Do you want to learn daily trading cryptocurrencies and earn a consistent $500 per day? We often hear about the money you can make with day trading stocks. But what about cryptocurrency trading? In today’s lesson, you will learn how to trade cryptocurrencies using your favorite crypto analysis tools.

Our team at Trading Strategy Guides is fortunate to have over 50 years of combined daily trading experience. We will share the trades you need every single day for a living, and at the end of this trading guide you will know what it takes to be successful in this business.

Above all, a systematic approach and rules-based strategy are essential when day trading. It’s the same as swing trading or position trading you won’t trade every day, you won’t make money every day. Therefore, you need a daily trading cryptocurrency strategy to protect your balance.

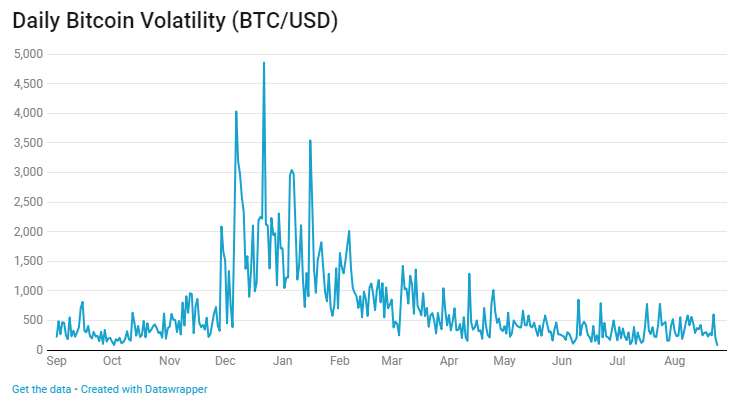

The high volatility of Bitcoin and other cryptocurrencies has made the cryptocurrency market like a rollercoaster. This is the perfect environment for day trading as there are up and down swings during the day that will allow you to earn enough returns.

Moving forward, we will teach you what it takes to learn how to handle cryptocurrency trading on a day-to-day basis and share ready-to-use rules-based daily trading strategies.

How to trade cryptocurrencies

Due to the unique nature of the crypto market, you need to have a good understanding of how it works. Otherwise, the experience can be like skydiving without a parachute.

The good news is that it will give you everything you need to survive in cryptocurrency trading.

Daily trading in the cryptocurrency market can be a very lucrative business due to its high volatility. Since the cryptocurrency market is a relatively new asset class, it has seen significant price increases.

Before trading Bitcoin or other altcoins, we recommend waiting until you feel the volatility is high. The good news is that even when volatility is low compared to other asset classes, you can still make modest gains on the trade because volatility is still high.

Cryptocurrency trading also requires proper timing and liquidity for accurate inputs.

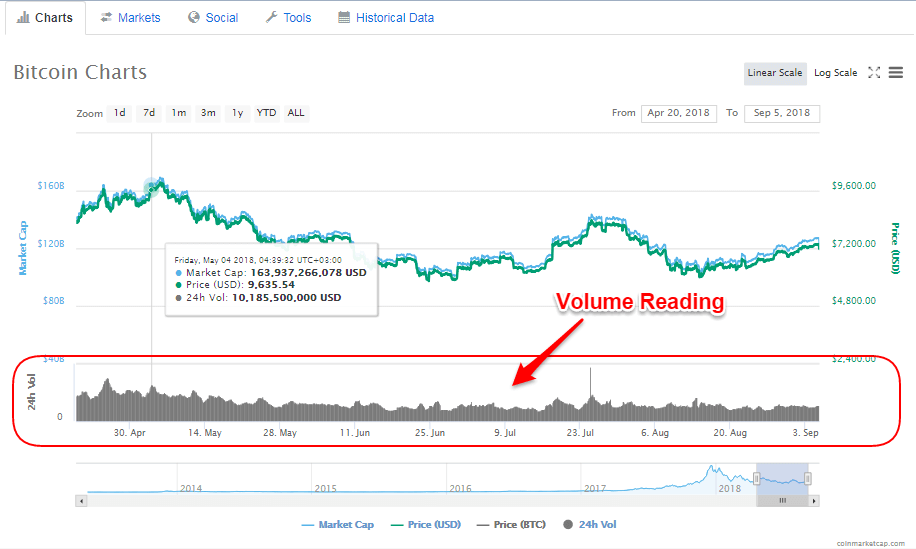

Many cryptocurrencies and crypto exchanges are not very liquid and do not have the kind of liquidity that can be found when trading forex currencies.

