The meteor candle strategy is similar to a small bearish reversal exploration candlestick pattern reversal hammer. Among price action traders, Shooting Stars are also known as Pin Bars and have distinctive price features. When this happens in the right place, it becomes a very dangerous pattern.

If this is your first time on our website, the Trading Strategy Guides team welcomes you. Hit the subscribe button to get your weekly free trading strategies directly into your email box.

Once you understand what a meteor trade is, you will understand why one candle pattern has the same strength to signal a bullish trend reversal. Few people are good at reversal trading. In fact, most traders work so badly that they burn out their accounts.

The Best Meteor Strategy solves this problem and shows you how to catch falling knives without cutting our fingers. The Shooting Star candlestick pattern helps you spot the tops in the market and how to trade them correctly.

First, let’s go over some basics.

Shooting Star Candlestick Chart Pattern – Definition

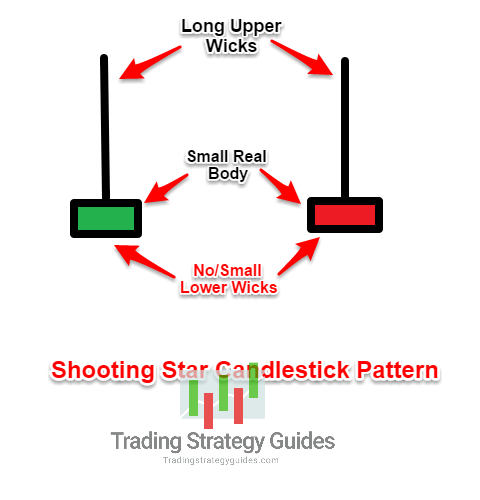

A shooting star is a bearish reversal chart pattern characterized by a long upper wick, little or non-existent lower wick, and a small body. In technical analysis, a shooting star pin bar consists of one candlestick.

The Shooting Star Inverted Hammer can only be trusted at the end of an uptrend.

The picture below is a good representation of the Shooting Star candlestick pattern.

Depending on your chart setup, the actual body of an inverted hammer may be green (bullish) or red (bullish). However, bearish shooting stars are stronger because the closing price is lower than the opening price.

Another characteristic of a bear shooting star is that the wick should be at least 2-3 times the size of the body.

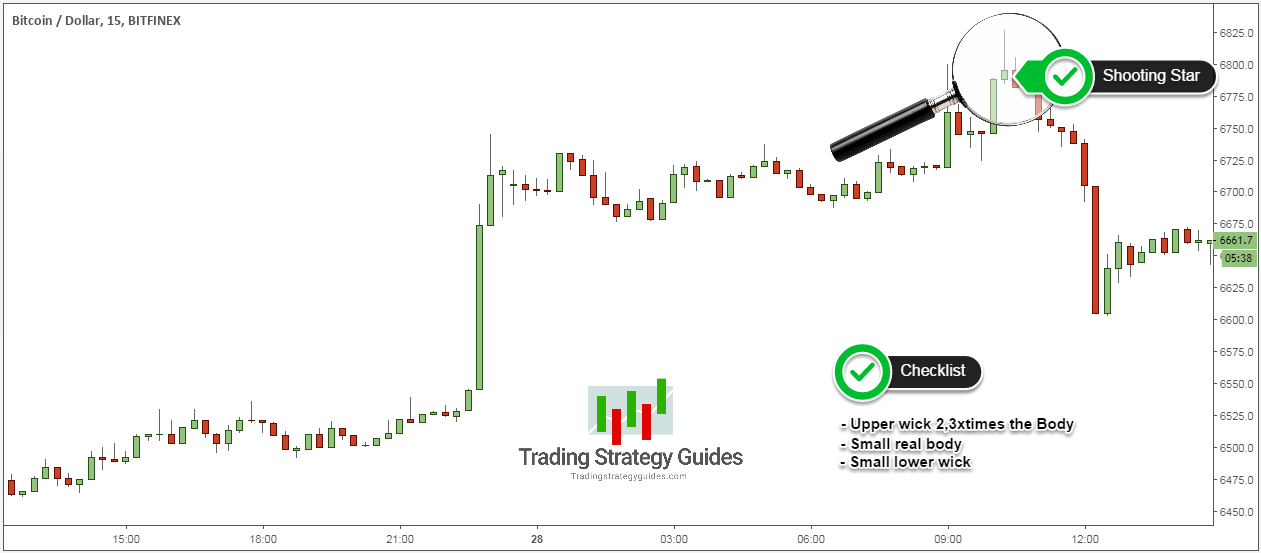

Here’s what a real shooting star pattern looks like on a candlestick chart:

Let’s take a closer look at this candlestick pattern to properly understand the battle of bulls and bears behind the shooting star pattern.

