Thanks for stopping by! We have received many requests for our best scalping trading strategies over the years. We decided to jump on board and give you some easy scalping techniques. We think this is the best scalping system out there. This strategy is called The Triples S or (Simple Scalping Strategy). Triple S is easy to learn. In practice, it will be a great addition to your expansion strategy. It might be the best scalping method you’ve ever had. This strategy is included in our Best Trading Strategies series. We created this series to help traders succeed.

While most of our favorite strategies focus on maximizing the potential for big gains, scalping focuses on finding many small gains in a short amount of time. Rather than focusing on quality deals, scalpers are far more interested in quantity.

What is scalping?

A scalper can make thousands of trades within a given trading window. A scalping strategy has three characteristics: short positions, small profits, and high leverage. Scalpers target price gaps and other short-term trading “loopholes,” allowing you to quickly turn large positions for a profit.

To find expansion opportunities, you should start by selecting a few key technical indicators. These indicators help determine the likelihood of a short-term price gap.

Because scalpers focus on short-term positions that are less profitable, the best scalping strategies (such as the Triple S strategy mentioned below) require some leverage. Scapers are advised to start with a large amount of capital. By opening and closing larger positions, you can reduce the marginal cost of your trade and maximize your potential profit.

A simple scalping strategy designed exclusively for scalping. You can try it on a 1 hour or 4 hour time chart. Let us know how it works for you by commenting below!

We think it works best with a 5 minute 15 minute timetable. You can try this with the one-minute scalping strategy. However, we will focus on the M5 and M15 charts.

This is a profitable forex scalping strategy that uses highly accurate scalping indicators.

A simple scalping strategy uses volume indicators along with price action analysis.

Let’s talk a little about this indicator.

What is a Volume Indicator in Forex? How does it work?

Here’s how to get started:

The volume indicator can be interpreted as “the fuel tank of a major trading machine.” Some argue that trading volume cannot be used to trade the forex market. Since there is no “central exchange”, how can you read effectively? Another argument is that the volume seen in Forex is the “tick” volume that occurs. This means you are not looking at the full volume of what is being traded at the time, like stocks.

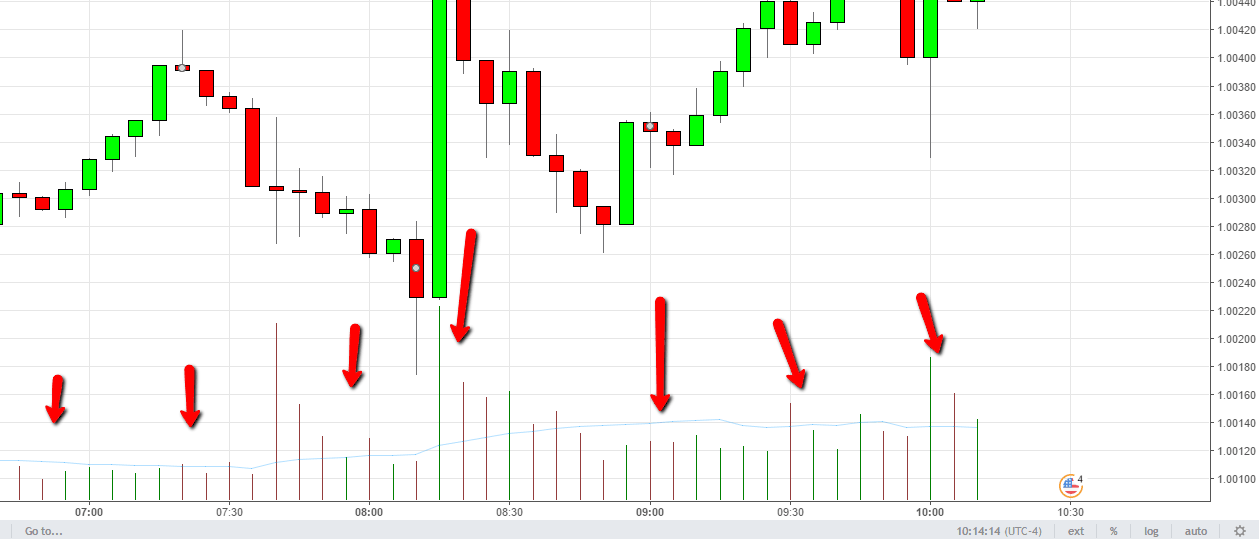

Tick volume is measured by how many times the price has jumped “up” or “down” on a particular candle bar. So as more people come in, the volume line gets longer. This is because there is more movement in price action as all exit orders are blown away. Therefore, the volume indicator is, first of all, very accurate, and secondly, there is no real delay. Current price action shows the number of “ticks” on that candle bar. The resulting bar should look like this.

