Key Differences Between Binary Options and Forex

Binary options and Forex trading are two popular forms of financial trading, each with its own unique characteristics and advantages. One key difference between the two is the way in which profits are made. In binary options trading, traders have the opportunity to make fixed returns on their investments, typically ranging from 70-90% of the initial investment amount. This means that even if the asset price moves in the desired direction by just a small amount, the trader can still make a profit. On the other hand, in Forex trading, profits are made by taking advantage of the fluctuations in the exchange rates between different currency pairs. This means that traders can potentially make unlimited profits, but they also face the risk of losing their entire investment if the market moves against them.

Another key difference between binary options and Forex trading is the level of risk involved. In binary options trading, the risk is limited to the amount invested in each trade, making it a more predictable and controlled form of trading. This is because traders know upfront the potential profits and losses they can make on each trade. In Forex trading, however, the risk is unlimited, as traders can lose more than their initial investment if the market moves against them. This makes Forex trading more risky and volatile compared to binary options trading.

Additionally, the time frame in which trades are executed is another key difference between binary options and Forex trading. In binary options trading, trades are typically short-term, ranging from minutes to hours, making it ideal for traders who prefer quick profits. In Forex trading, on the other hand, trades can be held for days, weeks, or even months, allowing traders to take advantage of long-term trends in the market.

In conclusion, binary options and Forex trading are two distinct forms of financial trading, each with its own advantages and risks. While binary options trading offers fixed returns and limited risk, Forex trading provides the opportunity for unlimited profits but also comes with higher levels of risk. Traders should carefully consider their online trading goals and risk tolerance before deciding which form of trading is best suited for them.

Market Structure: Binary Options vs Forex

Market structure refers to the organization of a market in terms of the number and size of firms, the nature of the product, and the ease of entry and exit. When comparing binary options and Forex, two popular trading options, it is important to consider their market structures.

Binary options and Forex are both financial instruments that allow traders to speculate on the movement of asset prices. However, they differ in terms of market structure. Binary options are structured as a simple yes or no proposition – traders are required to predict whether the price of an asset will go up or down within a specified time frame. If the prediction is correct, the trader receives a fixed payout; if it is incorrect, the trader loses the initial investment.

On the other hand, Forex trading involves buying and selling currency pairs in the foreign exchange market. Traders can profit from the fluctuations in exchange rates by buying a currency pair at a lower price and selling it at a higher price, or vice versa. Unlike binary options, Forex trading allows for more flexibility and customization, as traders can choose their own entry and exit points, as well as set stop-loss and take-profit orders.

In terms of market structure, binary options are typically offered by online brokers in a decentralized market, where traders can access various assets and expiration times. The simplicity and fixed payouts of binary options make them appealing to beginners and those looking for quick profits. However, the limited risk-reward ratio and potential for fraud have led to increased regulation of the binary options industry in recent years.

Forex, on the other hand, operates in a global decentralized market where currencies are traded 24 hours a day, five days a week. The Forex market is the largest and most liquid financial market in the world, with trillions of dollars traded daily. Due to the high liquidity and volatility of the Forex market, traders have the opportunity to profit from small price movements and leverage their positions to increase potential returns.

In conclusion, while both binary options and Forex offer opportunities for traders to profit from the financial markets, they differ in terms of market structure and complexity. Traders should carefully consider their trading goals, risk tolerance, and market knowledge before choosing between binary options and Forex.

Risk and Reward in Binary Options and Forex

Binary options and Forex trading are popular forms of investment that offer the potential for high rewards, but also come with high risks. Both involve predicting the movement of asset prices and making trades based on those predictions.

In binary options trading, traders have only two possible outcomes: they either make a profit or lose their initial investment. This simplicity is what attracts many traders to this form of trading, as it allows for quick and easy profits. However, the high risk involved means that traders can also lose large amounts of money in a short period of time.