See below:

The psychology behind a shooting star

Who is in control?

Bulls? Or a bear?

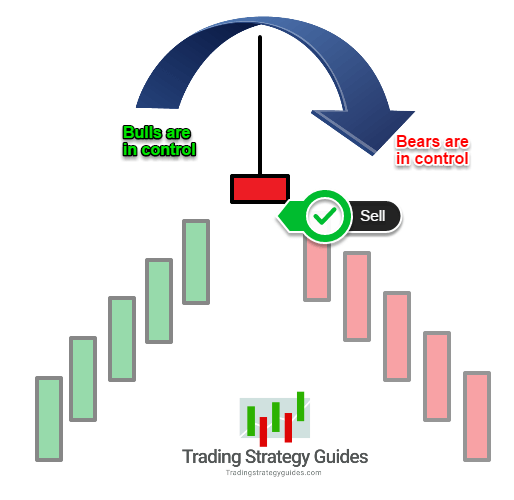

First of all, the uptrend is under control as the uptrend continues to move. Bulls push the price to new highs. As the bull peaks and reaches candle height, everything looks bullish.

But at this stage the bears enter the market and fight. They succeed in overcoming the bulls and bring the price below open.

For bearish shooting stars, the close is below the open and near the bottom of the bar. And, for a bullish shooting star, the close is above the close but near the close open.

The ability of bearish invert hammers to pressure lower-than-thatched candles gives bearish shooting stars more power to reverse a typical bullish trend.

What is Shooting Star Trading?

We need to train our eyes to read the sentiment of hammer candles considering the overall market environment. Identifying the exact textbook shooting star is futile.

If there is no bullish trend above the inverted hammer candle, it is not a tradable candlestick pattern. In this case, the Shooting Star deal will fail.

The shooting star candle is confirmed when we go below the candle. However, you should always get confirmation from another source to confirm your trades based on your risk profile.

It is advised not to be an active trader when trading the shooting star chart pattern.

You can backtest different types of entry strategies, but the more confluences you use, the more likely your price will be far from your ideal entry price.

Now let me explain the rules of the Best Shooting Star Strategy . We always recommend having a piece of paper and a pen and writing these rules down.

In this demo, we’ll look at the bearish shooting star or inverted hammer.

Shooting Star Candle Strategy

The Meteor Candle Strategy is a very simple yet very effective way to trade the financial markets. You can trade stocks, forex, currencies, commodities, futures and cryptocurrencies across different timeframes.

With this reversal trading strategy, the kind of trade setups we are going to suggest have an amazingly high success rate. However, the only downside is that it only shows up once on the Forex candlestick chart.

Let’s get started and get our feet wet.

