Learn how to use the Aroon Indicator trading strategy to detect changes in trend direction with lethal accuracy. Every trader needs to know how to evaluate a given trend and strength of an asset. Arun is a two-in-one technical indicator that helps you invert correctly and identify your own strengths and weaknesses. This guide explains how to use this powerful tool to spot trend changes.

If this is your first time on the website, the Trading Strategy Guides team welcomes you. Hit the subscribe button to get free trading strategies delivered weekly to your inbox.

Market trends are constantly changing. Don’t be fooled by the trend to shift gears. The problem is that most traders have trouble identifying when a trend is changing. Market wizard and billionaire hedge fund manager Paul Tudor Jones explains how to identify trend changes:

“Whether it’s the end of a bull market or the end of a bear market, there is no education, classroom or other way to prepare you to trade the last third of the move.”

For more famous trading quotes that offer a glimpse into the mindset of some of the most successful traders and hedge fund managers, see Top Trading Quotes of All Time – How to Trade.

You need to have the right tools in place to detect large trend changes.

So what’s the best indicator?

The best indicator to identify trend changes and trend strength is the Aroon Oscillator.

Next, we define the Aroon indicator MT4 and reveal the secret Aroon oscillator formula.

4 Aroon Oscillator Trading Strategy

What is an Aroon indicator

The Aroon Oscillator is a technical indicator that is part of the Oscillator Indicator family. Aroon was developed by Tushar Chande in 1995 and can help you identify incoming trends and their strengths. Chande was born in India, and in the Sanskrit dialect Aroon means “Dawn’s Early Light”.

As the name suggests, these oscillators are designed to mark the early beginnings of a new trend.

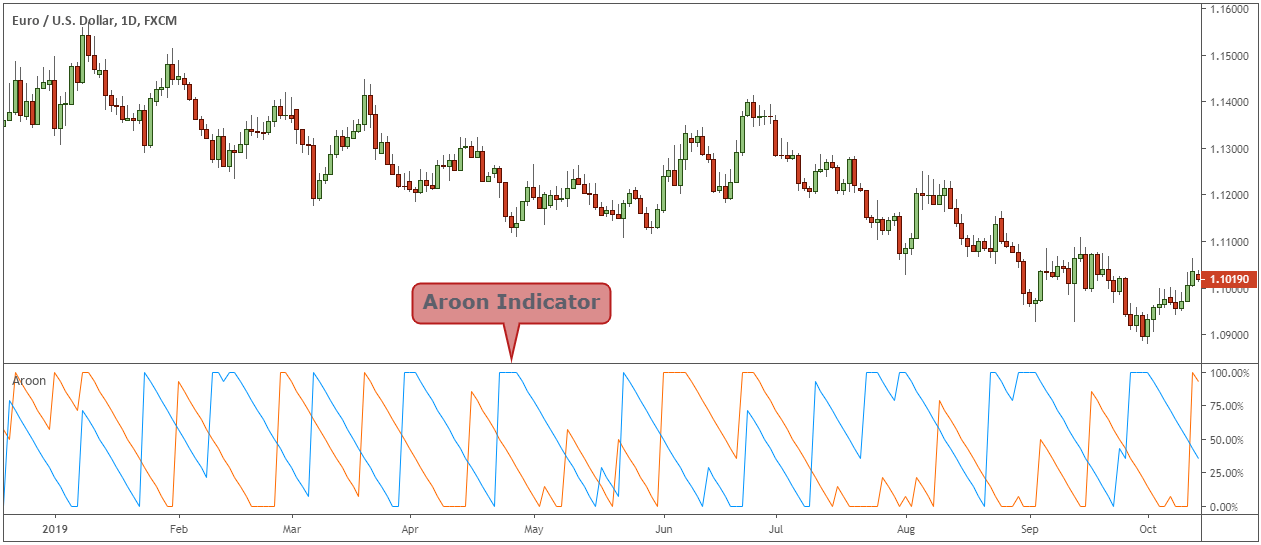

Check out the Aroon chart below.

Typical momentum indicators focus only on detecting the relative strength of a trend. For example, the ADX indicator can be used to determine only strong directional movements.

See how to measure the strength of a trend with Best ADX strategies built by Professional Traders.

In essence, Aroon technical indicators combine the advantages of the other two oscillators.