Before trading Bitcoin or any other alternative coin, it is also important to check how liquid the cryptocurrency you wish to trade is. You only need to view 24 hours worth of crypto trades.

CoinMarketCap is a good free resource for reading and measuring the market size of a particular coin.

Note * Insufficient liquidity can lead to significant slippage and lead to larger losses.

As mentioned earlier, cryptocurrency trading does not require trading every day. We only like day trading cryptocurrencies when all conditions are in our favor. If this is the case, avoid trading on weekends and limit trading to only days with the highest volume.

Fasten your seat belts because the following will reveal how professional traders reveal their daily trading cryptocurrencies.

Crypto Day Trading Strategy

The idea behind cryptocurrency trading is to find trading opportunities that offer the potential to make quick profits. If day trading suits your personality, take a look at our step-by-step guide on how to trade cryptocurrencies.

Now, before we go any further, it is always a good idea to bring a paper and pen and write down the rules of these two strategies.

In this article, we will look at the ‘purchase’ aspect.

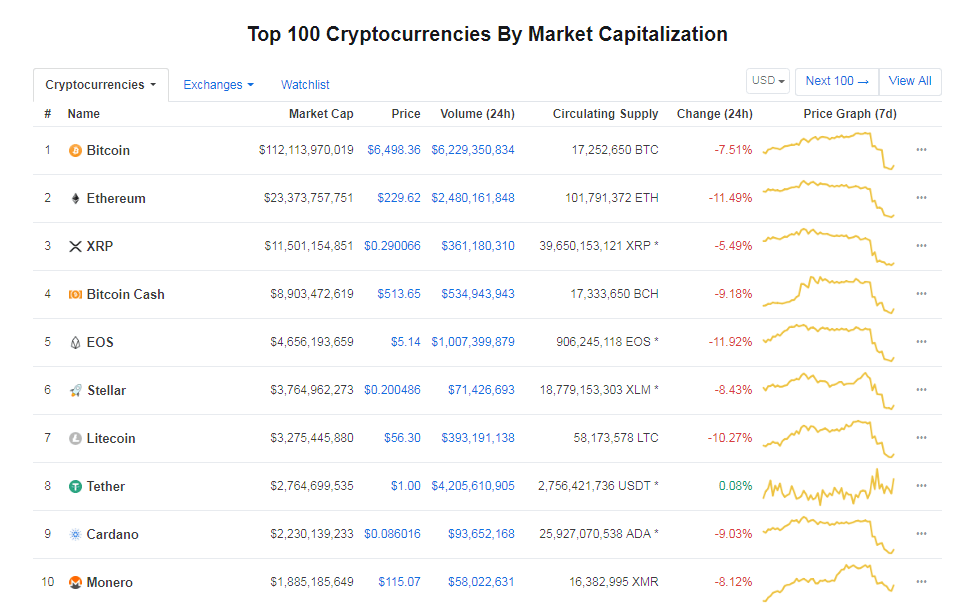

Step 1: Receiving coins with high volatility and high liquidity

As discussed earlier, you should choose the most volatile and liquid coins. If you don’t trade Bitcoin for a day, it’s the most liquid coin, and if you like altcoins, pick a coin with good liquidity and volatility.

There are over 1600 coins on the market and it is growing. If you follow only the best cryptocurrencies, you will have fewer choices.

Cryptocurrency trading in small exchanges is also a lucrative business, but with higher risks. Cryptocurrency prices can crash as fast as they rise.

In the future, you will learn how to trade cryptocurrencies.