Scalpers use volume indicators for many reasons. Volume and price have a very strong relationship in the short term, but changes in volume usually occur before sustained price movements. Paying attention to the volume indicator can help you take advantage of these moves before they actually happen.

Candlestick charts allow scalpers to quickly see the market. Candlestick charts contain more information than simple price charts (such as daily price ranges), allowing traders to understand the current price trend. Below we will discuss the 1 minute scalping strategy.

One minute scalping strategy

Scalping is generally the most effective trading strategy using a short period of time. Unlike position trading strategies, scalping focuses on making many profitable trades with significantly smaller margins.

Scaling is ideal for day traders and individuals who can make key decisions in a short amount of time. There is usually no time to do a thorough fundamental and technical analysis while scaling. Moving averages are constantly changing and prices are constantly being corrected.

If you’re scalping EUR:USD, other currency pairs, or other assets other than forex, you need to pay attention to the details. Scaling typically occurs in 5-20 minute increments. However, if you want to implement a 1-minute scalping strategy, the first things you might look at are volume indicators, M5/M15 time charts, and price action trends.

The key to scaling while using short time frames is identifying price changes before the rest of the market acts. You also have to be willing to accept very low profit margins. It’s still in your best interest to make a profit of less than 1% on any given action. This allows many scalpers to implement tight stop-loss and stop-limit orders over time. Also read more about the best hedging strategies.

Let’s see!

Triple S Simple Scalping Strategy Rules – Best Scalping System

Side note ** Price is very sensitive to any news as it goes all the way down to the M5 or M15 time chart. Because of this, I wouldn’t use this strategy 30 minutes before or after a major news announcement. Check here to find out if there are any news announcements.

Rule 1: Apply the best scalping strategy indicator: Volume

The trading volume platform comes standard with all trading systems (platforms), so there is no problem with any trading system platform.