- On the one hand, we can tell when a new trend will emerge. You can use a mass index indicator to identify market reversals (Check Mass Index – The Definitive Guide to Trend Reversals).

- However, you can spot the strength of a trend without using other technical indicators. To develop trading skills that accurately read market strengths, check out the Sure Thing Indicator Strategy.

We can view Aroon, a technical indicator, as a combination of the Mass Index and KST indicators.

Too many technical indicators can cause analysis paralysis.

So, being able to use just one metric and extract multiple pieces of information is a huge advantage.

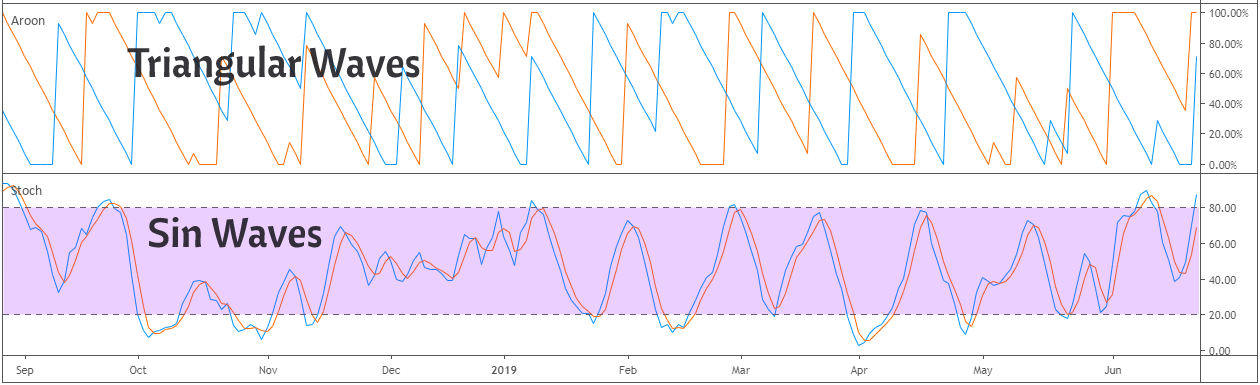

Second, conventional oscillators use sine waves to provide a visual representation of the indicator’s reading. However, the Aroon line is more triangular. For the more visually oriented technical trader, trading signals are a million times easier to spot, which in itself can provide an edge.

추세 반전 및 강도를 결정하는 요령은 Aroon 오실레이터 공식을 이해하는 데 달려 있습니다.

이제 시작하겠습니다.

What is Aroon Oscillator Formula?

The main idea of the Aroon technical indicator is that a strong uptrend can see new highs and a strong downtrend can see new lows. In essence, Aroon provides important insights as these new highs and new lows form.

The Aroon indicator consists of two lines oscillating between 0 and 100.

