders to profit from binary options without a strategy, it will be exponentially difficult.

Novice traders can also benefit from just trying to build their own binary options trading strategy. Once it took time to analyze the different methods and strategize from scratch. It is much easier to evaluate strategies offered by others. Without an initial grounding in the art of trading strategies, it is very easy to become addicted to the myriad promises of wealth using other people’s trading strategies or expensive software.

A demo account can be a great place to experiment with binary options trading strategies without risking your capital. Read the full list of demo account brokers here.

Major Brokers:

Elements of a Profitable Strategy

There are three binary strategy elements that every trader should know about. This article presents each type strategy and examples for beginners and advanced traders.

Here’s what you learn in detail:

- What Types of Binary Options Strategies Are There?

- Why do you need a trading strategy?

- Why do you need a money management strategy?

- Why do you need an analysis and improvement strategy?

- With this information, you can instantly choose the right strategy and become a successful binary options trader.

Select sub-strategy

Three sub-strategies must be combined to create a successful binary options strategy.

- trading strategy

- money management strategies

- analysis and improvement strategies.

Each of these strategies does a very specific thing. You need all three to be successful. Without one, the other two become useless.

Let’s look at each type of sub-strategy and see how to find the right one.

Why You Should Use Strategies

Trading strategies are the most famous type of sub-strategy for binary options. It is very famous that many traders make the mistake of thinking that this is the only strategy they need. But more on that later. For now, let’s focus on how to find a good trading strategy.

Trading strategies will help you find profitable investment opportunities. It defines which assets to analyze, how to analyze them and how to generate signals.

For example, a trading strategy can be defined to only trade large currency pairs between 8:00 and 12:00 AM, use a 15-minute price chart, and invest in a 10-period moving average and a Money Flow Index (MFI). Both point in the same direction. For example, if the moving average is pointing up and the MFI is in an oversold area or vice versa.

The great advantage of these clear strategies is that trades can be repeated. Always make the same decisions in the same circumstances.

value investing

Since binary options is a numbers game, these trading methods are critical to your success. While financial investments usually include the risk of losing trades, the short-term frames of binary options are particularly erratic. We’re not entirely sure what will happen next. Even the best traders will only win 70-80% of their trades, and those with high paying strategies may even benefit from a 30% win rate.

Successful trades are not always right. That means they are often right enough to turn a profit. Think of a coin toss. If you win 50% of your trades and get double your investment on the winning trades, you know you will break even after 100 flips. However, I knew that if there was a way to increase my win rate to 60%, I could make money. Even if there are ways to increase payouts. Your trading strategy will do exactly this for binary options trading.

hitting rate

For example, if you trade a high/low option, the average payout is 70-75%. This means you have to win 60% of your trades to make money. Our trading strategy will help you identify situations where you can win over 60% of your trades and make a profit if you always invest according to your strategy.

Without a specific trading strategy, you never know if you can win enough trades to make a profit. One day you’ll get lucky and make a lot of money, but another day you’ll lose half of your account balance. Sooner or later, you will have a bad day and lose all your money.

A trading strategy can help you avoid such disasters. A trading strategy is an important cornerstone of long-term trading success.

Why use Money Management?

A money management strategy is the second cornerstone of trading success. Let’s go back to the example of flipping a coin to understand its purpose. Even if you have a preferred strategy, for example guaranteed to win 60% of your flips, this strategy will lead to disaster if you bet all your money all the time. You may win the first one, but it will soon turn over and all your money will be gone.

To avoid bankruptcy, you must limit your investments. This is the first purpose of any money management strategy.

The second purpose is to help you align your investments according to your capabilities. Going back to the coin flip as a strategy that wins 60% of trades, let’s look at a number of money management strategies that can fail.

- Always invest the same amount. Starting with £100 and investing £1 on every trade you can make good profits at first. You will also have plenty of room to survive a streak of bad luck. However, as your account balance increases, your investment will soon decrease in size. For example, if you reach 1,000 pounds, just winning 1 pound won’t make much of a difference. The problem with this type of money management is that it doesn’t grow with you.

- Invest in how you feel. Some traders vary their investments based on their intuition. They invest more when they feel or win their last trade. This strategy is risky because the losses outweigh the wins. When these traders lost several trades in a row and invested a little more on these trades, they lost a significant portion of their entire account balance. It is difficult to re-invest because you have to drastically reduce your investment. Step by step they lose more money. The hole they dig will always be bigger than your ability to get out of them.

- Invest more after a loss. Some traders increase their investment by doubling their investment after a loss. They hope to eventually win the trade, make a profit, and start the cycle anew. These strategies work until they fail. Even if you choose to make a very small initial investment, binary options allow you to make many trades that will bankrupt you within a year.

Lessons in Money Management

What can we learn from these examples of failed strategies? I have three classes.

- You must reconcile your investments to your full account balance.

- It is necessary to accurately define the amount invested and the amount invested in proportion to the total account balance.

- You should reduce your investment after losing trades and increase your investment after winning trades.

To meet all three of these criteria, a good money management strategy always invests a minimum percentage (2-5%) of your overall account balance. For example, if you decide to invest 2% per trade, you will invest £2 with an account balance of £100. If your account balance increases to £200, you can invest £4 per trade and so on.

Whether you should invest 2% or 5% on every trade depends on your risk tolerance and strategy. You can make more money by investing more, but losing a line is more expensive. We recommend using a demo account to find the right settings for you.

Analysis and improvement strategy

The analysis and improvement strategy is the most overlooked sub-strategy. It helps you find weaknesses in your trades and improve them over time. Without an analysis and improvement strategy, long-term success is at least difficult, if not impossible.

There is still a lot to learn when starting binary options. That means you have to try different strategies, change and improve the parameters of each strategy. This may sound simple, but it’s very difficult to figure out what works for you and what doesn’t. There are so many variables that it’s almost impossible to connect all the dots.

Without an analysis and improvement strategy, newcomers lose out on deals that become endlessly complex. This complexity can be managed through analysis and improvement strategies.

analysis definition

There is no precise definition of an analysis and improvement strategy, but the most common approach is to use a trading diary. A trading journal records all aspects of a decision. After investing, record the indicators used, time period, asset and maturity date. You also write down your location, mood, time of day and trading device. After the transaction is complete, you can check the result.

After a while you can analyze your diary. You may find that you win significantly more trades in the morning in the afternoon, use your phone better than your PC, or interpret moving averages better than forming candlesticks.

Trends to identify strengths and weaknesses

No matter what you find, the results will help you focus on the elements of your trading strategy and money management that suits you and eliminate everything else. You will only get better and eventually you will be good enough to turn a profit. In any case, continuing to keep a journal can help you recognize mistakes that come in before they cost you a lot.

Theoretically, anything could be a trading diary. Some traders take screenshots, others keep excel files, and some write outdated books. Pick a diary that suits you and you will be fine.

Sub-Strategy Conclusion

Binary Options Strategy is your guide to trading success. At first, finding the right strategy based on the right information can seem daunting, but things are rather simple. You need a trading strategy, a money management strategy and an analysis and improvement strategy and you will be fine.