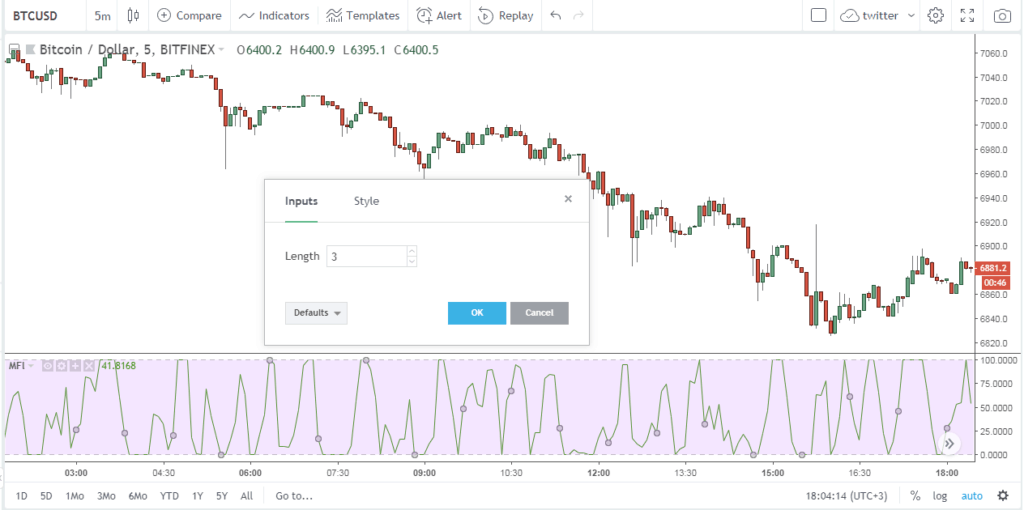

Step 2: Apply the Money Flow Index Indicator to the 5 Minute Chart

This particular day trading strategy uses one simple technical indicator, the Money Flow Index. We use this metric to track smart money activity and measure when institutions are buying and selling cryptocurrencies.

The default setting for the MFI indicator is 3 cycles.

It also changes the default buy and sell levels from 80 to 100 and from 20 to 0 respectively.

The following steps outline how to use the IMF indicator.

See below:

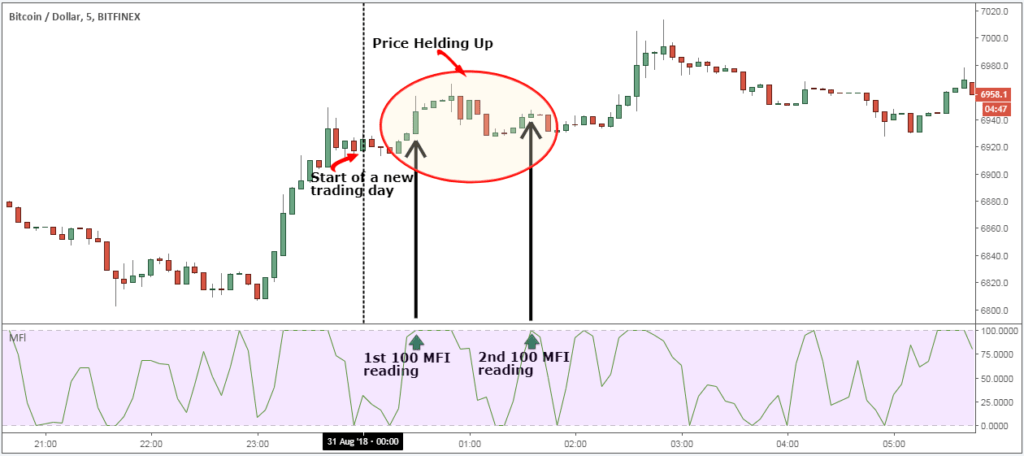

Step 3: Wait for the Money Flow Index to reach level 100.

An MFI figure of 100 shows that a big shark is entering the market. Smart Money cannot hide its footprint when making purchases. They inevitably track their activity in the market and we can read that activity through the MFI indicator.

Technical indicators aren’t always right, so we’ve added a few conditions to fine-tune your weekly trading strategy. That means you should skip the first two MFI readings of 100 for the current day and study the crypto price reaction.

The price should hold during the first and second 100 MFI readings.

If the price drops after the first two MFI 100 readings, a down day is likely to come.

Now let’s decide the right place to buy Bitcoin and the technical conditions that need to be met.

