Believe it or not, successful traders have the mindset of the legendary Japanese warrior samurai. Our Heiken Ashinoko strategy derives from samurai culture because it follows the same principles that guide the samurai in Japan.

Our team at Trading Strategies G uides believes that the samurai code of honor known as bushido, i.e. the warrior, has excellent principles that are estimated and applied to trading in any market. Like a warrior, you must be disciplined and pay attention to the situation in front of you.

One of the unwritten rules of the Samurai Code of Conduct states that a samurai is never afraid to act. A samurai lives life fully and splendidly. The Heiken Ashi Trading System PDF instills the confidence you need to succeed in market trading and overcome your trading fears.

The Heiken-Ashi technique is another form of chart viewing that traders can use to spot trading opportunities. This innovative new way of viewing charts can be applied to any time frame.

Regardless of your trading style (day trading, swing trading, follow-follow), you can make better decisions by implementing this trading method. It is also a good idea to learn how to identify the right swings to increase your profits.

First, let’s understand what the Heiken Ashi charting technique is. Then we outline the rules of the Heiken Ashi trading system PDF.

Another benefit is that it highlights real trading examples to better understand the best Heiken Ashi PDF strategies.

What is the Heiken Ashi Technique?

The three most popular price setups are bar charts, candlestick charts, and line charts. And there are less used charting techniques like Heiken Ashi. The Heiken Ashi chart provides an in-depth look at the market. Use it when making transactions that require accurate entry and exit.

Heiken Ashi is a charting technique that can be used to read price action and predict future prices. This is similar to a traditional candlestick chart. Unlike candlestick charts, Heiken Ashi charts try to filter out some of the market noise to better capture market trends.

Simply put, Heiken Ashi is a different way of displaying prices on charts.

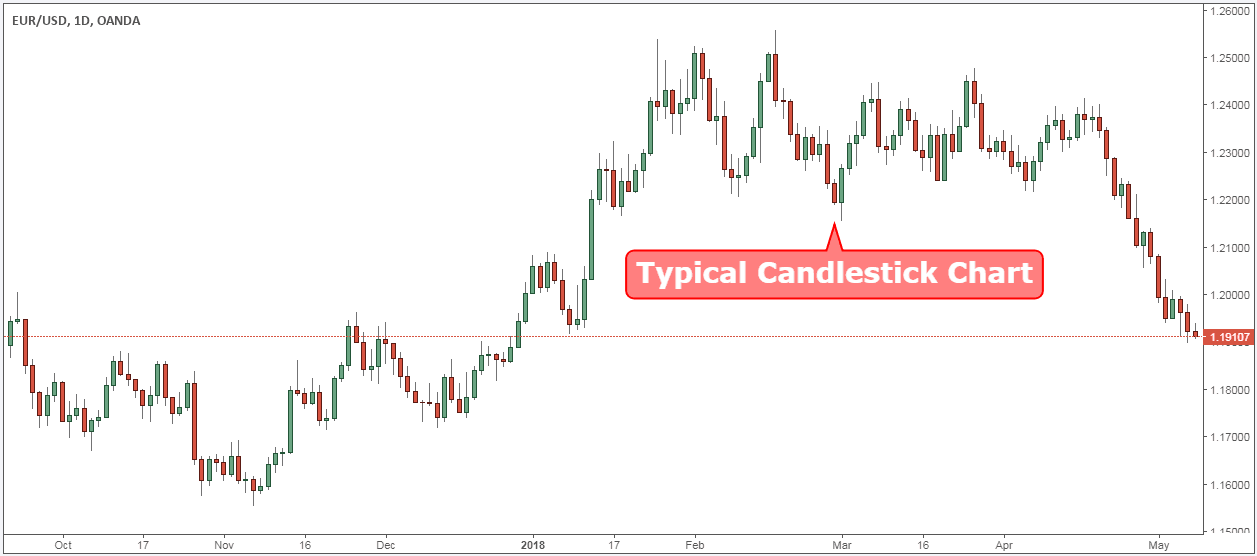

Here is a typical EUR/USD candlestick chart.