Specific strategy examples:

60 seconds expiry

This basic strategy targets 60 seconds (shown as a 1 minute option on some brokers).

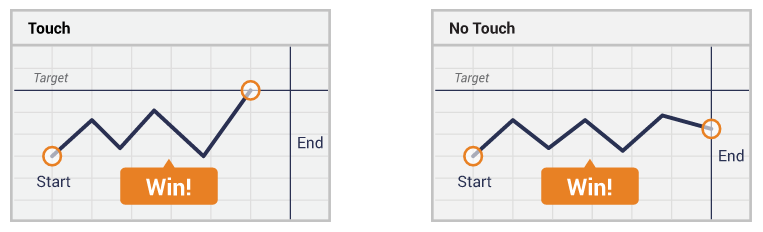

1. Find support and resistance levels in the market where a short-term bounce is possible. Pivot points and Fibonacci retracement levels can be especially useful while trading long term instruments as they are on different timeframes.

2. When you first touch the level, you trade setup. When trading assets with a high level of ‘noise’. I think increasing your trading volume can actually give you an advantage. 60 second / 1 minute trades definitely fall into this category.

For those unfamiliar with this form of analysis for long term expiry: Prior to trading, it is recommended to look for an initial rejection of an already indicated price level. Therefore, it is important to display support and resistance. Rejecting the level helps further validate the robustness of the price level. Trade on subsequent contact. This reduces the amount of trades exchanged with more accurate trades. The first touch is not transacted, but is used to confirm the next transaction. Less transactions, but more accurate.

Increased trading volume by 60 secondary trades

The inherent noise of each 60 second trade is too much to begin with, and I think the trades may actually work to the trader’s benefit more often. It helps to even out the accuracy fluctuations that occur when trading these short expiry times.

The overall accuracy of trading ‘in the money’ will suffer. This means that the expected value of each transaction will be lower. However, higher volumes can compensate.

For example, 100 trades with an expected profit of 1.25 will return 125 (25 profit). But 200 trades with a lower value like 1.18 would make 236 (36 profit). So a lower strike rate doesn’t always mean lower profits if you can find more trades over the same period.

Let’s see another point of view. If you trade 60 second options and only make 1-2 trades in 4+ hour sessions (i.e. very conservative). You will have to wait a long time before your true trading skill level becomes clear.

60 second options can be less profitable. Better to find out sooner rather than later.

3. Do not blindly trade all support and resistance. Continue to consider price action (e.g. candlestick type and composition), trend direction and momentum. They are also open to ‘gut feelings’. Your trading experience will continue to grow and your ‘feel’ on the market will improve. Sometimes, these instincts can override other signals. But keep in mind that many trading lessons are learned the hard way as you lose trades.

momentum strategy

Momentum is an important indicator of how fast an asset’s price is moving. For binary options traders, it can be a great way to find trading opportunities and a useful tool in choosing the right type of binary option for the current market environment.

What is Momentum Strategy?

Momentum is a technical indicator by which an asset’s price compares to historical prices. There are several ways to calculate momentum.

That’s right . This way it compares the current price to the past price and ignores everything in between. The most common absolute interpretation is the momentum indicator, which compares the closing price of the last period to the closing price of 14 days ago (you can choose other numbers, but 14 is the default setting).

process oriented. This method of analyzing momentum considers all cycles and calculates the average cycle distance traveled. Many technical indicators calculate this value in slightly different ways, but the most popular is the Average True Range.

opponent . Some indicators compare the market’s current momentum to historical averages. This indicator helps you understand the type of binary option where the current market environment creates higher payouts but requires strong moves (such as One Touch Options or Ladder Options), or low-risk alternatives that allow you to win trades with small moves. Makes low payouts.

In most cases, this metric presents results as a percentage value of average exercise volume, with 100 being the baseline. The two signs are similar but very different. Let’s see how we can use it to trade binary options.

How can I trade the momentum strategy?

Binary options offer many great strategies for trading momentum. The simplest one uses momentum indicators and boundary options.

Boundary options are an excellent way to trade momentum because they are the only option type that allows you to trade momentum. A boundary option defines two target prices. One is above the current market price and the other is below it. If both target prices are equally far apart, you get a pick as soon as the market touches one of the target prices.

This means that markets don’t matter as long as they move. Momentum can help with these predictions. Assume the asset is trading at £100. The broker offers boundary options with target prices of £99 and £101, read 2 if you adjust your momentum to hit expiry.

Now you know that the market moved twice as much in the recent past than it would have to move to get a boundary option. This looks like a good investment opportunity. When momentum is only 0.5, you know it’s a bad time to invest.

5 minute strategy

A good 5-minute strategy is one of the best ways to trade binary options. There are a few things you need to know to get it right.

What is the 5 Minute Strategy?

The 5-minute strategy is a strategy that trades binary options with an expiry of 5 minutes. While there are possible 5-minute strategies for 5 minutes, there are some criteria that can help you identify the ideal strategy. In the eyes of many traders, 5-minute expiry is the sweet spot for expiry.

- Markets don’t move as randomly as short periods of time, so the risk is reduced.

- You can make a lot of trades in a day, which increases your earning potential.

The 5-minute expiration is the shortest possible but necessary amount of time. You can take advantage of this perfect connection with the 5-minute strategy. Let’s look at two possible 5-minute strategies. Strategy 1: Trade MFI Extremes with High/Low Options With one exception, all 5-minute strategies are based on technical analysis.

Fundamental impact over the next five minutes is insignificant. For example, inventory is not growing because the company behind it is running well. What matters is the relationship between supply and demand on the stock exchange. Whether the trader is currently buying or selling. The only way to understand this relationship is technical analysis. One of the technical indicators that can best describe the relationship between supply and demand is the Money Flow Index (MFI). MFI compares the number of assets sold to the number of assets purchased, generating a value between 0 and 100.

- If the MFI reads 0, everyone who wants to trade the asset wants to sell it.

- When the MFI read 100, everyone who wanted to trade the asset wanted to buy it.

- When the MFI reads 50, the number of traders who want to sell the asset is exactly equal to the number of traders who want to buy the asset.

Our relationship with traders buying and selling allows us to understand what will happen to the price of the next asset. Since prices are determined by supply and demand, a strong movement with too many people already buying and selling consumes one aspect of this relationship. The market must change.

- When too many traders have already bought an asset, there are too few traders pushing the market upwards. Demand will run out and the market will fall.

- When too many traders have already sold their assets, there are too few traders left to push the market down. The supply will run out and the market will rise.

MFI helps identify the following situations:

- When MFI reaches a value greater than 80, the market becomes overbought. It will start to fall off soon.

- When MFI reaches a value below 20, the market is oversold. will rise soon

Binary options provide an ideal tool for trading this prediction.

- When MFI reaches a value greater than 80, invest in lower options.

- When MFI reaches a value below 20, invest in higher options.

This strategy is particularly effective as a 5-minute strategy. During long-term trends (more than one year), the MFI often stays in overbought or overbought territory. Fundamental influences are strong in these periods and may continue to propel the market in the same direction for years to come. In shorter timeframes, the underlying impact is insignificant. It is more important to identify the remaining number of traders buying and selling the asset and draw correct conclusions from this indicator.