Forex trading, on the other hand, is more complex and involves trading currencies on the foreign exchange market. Traders can make money by buying and selling currencies based on changes in their value relative to one another. While Forex trading offers the potential for higher returns than binary options, it also comes with higher risks. The market is highly volatile and can change rapidly, leading to significant losses if traders are not careful.

Despite the risks involved, many traders are drawn to binary options and Forex trading because of the potential for high rewards. With the right strategy and knowledge, traders can make substantial profits in a short amount of time. However, it is important for traders to be aware of the risks involved and to Forex trading app with caution.

To minimize the risks associated with binary options and Forex trading, traders should educate themselves on the market and develop a solid trading strategy. They should also carefully manage their investments and only trade with money that they can afford to lose. By being aware of the risks and taking steps to mitigate them, traders can increase their chances of success in these high-risk, high-reward forms of investment.

How Binary Options Work

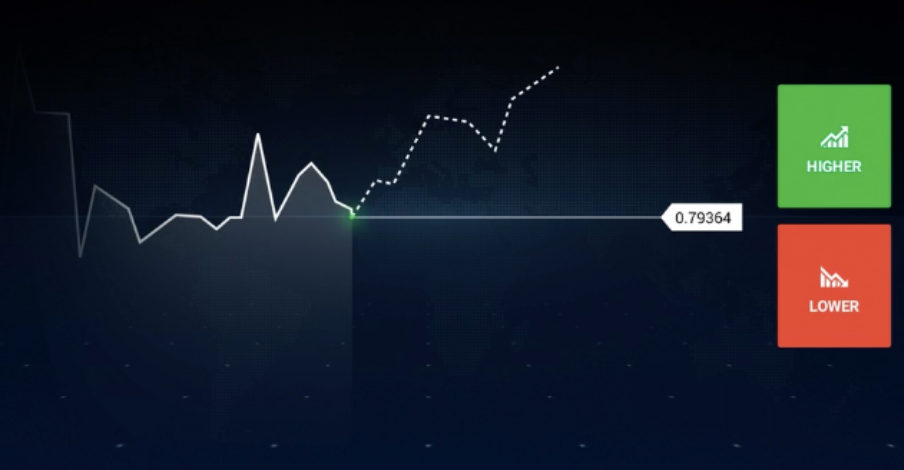

Binary options are a type of financial trading option where the payoff is either a fixed amount of a particular asset or nothing at all. This type of trading is based on a simple yes or no proposition – will the price of a specific asset be above a certain price at a certain time? If the answer is yes, the trader receives a fixed amount of money; if the answer is no, the trader loses their initial investment.

One of the key aspects of binary options trading is the fixed payout structure. This means that the potential profit and loss are predetermined at the outset of the trade, allowing traders to know exactly how much they stand to gain or lose before placing the trade. This fixed payout structure makes binary options a popular choice for both experienced and novice traders, as it eliminates the need for complex calculations and market analysis.

Another important feature of binary options trading is the short time frame in which trades are executed. Unlike traditional trading options that can take weeks or months to see a return on investment, binary options trades typically expire within minutes or hours. This short time frame allows traders to capitalize on small price movements in the market and make quick profits.

Binary options trading also offers a wide range of assets to trade, including stocks, commodities, currencies, and indices. This variety of assets allows traders to diversify their portfolio and take advantage of different market conditions. Additionally, binary options trading platforms offer various trading tools and resources to help traders make informed decisions and maximize their profits.

In conclusion, binary options trading is a simple and straightforward way to trade financial markets. With its fixed payout structure, short time frame, and variety of assets to trade, binary options offer traders a unique opportunity to profit from market fluctuations. However, as with any form of trading, it is important to understand the risks involved and to practice responsible Forex trading strategies.

Understanding Binary Options Contracts

Binary options contracts are a type of financial instrument that allows traders to speculate on the price movement of underlying assets, such as stocks, commodities, currencies, and indices. Unlike traditional options, binary options have a fixed payout and a fixed expiry time, making them a simple and straightforward way to trade financial markets.

