What Are Contracts for Difference (CFDs)?

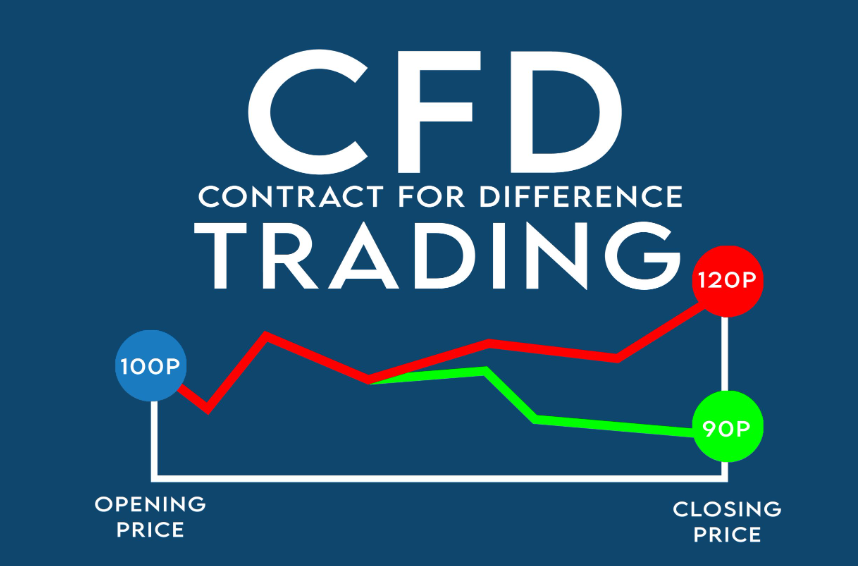

Contracts for Difference (CFDs) are financial instruments that allow traders to speculate on the price movements of various assets, such as stocks, commodities, currencies, and indices, without actually owning the underlying asset. In essence, a CFD is a contract between a buyer and a seller, where the buyer agrees to pay the seller the difference between the current price of the asset and its price at the time the contract is closed. This allows traders to profit from both rising and falling markets, as they can go long (buy) or short (sell) on an asset depending on their market outlook.

One of the key advantages of trading CFDs is the ability to leverage one’s trading capital, meaning traders can control a larger position with a smaller amount of money. This can amplify profits, but it also comes with increased risk, as losses can exceed the initial investment. Additionally, CFDs are traded on margin, which means that traders only need to deposit a fraction of the total value of the trade to open a position. This can lead to significant gains or losses, depending on the market movements.

Another advantage of CFD trading is the ability to access a wide range of markets and assets, all from a single trading platform. This allows traders to diversify their portfolios and take advantage of opportunities in different markets without the need to open multiple accounts. Furthermore, CFDs are traded 24 hours a day, allowing traders to react quickly to market news and events that can impact asset prices.

It is important to note that CFD trading carries a high level of risk and may not be suitable for all investors. It is crucial for traders to have a solid understanding of the markets, risk management techniques, and their own financial goals before engaging in CFD trading. Additionally, it is recommended to use stop-loss orders and other risk management tools to protect against large losses. Overall, CFDs can be a powerful tool for experienced traders looking to profit from short-term price movements in various markets.

How Crypto CFDs Work Compared to Traditional Crypto Trading

Cryptocurrency Contract for Difference (CFD) trading has become increasingly popular in recent years as a way to speculate on the price movements of various cryptocurrencies without actually owning the underlying assets. Unlike traditional cryptocurrency trading, where investors buy and sell actual coins on a cryptocurrency exchange, CFD trading allows traders to enter into a contract with a broker to exchange the difference in the price of a cryptocurrency from the time the contract is opened to when it is closed.

One of the key differences between crypto CFDs and traditional crypto trading is the leverage that is available to traders. With CFD trading, traders can use leverage to amplify their potential profits, but also their potential losses. This means that traders can open positions with a smaller amount of capital than would be required in traditional trading, allowing them to potentially earn higher returns on their investments. However, it is important to note that leverage also increases the risk of losing money, as losses can exceed the initial investment.

Another difference between crypto CFDs and traditional trading is the ability to short sell cryptocurrencies. In traditional trading, investors can only make a profit if the price of a cryptocurrency increases. However, with CFD trading, traders can profit from both rising and falling markets by entering into short positions. This allows traders to potentially profit from market downturns, as well as upswings.