See below:

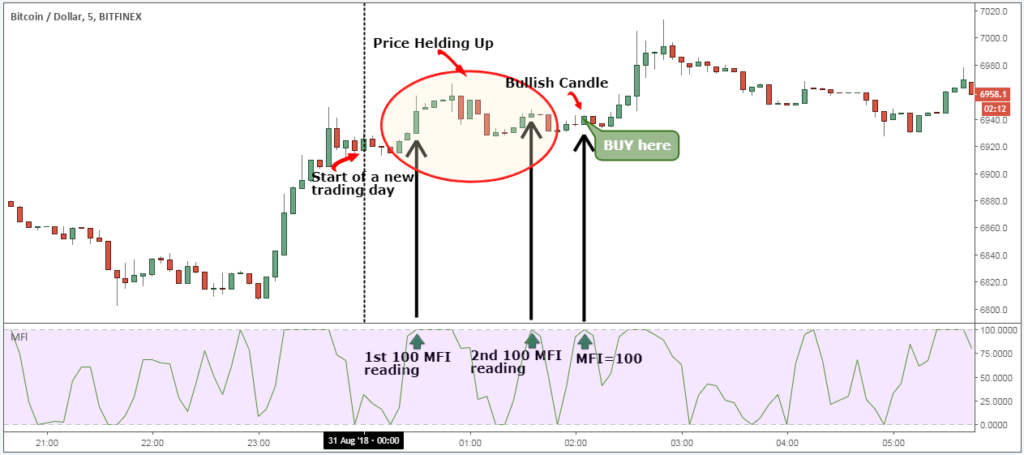

Step 4: Buy if MFI is 100 and subsequent candles are bullish

Now you can wait until the third MFI reading exceeds 100. It’s not necessarily the third MFI = 100 reading, it can take all other MFI = 100 readings. If time passes and the third 100 reading cannot be captured on the MFI indicator, the next reading may be selected as long as all other technical conditions are met.

Next, we also need a candlestick when the MFI = 100 reading is bullish. The closure of these candles should be near the top, giving us very small wick candles.

This brings us to the next important point to set when trading day trade cryptocurrencies.

See below:

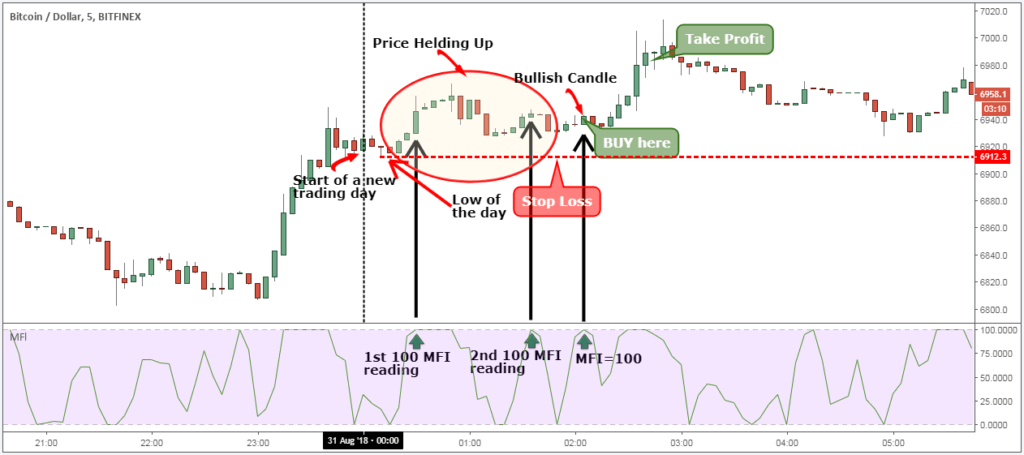

Step 5: Hide your protective stop loss at the lowest of the day. Start taking profits in the first 60 minutes after starting a trade.

A surefire place to hide your protection stop loss is lower than day. A price lower than this would suggest a change in market sentiment, and it is best to stay out of the trade. This could also signal a reversal day.

More flexible when it comes to exit strategies. However, the only rule to be followed is to take profits during the first 60 minutes or first hour of trading. If you keep trading for more than 1 hour, your success rate will be lower. At least that’s what our inverse test results have shown us.

Conclusion – Cryptocurrency Trading

If you take the time to read our trading crypto guide all day long, you can buy and sell Bitcoin and make money every day. If you want to learn how to trade cryptocurrency, be well-informed before jumping into the market.

Cryptocurrency trading can be a great way to grow your crypto portfolio and is a very lucrative alternative to the possessive mentality that is ruining the crypto community.

Due to the high volatility of the cryptocurrency market, creating a daily trading cryptocurrency can be much easier. The high volatility makes it very suitable for day trading so you have the right environment to succeed. You may also want to read our guide to the Best Cryptocurrencies Investments in 2019.

Thanks for reading!

Please leave your comments below. We read and respond to everything.

Also, if you were satisfied with this strategy, please give it a 5 star!