To understand binary options contracts, it is important to first grasp the concept of binary options. In binary options trading, traders must predict whether the price of an asset will rise or fall within a specified time frame. If the prediction is correct, the trader receives a predetermined payout. If the prediction is incorrect, the trader loses the initial investment. For those new to the financial markets, it’s also helpful to explore related concepts, such as what is fx trading, to better understand how different types of trading operate and how they can complement each other.

One of the key features of binary options contracts is the fixed payout structure. This means that traders know exactly how much they stand to gain or lose before placing a trade. For example, if a trader invests $100 in a binary options contract with a payout of 80%, they will receive $180 if their prediction is correct and lose $100 if their prediction is incorrect.

Another important aspect of binary options contracts is the fixed expiry time. This time frame can range from minutes to hours, days, or even weeks, depending on the type of binary options contract being traded. Traders must make their predictions within this time frame, adding an element of urgency to their decision-making process.

In conclusion, understanding binary options contracts requires a basic understanding of how they work and the key features that set them apart from traditional options. By grasping the concept of binary options, traders can take advantage of the simplicity and accessibility of these financial instruments to potentially profit from the price movements of various assets in the financial markets.

Expiry Times and Payouts in Binary Options

Expiry times and payouts are two important factors to consider when trading binary options. In binary options trading, traders predict the direction of an asset’s price within a specific timeframe. The expiry time refers to the duration of the trade, which can range from minutes to hours or even days. Payouts, on the other hand, refer to the amount of money a trader can earn if their prediction is correct.

Expiry times play a crucial role in binary options trading as they determine the outcome of a trade. Short expiry times, such as 60 seconds or 5 minutes, are ideal for traders who prefer quick profits and rapid trades. On the other hand, longer expiry times, such as 1 hour or 1 day, are better suited for traders who prefer to take a more conservative approach and analyze market trends over a longer period.

Payouts in binary options trading can vary depending on the broker and the type of trade. Typically, payouts range from 70% to 90% of the initial investment. Traders can earn a fixed amount of money if their prediction is correct, regardless of how much the asset’s price moves in their favor. However, it is important to note that in binary options trading, traders can also lose their entire investment if their prediction is incorrect.

It is essential for traders to carefully consider both expiry times and payouts when trading binary options. By selecting the right expiry time and understanding the potential payouts, traders can maximize their profits and minimize their risks. It is also important to conduct thorough research and analysis before making any trades to ensure informed decision-making.

In conclusion, expiry times and payouts are key components of binary options trading that can significantly impact a trader’s success. By understanding how these factors work and using them to their advantage, traders can increase their chances of achieving profitable trades in the dynamic world of binary options.

How Forex Trading Works

Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies on the foreign exchange market. The Forex market is the largest and most liquid market in the world, with an average daily trading volume exceeding $5 trillion. The basic idea behind Forex trading is to profit from the fluctuations in exchange rates between different currencies. Traders can make money by buying a currency when its value is low and selling it when its value is high, or by selling a currency when its value is high and buying it back when its value is low.

Forex trading works by pairs of currencies being traded against each other. For example, if a trader believes that the Euro will strengthen against the US Dollar, they would buy the EUR/USD currency pair. If the Euro does indeed strengthen, the trader can then sell the EUR/USD pair at a higher price than they bought it for, making a profit. On the other hand, if the Euro weakens, the trader will incur a loss.

Forex trading is typically done through a broker, who acts as an intermediary between the trader and the market. The broker provides the trader with a fx trading platform, which allows them to place orders to buy or sell currencies. Traders can also use leverage, which allows them to trade larger positions than their initial investment would normally allow. While leverage can amplify profits, it also increases the risk of losses.

One of the key factors that influences the Forex market is economic data, such as GDP growth, employment figures, and inflation rates. Traders monitor these indicators closely to anticipate how they will affect currency prices. Political events, such as elections or geopolitical tensions, can also have a significant impact on the Forex market.