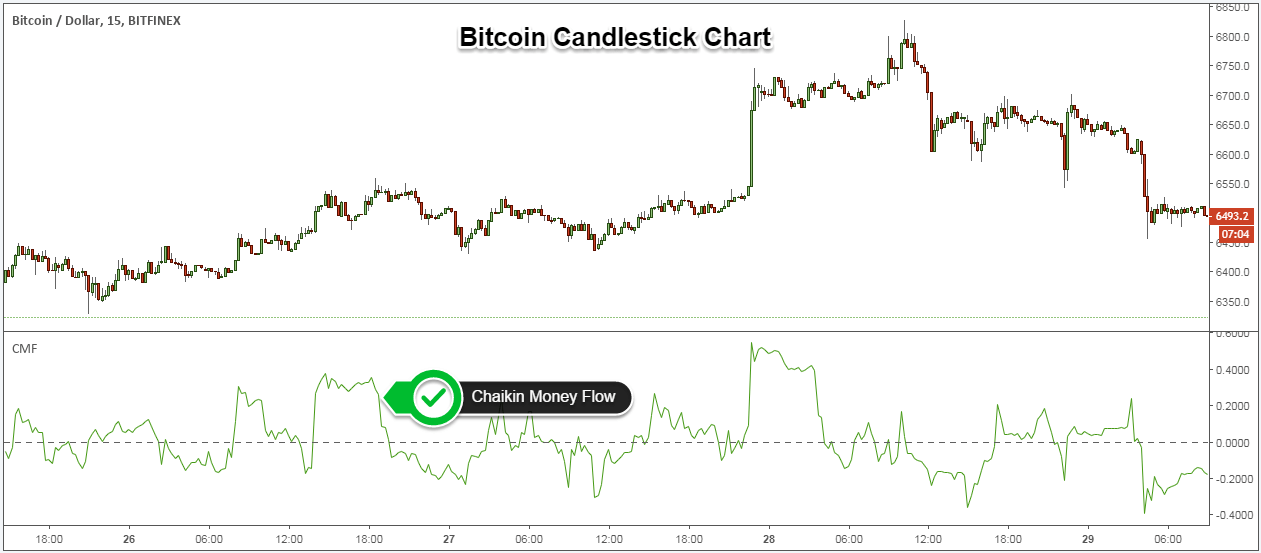

Step 1: Attach the Chaikin Money Flow Indicator to your preferred time frame

First, get your chart ready for battle. Simply attach the Chaikin Money Flow Indicator at the desired time frame. This is the only additional technical tool to use to validate a bearish shooting star pattern.

One important thing was achieved using the CMF indicator.

As soon as a Bearish inverted hammer develops on a Bitcoin candlestick chart, a Bearish shooting star is immediately validated or invalidated. This means that the price will no longer move from the ideal entry price.

Now let’s focus on price action.

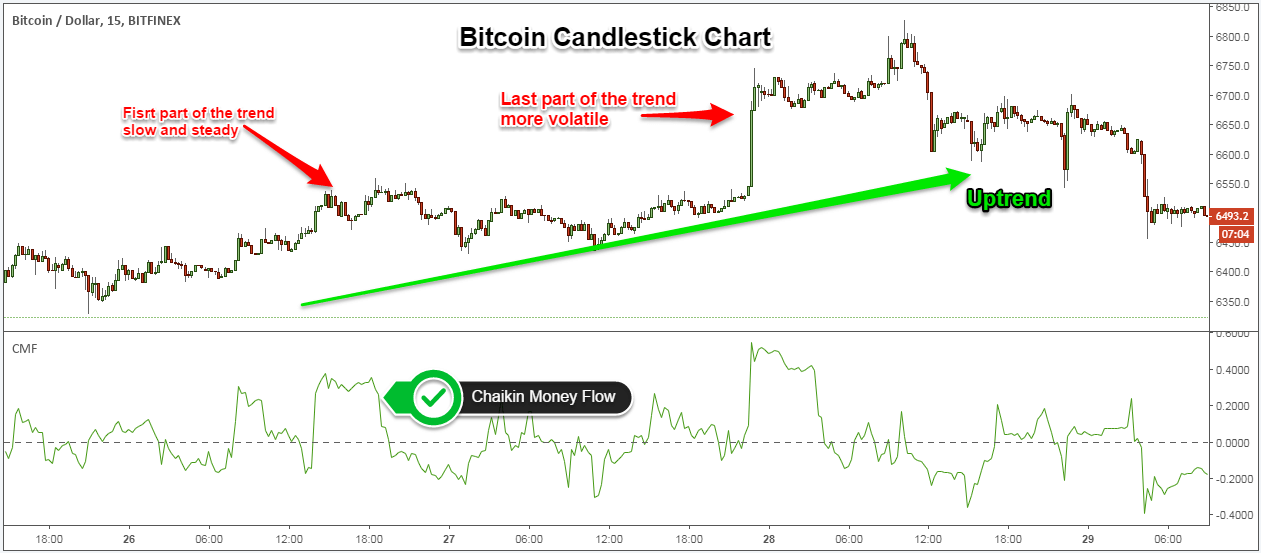

See below:

Phase 2: Shooting Star Candle Bullish Bullish

The place or place where the shooting star candlestick develops is very important.

This whole ingredient makes bearish shooting star candles work with very high accuracy. We need a strong uptrend with two important features.

- The first part of the trend is a slow and steady uptrend.

- The last part of the uptrend before the shooting star candle should be more volatile

Basically, we are looking for a full-blown market top where the bulls are exhausting and peaking.

Now let’s zoom in on the chart to see if the inverted hammer meets all the requirements.

