Crypto pattern trading strategies teach you how to properly trade and draw crypto patterns. You can use your own crypto harmonic patterns on your own and have a profitable forex trading strategy.

It’s no mystery that geometric patterns exist on Forex price charts. And the password pattern expresses that very well. Cypher pattern forex is part of harmonic trading patterns and is the most interesting harmonic pattern. Because it has the highest win rate.

The Trading Strategy Guides team is working on a step-by-step guide to harmonic trading patterns. I recommend reading Introduction to Harmonic Patterns. Here is our Knowledge Base, Harmonic Patterns Trading Strategy – Easy Step by Step Guide.

It is important to read the introductory article on harmonic patterns. You will get a better understanding of this. We also provide training on how to trade with the Gartley pattern.

Cypher pattern forex works in all markets and all time zones. The Trading Strategy Guides team recommends avoiding lower times. Stick to higher timeframes, preferably 4h and daily charts only. We want to make sure our readers are satisfied.

So, if you mainly trade in the low period, read Best Stochastic Trading Strategy – Easy 6 Step Strategy. Recently, this article has received a lot of attention from readers.

To help you trade harmonic patterns, we provide you with the tools and information you need for success. In this regard, we will have a series of strategies for exchanging different harmonic patterns, such as:

- ABC stress / bearish

- AB = CD Bull / Bear

- 3-drive bullish/bearish

- Gatley accent / bear

- Butterfly accent / bearish

- bat accent / bearish

- Crab stress / bearish

- shark accent / bearish

Before you get started, review the indicators you need to successfully trade the Cypher Pattern Trading Strategy.

To better identify cipher pattern forex and plot cypher patterns, you should use the harmonic pattern indicator (see picture below). In the indicators section, you can detect harmonic pattern indicators from the most popular Forex trading platforms (TradingView and MT4).

Do not forget that you have to draw Cypher pattern forex yourself. Check if it matches the Fibonacci rules. We will elaborate on this in the next few paragraphs. Also read Personal Trading Plan reviewed by Kim Krompass.

Now let’s define and define Cypher pattern forex.

What is Cypher Pattern Forex?

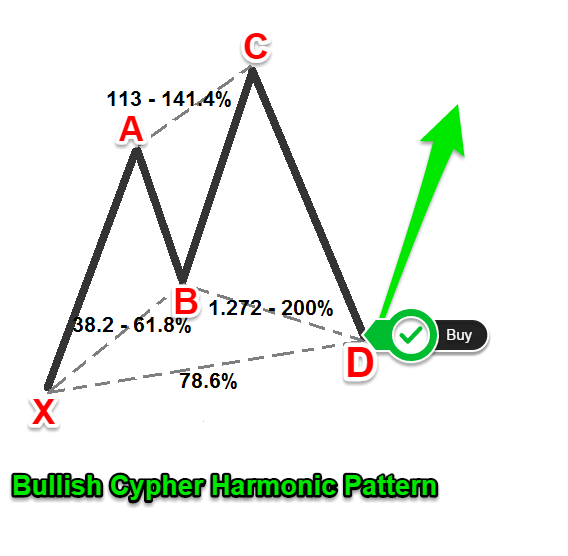

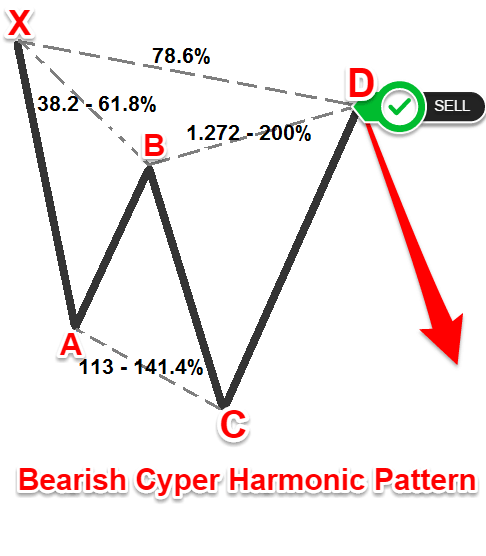

In the world of harmonic patterns, the Cypher pattern forex is a four-legged reversal pattern. Patterns follow certain Fibonacci ratios. Cipher pattern forex appears less frequently than other harmonic patterns. This is because it is difficult for market prices to meet these strict Fibonacci ratios. Cypher pattern forex must meet the following Fibonacci rules.

- AB = 0.382 to 0.618 return of XA swing leg;

- BC = extends to a minimum of 1.272 and a maximum of 1.414 of the XA swing leg;

- CD = return to 0.786 of the XC swing leg;

Strategy definition

The first rule of Cypher pattern Forex is that a retracement from X to A must be made. It should touch the 0.382 Fibonacci rate, but cannot close below the 0.618 Fibonacci rate. Between the 0.382 and 0.618 Fibonacci retracement of the XA swing leg, we have the third point of the Cypher pattern forex labeled “B”.