In Japanese, Heiken Ashi means “Average Bar” and refers to the average price or rate of price.

Heiken Ashi candlestick charts allow you to avoid trading periods and periods.

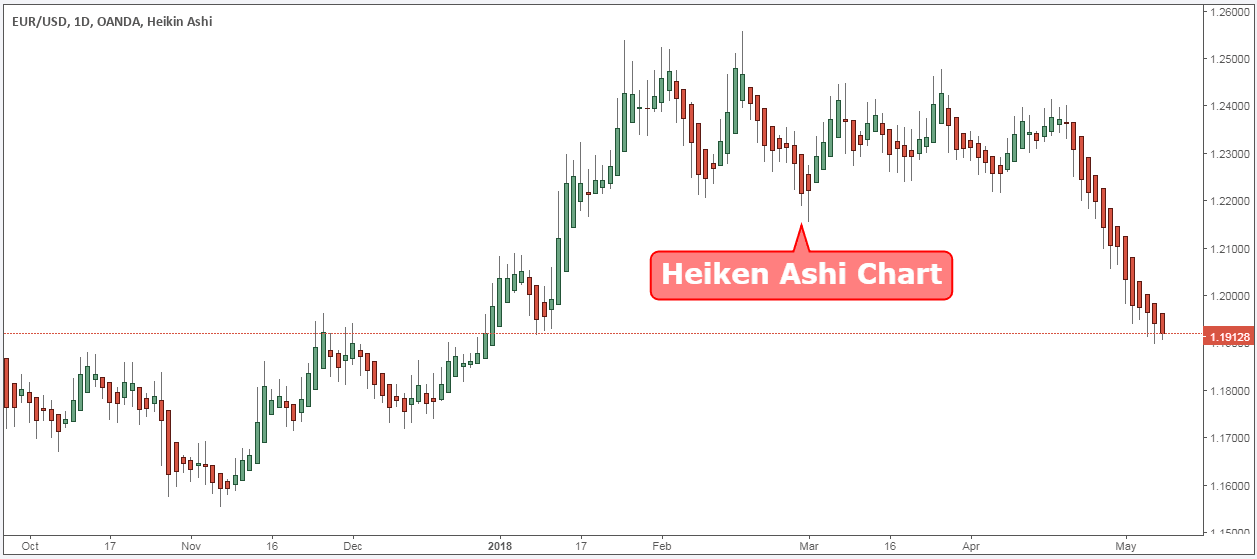

Here is the same EUR/USD chart, but with the Heiken – Ashi chart applied:

As we can see, there are noticeable differences between the two types of charts. This is because Heiken Ashi candlesticks use complex mathematical formulas to determine OHLC prices.

The good news is you don’t have to do the math to exchange the best Heiken Ashi PDF strategies. You just need to understand the principles.

There are two main trading signals that can be identified through Heiken Ashi candlesticks.

- A bullish candlestick has no wick or very small wick. They represent a strong uptrend and excellent buying opportunities.

- The small candlestick features a small body, large upper and lower wicks. They signal a potential reversal.

Here are the best ways to conquer the market using the Heiken Ashi trading system PDF.

Best Heiken Ashi PDF Strategies

As long as you apply the best risk management rules, the best Heiken Ashi PDF strategy can help. Now you know what Heiken Ashi candles are and how they differ from common price candles. Let’s see how they can benefit more than traditional price candles.

Heikin-Ashi Candles uses three data sets according to open and closed.

- Price data of the current open high and close prices.

- Current Heikin-Ashi value.

- Previous Heikin-Ashi value.

Now, it’s always a good idea to get a paper and pen before going any further. Write down the rules for this input method.

Hey Ken Ashi Technique Formula

To use the Heiken Ashi technique, we recommend using a trading software that allows you to create charts. Because of this, memorizing Heiken Ashi chart formulas is not absolutely necessary. However, knowing the formula can help you understand why this technique is useful.