MFI is the perfect tool for this diagnosis and binary options are the ideal way to trade.

5 Minute Strategy 2: Trading the News

If you feel uncomfortable with a strategy that uses only a mathematical basis for forecasting, an alternative to technical analysis as the basis for a 5-minute strategy is news trading. When important news hits the market, there is usually a quick and strong reaction. Depending on your preference and risk tolerance, you can trade this reaction for High/Low Options, One Touch Options, or Ladder Options. This strategy works well as a 5-minute strategy. This is because longer expirations face the threat of other events affecting the market and triggering price movements. However, news will dominate the market for 5 minutes after important news is announced.

rainbow strategy

Rainbow strategies for binary options combine sophisticated predictions with simple signals. It is ideal for traders who want to increase their profits using proven and successful strategies.

What is the Rainbow Strategy?

The rainbow strategy is a three moving average crossing strategy. Most traders use different colors for different moving averages, hence the name ͚rainbow͛ strategy. The idea behind the rainbow strategy is simple. Moving averages that use more timeframes in their calculations take longer to react to price changes than moving averages that use fewer timeframes to calculate.

So during a strong move, several moving averages should be in stock from the lowest to the highest in the direction of the current market price.

- The fastest moving average should be closest to the current market price.

- The second fastest moving average will be the second closest to the current market price.

When multiple moving averages stack up in the right way, it shows that the market direction is strong and that now is a good time to invest. This is the basic logic of the rainbow strategy. You could theoretically use as many moving averages as you want for this strategy, but the rainbow strategy uses 3. Three is a good place because it allows you to get things done accurately yet simply.

Adding more indicators doesn’t improve the accuracy much, but using only two moving averages makes it much less accurate without simplifying. These three moving averages determine when to invest.

- If the shortest moving average is higher than the middle moving average, which is higher than the longest moving average, you invest in rising prices.

- If the shortest moving average is lower than the middle moving average, which is lower than the longest moving average, you invest in falling prices.

Multiple time periods are available for each moving average. Still, there are at least two rules to consider.

- Double the number of periods for each moving average. If your fastest moving average uses 5 periods, use 10 and 20 for slower periods. This ratio guarantees that the moving averages are different enough to produce meaningful signals, but similar enough to produce some signals.

- Use popular values. A trading week has 5 days, so we recommend using a multiple of 5 for this strategy. These values help you see the same trading opportunities as other traders, increasing the supply and demand that others will offer in your favor.

How to Trade the Rainbow Strategies with Digital Options

To trade rainbow options with binary options, you have to wait for the moving averages to stack in the right order. When that happens, you have three options for when to invest.

- Invest immediately. Some traders invest immediately when the final moving averages are placed in the correct order. These methods of trading the rainbow strategy generate the most signals and therefore offer the highest potential, but also the highest risk.

- Please wait. Some traders wait for the moving average to stay in order until the end of the next period. If that’s the case, it took very little time, but it gave me a lot of security knowing that the signal was more than the result of sideways movement.

- Wait more than once. Some traders wait for more than one period to confirm a signal. However, if you wait too long, the signal will be less accurate because the market may have already started to turn. I would recommend waiting more than 3 cycles or ignoring the signal. You can trade this strategy with High/Low Options, One Touch Options or Ladder Options. The high/low option is the safest bet. The ladder option has the highest potential. Decide which type of binary option is right for you based on your personality, especially your risk tolerance.

exit strategy

The doomsday strategy for binary options can help you find profitable trading opportunities with only a very limited investment of time.

End of Day strategy explained

A doomsday strategy is not a strategy that tells you which signals to use and when to look for them. This strategy assumes that the best time to trade is at the end of the day.

The end of the trading day reveals some unique characteristics. This is mostly due to the fact that day traders stop trading when the stock exchange closes.

Day traders are traders who do not hold overnight positions. They invest in the short term and claim that a lot can happen overnight, which is why it is unwise to take positions at this time of year.

Since there are many traders during the day, their absence significantly reduces the trading volume. The market is a bit slow and does things other times of the day can’t. Traders with terminal strategies await this environment claiming that the signals are clearer and the trading opportunities are better.

trade close option

While any trading strategy can theoretically be traded at the end of the trading day, there are a few strategies that work particularly well during this period. Let’s take a look at the most profitable trade closing intervals.

The end of the trading day is the best time to trade, as the closing times of trading intervals are particularly likely during low-volume times. Accurate prediction of closing intervals is particularly attractive to traders of higher payout binary options types such as One Touch Options.

A gap is a spike in price action. For example, if an asset trades at £100, and it jumps to £100.1 without including the range, trading at £100.01, £100.02, etc., this will result in a difference of £0.1.

Depending on how this difference arose, it could have different meanings. A gap accompanied by a high volume could be the result of important news reaching the market, which will probably start a new movement. However, by the end of the trading day, these differences are virtually non-existent.

What we find instead is gaps that are likely to close.

At the end of the trading day, there are very few traders left in the market, so a handful of traders, even a single trader, is enough to make the market jump. The resulting difference is weak because it is the result of one person’s decision. Most other traders consider it unjustified in advance and invest in the opposite direction.

- If the divergence points upward, most traders will consider the new price too high. They will sell their assets.

- If the gap points downward, most traders consider the new price too low. They will be buying new assets.

The gap at the end of the day will decrease for two reasons.

With this knowledge you can trade one touch options. When a broker offers a one-touch option at a target price within the gap range, you know the market can reach this target price. Invest if the maturity is reasonable.

Alternatively, you can trade high/low options that predict closing intervals.

expiry strategy

Base Line Expiry

A long time ago we learned how to judge the duration of a given signal. Before you start trading binary options. Here we will explain how to develop an expiry strategy. The first thing you need to do is identify what your signal is.

- trend line bounce

- stochastic crossover

- change in momentum

- candlestick pattern

- or combination

Once done, go back over the chart over a period of time to identify any signals. The time frame doesn’t matter at this point, this technique doesn’t work at all. Show strong and weak signals. Now count the bars or candles each signal takes to move into the money.

Once done, you can take the average of the number of bars you need. Both strong and weak signals go into the money. This average is now the signal’s baseline expiration. If you are using an hourly price chart and your signal takes an average of 3.7 seconds, you are better off using an expiry that matches that hour. This can be noon, end, 4 hours or any other option. The expiry date coincides with the signal horizon. If you use the daily chart the signal takes 3.7 seconds and that means 3.7 days. If you’re using hourly charts, that means 3.7 hours, etc.

