The swing trading options strategy is an uncomplicated approach to making quick and safe profits. This is a guide to the best swing trading options that the Trading Strategy Guides team has been using for years to earn significant returns in the market. Here’s how to identify the right swings to increase your profits.

If you are not yet familiar with options trading, read our highly profitable options trading tutorial to help you understand how to trade stock options. How to Trade Stock Options for Beginners – Best Options Trading Strategies.

The swing trading options strategy has three main benefits.

- The potential to experience notable gains from your initial investment.

- The best swing trading options can limit your risk exposure.

- You can trade expensive stocks with a very small account.

If you are trading a small trading account, swing trading options are a good strategy to capitalize on your initial investment. You don’t necessarily need a lot of capital to trade with the best swing trading options, as you can trade “expensive” stocks like Amazon, Netflix or Alphabet without spending a lot of money.

Swing trading options strategies tend to stick primarily to basic call and put options.

Basically, if you want to buy a stock, you buy a call option. Conversely, if you want a more convenient way to sell a stock, your best bet is to buy a put option. Also read our weekly trading strategies to keep you sane.

Why Swing Trading Options?

The simple reason why we chose swing trading options as our primary strategy for profiting from stock trading is its massive profit potential.

Everyone wants to make big profits, and the swing trading options strategy is a safe and secure investment vehicle to achieve your monetary goals.

now…

Let’s go a little deeper and outline some of the more prominent principles behind swing option options.

Swing Trading Options Strategy – Buy Call Options

The Swing Trading Options Strategy is a six-step process applicable to any market. What you are trying to learn is simply the best swing trading option.

You can view this as a set of principles that can help you better understand options trading and how to effectively apply swing trading options strategies.

Also read the Simple Gold Trading Strategy here.

Step 1: Choose the Right Stock

This is the first step in exploring swing trading options.

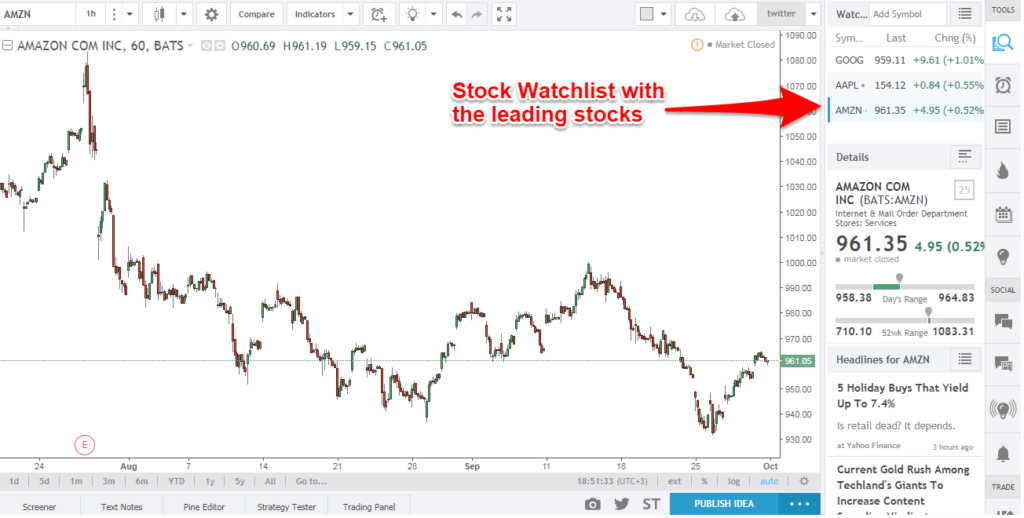

Picking a stock can be a daunting task, as there are numerous stocks listed on the New York Stock Exchange and available for trading. Naturally, what you want to do is build a solid sector watchlist with major stocks.

Wait for external moves and large percentage moves on your stock watchlist, then implement a swing trading options strategy using those stocks.

It is better if there is a strong catalyst because it means that a larger percentage move is due to some earnings report and the stock price is driven by strong fundamental reasons.

Step 2: Evaluate the market environment, look for the Bullish Trend if you want to buy a call option

You need to know what kind of market it is in order to successfully trade the best swing trading options.

Once you understand what kind of market you are in you will be guided on which side of the trade to go long or short.

The simplest way to define a bullish trend is to look for a series of higher highs and lower lows.

In addition, determining the overall market trend should also evaluate the characteristics of the market environment with low market volatility and high volatility. This will help you choose the expiry date of your swing traded options later. Also learn about the difference between options and RSUs.

Step 3: Choose a Strike Price

The next step that a swing trading options strategy has to offer is the strike price.

Setting a strike price can be a challenge if you don’t know what to look for. Ideally, what you want to do is choose options that are out of the money, but not too far out of the money and into the money.

What are in the money options?

According to Investopedia: “Out of the Money (OTM) is a term used to describe a put option that has a strike price higher than the market price of the underlying asset or a strike price lower than the strike price. The market price of the underlying asset.”

Step 4: Select Expiration – Monthly Option

An optimal swing trading options strategy should provide enough time for the stock to be exercised so that the corresponding call option pays off. Otherwise, the option may expire worthless.

In general, a too large expiry time reduces the risk, but at the same time reduces the percentage increase.

In other words, if you buy more time, your risk will be considerably reduced and your potential losses will be much smaller.

The best way to swing trade options is to use monthly options when you get a relatively high percentage gain.

Step 5: Immigration Optimization – Purchase Pullback

The most important part of any best swing trading option is optimizing your entry and exit.

In general, swing trading options take time and you need to be patient.

Also, some swing trades can’t afford the best types of items because the best swing trade options will get you cheaper prices if you’re patient.

If you are buying a call option, a trading strategy you can use to optimize your entry is the pullback buy.

You can use trading tactics on how to trade pullbacks: How to Profit from Trading Pullbacks.

Also, always define your maximum stop loss after buying an option, and align your take profit to where you expect the market to be before the option expires.

Step 6: Trade Management

During periods of low volatility, you want to short your positions when doing swing trading options.

If you still believe in the trade and feel you need more time, roll the option over to the next month. This is a smart money trade that you won’t lose due to the decay of time.

*Note: Time decay is simply a ratio measuring the change in an option’s price over a decrease in expiration time.

The most profitable options trading strategy should be suitable for executing both Put and Calls options.

*Note: The above is an example of buying currency options using the options trading tutorial. Use the same rules when buying put option trades.

In the picture below you can see an example of a real buy put option using the best swing trading option.

The Swing Trading Options Strategy is a powerful option for swing trading, but like any other strategy, it requires knowledge on how to use it properly. We hope our best swing trading options will help you generate stable profits.

The opportunity to make money through swing trading options is extremely lucrative and is a much safer way to trade than simply trading stocks. You can also take our trader profile quiz.

The daily fluctuations in the stock market tend to shake many people out of their trades, and the best swing trading options tend to smooth the price action a bit to reflect a slightly more stable trading opportunity. Also read Best Binary Options Strategies.