Heiken Ashi uses the COHL formula for “close, open, high, low”. These are the 4 components that affect the shape, size and orientation of the bar. The formula for each of these components is:

- Closing price (average price display) = (close price + close price + close price + close price) / 4

- Open (represents the average of previous bars) = (Previous open + Previous close) / 2

- High (highest value) = highest recent high, open and closed values

- low (lowest value) = lowest value of recent low, open and close

Once each of these variables is recognized, a Heiken Ashi chart can be created. Sometimes, when some of these values are the same, it affects the overall appearance of the chart. Adjusting the time period also greatly affects the appearance of the graph. Many traders prefer the 5-minute Heiken Ashi trading strategy. However, it is also possible to use 15-minute, hourly, or even daily timeframes.

In this article, we will look at the buying side.

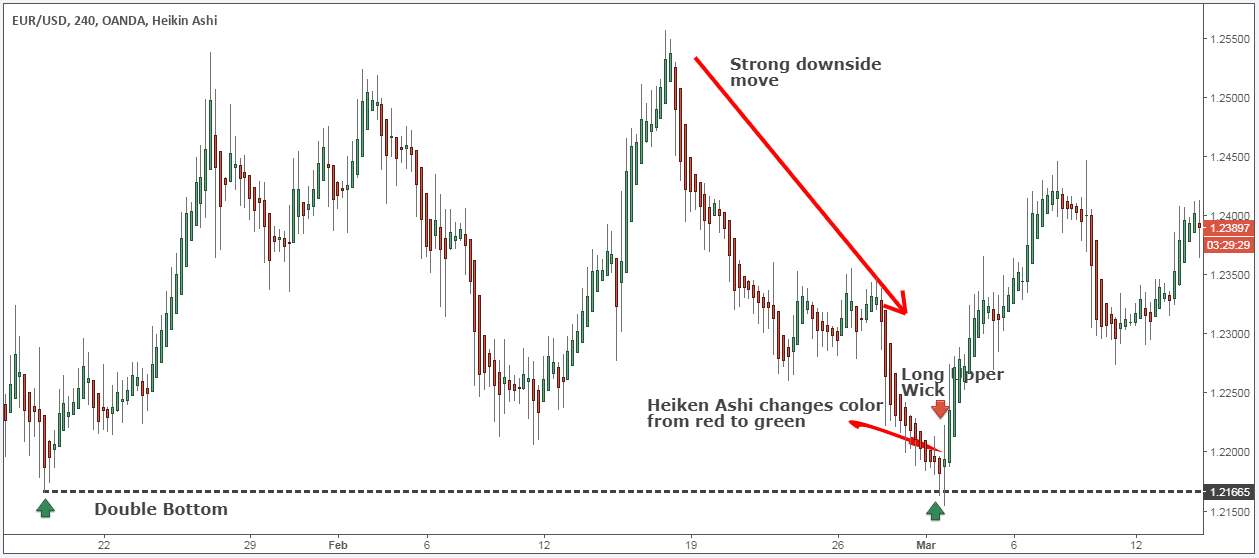

Step 1: Identify strong moves to the downside.

What we will be looking at now are a few ways you can combine these Heiken Ashi candles with traditional technical analysis and start looking for specific trading ideas.

One simple way we can use the Heiken Ashi candlestick is to change the reversal as the color of the candle changes.