In conclusion, Forex trading involves buying and selling currencies on the foreign exchange market to profit from fluctuations in exchange rates. Traders use brokers and trading platform to execute their trades, and closely monitor economic and political events that can affect currency prices. Like any form of trading, Forex trading carries risks, but with careful analysis and risk management, traders can potentially generate significant profits.

Currency Pairs and Forex Market Basics

Currency pairs are a fundamental concept in the Forex market, which is the largest financial market in the world. In automated Forex trading, currencies are always traded in pairs, with one currency being bought or sold in exchange for another. The value of a currency pair is determined by the exchange rate between the two currencies.

There are three main types of currency pairs in the Forex market: major pairs, minor pairs, and exotic pairs. Major pairs are the most commonly traded pairs and include currencies like the US dollar, euro, Japanese yen, British pound, Swiss franc, Canadian dollar, and Australian dollar. Minor pairs, also known as cross pairs, include currencies that are not paired with the US dollar, such as the euro/Japanese yen or the British pound/Swiss franc. Exotic pairs involve currencies from emerging or smaller economies, such as the US dollar/South African rand or the euro/Turkish lira.

When fx trading currency pairs in the Forex market, traders speculate on the direction in which the exchange rate between the two currencies will move. If a trader expects the value of one currency to appreciate relative to the other, they will buy the currency pair. If they expect the value to depreciate, they will sell the currency pair.

The Forex market operates 24 hours a day, five days a week, allowing traders to buy and sell currency pairs at any time. The market is highly liquid, with trillions of dollars being traded daily, making it an attractive option for investors looking to profit from fluctuations in exchange rates.

In conclusion, understanding currency pairs is essential for anyone looking to trade in the Forex market. By knowing the basics of how currency pairs work and the factors that influence their value, traders can make informed decisions and potentially profit from the dynamic and fast-paced world of Forex trading.

Spot, Forward, and Futures Markets in Forex

The foreign exchange market is one of the largest and most liquid financial markets in the world. It consists of various types of markets, including spot, forward, and futures markets. These markets play a crucial role in the Forex market by providing liquidity, price discovery, and risk management for market participants.

The spot market is where currencies are bought and sold for immediate delivery. In this market, transactions are settled within two business days. The spot market is the most widely traded market in the Forex market and is where most retail traders and investors participate. Prices in the spot market are determined by supply and demand factors, as well as market sentiment and economic data.

The forward market is where contracts are traded that specify the exchange rate for a future date. These contracts are customized and can be tailored to the specific needs of the parties involved. The forward market allows market participants to hedge their currency exposure and manage their risk. It also provides a way for businesses to lock in a future exchange rate for their international transactions.

The futures market is similar to the forward market, but contracts are standardized and traded on organized exchanges. Futures contracts are legally binding agreements to buy or sell a specified amount of a currency at a predetermined price on a future date. The futures market provides transparency, liquidity, and price discovery for market participants. It is also used by speculators and investors to profit from changes in currency prices.

Overall, spot, forward, and futures markets in Forex play complementary roles in the Forex market ecosystem. They provide market participants with the tools they need to manage their currency exposure, hedge their risk, and speculate on currency prices. These markets help to ensure the efficient functioning of the Forex market and contribute to price stability and liquidity.

Advantages of Binary Options Trading

Binary options trading offers several advantages over traditional forms of trading. One of the main advantages is the simplicity of the process. In binary options trading, traders only need to predict whether the price of an asset will go up or down within a specified time frame. This makes it much easier for beginners to get started in trading without having to learn complex Forex trading strategies. Additionally, binary options trading has fixed payouts and risks, which means traders know exactly how much they stand to gain or lose before entering a trade. This can help traders manage their risk more effectively and avoid large losses.

Another advantage of binary options trading is the ability to trade on a wide range of assets. Traders can trade on stocks, commodities, currencies, and indices, giving them a diverse range of options to choose from. This allows traders to take advantage of different market conditions and opportunities. Additionally, binary options trading offers fast returns, with some trades expiring in as little as 60 seconds. This can be appealing to traders who want to make quick profits.