Step 2: Go to the M5 or M15 time chart

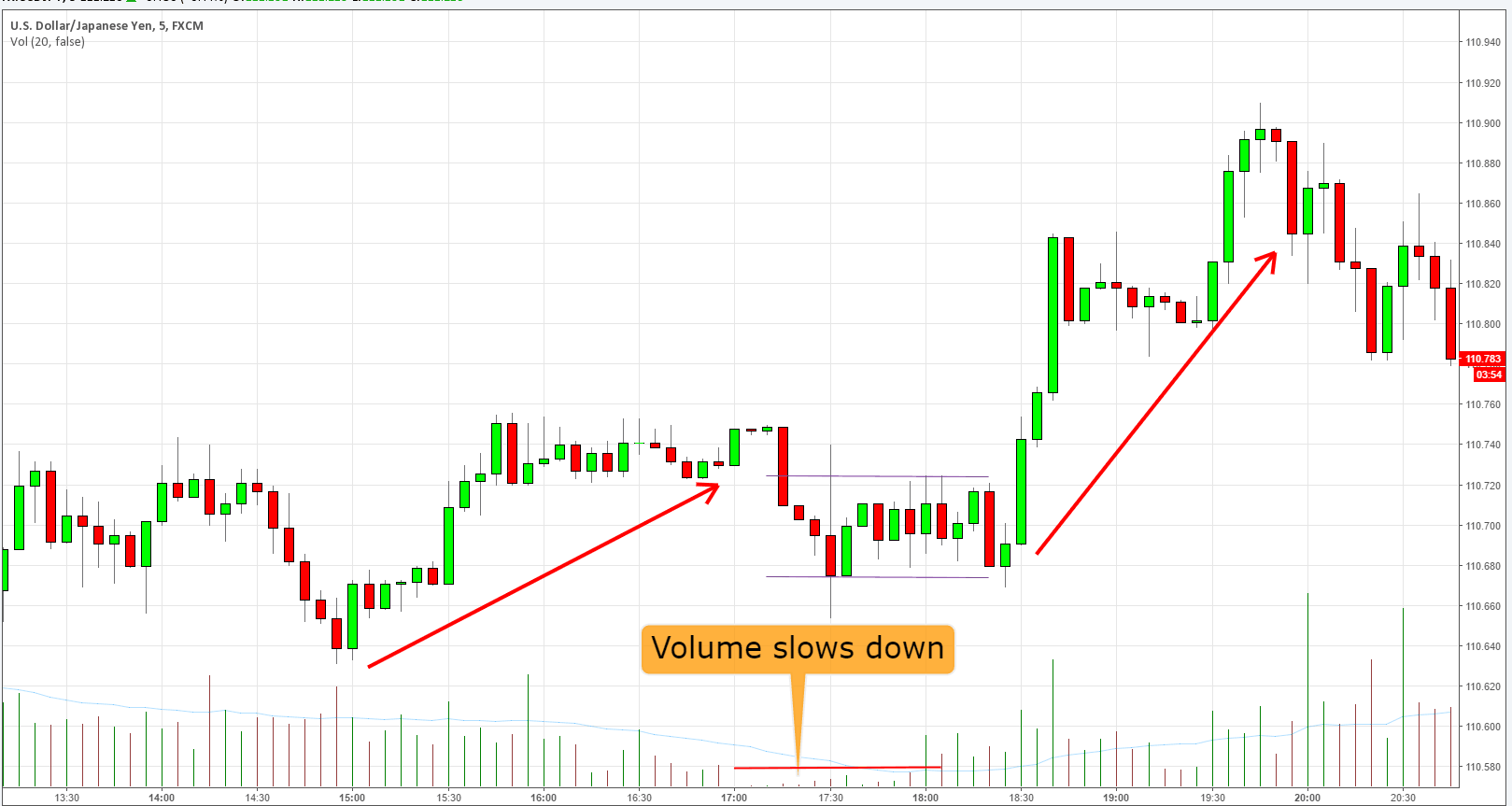

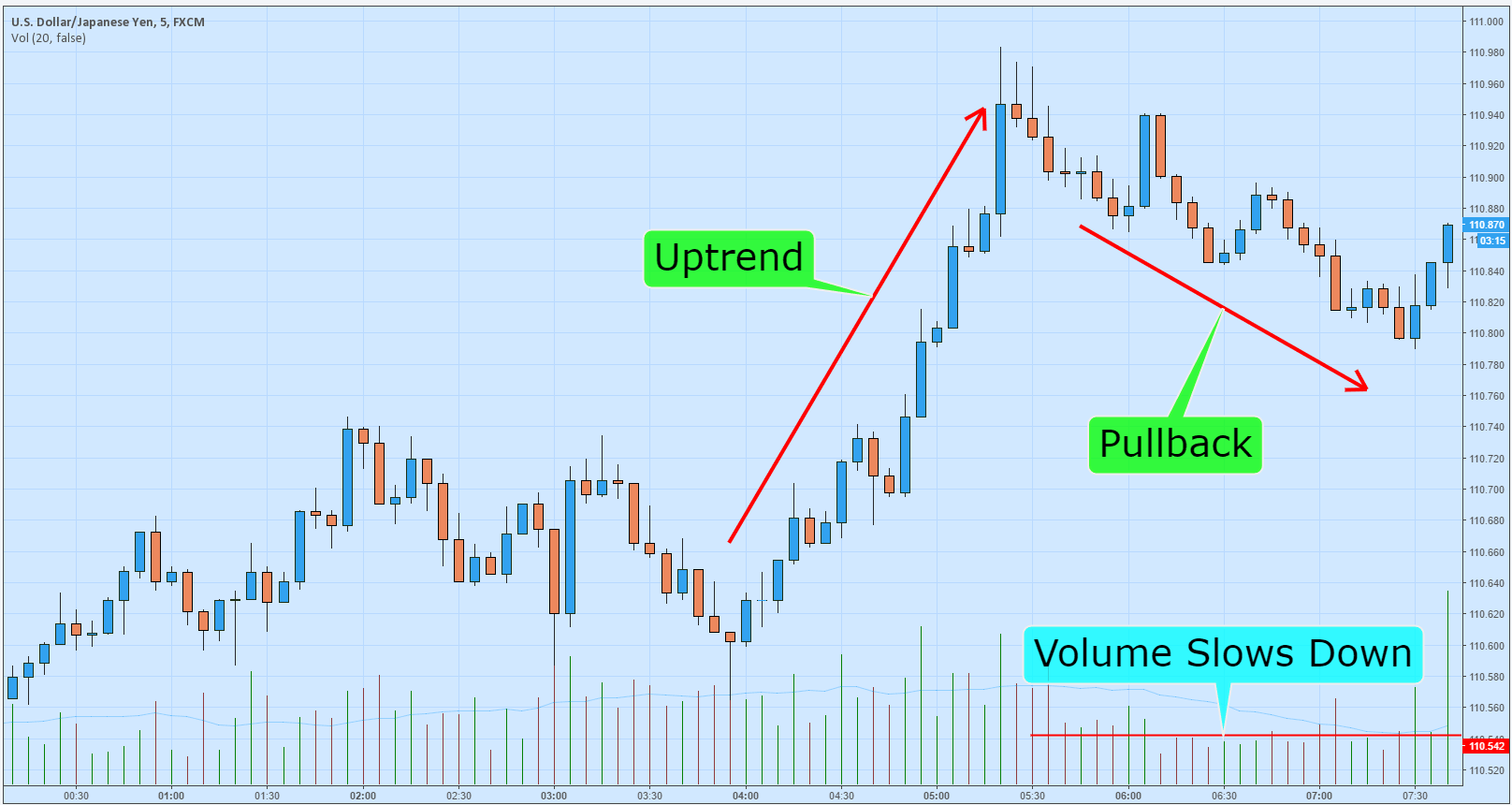

On this particular M5 time chart, we are looking at the USDJPY pair.

First you want to see if the volume indicator is showing a trend, reversal or stagnant price action. When the volume indicator increases, so does the price action. Because there is a lot of interest in that currency pair.

If you see a drop in the volume indicator, you know there are fewer “ticks” and less interest in that trend. The strategy we want to focus on is trend trading. You can use volume indicators for reversal trades. But that’s not what we’re interested in with this strategy.

Step 3: Among the best scaling systems, we recommend analyzing the volume indicator: look for a healthy uptrend or downtrend. Look for a pullback in the price action and wait for the volume to slow or “stop”.

The volume indicator tells you a lot of information. If you see a volume indicator, do the following:

A trend is one of the following:

A. I am dying and heading for a reversal.

B. Take a break before going backwards.

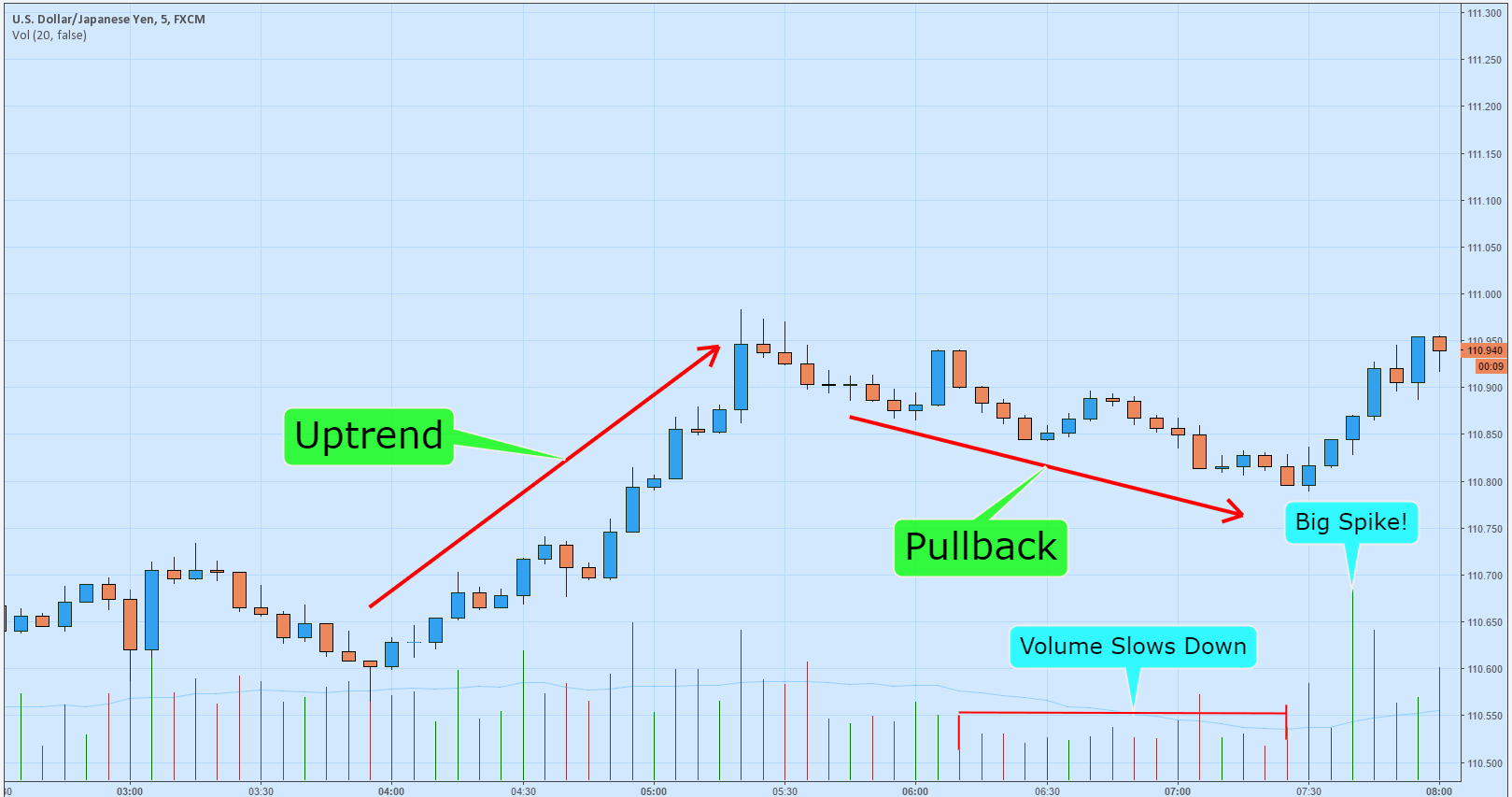

In this case, I needed a break. At the time, there were fewer buyers and sellers (traders making trading decisions). Then they picked up and continued upside down. Our strategy takes advantage of this pullback before price action continues to rise in this example.

So, in this analysis step for your strategy, you need to check the volume indicators. Based on what you know, make appropriate trading decisions based on current price action.

Using this example, a steady uptrend is followed by a pullback/retrace phase.

Likewise :