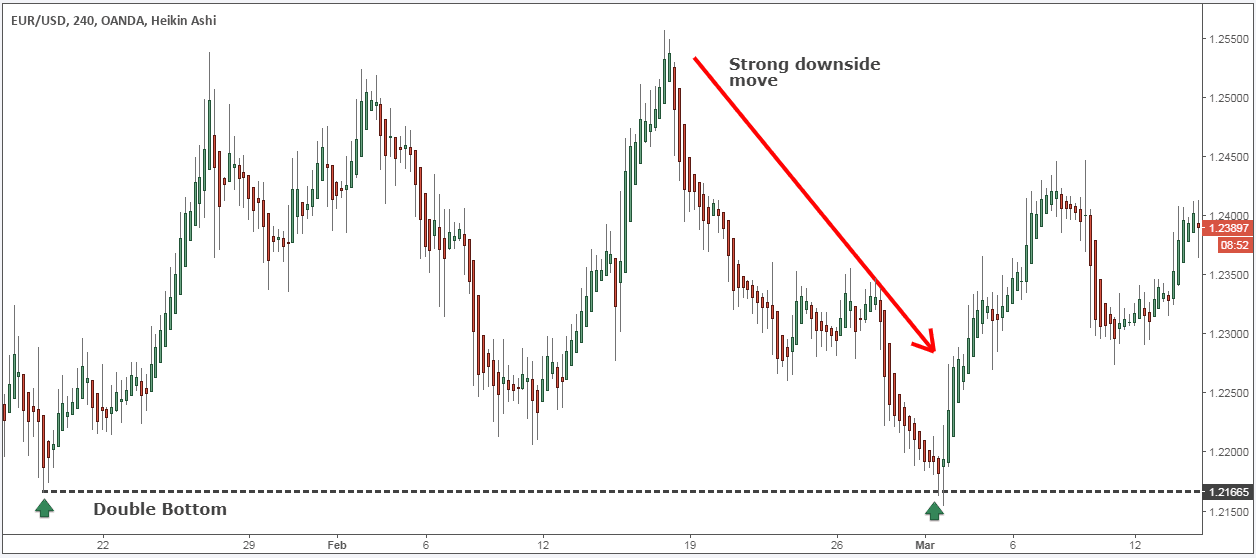

First, we will look for a bearish trend or a strong move to the downtrend.

Note * Heiken Ashi charts tend to have much more extended and smoother bullish and bearish price candles. This is due to the way the calculation is used to average out the range of bars.

There is a double bottom on the EUR/USD chart above, which is a classic technical setup.

Both troughs formed at approximately the same level. This is a traditional bullish reversal signal.

A Heiken Ashi strategy requires one or more conditions to be followed before pulling the trigger.

See below:

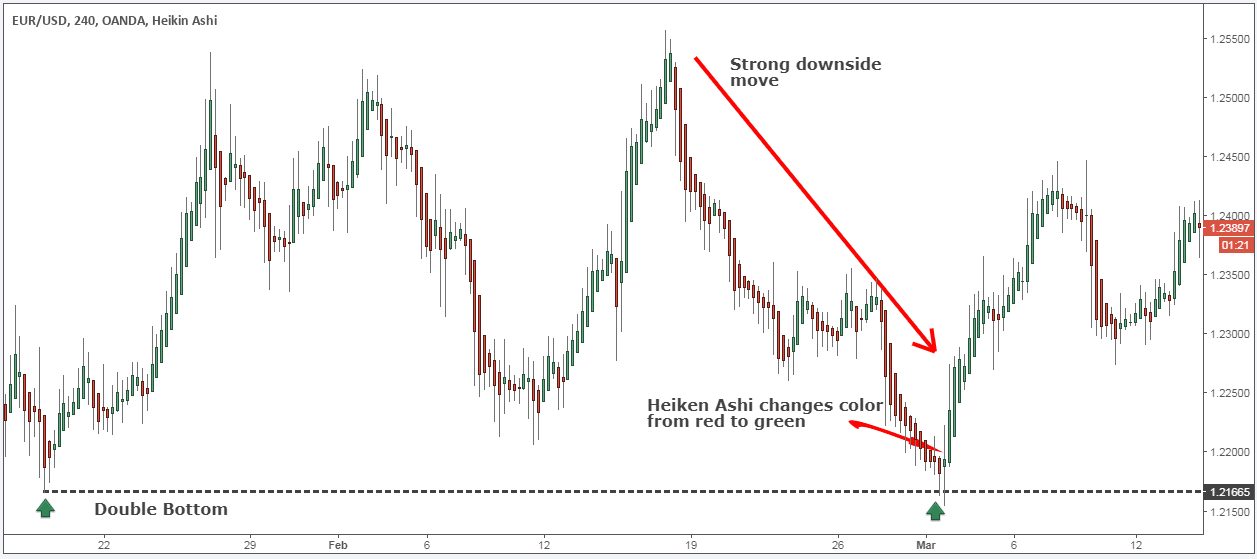

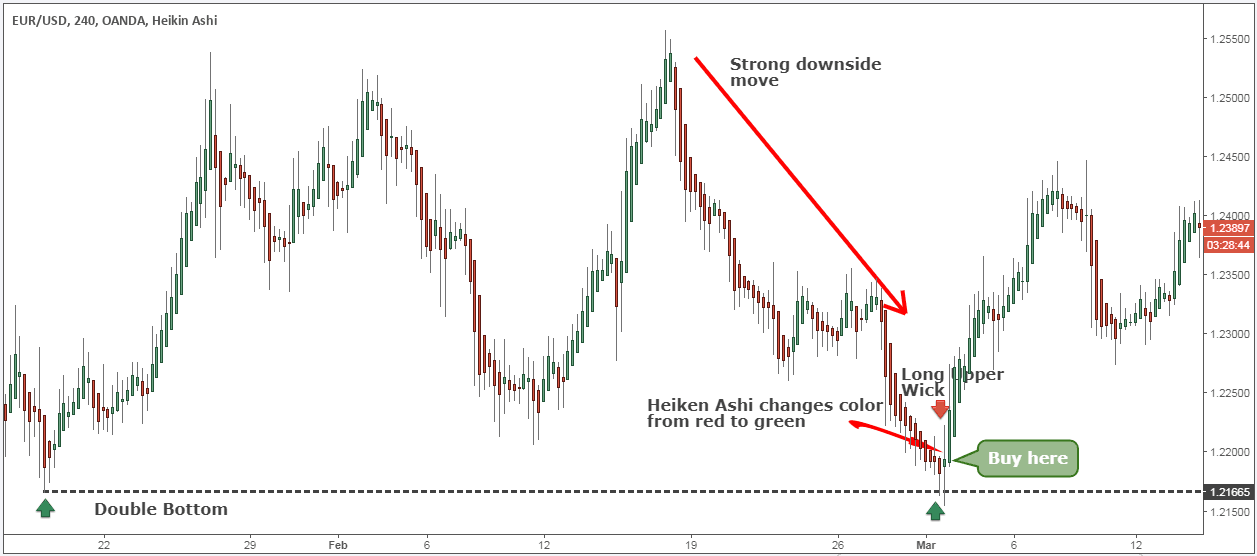

Step 2: Wait for the Heiken Ashi bar to change color from bearish (red) to bullish (green).

The first sign that the price is about to go higher is when you see the green Heiken Ashi candle.

Changing the color of the Heiken Ashi bar requires a significant change in the spell flow. This usually translates into a much more stable signal than when a typical price candle color changes on a typical price chart. When the color changes, it’s time to make a deal.

The way to use this feature is to simply implement traditional technical analysis and use the Heiken Ashi chart to find potential reversal areas.

We use our price action reading technique as a filter to identify potential trades. Then proceed with the trade using the Heiken Ashi chart as confirmation.

Step 3: The first bullish Heiken Ashi candle should have a larger than average top wick.

Long wickers (upper shadow) can provide surprising trading signals. Especially when using the Heiken Ashi price chart.

You can also wait until you see a bullish Heiken Ashi candle with no lower wick. However, this method will result in leftover revenue on the table.

The Heiken Ashi trading strategy meets all trading conditions. This means we can move forward and outline the trigger conditions for our entry strategy.

See below:

Step 4: Buy from the market when the next Heiken Ashi candle opens

Our admission process is very simple.

Since this is a bullish reversal setup, we are looking for opportunities if everything falls into place.

Now, we can expect a reversal to happen. You can buy EUR/USD at the start of the next Heiken Ashi candle.

This will help you figure out what’s next important to you to create the best Heiken Ashi PDF strategy. Where do I put my protection stop loss?