Additionally, CFD trading offers greater flexibility and convenience compared to traditional trading. Traders can easily access the cryptocurrency markets through online trading platforms, and can trade 24/7 without the need for a cryptocurrency wallet or exchange account. This makes CFD trading a more accessible option for investors who are looking to diversify their portfolios with cryptocurrencies.

Overall, while both traditional cryptocurrency trading and crypto CFD trading have their own advantages and disadvantages, CFD trading offers a unique and potentially lucrative way for investors to participate in the cryptocurrency markets. It is important for traders to carefully consider their risk tolerance and investment goals before engaging in CFD trading, and to conduct thorough research and analysis before making any trading decisions.

Advantages of Trading Crypto CFDs

Trading crypto CFDs, or contracts for difference, offers several advantages for investors looking to profit from the volatile cryptocurrency market. One of the key benefits of trading crypto CFDs is the ability to speculate on price movements without actually owning the underlying asset. This means that traders can potentially profit from both rising and falling prices, allowing for more flexible trading strategies. Additionally, CFDs are a leveraged product, meaning that traders can open larger positions with a smaller amount of capital. This can amplify potential profits, but also increases the risk of losses. Another advantage of option trading crypto CFDs is the ability to trade on margin, which allows traders to access more capital than they have deposited in their account. This can provide additional flexibility and potential for larger profits, but also carries increased risk.

Furthermore, trading crypto CFDs offers greater liquidity compared to trading the actual cryptocurrency itself. This means that traders can enter and exit positions more easily, without worrying about finding a buyer or seller for the asset. Additionally, CFDs are typically offered on a wide range of cryptocurrencies, allowing traders to diversify their portfolio and take advantage of opportunities in different markets.

Another advantage of trading crypto CFDs is the ability to hedge existing cryptocurrency positions. By opening a CFD position that is inversely correlated to an existing cryptocurrency holding, traders can protect themselves against potential losses if the market moves against them. This can help to mitigate risk and provide a more balanced investment strategy.

Overall, trading crypto CFDs offers a range of advantages for investors looking to profit from the cryptocurrency market. From the ability to speculate on price movements without owning the underlying asset, to the increased flexibility and liquidity offered by CFDs, there are numerous benefits to trading crypto CFDs. However, it is important for traders to carefully consider the risks involved and to develop a solid trading strategy before entering the market.

Popular Cryptocurrencies for CFD Trading

Cryptocurrencies have taken the financial world by storm in recent years, with many investors flocking to take advantage of this new and exciting asset class. One popular way to trade cryptocurrencies is through Contracts for Difference (CFD) trading, where traders can speculate on the price movements of various digital currencies without actually owning the underlying assets. There are several popular cryptocurrencies that are commonly traded through CFDs, with some of the most well-known including Bitcoin, Ethereum, Ripple, and Litecoin.

Bitcoin is the original and most widely recognized cryptocurrency, often referred to as digital gold. It has a limited supply of 21 million coins and is seen as a store of value and a hedge against inflation. Ethereum, on the other hand, is a decentralized platform that enables developers to build and deploy smart contracts and decentralized CFD trading app. It is the second-largest cryptocurrency by market capitalization and has a vibrant and active community of developers and users.

Ripple, also known as XRP, is a digital payment protocol that aims to facilitate fast and low-cost cross-border transactions. It has partnerships with several major financial institutions and has been gaining traction as a viable alternative to traditional payment systems. Litecoin is another popular cryptocurrency that was created as a faster and cheaper alternative to Bitcoin. It has a faster block generation time and a larger supply cap, making it ideal for smaller and faster transactions.

When trading these popular cryptocurrencies through CFDs, traders can benefit from the high volatility and liquidity of the markets, allowing them to potentially profit from both rising and falling prices. However, it is important to remember that CFD trading carries a high level of risk and is not suitable for all investors. It is essential to conduct thorough research and have a solid risk management strategy in place before engaging in cryptocurrency trading. Overall, with the growing popularity of cryptocurrencies, CFD trading offers a convenient and accessible way for investors to participate in this exciting market.

Bitcoin (BTC) CFDs

Bitcoin CFDs, or Contract for Difference, have become a popular way for traders to speculate on the price movements of Bitcoin without actually owning the cryptocurrency itself. CFDs allow traders to take advantage of the volatility of Bitcoin prices by betting on whether the price will rise or fall.

