The wedge trading strategy is a reversal trading strategy that can generate large profits. When it comes to price action trading, the most important thing is to recognize certain patterns in the market. The Korea-option.com team has invested a lot of time to teach you the most popular and profitable price patterns similar to the Head and Shoulders price pattern strategy.

This guide explains how to define or define falling wedge patterns and symmetrical wedge patterns. They’re pretty much the same pattern, but not exactly the same.

Like most price patterns, you can trade this pattern on any market and time frame. No matter what type of trader you are, be it a swing trader, day trader or scalper, you can make big profits by trading falling wedge patterns.

Regardless of the environment in which the Wedge Pattern falls, its shape and the information it actually provides in its price pattern has a very clear bullish bias. Going forward, we want to focus on recognizing descending and symmetrical wedge patterns, and how to trade strategies effectively.

Note * Technical indicators are not required to trade the wedge trading strategy. Because we are dealing with a pure price action trading strategy.

Before delving into the rules of a strategy in depth, define and learn how to recognize each rule. Also read about Forex mentors and best investments.

Describing the falling wedge pattern

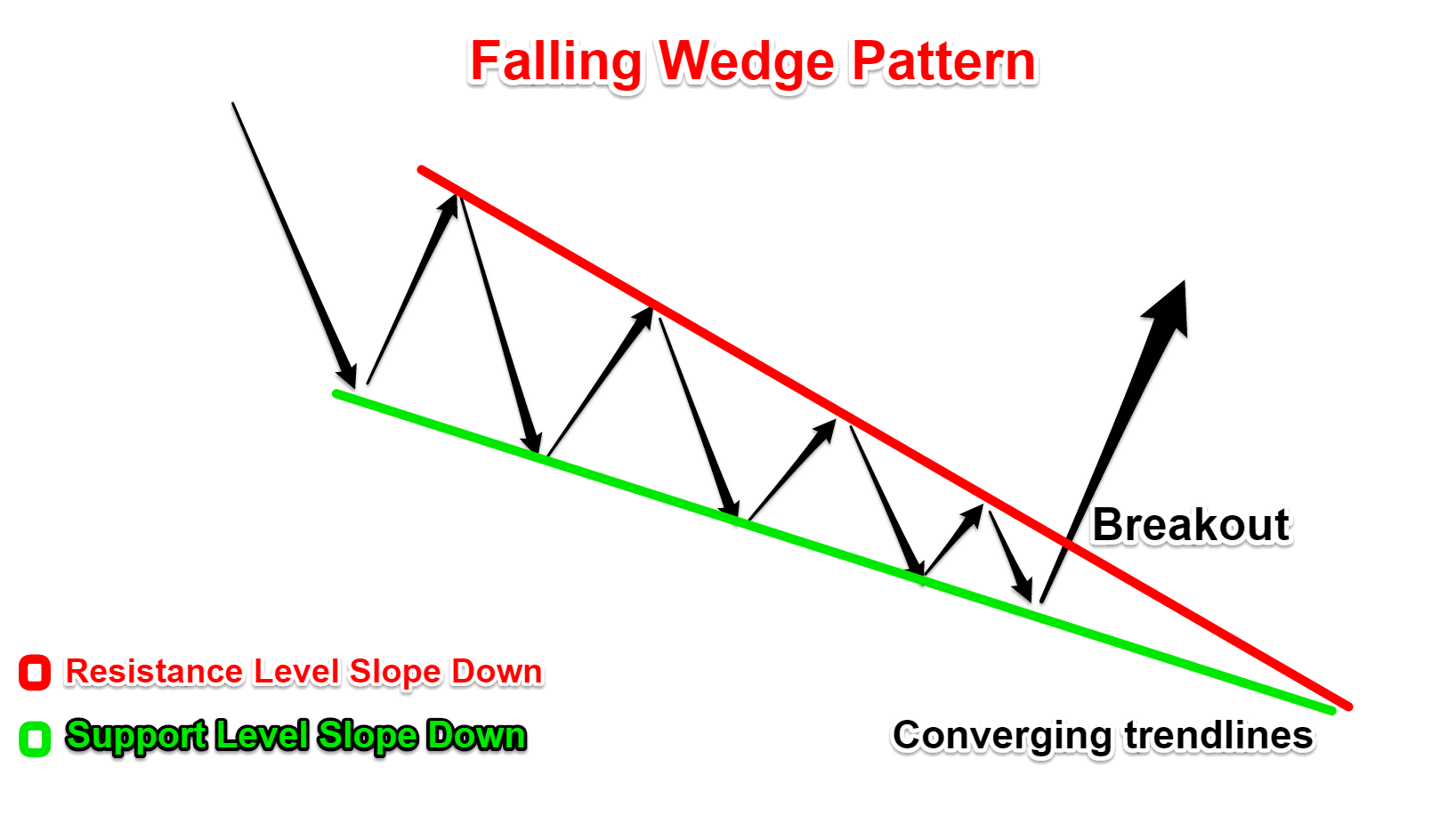

It is important to realize that falling wedge patterns are made up of two parts in the price pattern structure.

- The main feature of the falling wedge pattern is that the pattern must have bearishness before it develops. This is because it is an inverted pattern.

- Part 2 is an actual falling wedge pattern that looks like a downward pointing triangle.

Now, how to recognize the price structure of a falling wedge pattern?

You need a series of low highs, and the more low lows the better. Each lower point must be lower than the previous low and each upper point must be lower than the previous high.

However, as you approach the end of the falling wedge pattern, you won’t notice the price moving lower.

Notice that the swing waves taper in length while the falling wedge pattern develops. Especially when it comes to the downside. And at some point in the future, the two trend lines connecting the highs and lows will converge.

A falling wedge pattern is not confirmed until it breaks into rising resistance.

It can be said that there are common characteristics between wedge patterns and bull flag patterns, but the difference is that flag patterns are short-term aggressive patterns, while wedge patterns are long-term price action. We also provide training on the best short term trading strategies.

Before jumping into the rules, we need to define a second pattern that favors the symmetrical wedge pattern.