See below:

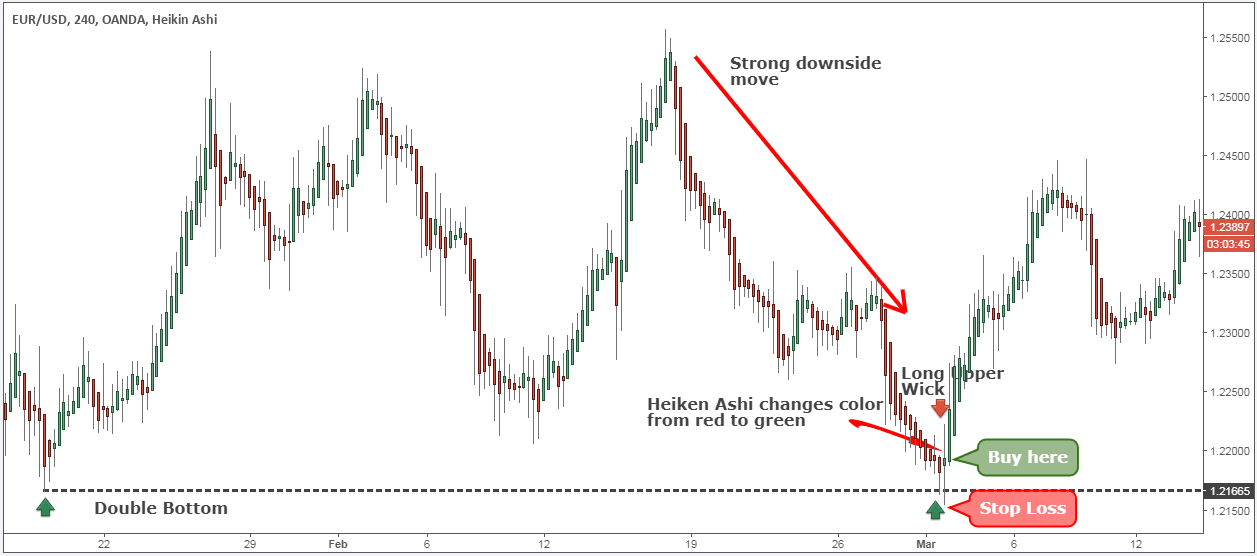

Step 5: Hide your defensive loss loss below the first bullish candle.

One really fantastic thing about Heiken Ashi candles and why they are so good for trading is how we can place a protection stop loss.

As the candles tend to linger, we may continue to be firmly anchored in our stops. You can simply set the signal loss to below signal seconds.

Finally, you need to define where you want to make money.

See below:

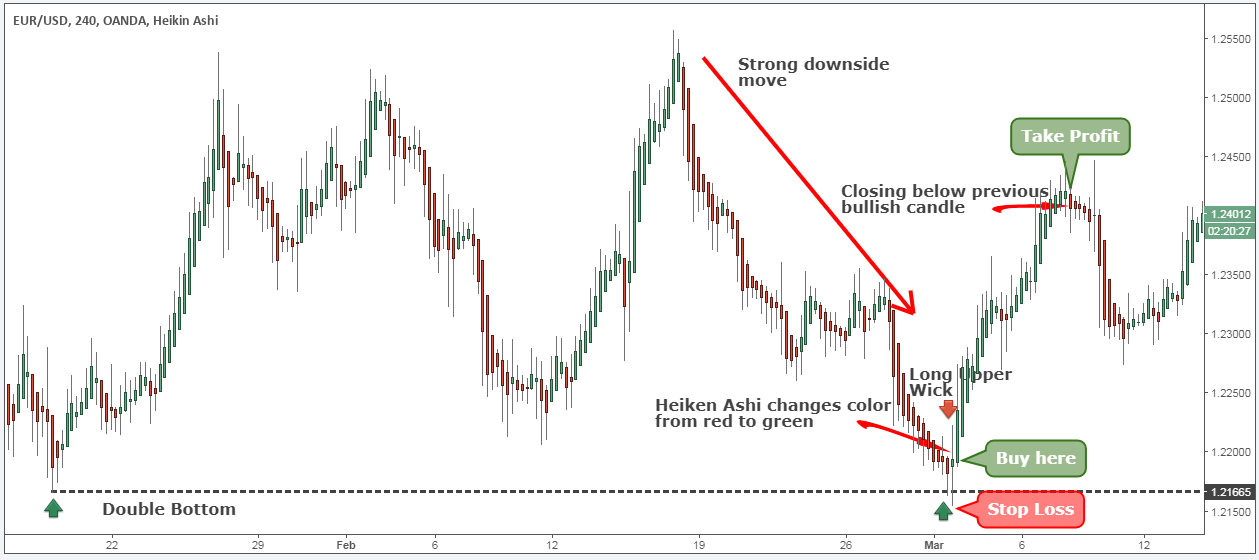

Step 6: Take profit after the close below the previous bullish candle.

Good Heiken Ashi trade setups tend to run much longer than typical price action setups. When we do business with Heiken Ashi candles, we really want to take advantage of these. It is important to keep trades open longer than usual.

Since we are using such a stop-stop loss, we only need a small price movement to make a good profit on this trade.

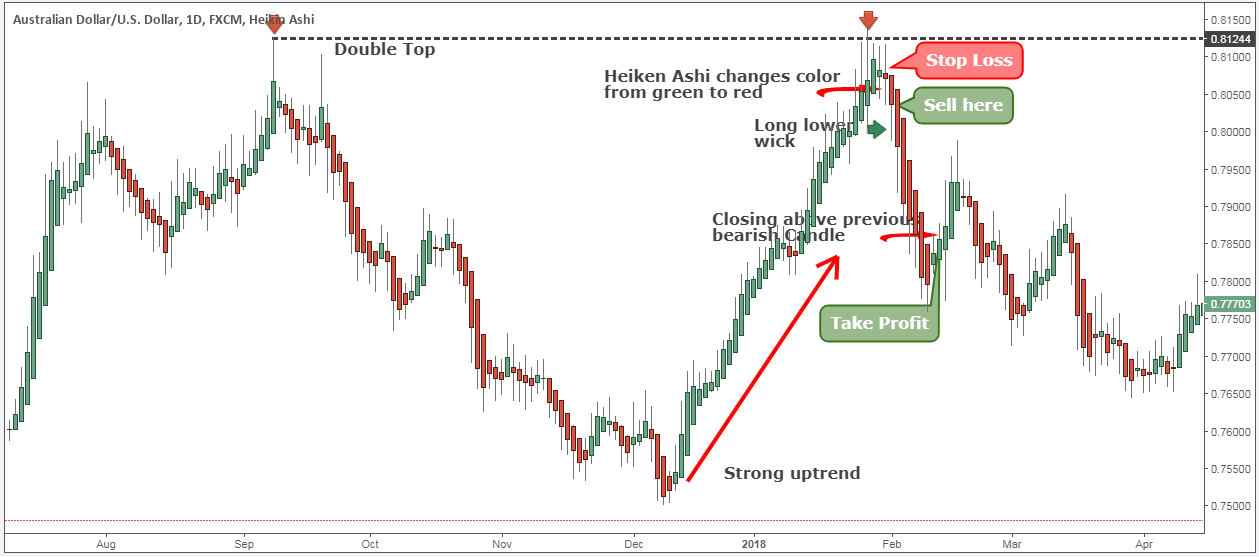

Note ** The above is an example of a BUY transaction using the Heiken Ashi trading system PDF. Use the same rules for SELL transactions. In the picture below you can see an example of a real sale transaction.

Conclusion Heiken Ashi Trading System PDF

Unlike traditional candlestick readings that try to trade reversals, the Heiken Ashi strategy can help you catch falling knives. Another major benefit of using the Heiken Ashi chart is an improved reward-to-risk ratio. This gives us a much tighter risk tolerance. There is also training on Japanese candlesticks and how to use them.

The Heiken Ashi technique is one of the best reversal trading strategies. It provides a smart way to manage your transactions. If you are confused by the noise generated by classic candlestick charts, you should turn to the Heiken Ashi forex strategy.