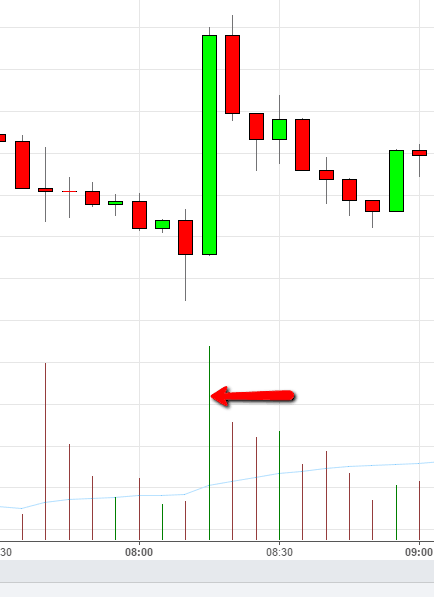

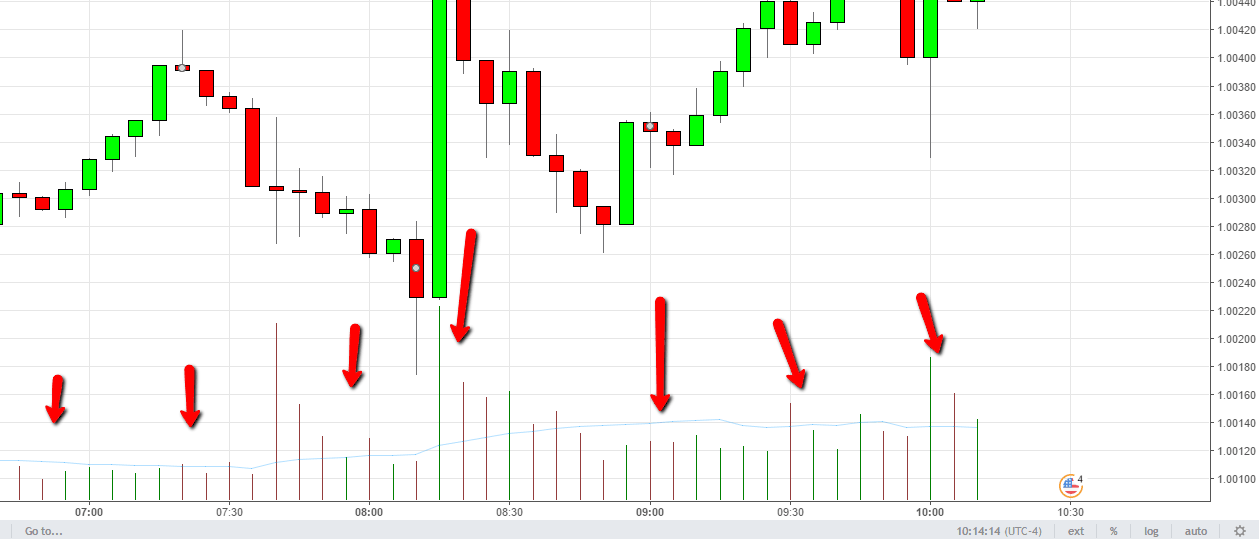

Step #4 Once you see a rise/spike in volume (after it slows down), base your trading decisions on current price action: The Best Scalping System

This part is all up to you. No “line crossing”, “arrow marks” or “little voice telling you to buy now”! You should understand a bit how price action works before deciding on an entry. Using this example, the volume indicator increases dramatically, causing traders to take action and push the price up!

watch:

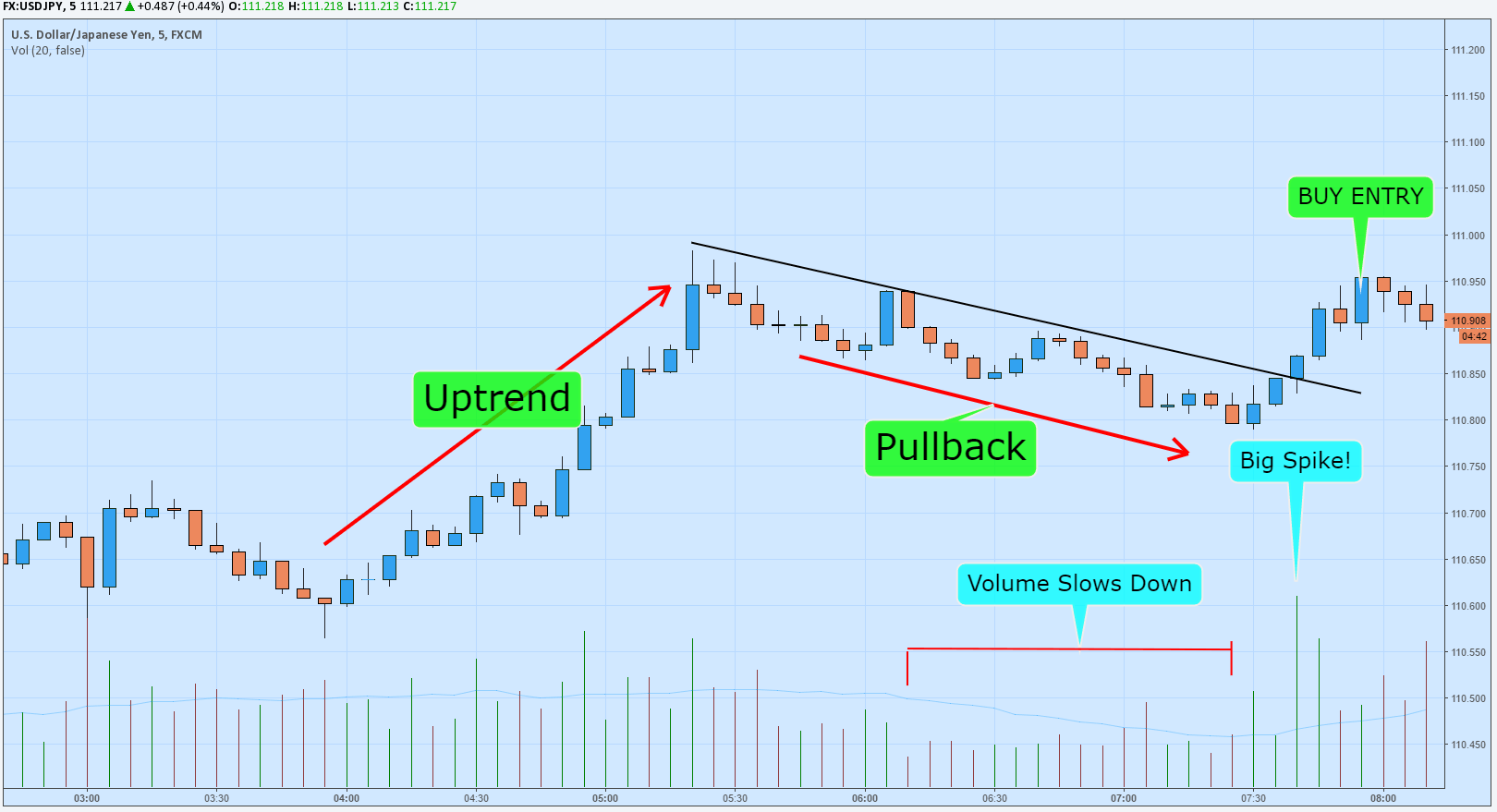

You may see this spike or see the volume indicators showing action indicating that you are ready to engage in this BUY trade as everything is heading up.

