We will always answer any questions you may have. How Does Robinhood Work? Robinhood is a free US-based stock trading app that allows 100% commission-free trading of stocks, options, cryptocurrencies and ETFs. This guide will teach you everything you need to know about Robinhood so you can trade effectively.

If this is your first time on our website, the Trading Strategy Guides team welcomes you. Hit the subscribe button to have free trading strategies delivered to your email inbox every week.

The biggest reason RobinHood is so popular is its commission-free nature. In short, they charge no transaction fees and have a $0 minimum account. Which one raises the issue? How Does Robinhood Make Money?

We will answer this question in the next section. By the end of this guide, you will know exactly how Robinhood works and how to start trading.

In 2019, the RobinHood app became the largest online stock broker in the US, surpassing E-TRADE. Until this year, E-TRADE was the largest broker-dealer in terms of number of clients. Today, Robinhood is the most popular mobile trading app with over 6 million customers.

First, let’s start by answering the first basic question: Is Win Hat Robinhood?

What is Robinhood?

Robinhood is a broker-dealer app that allows users to trade stocks, options and ETFs with no fees or commissions. You can also buy and sell cryptocurrencies on the Robinhood app. Robinhood allows users to trade cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

Since Robinhood does not charge trading fees, it is much easier for beginner traders to learn how to make money. The second advantage is that there is no minimum deposit requirement to start trading on the Robinhood App.

You can start investing with the Robinhood app no matter how much money you have.

The downside is that they don’t offer tax-protected accounts like IRAs or other types of retirement accounts. Another downside to Robinhood is that it currently does not offer an automated trading feature.

You can trade the following commodities on the RobinHood app:

- Stocks

- ETFs

- Ritz

- Options

- Cryptocurrency

RobinHood is the first brokerage account to introduce $0 fee trading. Typically, when you start trading stocks, stockbrokers will charge you between $5 and $15 to buy a stock. When you want to sell at a profit, your stockbroker will charge you extra. Not so with Robinhood.

The Robinhood app also allows users margin trading through their premium account tier, Robinhood Gold. With a commission-free model and a wide range of tradable tools, this app has grown significantly in 2019.

Now let’s answer another question many new aspiring traders have:

Is Robinhood Safe?

Are you Robinhood Legit?

Is Robinhood Legit? Are Robinhood apps safe? This is a legitimate problem that individuals investing in the stock market may have.

Your money on RobinHood is protected by the Securities Investor Protection Corporation (SIPC) with up to $500k in securities and up to $250k in cash claims, so you can trade with confidence.

Additionally, Robinhood is regulated by the Financial Industry Regulatory Authority (FINRA), making Robinhood more secure to use. So, in terms of security, investors’ money is very well protected.

Since Robinhood is a stock broker, it must be regulated by the United States’ financial regulator, namely the Securities and Exchange Commission (SEC). Besides being regulated by the SEC, Robinhood has other safety procedures to protect your hard-earned money and personal data.

Even though opening an account with Robinhood is different from a traditional stock brokerage account, you still need to collect certain information from your customers. This includes trading activity and tax information. You must provide your Social Security Number (SSN) to file your information tax form.

But apps don’t come without risk.

Trading on the go and being an inexperienced trader can be a recipe for disaster. That’s the only risk the RobinHood app owns. This is because it boasts of being the most loved investment app by millennials. And we know that many millennials are still losing the financial savvy to become successful stock traders.

The good news is that the app itself is simple and easy to use, even for new stock traders.

The following gives you a basic idea of how Robinhood works.

See below:

How Does Robinhood Work?

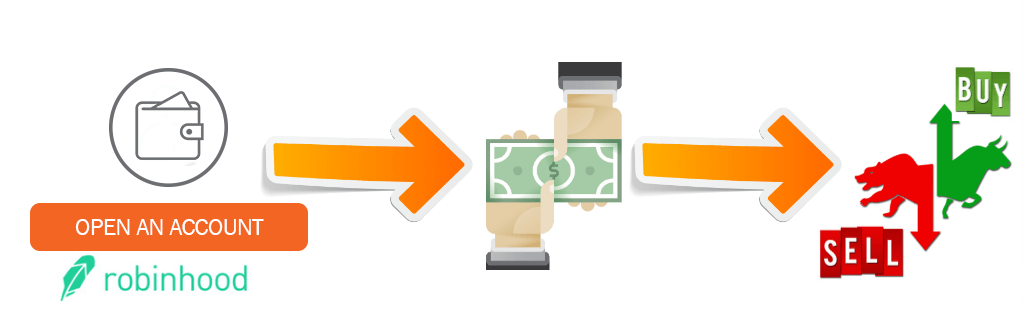

RobinHood works the same way as any other online stock and options broker. Follow the same standard process.

- First, submit an application to open an account with Robinhood.

- Second, transfer the funds to your RobinHood account.

- As soon as the money reaches your Robinhood account, you can start buying and selling stocks, options, ETFs, and cryptocurrencies.

If you’re not familiar with the slick Robinhood interface, you should know that it offers an alternative way to buy stocks. The following section shows an example of how to buy and sell stocks on Robinhood through the convenience of your smartphone.

Using an investing app can be intimidating and scary, but it’s actually very easy.

Buying and selling stocks on RobinHood up is as simple as these 7 steps.

- Load the RobinHood app.

- Search for your favorite stock, ETF or cryptocurrency.

- Click the “Trade” button.

- On the next page you will have the option to buy or sell. Click the “Buy” button.

- Choose an order type from the top right order and number of shares you want to buy.

- Confirm your order.

- Swipe up to submit your order.