See below:

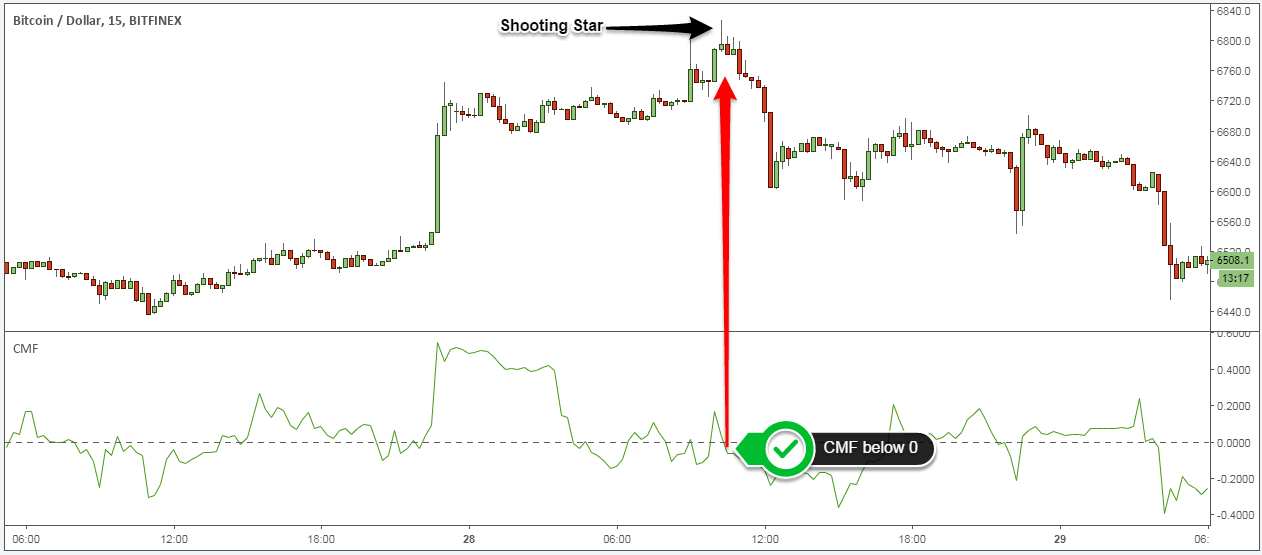

Step 3: When a bearish shooting star candle develops, the CMF indicator should be below the zero line.

Chaikin Money Flow is an excellent tool for reading and measuring institutional accumulation-distribution activity in any market. Basically, a CMF reading below the zero line shows that sellers have an edge and control the market.

Spotted bearish shooting stars meet all the requirements of a bearish reversal hammer. The shadow is at least twice as long as the body, small body, very low shadow. If the close was lower than the open, these candles would have been more powerful.

However, all other features make it still a good pattern to trade.

Now it’s time to highlight how to find the right entry point into a bearish shooting star candlestick.

See below:

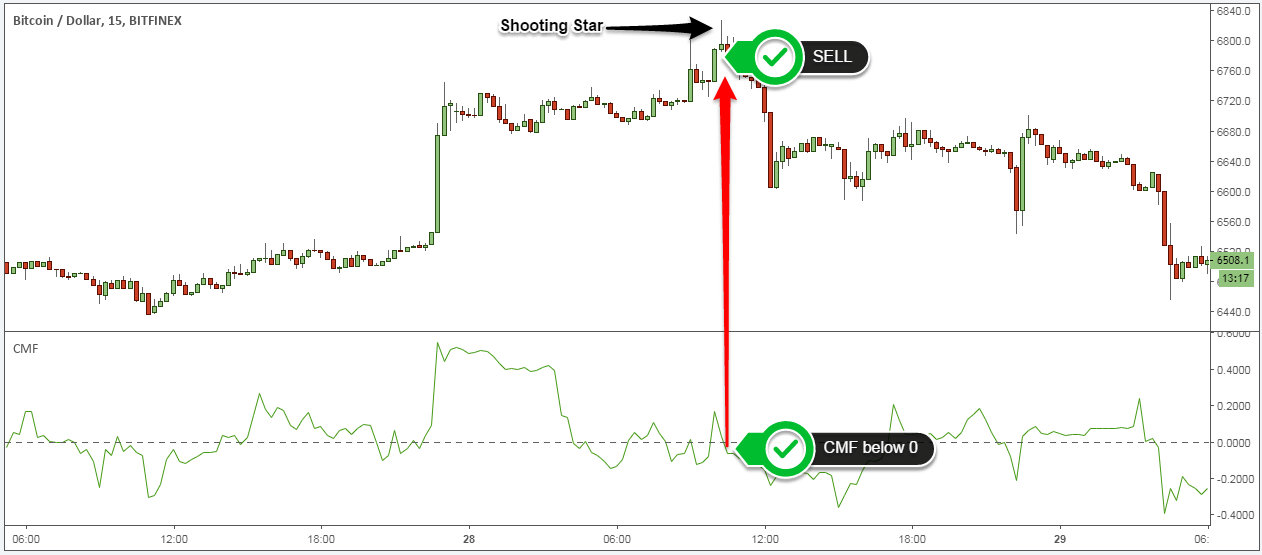

Step 4: Sell when it breaks the Low of the Shooting Star Candle

Simply place a limit sell order below the minimum price of Shooting Star. There is nothing complex about our entry strategy. It’s consistent with textbook rules.

What is the ideal place to hide your protection stop loss? Where to end profitable trades when trading shooting star candles?

See below:

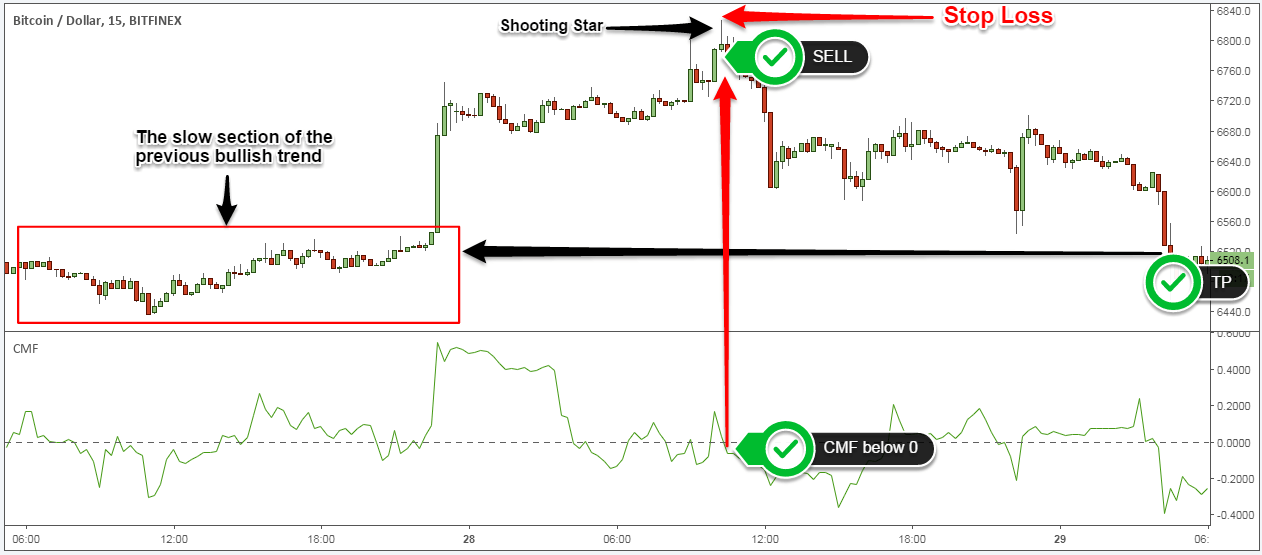

Step 5: Hide the SL at the height of the shooting star candle. TP when we fall into the slow part of the prevailing trend.

Just hide the protective SL over the shooting star pattern. You can add a few pips of buffer to prevent possible false breakouts.

A full-fledged top creates the necessary space that bears won’t find the level of support to stop them from falling. The last phase of the trend has always been more volatile. When combined with the reversal shooting star pattern, it becomes a killer trading strategy.

Conclusion – Best Shooting Star Strategy

The best meteor strategy is one of the most reliable and efficient methods of trend reversal in trade. This single candlestick pattern can offer one of the most attractive risk to reward ratios. If you risk between 10 and 30 pips and take a profit of between 200 and 300 pips, you can get a profit of 20 to 30 times.

Consider it the next time you look for a shooting star candle that meets all the rules outlined in this trading strategy guide.

Many traders warn against trading reversals. However, if you have a proven method like the Shooting Star Candle Strategy, you can find the best in the market and successfully execute trade reversals.