Symmetric Wedge Pattern Description

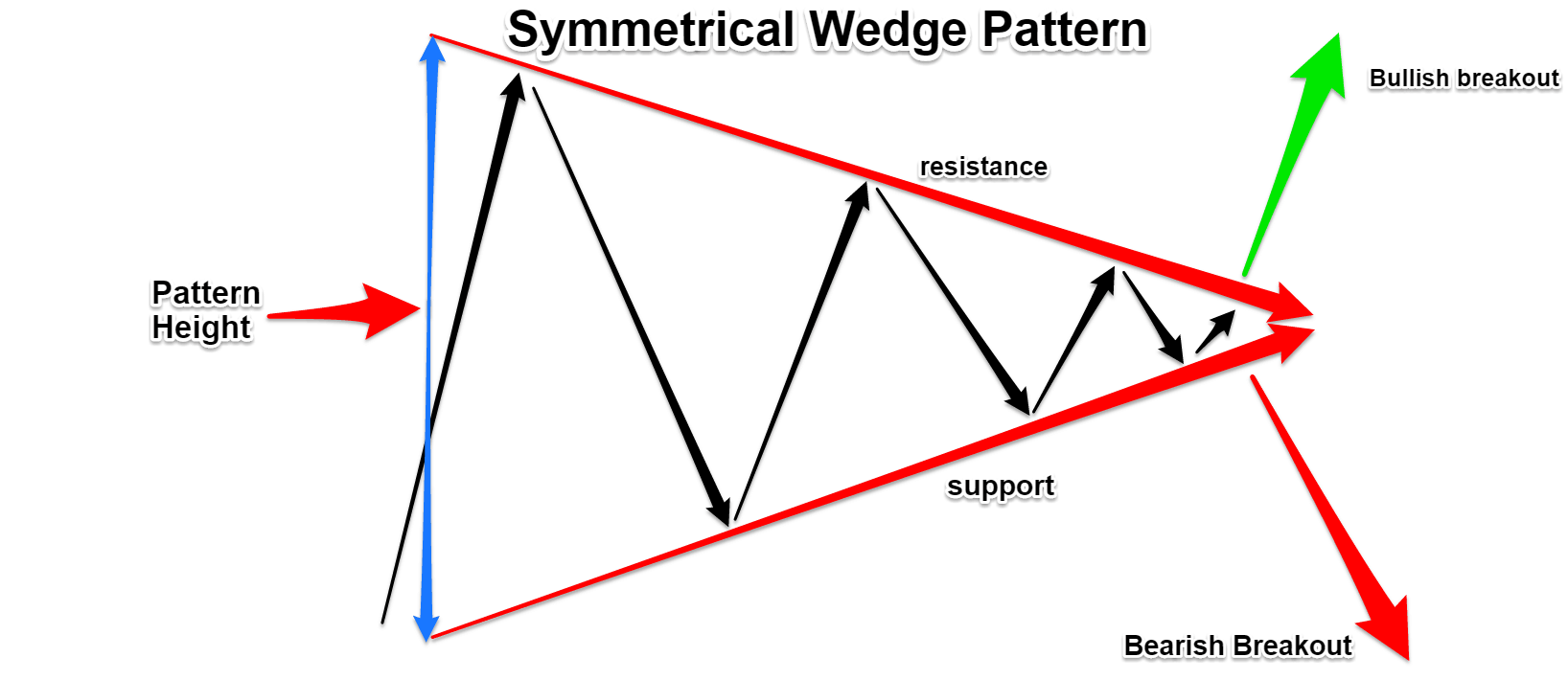

The Symmetrical Wedge Pattern is another simple price action pattern. It is constructed almost identically to the falling wedge pattern. The symmetrical wedge pattern has the shape of a symmetrical triangle. It is recognizable by its distinctive shape created by two divergent trend lines.

This is identified by drawing two trend lines.

- One downward resistance trend line connecting a series of lower peaks.

- A single upward support trend line connecting a series of higher lows.

And at some point in the future, the two trend lines connecting the highs and lows will meet together on the right side of the pattern.

There are many opportunities to trade symmetrical wedge patterns. This pattern can occur at the end of a bearish trend as well as at the end of a bullish trend. You can also trade in a continuation pattern rather than simply a reversal pattern.

Often, a break in one of the two trend lines results in a temporary directional fluctuation. Your job as a trader is to wait patiently and only enter after a breakout has occurred.

Now let’s look at how you can effectively trade falling and symmetrical wedge patterns. Follow the wedge trading strategy rules below.

Wedge Trading Strategy Rules – Buying Opportunities

It is important to keep in mind that, in general, the longer the market consolidates between the upper and lower bounds of the falling wedge pattern and the symmetrical wedge pattern, the more likely it is to occur sooner rather than later.

First, we will focus on falling wedge patterns because they have the potential to generate superior returns.

Step 1: Wait until you notice the structure of the falling wedge pattern on the price chart and draw two trend lines connecting the highs and lows.

We are looking for a visual representation of the falling wedge pattern. So the more compressed the pattern, the better. Eventually we’ll go backwards. The spike in volatility will push the price up very quickly.

NOTE** The shape and pricing structure of often falling wedge patterns may vary from pattern to pattern. Ideally, you should trade falling wedge patterns that adhere to these rules, as long as you follow the definition given earlier.

Next, we need to figure out where to go for trade.

Step 2: Buy when breaking above the downward resistance trend line

It is important to see the price fall within both trend lines. So, sellers step in when the price hits the resistance trend line, and buyers step in when the price hits the support trend line.

Ultimately, we’re pressuring prices to act within this range.

That’s what we’re focusing on as we get tighter and the increased pressure eventually leads to a breakout. I would wait close to the top slope before actually making a purchase to avoid the possibility of a false breakout.

Note *** Sufficient energy and momentum are required to exceed the upper limit of resistance to which the wedge pattern falls. Still, if you’re having trouble identifying a true breakout, it’s worth taking a quick look at the breakout trading strategies used by Professional Traders.

Now that you’re trading, you need to find your target, so move on to the next step.