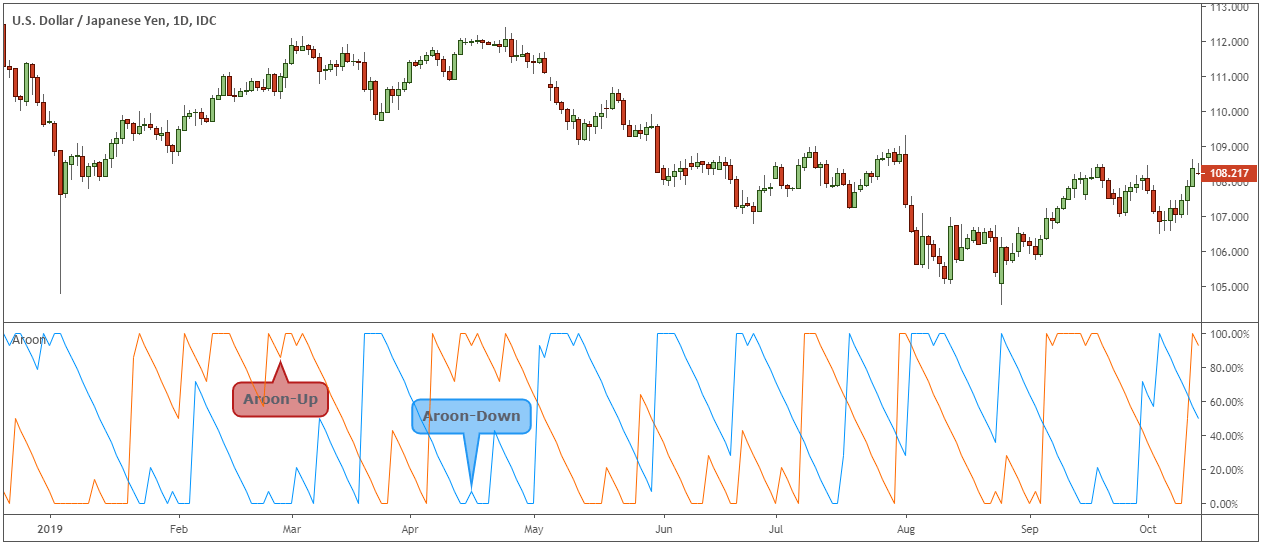

- Aroon-Up measures the strength of a bullish trend.

- Aroon-Down, a measure of the strength of a bearish trend.

The Aroon-up line uses the highest price for calculation and the Aroon-down line uses the lowest price for calculation. These two lines are displayed side by side for better visual presentation.

Aroon’s default parameter setting is 14 periods.

But what are the best settings for Aroon indicators?

Chande recommends applying the best settings for the Aroon indicator with 25 cycles of data.

- Aroon-up shows how much time has passed in the last 25 years.

- Aroon-down shows the low end of the last 25 years

Note * For long-term trading strategies, you want to look far past prices (> 25 cycles). However, for short-term trading strategies, you want to look at the most recent price data (<25 cycles).

Aroon indicator settings:

Unlike other momentum oscillators that are based on price movements and time, the Aroon indicator is quite unique. It also incorporates the highest and lowest values of 25 cycles into the Aroon oscillator formula.

The mathematical formula above shows how to calculate the Aroon indicator line.

The Aroon up and down indicator should track highs and lows over the past 25 years.

Luckily, you don’t have to remember the math behind Aroon’s calculations. Our trading platform will do that for us.

Let’s see how to trade money using Aroon indicators.

Here’s how to get started with Aroon Technical Indicators

How to use Aroon Oscillator

For example, traders can use the technical indicator Aroon to:

- Identify new trends (up or down).

- Evaluate the strength of the trend.

- Identification of Scope Areas and Aggregations

- And expect a market reversal.

Above are some examples of how to use the Aroon indicator.

For items, we will also use them next to the upper (100) and lower (0) bounds of the centerline (50).

The basic interpretation of Aroon measurements is as follows.

- A reading close to the 100 level indicates a bullish/bearish trend.

A reading close to the

- 0 level indicates a bearish/bearish trend.