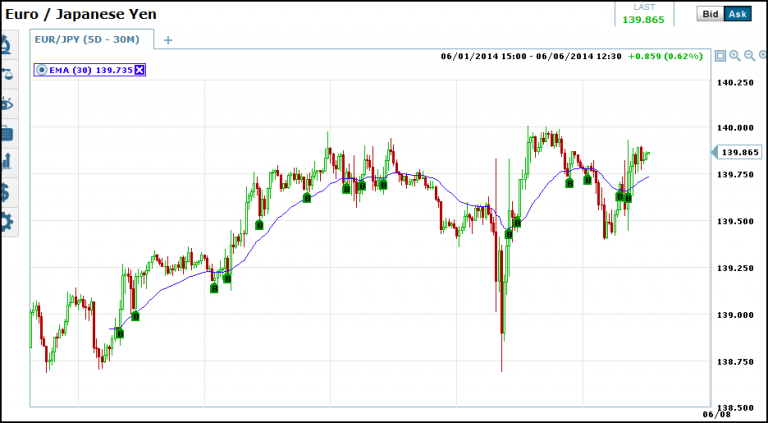

Study the chart below. I will demonstrate using a basic moving average strategy. A 30 bar exponential moving average is used. This figure will drive the price down and count more signals than a simple moving average.

Additionally, we are only selecting the bullish trend following the signal to weed out the false signals and improve the results. So there are 15 signals in total. 6 weak signals and 9 strong signals. On average, it takes 4.2 bars for these signals to move into the money and peak.

That said, since this is an hourly chart, each signal will move towards profitability, peaking that move in about 4 hours. So for expiry I want to choose the expiry closest to 4 hours possible. You can’t trade comfortably if you can’t make good choices. Don’t try or force a trade where it doesn’t make sense.

When classified as weak, the weak signal peaks in about 2.6 hours compared to the weak signal. A stronger signal takes about 5.3 hours. Putting this knowledge into perspective, a weak signal can be anything close to resistance. A strong signal might be one that isn’t close to resistance. Also, strong signals can have long white candles due to price action and move decisively above or above the moving averages, while weak signals can only create small candles and spinning tops.

More Tips For Picking Binary Options Expiration

Choosing an expiration date is one of the most important factors in trading. Another key factor is orientation. All too often I get asked why a deal went bad at the last minute. One of the most common error areas I’ve found is choosing to expire.

Of course, any analysis, trend, or random event can also have errors. However, the focus of this discussion is maturity. It is clear that you do not want to use 60 second expiry when trading on the weekly chart. Similarly, when trading the 60 second chart, I would not use expiry expiry. So how do you know what is the best expiry date?

One question you should ask yourself is whether you are trading or against the trend.

When trading with trends, we suggest shorter expirations over longer expirations. Simply because the probability of an extended moving counter to the trend is small. Expiration should be more precise. Expiration may be slightly further away if you trade with the trend.

Trends following a trade do not have to be exact as they are more likely to close out of the money. Signals that follow a trend are much more likely to be in the money than signals against a trend.

Another factor that expiry can have the most impact on any given trade is support and resistance. The price level relative to a support or resistance level is a factor in how likely a trade is to move in a given direction.

If the price is near and away from the S/R line, the option is much more likely to close out of the money than if the price is near and moves towards the S/R line. When price moves towards one of these lines, the movement is much more likely to stop and/or reverse than when price moves away from one.

So how does this apply to expiry? If you receive a signal that is likely to stop or reverse, you want to choose a shorter expiration than if the same signal were not facing an S/R level. I intentionally didn’t say call or put, bullish or bearish. This is because it applies to both bullish and bearish trades. Support and resistance can also be in the form of interesting price action or lines drawn on areas of peaks, moving averages, Fibonacci, envelopes and bands.

1 hour strategy

With binary options, you can make more than 70% profit in 1 hour. Compare this to stocks and you will understand why binary options are so successful. There are a few things you need to know to trade the 1 hour strategy with binary options. This article explains them.

We detail the three important steps to trading the 1 hour strategy using binary options.

- Step 1: Find the Right Indicator

- Step 2Find the Right Time Zone

- Step 3: Finding the Right Binary Options Type

These three steps will allow you to instantly create and trade successful 1 hour strategies using binary options.

Step 1: Find the Right Indicator

The first step in trading the 1 hour strategy with binary options is to decide what type of indicator you will use to generate your signals.

To find the metric that’s right for you, there are a few things to consider.

- your abilities. Some strategies are ideal for traders with good pattern matching skills. Others are ideal for traders with large numbers. To create a successful strategy, you must align your strategy with your skills.

- your personality. Some indicators produce many but dangerous signals. Others are reliable but produce less signal. Depending on your tolerance, you should choose the type of indicator that will help you sleep at night and not get bored.

- daily schedule. Some indicators require trading during certain times of the day. For example, traders with closing gaps can find the best signals during slow market conditions to close their trades. Also, some metrics require more time to analyze than others. Choose metrics that you have plenty of time for and that fit your schedule.

With these criteria clearly defined, let’s look at some indicators for each type of trader. To keep things simple, we will focus on strategies you can trade throughout the day. We will later mention some strategies that can only be traded at special times.

On the main criterion, we divide strategies into pattern matching and numerical strategies.

- To use a pattern matching strategy, you need to look for specific patterns in asset price movements.

- Numerical strategies must interpret numerical values.

Furthermore, it divides strategies into high-reward and low-risk/risk strategies and fast and detailed strategies.

- High-reward strategies are risky but have a lot of potential, and low-risk strategies are safe but have limited potential.

- A quick strategy will take less time but you will have to blindly trust the indicators, a detailed strategy will take more effort but it will be easier to trust the signals.

Let’s see how other strategies fit these criteria.

| pattern matching strategy | numerical strategy | |

| high reward, fast | Simple candlestick analysis. This strategy trades special structures of 1 to 3 candlesticks. Finding these configurations is quick and easy, but lacks the reliability of more complex signals. However, because there are so many candlesticks, you can win more trades than any other strategy if you play this strategy well. | MFI’s trading in extreme areas. The Money Flow Index (MFI) creates a value between 0 and 100 representing the strength of the movement. Values above 80 indicate that the market has little room to rise, and values below 20 indicate that the market has little room to fall. All you need to do is invest in low options when the market reaches a value greater than 80, and invest in high options when the market reaches a value below 20. This strategy can generate many signals, but for a single technical indicator, it is also risky. |

| High reward, detailed | swing trading. During a trend, the market moves up and down. Swing traders try to take advantage of each of these moves. While this strategy offers many trading opportunities during trends, trading a single swing is always riskier than trading the entire trend. | Trading ATR and ADX as perimeter options. ATR calculates the average extent of past moves, directional strength of ADX. Both values can be used to predict whether the market has enough energy to reach one of the target prices. This strategy generates many signals and can create high payouts, but it is risky. |

| low risk, fast | 3 Moving Average Crossover Combining 3 moving averages creates a very safe signal. You need to do almost nothing to put your strategy into action. Sit back and wait for the software to generate a signal. On the downside, this strategy produces very little signal, limiting its potential. | The difference between MFI transactions. If the MFI’s movement doesn’t reflect the market, the current trend is a serious problem. For example, in an uptrend, if the market makes a new high but the MFI does not make a new high, the market will soon fall. You can take advantage of this prediction by investing in lower options. This strategy can generate safe signals with a small investment of time. |

| low risk, detailed | continuation and reversal patterns. A continuation pattern is a large price construction that allows accurate predictions. Although these patterns are rare, they can account for a high percentage of your trades. | Combining multiple technical indicators By themselves, any technical indicator is unreliable. However, combining multiple indicators can filter out bad signals and create a more reliable strategy. For example, combining MFI with RSI or ADX is a good idea. These strategies produce fewer signals because they filter out some of them. |

Step 2: Finding the Right Time Frame

Once you’ve found the right indicator, you’ll need to consider which time zone you’ll be using. We create a strategy with an expiration time of 1 hour to give you the first indication. However, depending on which indicator you use, you will have to trade very different timeframes.