One of the key advantages of trading Bitcoin CFDs is the ability to leverage your position. This means that you can control a larger position with a smaller amount of capital, allowing you to potentially make larger profits. However, it’s important to remember that leverage can also amplify losses, so it’s crucial to use it wisely and manage your risk effectively.

Another advantage of trading Bitcoin CFDs is the ability to go long or short. This means that you can profit from both rising and falling prices, giving you more opportunities to make money in any market conditions. This flexibility is particularly valuable in the highly volatile cryptocurrency market, where prices can swing wildly in a short period of time.

Trading Bitcoin CFDs also offers the convenience of being able to trade 24/7, unlike traditional stock markets that have set trading hours. This means that you can trade Bitcoin CFDs at any time of day or night, allowing you to take advantage of price movements as they happen.

However, it’s important to remember that trading Bitcoin CFDs carries a high level of risk. The cryptocurrency market is highly volatile and prices can change rapidly, so it’s crucial to have a solid risk management strategy in place. It’s also important to do your research and stay informed about market trends and news that could affect the price of Bitcoin.

Overall, Bitcoin CFDs can be a profitable and exciting way to trade the cryptocurrency market. With the right strategy and risk management in place, traders can take advantage of the opportunities that Bitcoin CFDs offer and potentially make significant profits.

Ethereum (ETH) CFDs

Ethereum (ETH) CFDs, or Contracts for Difference, have become increasingly popular among traders and investors in the cryptocurrency market. Ethereum, the second-largest cryptocurrency by market capitalization, has seen significant growth in recent years, making it a prime asset for CFD trading.

CFDs allow traders to speculate on the price movements of Ethereum without actually owning the underlying asset. This means that traders can profit from both rising and falling prices of Ethereum, making it a versatile and potentially lucrative investment option.

One of the key advantages of trading Ethereum CFDs is leverage. With leverage, traders can control a larger position with a smaller amount of capital, amplifying potential profits. However, it is important to note that leverage also increases the risk of losses, so traders should exercise caution and use risk management strategies when trading Ethereum CFDs.

Another advantage of trading Ethereum CFDs is the ability to trade on margin. This means that traders can open positions larger than their account balance, allowing for greater flexibility and potential returns. However, trading on margin also carries risks, as losses can exceed the initial investment.

Additionally, trading Ethereum CFDs allows for greater flexibility in terms of trading strategies. Traders can use various tools and techniques, such as technical analysis, to predict price movements and make informed trading decisions. This can help traders maximize profits and minimize risks in the volatile cryptocurrency market.

Overall, Ethereum CFDs offer a convenient and accessible way for traders to participate in the cryptocurrency market. With the ability to profit from both rising and falling prices, leverage, and margin trading, Ethereum CFDs provide traders with a range of opportunities to capitalize on the potential growth of Ethereum. However, it is important for traders to conduct thorough research, practice risk management, and stay informed about market developments to make informed trading decisions.

How to Get Started with Crypto CFD Trading

Crypto CFD trading is a popular way for investors to get involved in the cryptocurrency market without actually owning the underlying assets. If you’re interested in getting started with crypto CFD trading, there are a few key steps you’ll need to take. First, you’ll need to choose a reputable and regulated CFD broker that offers CFD crypto trading. Look for a broker that offers a wide range of cryptocurrencies to trade and has a user-friendly platform. Once you’ve chosen a broker, you’ll need to open an account and fund it with some initial capital. It’s important to start with a small amount of money until you have a good understanding of how the market works.

Next, you’ll need to familiarize yourself with the basics of CFD trading and how it works. CFDs, or contracts for difference, are derivative products that allow you to speculate on the price movements of an asset without actually owning it. When crypto options trading CFDs, you can go long (buy) if you think the price will rise or go short (sell) if you think the price will fall. It’s important to have a solid trading strategy in place before you start trading, as the cryptocurrency market can be highly volatile.

As you start trading, it’s important to keep a close eye on the market and stay up to date with news and events that could impact the price of cryptocurrencies. It’s also important to set stop-loss orders to limit your losses and take-profit orders to lock in your profits. Remember that trading CFD carries a high level of risk, so it’s important to only trade with money you can afford to lose.

Overall, getting started with crypto CFD trading can be a rewarding and profitable venture if done correctly. By choosing a reputable broker, educating yourself on how CFD trading works, and developing a solid trading strategy, you can increase your chances of success in the cryptocurrency market.