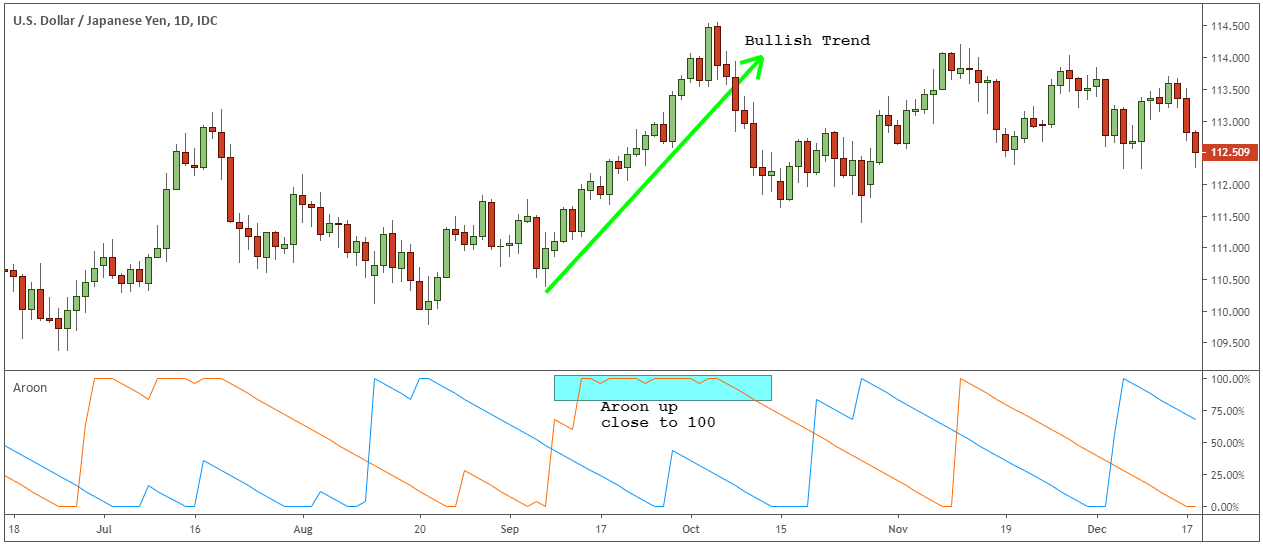

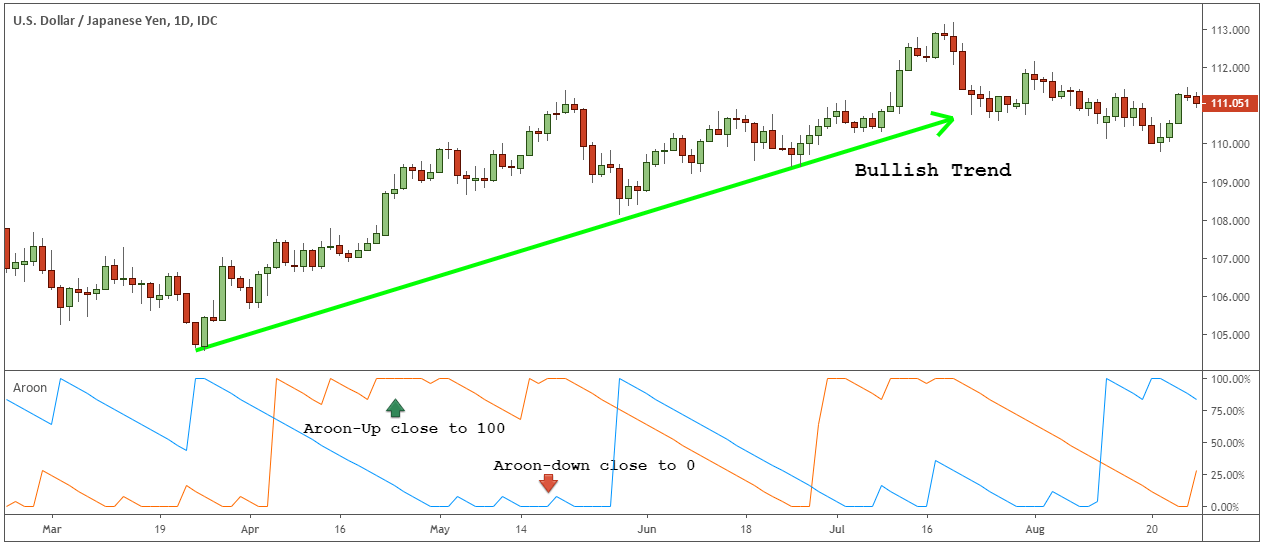

When the Aroon upline is close to the 100 level and the Aroon downline is close to the 0 level, the market is in a strong uptrend.

Conversely, when the lower Aroon line is close to the 100 level and the upper Aroon line is close to the 0 level, the market is in a strong downtrend.

Aroon rise and fall lines decrease with the elapsed time between new highs or lows.

When to enter a trade based on the new high formation versus the new low formation?