Binary options trading also offers a high level of flexibility. Traders can choose the size of their trades and the expiry times, giving them control over their trading strategy. Additionally, binary options trading can be done from anywhere at any time, as long as traders have access to the internet. This flexibility allows traders to fit trading into their busy schedules and trade whenever it is convenient for them.

Overall, binary options trading offers several advantages over traditional forms of trading. From its simplicity and fixed payouts to its wide range of assets and fast returns, binary options trading can be a profitable and accessible option for traders of all levels of experience.

Advantages of Forex Trading

Forex trading, also known as foreign exchange binary trading, has become increasingly popular in recent years due to its numerous advantages. One of the main advantages of Forex trading is that it offers high liquidity, meaning that traders can easily buy and sell currencies without worrying about price fluctuations. This makes it easier for traders to enter and exit trades quickly, maximizing their potential profits. Additionally, the Forex market is open 24 hours a day, five days a week, allowing traders to trade at any time that is convenient for them. This flexibility is especially beneficial for traders who have other commitments such as a full-time job or family responsibilities.

Another advantage of Forex trading is the high leverage that is available to traders. Leverage allows traders to control a larger position with a smaller amount of capital, increasing their potential profits. However, it is important to note that leverage can also amplify losses, so traders should use it carefully and only trade with money that they can afford to lose. Additionally, the Forex market is highly liquid, with a daily trading volume of over $6 trillion, making it one of the largest financial markets in the world. This means that traders can easily enter and exit trades without having to worry about price slippage or market manipulation.

Furthermore, trading fx offers a wide range of currency pairs to trade, allowing traders to diversify their portfolios and take advantage of opportunities in different markets. This can help reduce risk and increase potential profits. Additionally, Forex trading is accessible to traders of all levels, from beginners to experienced professionals. There are numerous online resources available to help traders learn about the Forex market and develop their trading skills. Many brokers also offer Forex trading demo accounts that allow traders to practice trading without risking real money.

In conclusion, Forex trading offers numerous advantages, including high liquidity, flexibility, leverage, and a wide range of currency pairs to trade. It is a popular choice for traders who are looking to diversify their portfolios and potentially earn high returns. However, it is important for traders to educate themselves about the Forex market and use risk management Forex day trading strategies to protect their capital.

Risks Involved in Binary Options and Forex

Binary options and Forex trading robots are popular investment options for traders looking to make quick profits. However, these trading methods come with a high level of risk that traders should be aware of before getting involved. One of the main risks of binary options and Forex trading is the high volatility of the markets. Prices can fluctuate rapidly, leading to significant losses if traders do not have a proper risk management strategy in place. Additionally, trading in these markets requires a deep understanding of technical analysis and market trends, which can be challenging for beginners.

Another risk of binary options and Forex trading is the potential for fraud and scams. Due to the decentralized nature of these markets, there are many unregulated brokers and platforms that may engage in unethical practices, such as price manipulation or refusing to honor withdrawals. Traders should be cautious when choosing a broker and do thorough research to ensure they are dealing with a reputable company.

Leverage is another risk factor to consider when fx prop trading binary options and Forex. While leverage can amplify profits, it can also magnify losses, potentially wiping out a trader’s entire account. Traders should be cautious when using leverage and only trade with money they can afford to lose.

Overall, binary options and Forex trading can be a lucrative investment opportunity, but it is important for traders to understand and manage the risks involved. By having a solid risk management strategy in place, doing thorough research on brokers, and avoiding excessive leverage, traders can mitigate some of the risks associated with these markets. It is also advisable for traders to start with a demo account to practice their Forex trading strategies before risking real money.

Which is Better for Beginners: Binary Options or Forex?

When it comes to deciding between binary options and Forex trading for beginners, there are a few key factors to consider. Binary options trading is often seen as simpler and more straightforward for beginners, as it involves making a prediction on whether an asset’s price will go up or down within a specific timeframe. This can be appealing to those who are new to trading and want a more user-friendly platform to start with. Additionally, binary options typically require a smaller initial investment compared to Forex trading, making it a more accessible option for beginners with limited funds.