Step 3: Profit by crossing the origin (starting point) of the falling wedge pattern

The starting point of a wedge pattern is the first wall of resistance and obviously you want to cash in your profits in the first problem area. This is a more conservative goal.

Alternatively, you can track your stop loss below each swing low and try to catch as many as you can in the new trend.

Now that you have a good understanding of where to take your profits, there is still one more thing you need to pay attention to.

Step 4: Place the protection SL under the last swing before the breakout.

Where we hide our stop loss is pretty intuitive to figure out. The last volatility before the breakout can offer very attractive low risk compared to the potential profit.

Below the last swing low, the wedge price structure will decline, allowing you to minimize your losses and get out of the trade.

Note * The above is an example of a buy trade… For short trades, you should trade the “Coushin” pattern, which is a rising wedge pattern. Use the same rules for sales transactions.

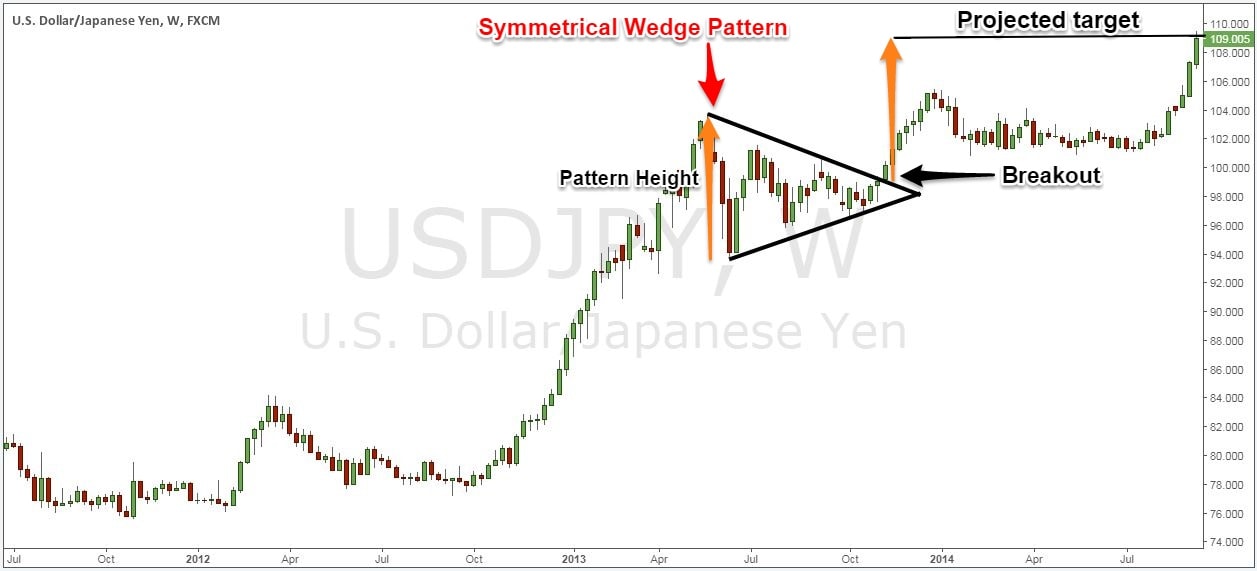

The Symmetric Wedge Pattern follows the same wedge trading strategy rules, the only difference being that you have a more pragmatic way to measure your profit target.

The profit target measures the distance between the high and the low of the symmetrical wedge pattern and adds this distance to where the breakout price is.

summary

The reason people choose to use a falling wedge pattern and a symmetrical wedge pattern is because people don’t know what’s developing until after the breakout, but if you train your eye to make big profits by spotting these price patterns in advance, you’ll be able to reduce waiting for You can also trade with the Breakout Triangle Strategy.

The psychology behind falling wedge patterns is that as price action narrows, buyers become more aggressive and sellers don’t have enough strength to keep pressing the paddle.

After reaching the maximum compression level, if you compress the object hard enough, it will snap tight again. The same principle can be applied to the falling wedge pattern, which has tremendous potential for significant returns.