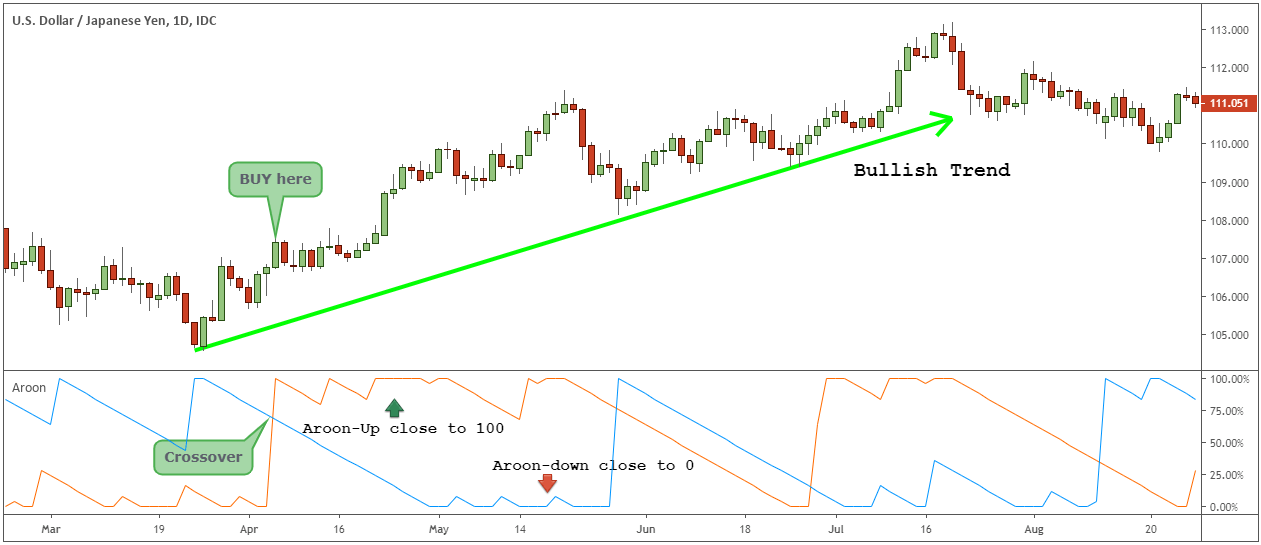

Aroon’s buy and sell signals are simple.

A key Aroon Buy signal occurs when Aroon-Up moves up. As the Aroon-up increases towards the 100 level, the chart shows price rising in a bullish direction. The rationale for this is that our charts are now forming higher peaks. We are getting more candles announced by the Aroon line. Also read the Best Candlestick Strategy PDF Guide.

In addition to the Aroon-Up moving up, the Aroon-Down should also move down to confirm the bullish trend. A buy signal is generated when Aroon-up crosses over Aroon-down.

Interpretation of this signal means that we are getting higher peaks or lower troughs recently. Overall, this is a clear indication of a bullish trending market.

NOTE** Aroon sell signals are almost the exact opposite. Aroon sell signals are triggered when Aroon-Down passes under Aroon-Up.

Next, we’ll explore 3 powerful Aroon trading strategies to explore all types of assets and markets.

Aroon Oscillator Trading Strategy

Aroon is a very versatile trading indicator with many built-in trading features. It can be used as a trading system on its own. The top 3 trading strategies based on the Aroon indicator are:

- Aroon Breakout Trading Strategy (Helps you spot connections and breakouts).

- Aroon trend strength strategy (helps you ride the trend).

- Aroon pullback trading strategy (helpful with retrading trades).

#1 Aroon Breakout Trading Strategy

How to spot consolidations and trade breakouts with Aroon?