On the other hand, Forex trading offers more flexibility and depth for those who are willing to put in the time and effort to learn the ins and outs of the market. While it may be more complex than binary options, Forex trading allows for greater control over trades and offers the potential for higher returns. It also provides the opportunity to trade a wide range of currency pairs, giving beginners a chance to diversify their portfolios and learn more about different markets.

Ultimately, the decision between binary options and Forex trading comes down to personal preference and individual goals. For beginners who are looking for a simpler and more straightforward trading experience, binary options may be the better choice. However, those who are willing to put in the time and effort to learn the intricacies of the market may find Forex trading to be a more rewarding option in the long run. It’s important for beginners to carefully consider their own financial situation, risk tolerance, and trading goals before deciding which option is best for them. With the right approach and mindset, both binary options and Forex trading can be viable options for beginners looking to get started in the world of trading.

Costs and Fees in Binary Options and Forex

When it comes to trading in binary options and Forex, understanding the costs and fees involved is crucial for any trader. Both markets have their own unique fee structures that can significantly impact the profitability of trades. In binary option trading, the costs are relatively straightforward. Traders typically pay a fixed amount to enter a trade, known as the “strike price,” and if the trade is successful, they receive a predetermined payout. However, if the trade is unsuccessful, the trader loses the initial investment. Some brokers may also charge additional fees for withdrawals, account maintenance, or other services.

On the other hand, Forex trading involves more complex fee structures. Traders in the Forex market pay a spread, which is the difference between the bid and ask prices of a currency pair. This spread is essentially the cost of executing a trade and can vary depending on market conditions and the broker’s pricing model. Additionally, some brokers may charge a commission on each trade, while others offer commission-free trading with wider spreads. Traders also need to consider overnight financing costs, which are incurred when holding positions overnight and can eat into profits.

It’s important for traders to carefully consider these costs and fees when deciding which market to trade in and which broker to use. While binary options may have lower upfront costs, Forex trading can offer more flexibility and potentially lower overall costs in the long run. Traders should also be wary of brokers that charge excessive fees or have hidden costs, as these can quickly erode profits and make trading less profitable. By understanding the costs and fees involved in binary options and Forex trading, traders can make more informed decisions and maximize their chances of success in the markets.

Conclusion: Which is Right for You: Binary Options or Forex?

In conclusion, the decision between binary options and Forex swing trading ultimately depends on your individual preferences, risk tolerance, and financial goals. Binary options offer a simple and straightforward way to trade with fixed payouts and limited risk, making them appealing to beginners and those looking for quick profits. However, the high level of risk and potential for scams in the binary options market may deter more experienced traders. On the other hand, Forex trading offers more flexibility, liquidity, and the ability to use leverage to amplify profits. It is ideal for traders who are willing to put in the time and effort to analyze market trends and make informed decisions. However, the volatile nature of the Forex market can result in significant losses if not managed properly. Ultimately, it is important to thoroughly research both options, consider your own risk tolerance and financial goals, and possibly seek advice from a financial advisor before deciding which type of trading is right for you. Both binary options and Forex trading have their own advantages and disadvantages, so it is crucial to weigh these factors carefully before making a decision. Regardless of which option you choose, it is essential to practice risk management, stay informed about market trends, and continuously educate yourself to improve your chances of success in the trading world.

FAQ

Can I trade both Binary Options and Forex?

Binary options and Forex are two popular trading options in the financial market. While they are similar in some aspects, they also have significant differences that traders need to consider before deciding which one to trade.

Binary options trading involves predicting the price movement of an asset within a specified time frame. Traders have two options – to predict whether the price will go up or down. If their prediction is correct, they will receive a fixed payout. On the other hand, Forex trading involves buying and selling currency pairs in the foreign exchange market. Traders can profit from the fluctuations in exchange rates.