Pro Tip – You can create watchlists for quick access to your watchlists as efficiently as possible.

Don’t forget to read our guide where we break down the best day trading stocks with a mountain of cash, a general principle and the best way to pick stocks for day trading.

Now let’s talk about controversial things. How Does Robinhood Make Money?

See below:

How Does Robinhood Make Money?

Can stockbrokers make money without charging commissions and offering stock trading for free?

RobinHood appears to be appealing to investors while still earning income from a variety of sources. Going forward, we’ll outline how RobinHood can offer commission-free trading and make money as a company.

The way Robinhood makes money is actually very transparent. All sources of income are listed on the website. The RobinHood app does not charge transaction fees like competitors E*TRADE or TD Ameritrade. However, Robinhood makes its profits from the following sources of income:

- Premium account. Robinhood Gold is a premium feature that allows for margin trading and other benefits. RobinHood Gold starts at $5 per month.

- Profit. Like other stockbrokers, RobinHood earns interest from customer cash in the same way that banks collect interest on cash deposits.

- We charge $10 for every transaction over the phone.

- They can also help you buy foreign stocks for around $35 – $50.

- Payment for order flow. This is common practice in this industry.

Again, there are no RobinHood hidden fees! Now, you could argue that selling order flow with high frequency trading (HFT) can delay your order. Orders to buy shares may be forwarded to these HFT companies before routing them to the actual exchange. As a result, orders can be filled better, so it is considered a hidden cost in trade execution.

However, all users of this business are likely to place orders with these HFT companies before forwarding their orders to the exchange. So there is no way out of this way. You have to get used to it and embrace it as a way of doing business.

If you want to learn how high frequency trading works, check out our HFT guide HERE.

Various traders follow, so let’s cover another topic that some of you will appreciate. That said, we are going to give you a quick guide on how to trade options on Robinhood.

See below:

How to Trade Options on Robinhood

Before buying or selling options on RobinHood, make sure options trading is unlocked in your Robinhood account. Depending on your level of experience, you get a level 2 designation if you are a beginner trader and a level 3 designation if you know how to execute more complex option strategies.

With a level 2 designation, you can execute the following options trades:

- Buy calls and puts. Learn how to buy put and call options with our step-by-step guide on how to trade stock options for beginners.

- Currency. Become a smart options trader with this call strategy.

- Put for cash.

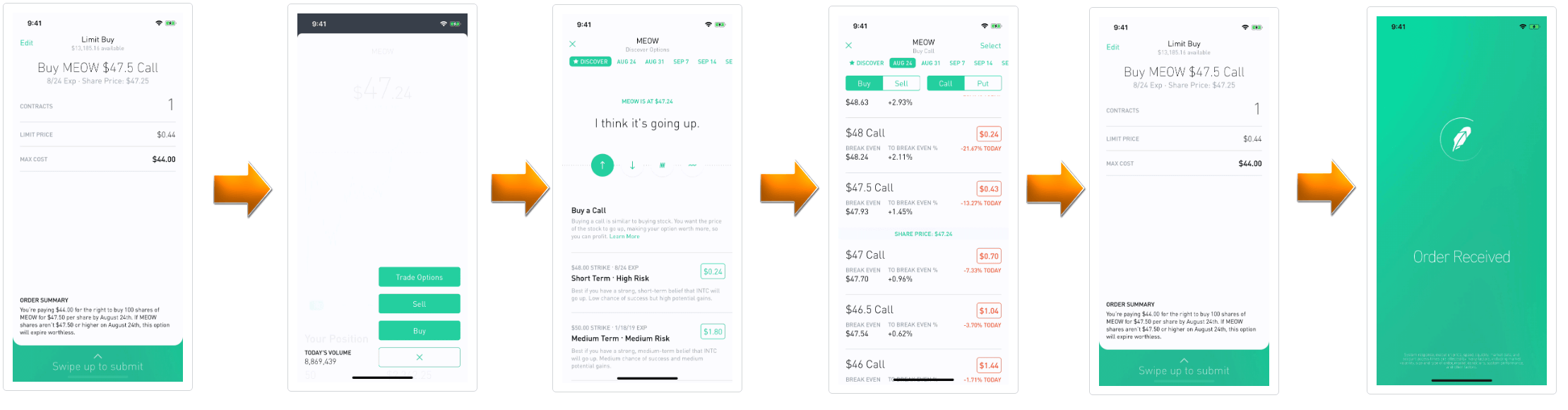

Opening an options trade on RobinHood is as easy as following three simple steps:

- Tap the magnifying glass and search for the stock you want to trade.

- Tap Transactions in the lower right corner of the stock detail page.

- 거래 옵션을 누릅니다.

(Click on the picture to enlarge)

Check out the different options trading strategies in our Options Investing Strategies Guide.

Final Words – How to Make Money on RobinHood

For certain types of stock traders, the RobinHood app can be the best stock trading app. However, the barrier to opening a RobinHood account is so low that you should still do your own research if you don’t want to lose your hard earned money. Before hitting the buy button, please follow our guide on how Robinhood works.

Get stocks for free with Robinhood

If you opened a new account today, you can get free stock by opening an account right now and opening an account with this link.

Although we have already given reasons why RobinHood is legit, this does not guarantee that you will always be able to make money. But you know that your funds are secured and you trade stocks through a reliable trading platform.

What if Robinhood doesn’t have a problem with how it makes money? And you love the convenience of trading through your smartphone. Trade your free stock today.

Thanks for reading!

Please leave your comments below. We read and respond to everything.

Also, if you were satisfied with this strategy, please give it a 5 star!