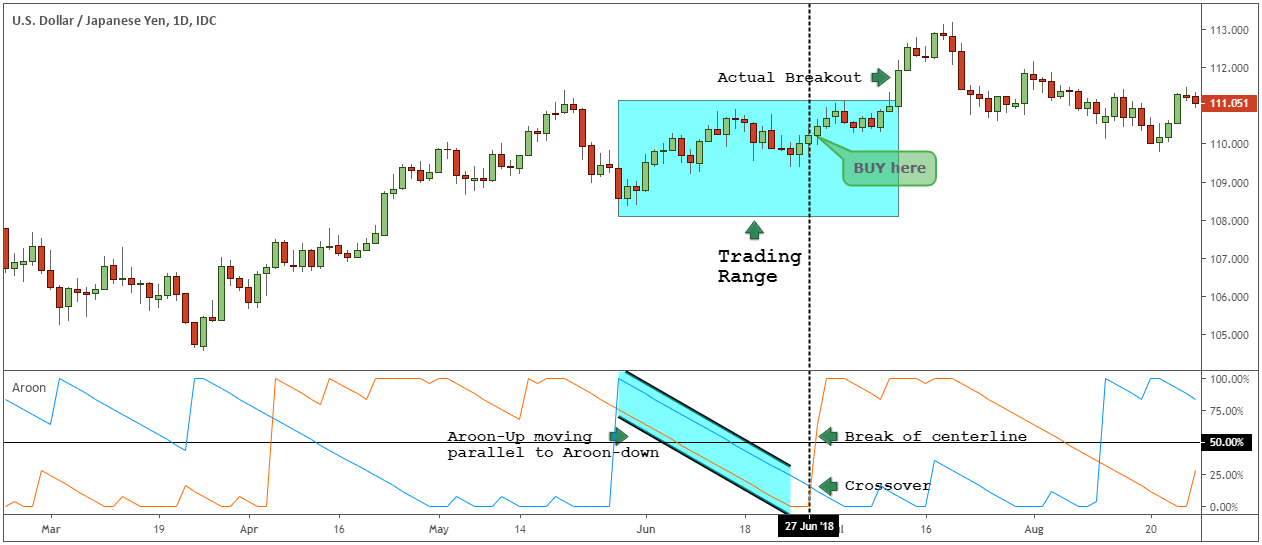

When the Aroon Up and Aroon Down lines are parallel to each other, it is a sign that prices are consolidating. The Aroon interpretation is that no new highs or lows are made during the underlying period.

There are two options for linking trades.

Wait for a breakout to occur and trade in the direction of the breakout.

Or wait for the Aroon crossover and centerline cross to add a confluence for the direction of the trade.

More often these Aroon signals occur prior to the actual breakout.

See the Aroon chart below:

So basically expect a breakout.

It’s like putting all market participants ahead.

Start trading before anyone else.

Now let’s see how to ride strong trends with Aroon. You will also learn how to trade using the RSI oscillator.

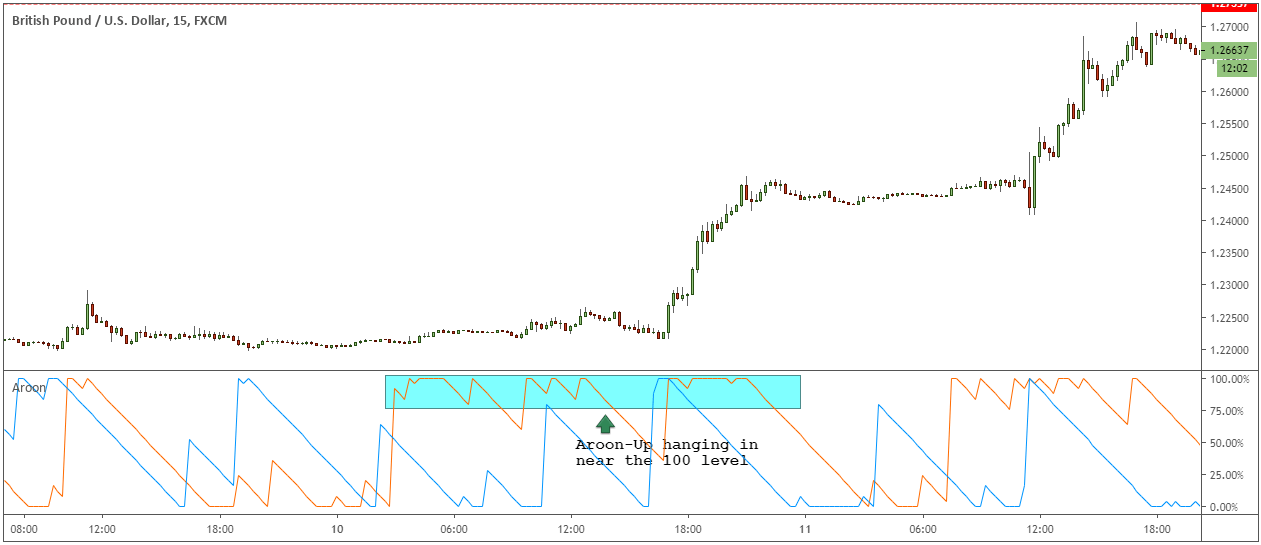

#2 Aroon Trend Strength Strategy

The underlying strength of the trend can be seen through the Aroon line.

When you reach level 100, you’ll start to see some changes from time to time.

Aroon UP simply hangs on like it’s reaching a plateau.

This is the same kind of activity you can look for when traditional oscillators reach overbought readings. And it stays at the overbought reading for a lot of the time.