The next rule of Cypher pattern forex is the Fibonacci extension of the XA leg. It comes out at 1.27 but does not exceed the 1.414 Fibonacci ratio. This move point is marked “C” and completes the BC swing leg of the Cypher pattern forex. The final leg of the Cypher pattern on which the spell will be executed is at finish point D. Point D is at the 0.786 Fibonacci retracement of the entire move from X to C.

Crypto Pattern Trading Strategy

Now learn how to trade the Cypher Pattern with a very simple set of rules. They will try to minimize risks and maximize profits. However, there is one more important step you need to know before defining your Cypher pattern trading strategy rules. First, we give an indication of how to apply harmonic pattern indicators.

How to draw a 1-step cypher pattern

We will guide you through this process step by step. You should follow this simple guide and refer to the picture below to better understand the process.

- First click on the harmonic pattern indicator. Indicators are located on the right-hand toolbar of the TradingView platform. You can find harmonic pattern indicators in the indicator library of your MT4 terminal.

- Identifies starting point X on the chart. These can be swing highs or lows on the chart.

- Once you find the first swing high/low point, you should follow the market swing wave movement.

- You need 4 points or 4 swing high/low points that combine with each other to form a forex harmonic pattern. All swing legs must be validated and adhere to the crypto pico nazi ratios shown above.

Now let’s review the Cypher pattern trading strategy rules.

See below…

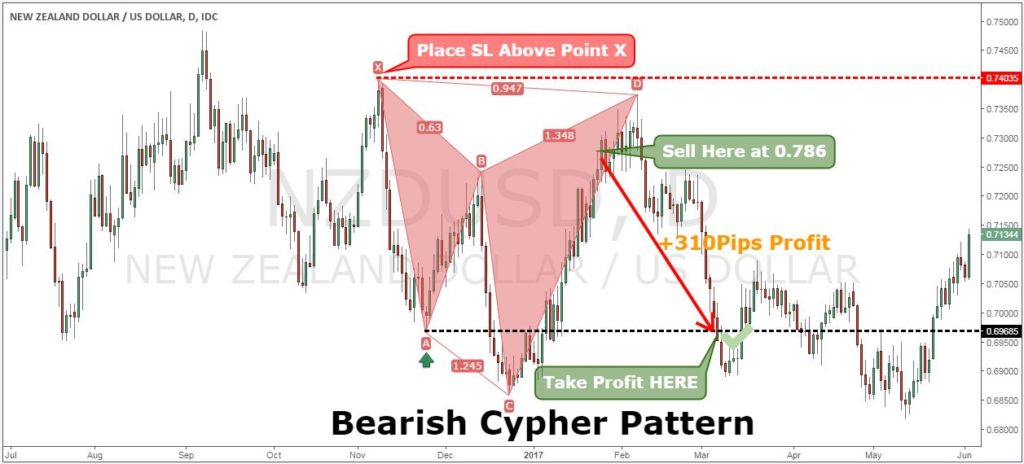

Step #2 What to buy: CD- Buy when the swing leg reaches the 0.786 retracement of the XC swing leg.

From a risk management perspective, Cypher patterns may be the most interesting harmonic patterns. Because it has the highest win rate. Our backtesting results consistently demonstrated that cipher pattern forex is a very stable harmonic pattern.

Next, buy with a market order on the opening candle before point D completes at the 0.786 Fibonacci retracement of the XC leg. When the market reaches the 0.786 level, we assume there is a wave D because we have no control over how far the market will go. We are only interested in satisfying Fibonacci ratios.

We can see that the price has only a small deviation from the 0.786 Fibonacci ratio (our entry point).

The next important thing to set is where to place your protection stop loss.

See below…

Step 3 – Stop Loss: Place your protective stop loss below the X wave.

For Bullish Cypher pattern Forex, you usually want to place your protection stop loss below point X. This is the logical place to hide your stop loss. Because any suspension below will automatically invalidate the transaction.

We need to establish the most logical places to profit from our Cypher pattern trading strategy.

See below…

Step 4 Bullish Cypher Pattern Forex – Make Profit: When you reach point A, you take profit.

The Cypher pattern trading strategy is a reversal strategy. You want to catch as much as possible in a new trend. If you are not a fan of reversal strategies and prefer trend-following strategies, you may want to learn MACD Follow-Follow Strategies – Simple Strategies. This strategy has garnered a lot of attention from the forex trading community.

Cipher patterns have conservative profit targets. When you reach point A of the pattern, you want to profit.

Why are you making a profit so quickly?

For most harmonic patterns, it is best to secure gains as soon as possible. The Cypher pattern is one of the most profitable harmonic patterns, giving price action more room to breathe. We at least have a chance to see a retest of wave A.

Note ** The above is an example of a BUY trade using the Bullish Cypher pattern trading strategy. Use the same rules for SELL transactions. In the picture below you can see an example of a SELL transaction in action.

watch:

conclusion

The rules of the Cypher pattern trading strategy are very simple. However, harmonic cipher structures are rarely found on charts, even though they have a greater win rate than other harmonic patterns. You should make the most of the instances you see.

We want our Cypher pattern trading strategy rules to be clear and concise. If you still have any questions, feel free to leave them in the comments section below.