An entry/exit strategy for a simple scalping strategy

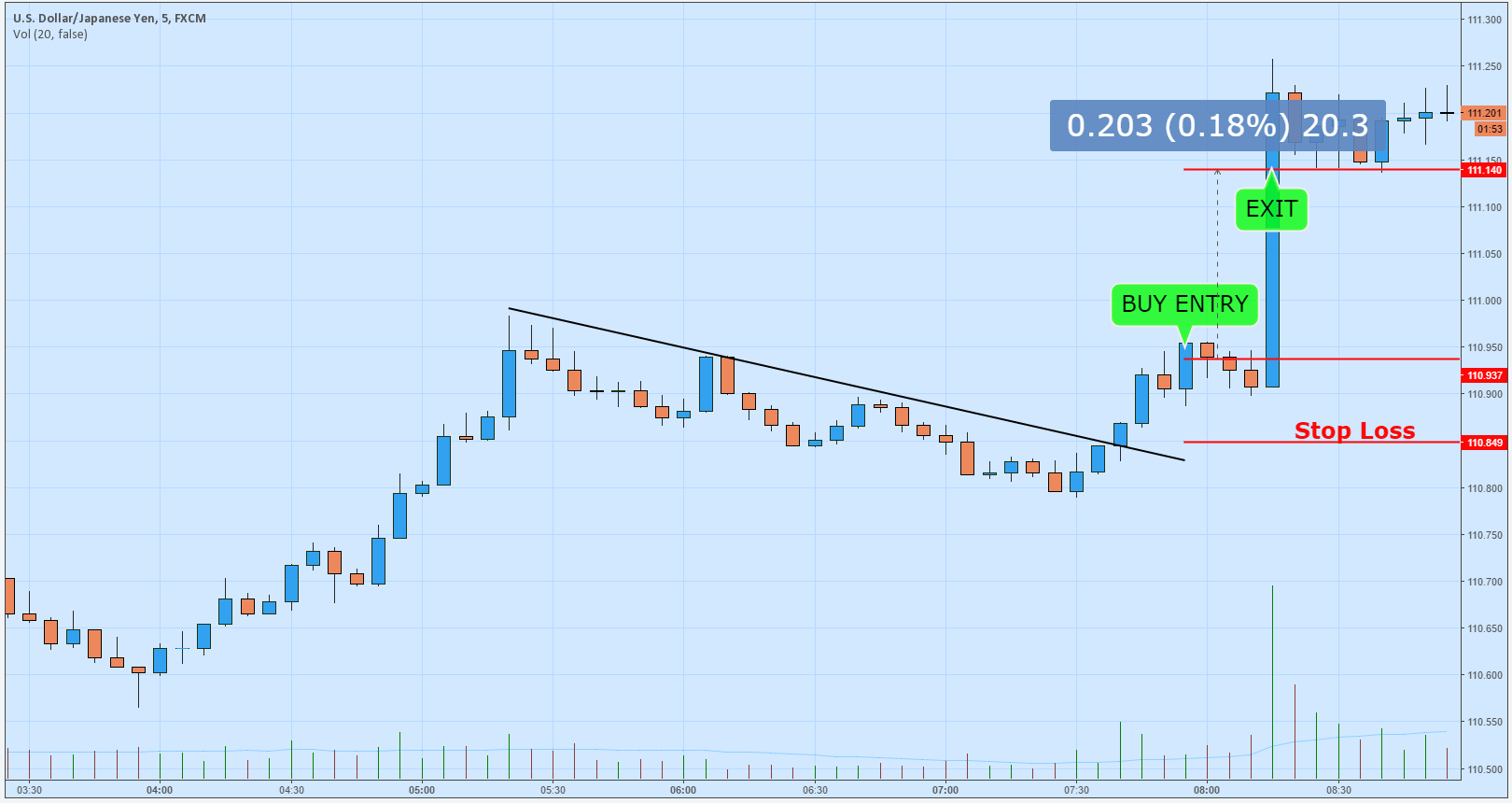

With the current structure of this trade, we saw a “spike” in our volume indicator and broke this little regressive trend so we pulled the trigger and started buying!

The exit strategy is simple. It goes 10-20 pips. Also place 5-8 pip stop losses. At 10 pips, you can move your stop loss to 5 pips to secure a small profit (even if the spread isn’t very large).

These 20 pips in less than 5 minutes don’t happen every time, but surely it will put a smile on your face if you do. major trends. I don’t want to leave too early.

Consider this strategy on major currency pairs and you will see some great results!

** The rules for sell trades are exactly the same only on the other side of the chart. (IE instead of starting with an upward trend, it becomes a downward trend)

Other Technical Indicators for Scaling Strategies

As you can see, simple scaling strategies mainly use volume indicators and candlestick charts. We developed this strategy knowing that these indicators give traders the tools they need to make fast and accurate trading decisions.

Since scalping is done through technical analysis, you should also consider using other technical indicators.

- Exponential Moving Average: This average is specifically weighted to be more sensitive to recent price movements. When using EMA charts, keep an eye out for potential “crossovers”.

- Moving Average Convergence Divergence (MACD): This trend-dependent momentum indicator helps balance the 26-period and 12-period moving averages. It can be assumed, but the MACD can be used within any trading period.

- Bollinger Bands: These handy bands contain most of the price movement (around 95%). Use these bands to determine when breakouts and trend reversals are most likely to occur.

- Relative Strength Index: The RSI is a momentum indicator that measures strength and resistance levels on a scale of 1 to 100. This helps limit the risks that come with scalping.

This metric will help you build an expansion strategy with better confidence. As long as you can consistently follow our strategies and include stop losses carefully, scalping will be a natural evolution of your trading strategy.

Simple Scalping Strategy can be a powerful 1-minute scalping system, try it on a schedule and let us know the results! We have the best scalping strategy indicators (volume) available and have a full range of strategies to use with your strategy. The reason is that you can see trends, you can see reversals, and you can show when interest is low between buyers and sellers.

This best scalping system is not only easy to scalp, but also a high win rate strategy and grow your account very fast. If you’re not a fan of scalping and enjoy swing trading or weekly trading strategies, check out our Rabbit Trail Channel Strategies as we show you how to get 50 pips in one go with high odds of winning!