A picture is worth a thousand words.

Aroon-Up continuous readings close to the 100 level indicate a very strong trend. However, at some point one or two trading scenarios may arise.

- To expect a trend reversal

- or to expect a fullback

Aroon’s interpretation of this type of reading suggests that we are building these high numbers over a very high period. For Aroon-Down, it forms a lower low.

Often, these excessive readings for the Aroon oscillator indicate a strong trend. However, if you want to scalp the market, you can exit your trade as soon as the Aroon-Up crosses below the center line.

But we try to trade with trends.

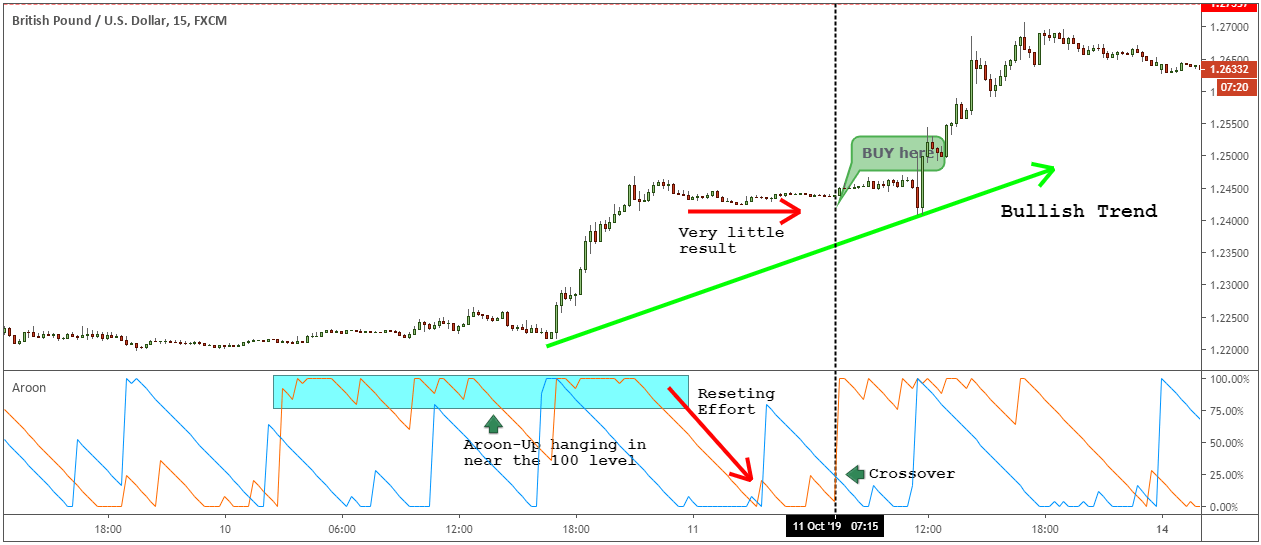

We’ve also developed a proven method to tell the difference between a fullback and a full reversal.

This is called the law of effort and the law of result.

Effort is activity measured in Aroon lines (Aroon-Up in this case). And the result is activity measured by price action. The theory is that if Aroon-UP resets by moving away from 100 readings and moving to 0 readings, price should follow the lead of Aroon-Up readings.

We expect these efforts to translate into lower prices. If not, if you see only a slight change in the price, you know that the uptrend is very strong.

This is how you can catch pullbacks with Aroon and trend trading.

We have combined the Aroon trend strength strategy and the Aroon pullback trading strategy into one big market advantage. If you enjoyed this method, check out our other proven Best Trading Strategies Article.

Final Words – Aroon Oscillator

The Aroon indicator is an unusual indicator that helps you identify the strength of a trend and ride that trend until it reaches a buy or sell climax. We love how versatile the Aroon Up and Down indicators are. The triangular Aroon oscillator line makes it easier for the untrained eye to spot buy and sell signals.

Collectively you have a momentum oscillator that can easily put you on top 3 technical indicators for profitable trading. The indicator you are using affects how you interpret trends. Of course, the holy grail of trading isn’t a single indicator.

Aroon is an effective tool for detecting changes in trend direction and trend strength.

To equip yourself with the right knowledge to win the war with checking out the world’s largest financial markets, see our how-to-forex trading guide for beginners.

Thanks for reading!