One common question that traders often ask is whether they can trade both binary options and Forex simultaneously. The answer is yes, but there are a few things to keep in mind. Firstly, it is important to understand the risks and rewards associated with each type of trading. Binary options offer high returns but also come with high risks. Therefore, before getting started, beginners should take time to learn how to trade binary options effectively and responsibly. Forex trading, on the other hand, is known for its volatility and requires a good understanding of the market.

Another factor to consider is the time commitment required for each type of trading. Binary options are short-term trades with expiry times ranging from a few minutes to a few hours. Forex trading, on the other hand, can be done on a longer time frame, ranging from days to months. Traders need to decide whether they have the time and resources to trade both types of assets effectively.

It is also important to consider the broker that you choose to trade with. Not all brokers offer both binary options and Forex trading, so it is important to do your research and choose a reliable and reputable broker that offers both options.

In conclusion, it is possible to trade both binary options and Forex, but it requires careful consideration of the risks and rewards associated with each type of trading. Traders should also consider the time commitment and choose a broker that offers both options. By doing so, traders can diversify their portfolio and potentially increase their profits in the financial market.

Which is safer: Binary Options or Forex?

When it comes to investing in financial markets, one of the most debated topics is whether binary options or Forex trading is safer. Both options have their own risks and rewards, and it ultimately comes down to the individual investor’s preferences and risk tolerance.

Binary options are a type of financial option where the payoff is either a fixed amount or nothing at all. This means that investors are exposed to a high level of risk, as they can lose all of their investment if the option expires out of the money. However, the fixed payout structure of binary options can also be appealing to some investors, as it provides a clear understanding of potential profits and losses.

On the other hand, Forex trading involves the buying and selling of currency pairs in the foreign exchange market. Forex trading is known for its high levels of volatility, which can lead to significant profits or losses in a short amount of time. While Forex day trading does offer the potential for higher returns compared to binary options, it also comes with a higher level of risk due to factors such as leverage and market fluctuations.

In terms of safety, both binary options and Forex trading have their own risks that investors need to be aware of. However, some argue that Forex trading may be slightly safer than binary options, as it is a more established and regulated market. Forex brokers are required to adhere to strict regulations and guidelines, which can help protect investors from fraudulent activities.

Ultimately, the safety of binary options or Forex trading depends on the individual investor’s knowledge, experience, and risk tolerance. It is important for investors to thoroughly research and understand the risks involved in both options before making any investment decisions. By practicing proper risk management and staying informed about market trends, investors can reduce their chances of incurring significant losses in both binary options and Forex trading.

Are there more risks with Binary Options than with Forex?

When it comes to investing in financial markets, there are always risks involved. However, the level of risk can vary depending on the type of investment you choose. Binary options and Forex trading are two popular options for investors looking to make a profit, but which one carries more risks?

Binary options are a type of financial option where traders predict the price movement of an asset within a certain time frame. If their prediction is correct, they earn a fixed payout; if not, they lose their investment. One of the main risks associated with binary options is the high level of volatility in the market. Prices can fluctuate rapidly, making it difficult to predict the outcome accurately. Additionally, there is a lack of regulation in the binary options market, which can expose investors to fraud and scams.

On the other hand, Forex trading involves buying and selling currencies in the foreign exchange market. This market is known for its high liquidity and round-the-clock trading, making it an attractive option for investors. However, Forex trading also carries its own set of risks. The market is highly volatile, and prices can change rapidly based on economic and political events. Traders need to have a solid understanding of market trends and analysis to make informed decisions.

In conclusion, both binary options and Forex trading come with inherent risks. However, the level of risk can vary depending on factors such as market volatility, regulation, and investor knowledge. While binary options may offer fixed payouts, the lack of regulation and high volatility make it a riskier option for investors. On the other hand, Forex trading provides more opportunities for profit, but traders need to be aware of market trends and analysis to minimize risks. Ultimately, it is essential for investors to conduct thorough research and seek professional advice before diving into either option to mitigate potential losses.