A chart’s time frame defines the amount of time that is aggregated into one candlestick. For example, if you are looking at a chart with a time span of 15 minutes, each candlestick on the chart represents 15 minutes of market movement. When looking at a chart with a time frame of 1 hour, each candlestick represents 1 hour of market movement.

Creating a signal on a chart with a time of 15 minutes creates a different signal than a chart with a time of 1 hour. To trade a successful 1-hour strategy, you need to find the right signal type for your indicator.

For one-hour strategies, every indicator requires a specific time frame within which the indicator’s forecast is valid and expires. Let’s look at an example of pattern matching.

- Simple candlesticks work best in hourly increments. A simple candlestick consists of 1 to 3 candlesticks, so your predictions only apply to the next candlestick. After that, the candlestick can be overridden by other influences and loses its predictive power. Therefore, you should only trade predictions expiring within the next candlestick. An expiry time of 1 hour means using a time frame of 1 hour.

- For swing trading, keep your time around 5 to 10 minutes. Swing takes time to develop. Trading the chart with a 5 minute time span and a 1 hour expiry time, you will have a candlestick at 12 swings. This is a good value for most trends. You can also try the 10 minute chart if you find the timing is a bit off.

- The 3 moving average crossover works best in the 1-5 minute time frame. When exchanging the 3 moving average crossover, you are looking for a movement involving many candlesticks. It is best to trade 3 moving averages in 5 minute increments, but you can also switch to a 1 minute chart if you want to give it more time. Everything else will be either too long or too short, respectively.

- Reversal and continuation patterns offer many opportunities. You can trade continuation and reverse patterns by either trading the long movement indicated or by trading the short breakout that occurs after the pattern completes. In the first case, you should use a time frame of 5-10 minutes to give your movements enough time. In the second case, you should trade the 4-hour or 1-day timeframe to ensure you actually trade the breakout and no more trades.

As you can see from this list, the indicator type predetermines how much time should be used for the one-hour expiration. Some indicators predict where the next candlestick will go, and in this case, long expirations are needed to adjust the length of one candlestick to the expiration. Other indicators predict long moves, in which case you need to trade shorter timeframes to give the market enough time to develop a full move.

This rule also applies to numerical strategies.

- Trading in extreme areas of MFI works best with a period of 5-10 minutes. This strategy allows for two trading styles. Some traders like to invest when MFIs enter extreme areas. Some invest when they get out of extreme situations. The first type uses a shorter time span to give the market a longer time, ideally (5 minutes or more). The second type allows you to trade longer time periods, ideally 10 minutes.

- For MFI quarters, use 1 minute or 5 minute time frames. When an MFI exits the market, it may take several hours for the market to catch up. Keep your time short to create these signals in an ideal environment for a one-hour strategy. A 1-minute or 5-minute chart provides an ideal environment for this strategy.

- For multiple technical indicators, use 15-minute charts. Combining multiple technical indicators creates a short to medium signal. These work best in a time range of 15 minutes. Of course, the ideal time range depends on your final strategy and the technical indicators you use. Adjust the time zone if necessary.

These recommendations are a good place to start for each strategy. However, these are only recommendations. Every trader is different, so if you get better results with a different time frame than our recommendation, use whatever one you like. There is no right or wrong, except for making money or losing money.

Step 3: Find the Right Trade Type

After matching the indicator to the period, it must match the binary options type. Binary options offer many different types, and each type has its own unique risk and reward relationships.

Let’s take a closer look at the different options types to explain how they relate to strategies. While it is difficult to make general recommendations, some binary options are better suited to some strategies than others.

- A high/low option is a typical option type, allowing you to predict whether the market will rise or fall over a period of one hour. High/Low options are low-risk trading methods that work well with all of these strategies because they allow you to win trades with the smallest possible move in the right direction. When executed well, each strategy should have a good enough percentage to make a profit.

- One-touch options define a target price, and you get an option when the market reaches this target price. The market does not have to hold this target price. This is a huge plus, but since the target price is farther away, a stronger move is needed. One Touch Options are great for trading simple candlesticks that predict strong moves such as breakouts and strong candlesticks in continuation and reversal patterns. also

- Ladder options allow you to define multiple target prices and whether the market closes above or below each target price. They allow risky bets that can generate the highest payouts of all binary options and safe bets that allow for high win rates. Traders in pattern matching strategies in particular can benefit disproportionately from this premise.

- Boundary options are one-touch options that have two target prices above and below the current market price. Obviously, boundary options are ideal for trading ATR and ADX. Boundary options are the only type of options you should trade with this strategy. For all other strategies, the boundary option is not suitable. All of these strategies provide clear predictions of where the market is going. The boundary option doesn’t need to predict the direction, so it wastes part of the prediction. You can get higher payouts and win many trades by trading one touch options.

1 Hour Strategies That Require Special Trading Hours

The beauty of all strategies in this post is that they work well in any market environment, any time. As a result, it can be used by any trader. However, there are also strategies that specialize in specific trading environments or specific times. These strategies may be better suited for traders looking to trade these environments anyway.

The most prominent example of this type of strategy is trading gaps. A gap is a spike in market price when the market moves from one price level to a much higher or much lower price level.

- If the gap is accompanied by high volume, it could indicate the start of a new move or the consolidation of an existing move. There is enough momentum for many traders to leave the gap behind and continue to push the price in the direction of the gap.

- The gap may close when trading volume is low. Few traders leave that gap behind, and most traders will consider it an unjustified development. They will invest in the opposite direction and the gap will close.

The beauty of closing the gap is that it provides one of the most accurate predictions you can find with binary options. Accurate expiry is possible with a variance within the next period, and the variance makes the target price clear.

Alternative transaction type

This information allows you to trade One Touch Options or Ladder Options. You should be able to win high percentage trades which means you get high payouts and you have a strong strategy on your hands.

The downside to this strategy is that it is difficult to find gaps that occur when volumes are low. There is too much volume in the market, and too little volume. Therefore, a small gap occurs near the end of the volume.

Many traders are day traders. They close their positions at the end of the day and do not hold positions overnight. These traders will stop trading when the market closes because there is not enough time for other trades.

trading hours

When day traders leave the market, trading will drop significantly. Now you can find gaps. Monitor all time frames from 15 minutes to 1 hour and predict closing intervals by exchanging found intervals with one-touch options with expiry times of 1 hour.

Traders who work during the day and can only trade after work can use this strategy to make a profit despite the work.

The important thing here is that you can trade successfully even if your time is limited. If you need to trade on your lunch break, you can also find successful strategies for this limit.

As with everything in life, success means using your limits to the fullest. Binary options can help you trade more successfully than without limits.

1 Hour Strategy Overview

The 1 hour strategy is one of the most popular types of trading strategies. It means that by combining expirations that seem natural to us with a wide range of possible indicators and binary options types, any trader can create a strategy that is ideal for them.

Whether you prefer pattern matching or numerical strategies, high-potential or low-risk approaches, simple or complex predictions, you can create a one-hour strategy based on any combination of these characteristics.

Unless you are trading boundary options with ATR and ADX, we recommend starting with High/Low options, these are the easiest types for beginners.

double red strategy

The double red strategy is an easy-to-execute strategy that allows binary options traders to find many trading opportunities. Here’s how to run it:

What is the Double Red Strategy?

The double red strategy is a trading strategy that attempts to identify markets where prices are declining. The double red line in the name indicates the fact that the strategy waits for two periods of decreasing price before generating a trading signal. Periods with periods of decline are often marked in red on trading charts.

The logic is simple. At significant price levels, the market often takes time to sort itself out. However, after sorting it out on its own, it is a great investment opportunity as downtrends in price are often stronger and more linear than uptrends.

For example, suppose we have a resistor. If the market reaches this resistance, it will never go back immediately. It gets closer and closer, tests the resistance a few times and eventually goes back. Turnaround times can be great trading opportunities, but finding the right timing is difficult. In the process of approaching and resisting resistance, the market has already created several periods of lower price that will not lead to a turnaround. You shouldn’t invest in this period.

To find the right time, the double red strategy waits for a second consecutive price drop to confirm a turnaround. When these periods occur, the market does not move around the resistance, but begins to break away from it again. Double red traders will now invest.

How to Execute the Double Red Strategy

To execute the double red strategy with binary options:

- Choose a shorter timeframe for your chart. Binary options are short-term investments and the chart period should reflect that. Choose a duration between 5 minutes and 1 hour.

- Find your resistance level. Sometimes, you can find resistance levels directly on a chart. A technical indicator can be added if the price itself does not provide a resistance level. Bollinger Bands and technical indicators of significant duration (e.g. 20, 50, 100, 200) usually provide large resistance levels that affect the market.

- Invest when you find two red periods in a row. If the market is close to resistance, monitor price movements closely. If two periods appear consecutively, predict a price decline. Most traders use low options for this strategy.

You can also use One Touch Options or Ladder Options if you want to add another indicator (e.g. average true range) and take a little risk.

Keep maturity short. The double red strategy generates signals based on two candlesticks, so the predictions are valid for very few candlesticks as well. Ideally, limit expiry to one or two candlesticks. For example, on a 15-minute chart, expiry dates are 15-30 minutes.

Strategies for Beginners

From potential risk to risk aversion, here are the 3 best strategies for beginners.

- What should beginners know?

- Risk Hedging Strategies: The Next Trend

- High Potential Strategy: Trade Volatility

- Intermediate Strategy: Trade Gap

With this information, you can find the best strategy to start trading binary options as a complete newcomer.

What should beginners know?

Binary options strategies for newcomers must meet some special criteria. It should be simple but effective, understandable and profitable. There are many complex strategies that can make money if executed perfectly by a trader.

However, newbies get overwhelmed, make mistakes and lose money. The goal of a good strategy that allows newcomers to create similarly positive outcomes while simplifying the strategy.

Let’s look at some strategies that can help you meet these criteria. We will present risk-averse strategies for traders who want to trade safely, risky strategies for those who want to maximize their earnings, and intermediate versions.

Beginner’s Method of Risk Hedging: Trend Tracking

The following trend is a safe and simple strategy that even beginners can execute. A trend is a long-lasting movement that makes a market make new highs and lows.

- A move that pushes the market to new highs is called an uptrend.

- A move that moves the market to a new low is called a downtrend.

The trick with trends is to understand that they never move in a straight line. The price of an asset is determined by the relationship between supply and demand, and there is no perfect movement where demand always exceeds demand or vice versa. It is possible for any trader to continue buying or selling continuously. The period for the market to gain new momentum should always be short.

This period is called concatenation. During consolidation, the market turns around or moves sideways until enough traders are willing to invest in the main trend direction.

The alternation of movement and reinforcement creates a zig-zag line in a specific direction. This is a trend.

- An uptrend moves the market up two notches, then one notch down, then two notches up again. etc.

- A downtrend takes the market two notches down, one notch up, and two notches down again. etc.

Find a trend

Looking at a price chart of a stock, currency, or commodity that has risen or fallen over a long period of time, you can find a trend for anything. A trend can last for several years, but if you zoom in on the price chart, you’ll see that every move is a trend on the 1-hour chart when viewed in a straight line on the daily chart. What appears to be a straight-line movement on the 1-hour chart becomes a trend on the 10-minute chart.

There are several levels of trends. No matter what timeframe you want to trade, there is always a trend you can look for.

Once you’ve identified a trend, you have a few other options.

- Invest in high/low options. This is the simplest strategy. When you recognize an uptrend, invest in higher options. If you see a downtrend, invest in lower options. Choose expiry by full cycle. If the uptrend takes 30 minutes and you want to create new highs and lows, choose a 30 minute expiry. Then the market should definitely be higher than it is now. You can also use double or triple expiry as cycles if you prefer. Keep it in multiples of your typical cycle length. Once you become familiar with this strategy, you can monitor disturbance fluctuations with the Money Flow Index (MFI) and Relative Strength Index (RSI) to assess the remaining strength of the trend or add moving averages to your strategy.

- Invest in one-touch options: By discovering trends, you can predict how fast the market will rise or fall. For example, if you know that the trend has increased the price of an asset by £0.1 every 15 minutes, you can calculate the trajectory of the trend and invest in One Touch Options. If your broker offers you a one touch option with a target price of £0.15 off the current market price and an expiry of 30 minutes, you know the market is likely to reach this target price. Find trends, check the broker’s one-touch options, and invest when you find them within your range.

- Combine both strategies. You can also combine both strategies. Once you find a trend, calculate whether it makes sense to invest in high/low options in the direction of the trend and invest in one-touch options. If so, invest in both options. If not, just use the High/Low option.

These are relatively safe strategies, so you can afford to invest a little more on each trade. We recommend 3 to 5% of your overall account balance.

Potential Beginner Strategies: Trading Swing

The trading swing is a variation of the first strategy following the trend. A swing is a single movement in a trend from high to low and vice versa. Every cycle in a trend consists of two swings. One for upward rotation and one for downward rotation.

Swing traders try to trade each swing on a trend individually, instead of trading the trend as a whole (like a trend follower).

The beauty of this strategy is that every trend offers multiple trading opportunities, not just one.

More trading opportunities means more potential winning trades and more trading opportunities means more money.

The downside to this strategy is that trading the swing is riskier than trading the trend as a whole. You are trading higher potential for higher risk – if that’s a good idea depends on your personality.

- Some traders lose interest if they only trade one option on a trend. They risk diverting from their strategies and making bad decisions. These traders will do better with a swing trading strategy.

- Some trades will get jittery when they follow the third or fourth consecutive swing in the trend. Fearing that the trend is about to end, they will deviate from their strategies and make poor decisions. These traders can do better if they follow the trend as a whole.

level of investment

If you decide to become a swing trader, we recommend using minimal to medium-sized investments per trade. 2 to 3.5% of your overall account balance is ideal. Only traders willing to take risks should invest more, but no more than 5% of their total account balance.

Choose an expiry based on your typical swing length. If you expect a rise time and a typical rise time takes about 30 minutes, use an expiration time of 30 minutes. Choosing the right expiration isn’t an exact science and it takes some experience to find the perfect timing.

Technical indicators can be used to identify ending swings. Momentum indicators such as the Relative Strength Index (RSI) or Money Flow Index (MFI) are popular choices, as are moving averages.

Intermediate Beginner Strategies: Trading The Gap

Trading Gap combines medium risk with high return potential. This strategy is simple enough that beginners can learn it within a few hours.

A gap is an increase in price in the market. At the end of one period, something has had a significant impact on the market, pushing the price to a higher or lower level as the next period’s opening price. Candlestick charts are ideal for finding gaps because they provide a clear visualization of the gap between the close price of one period and the open price of the next period.

gap type

The most common interval is the overnight interval. When the stock market opens in the morning, there is a rush of all new orders placed overnight. If a trader is bullish or pessimistic, most of their orders are likely going in the same direction. Markets rise or fall significantly, and there is a difference between yesterday’s last price and today’s first price.

This difference is a significant event because the same asset suddenly becomes much more expensive. Markets can react to shocks, and some traders may benefit. Or, as the market moves forward, it can provide the sense that this is the start of a strong move.

To know how to benefit from the difference, you need to know the difference between the three types:

- breakaway interval. Gaps occur when moving sideways. During this time, the market is unsure of where it wants to go and builds momentum for its next move. As prices rise and fall and volume rises, the market has created enough momentum to start a new movement.

- You can benefit from this knowledge and invest in higher options on the direction of the gap. Choose an expiration longer than the one period on the chart, as the movement is expected to be longer. For example, if you are trading the 15-minute chart, use a minimum expiry of 15 minutes.

acceleration gap. Acceleration differences occur during trends. Something that strengthened this momentum would have happened while the asset was already moving up or down. The market jumps in the direction of the trend and creates it. In an uptrend, acceleration gaps always occur upwards. In a downtrend, acceleration gaps always occur downwards. - Like breakaway intervals, acceleration intervals also come with a lot of volume. Use expirations similar to gap intervals. Also, accelerating gaps allow you to invest in one-touch options because after the gap the trend moves faster than before the gap. We know that an accelerated trend is more likely to arrive if the broker offers one-touch options where the previous trend has not reached. This could be a great opportunity.

- fatigue gap. Exhaustion gaps are very different from the first two gap types because they signal an imminent reversal. Similar to the acceleration gap, the exhaust gap occurs during strong movements in the direction of motion. The difference between the two gap types is that the exhaustion gap is accompanied by a small amount and the market is already starting to reverse during the period. After an exhaustion breakout, the market is likely to close the gap ahead, providing a great opportunity to trade one-touch options or high/low options.

general gap. Typical gaps occur when moving sideways. They are accompanied by normal amounts and represent random movements that make little sense in the long run. You can invest in one-touch options or high/low options because the common gap is narrowing.

price jump

The basic principles of the four intervals are the same. A gap is a significant price increase, which many traders are now motivated to take their profits from or enter the market. The two forces are pushed in opposite directions of the gap, closing it. The crevices are open, and to create new moves, the crevices must be accompanied by large amounts. This high volume indicates that many traders support this gap, and very few will take profits immediately after the gap or invest in the opposite direction.

Beginner Strategies – Conclusion

Even complete beginners and beginners can find simple but effective strategies to make money.

- Risk-averse traders can follow trends as a whole.

- Increased potential allows traders who are willing to take risks to trade swings.

- Traders who want a good mix of risk and potential can trade the difference.

risk-free strategy

Using binary options risk-free strategy is every financial investor’s dream. While not possible with some investments, binary options can get you closer than others.

Is a risk-free strategy possible?

There is always a risk when investing. Despite all efforts to predict what the market will do next, no one has always found the right strategy. Sometimes markets move in unpredictable ways and do things that seem irrational.

In hindsight, we often find good explanations for these events. As a trader, you have to make sure that this offspring bias doesn’t confuse you. At the end of the trading day, it’s easy to say that this event moved the market the most. However, at the start of a trading day, it is nearly impossible to predict which of the many events throughout the day will have the greatest impact on the market and how that will affect the market. Even beyond the stock market, financial investments are always risky.

- When you invest in a security with a fixed rate, there is always the possibility that the bank that issued it will file for bankruptcy. Many countries protect your money up to a certain amount, but beyond that you are at your own risk.

- When you buy government bonds, there is always the possibility that the government will go bankrupt. Because bonds have maturities of up to 30 years, a lot can happen during this time.

Simply put: no risk-free strategy is possible for any asset. However, binary options offer some tools with relatively little risk. Let’s see how we can do it.

How to approach a risk-free strategy

Most binary options brokers offer demo accounts which are great tools. A demo account works just like a regular account, but allows you to trade with play funds instead of real money. You can learn how to trade in the risk-free environment of a demo account.

You can try different strategies, find the one that works best for you and perfect it. You can wait until the end of each month to turn it into real trading until you have a solid strategy that will make you money. Although many stock brokers offer demo accounts, binary options have one big advantage. Binary options work on shorter time scales, so you learn faster and better.

- When buying a stock, you have to wait months or even years to know if you are making the right decision. In the meantime, many unique things happen, so in the end you can conclude that the situation cannot be repeated and that you have not learned anything.

- When you trade binary options, you will know in a few minutes if you made the right decision. In the meantime, there are no events that distort the result. Clear results when options expire. You don’t know what you’ve been working on. Because binary options operate on such short time scales, strategies can be written and tested far better than other types of investing.

After trading a strategy with a demo account and making profits for several months in a row, you will find that your chances of making profits when you start trading for real are very good. There is still some risk, but using binary options has helped me eliminate as much risk as possible.

For those still looking for risk-free trading, Arbitrage is another option.

Breakout Strategy

Breakout strategies use breakouts, one of the strongest and most predictable technical analysis events.

What is a Breakout?

A breakout occurs whenever the market completes a chart formation. This completion indicates a significant change in the market environment. The market will get strong up or down momentum, so many traders have to react to the change.

- Some traders close their positions because the event invalidates their predictions. If a trader predicts an increase in price, but the event predicts a decrease in price, this trader closes the position before losing money.

- Some traders will open new positions pointing in the direction of a new trend.

- Many traders will do both. When traders can predict where the market will go, there is no reason why they shouldn’t trade this prediction. Traders who know their original predictions were wrong will invest in the opposite direction.

All three of these possibilities create strong momentum in the same direction.

- When the market completes a downward formation, some traders sell their assets. Some will sell long positions. Both actions create downward momentum.

- When the market completes its bullish formation, some traders will buy the asset. Some will close short positions. Both actions create bullish momentum.

Since most traders anticipate payouts, they automatically fill orders when the market reaches a price level that completes price formation. This command further intensifies the momentum.

How can I trade breakouts with a strategy?

Digital options offer several strategies for small trades. The 3 most popular strategies are:

1. Breakout trades with high/low options. When anticipating a breakout, wait for the market to emerge. Once that happens, invest in high/low options in the direction of the breakout. If the spike is pointing upwards, invest in higher options. If the spike occurs downward, invest in lower options. Use expirations that are one period long. This is a low-risk/low-reward method of trading breakouts.

2. Breakout trading with one-touch options. A breakout is a strong move, making it perfect for one-touch options trading. One touch options define a target price and if the market touches this target price you win the trade. After you see the market crash, invest in one-touch options in the direction of the breakout. This is a risk/medium reward method while trading a breakout.

3. Breakout trading with ladder options. When an asset goes out, invest in ladder options to go out. Choose a target price that you feel comfortable with but still offers a high payout. This is a high-risk, high-reward method of trading breakouts. All three of these strategies work. Choose the one that best suits your personality.

3 Strategies for Bollinger Bands

There are hundreds of strategies using Bollinger Bands. No matter which strategy you use, there are few downsides to adding Bollinger Bands to your chart. Even if you trade or trade directly, having three extra lines is not confusing. On the flip side, it subconsciously influences us to make better decisions.

Nonetheless, we will now present three strategies that not only feature Bollinger Bands but also use them as key components. If you understand these strategies, you can also use Bollinger Bands in your strategies.

Strategy 1: Trade External Bollinger Bands with High/Low Options

This is the simplest strategy and the least risky strategy. It can be explained in two simple steps.

- Compare the current market price to the price range of the Bollinger Bands.

- If the market is near the upper Bollinger Bands, invest in lower prices with lower options. If the market is near the bottom of the Bollinger Bands, invest in rising prices with higher options.

That’s it. Even beginners can put this strategy into action right away.

Still, there are things you should know. Because the Bollinger Bands move with each new period, the upper range of the current Bollinger Band may not be the upper range of the next period. A fast-growing market will push the Bollinger Bands up as well. A rapidly falling market will break the Bollinger Bands.

Because of this limitation, the strategy works best if you keep the binary options expiry time short until a new period is created on the chart. If there are 30 minutes left in the current period and the market reaches the top of the Bollinger Bands, it is a good idea to invest in lower options with expiry periods of 30 minutes or less.

You can also recheck the forecast on a shorter timeframe if you wish. If you switch to a chart with a 15-minute timeframe and the market is close to the upper range of the Bollinger Bands, you know that it is likely to fall soon. However, if you are in the middle of this trading range, you may want to consider this trade.

You can also upgrade this option to trade binary option types with higher payouts. With the addition of momentum indicators, you can invest in option types that require strong movements. To understand how to add this metric, consider an example of the following strategy.

Strategy 2: Trade Middle Bollinger Bands with One Touch Options

There is a special characteristic in the middle of the Bollinger Bands. It provides resistance or support levels, but the market can overcome them. Doing so changes the meaning of the band.

- When the market trades above the Middle Bollinger Band, the band acts as support. If the market breaks through this support, the middle band becomes resistance. The market is stuck between the upper and middle bands and now it’s between the middle and lower bands.

- When the market trades below the middle Bollinger band, the band acts as resistance. If the market breaks through this resistance, the middle band becomes support. The market is stuck between the lower and middle bands, and now it’s between the middle and upper bands.

Both events change the overall market environment. When the market breaks through the middle band, it suddenly has enough room to move into the outer band. This means you know the direction and distance the market will move. This is a great foundation for trading high payout binary options.

What you do is:

- Wait for the market to break through the middle Bollinger Band.

- Once the market breaks through the middle Bollinger Band, invest in one-touch options in the direction of the next Bollinger Band. Invest in high one-touch options when the market breaks above the middle Bollinger Band upwards. When the market breaks below the middle of the Bollinger Band, invest in lower one-touch options.

The most important aspect of this strategy is choosing the right expiry.

- Long expiry moves the target price of a one-touch option farther.

- Short expiry keeps one-touch option’s target price close.

To understand this strategy, you need to use one-touch options with target prices that fall within Bollinger Bands. On the other hand, expiry should be long enough to give the market enough time to reach expiry. It may take some experience to get the right mix of intimacy and ample time. Momentum indicators such as the Average True Range (ATR) can also be used to provide a mathematical basis for estimates.

Strategy 3: Trade Outside Bollinger Bands with Low-Risk Ladder Options

The market is likely to break above the outer Bollinger Bands. This knowledge is a great foundation for trading low-risk ladder options.

Ladder options define a number of different target prices (usually 5-6). Some of these prices are above current market prices. Some are below it. Some are near, some are far. As a result of these characteristics, some target prices are within the price channel of Bollinger Bands. Some will be outside.

Since the market is most likely not going to move outside the Bollinger Bands, it is very unlikely that the target price will be reached outside the Bollinger Bands price channel. Ladder options allow you to make these predictions and win simple trades.

To implement this strategy:

- Set the chart period to Ladder Option Expiration

- Compare broker ladder option target prices with Bollinger price channels.

- Take a target price with the highest payout that is still outside the Bollinger Bands. We predict that the market will not be able to reach this target price.

- If the target price is below the Bollinger Bands, expect the market to trade above the target price when the ladder option expires.

- If the target price is above the Bollinger Bands, expect the market to trade below the target price when the ladder option expires.

- Repeat the process for all ladder option expirations offered by your broker.

To properly execute this strategy, make sure that the chart period coincides with the expiry. Bollinger Bands change with each new period. A target price that falls outside the range of the Bollinger Bands for the current period may fall within the range for the next period.

If you trade a ladder option with a 1-hour expiration based on a 5-minute price chart, many things can change so that the Bollinger Bands become almost pointless before the option expires. If you align the chart period with the expiry date, the Bollinger Bands will remain the same until the option expires.

volume strategy

Volume is one of the most undervalued indicators. Volume strategies combined with binary options can create great results.

What is a Volume Strategy?

Volume is a simple but important metric. Volume refers to the number of highly traded assets over a period of time. The direction of these trades does not matter to the volume.

- The period in which 10 stocks have exchanged hands is 10 regardless of whether the price has risen or fallen in that period.

- A period in which 20 stocks are exchanged will have a trading volume of 20 regardless of whether the price rises or falls.

Volume is very important as it helps interpret market movements.

- High volume adds meaning. If there are many periods, many traders will back the price movements of these periods. This means the market is likely to continue in the same direction.

- The importance of small questions. If the volume is low during a period, few traders will be able to support the price movement in this period. This means that many traders are likely to question the movement of the period and invest in the opposite direction of profits considering the wrong movement.

As you can see from this example, volume only makes sense in relation to the previous time period. A volume of 300 doesn’t tell you anything until you know whether the previous period was higher, lower or similar volume.

Volume strategies use each period’s volume to create a forecast of future price movements.

- For many timeframes, a volume strategy predicts that the market will continue to move in the same direction.