Choosing a Reliable Broker for Crypto CFDs

Choosing a reliable broker for crypto CFDs is crucial for traders looking to invest in the volatile cryptocurrency market. With the rise in popularity of cryptocurrencies like Bitcoin and Ethereum, more and more brokers are offering CFD options trading for these digital assets. However, not all brokers are created equal, and it is essential to do thorough research before selecting a broker to trade with.

One of the most important factors to consider when choosing a broker for crypto CFDs is regulation. It is crucial to ensure that the broker is regulated by a reputable financial authority, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. Regulation provides a level of protection for traders, ensuring that the broker operates within strict guidelines and standards.

Another important factor to consider is the trading platform offered by the broker. A reliable trading platform should be user-friendly, secure, and offer a wide range of CFD trading tools and features. It is also essential to consider the fees and commissions charged by the broker, as high fees can eat into your profits.

In addition to regulation and trading platform, it is also important to consider the reputation and track record of the broker. Look for reviews and feedback from other traders to get an idea of the broker’s reliability and customer service. A broker with a good reputation is more likely to provide a positive trading experience.

Lastly, consider the customer support offered by the broker. A reliable broker should have a responsive and knowledgeable customer support team that can assist you with any issues or questions that may arise during your trading experience.

In conclusion, choosing a reliable broker for crypto CFDs is essential for successful trading in the cryptocurrency market. By considering factors such as regulation, trading platform, fees, reputation, and customer support, you can ensure that you are trading with a trustworthy and reliable broker.

Using Demo Accounts to Practice Crypto CFD Trading

As the cryptocurrency market continues to grow in popularity, many individuals are turning to crypto CFD trading as a way to potentially profit from the volatility of digital currencies. However, trading in this market can be risky, especially for those who are new to the world of cryptocurrency.

One way that traders can practice their skills and strategies without risking their own money is by using demo accounts. These virtual trading accounts allow users to trade with fake money in a simulated market environment, giving them the opportunity to test out different trading strategies and learn how to navigate the ups and downs of the market.

Using a demo account to practice crypto CFD trading can be incredibly beneficial for both new and experienced traders. For beginners, it provides a risk-free way to gain hands-on experience and learn the ins and outs of trading without the fear of losing money. They can experiment with different trading techniques, analyze market trends, and develop a trading plan that works for them.

For more experienced traders, demo accounts can be a valuable tool for testing out new strategies or fine-tuning existing ones. They can use these accounts to practice trading in different market conditions, such as during periods of high volatility or low liquidity, and see how their strategies perform.

In addition to helping traders hone their skills, demo accounts can also be a useful tool for building confidence. By gaining experience and seeing positive results in a simulated environment, traders can feel more prepared and self-assured when they decide to trade with real money.

Overall, using demo accounts to practice crypto what is CFD trading can be a smart and effective way to improve trading skills, test out new strategies, and build confidence in the volatile cryptocurrency market. Whether you are a beginner or an experienced trader, taking advantage of these virtual trading accounts can help you become a more successful and profitable trader in the long run.

Crypto CFD Trading Strategies

Crypto CFD trading strategies are essential for investors looking to profit from the volatile cryptocurrency market. CFDs, or contracts for difference, allow traders to speculate on the price movements of cryptocurrencies without actually owning the underlying asset. This means that traders can profit from both rising and falling prices, making it a versatile and potentially lucrative trading tool.

One popular strategy for crypto CFD trading is trend following. This strategy involves analyzing historical price data to identify trends and then entering trades in the direction of the trend. By following the momentum of the market, traders can capitalize on the upward or downward movement of a cryptocurrency and maximize their profits. However, it is important to use risk management techniques such as stop-loss orders to protect against potential losses.

Another common strategy is range trading, which involves identifying support and resistance levels and entering trades when the price is trading within a specific range. Traders can profit from the price bouncing between these levels by buying low and selling high. This strategy is ideal for more stable markets where the price is consolidating rather than trending strongly in one direction.

Arbitrage is another strategy that can be used in crypto CFD trading. This involves taking advantage of price discrepancies between different exchanges or markets to profit from the price difference. By buying low on one platform and selling high on another, traders can make a profit with minimal risk.

Overall, successful crypto CFD trading requires a combination of technical analysis, risk management, and market knowledge. Traders should also stay up-to-date with the latest news and developments in the cryptocurrency space to make informed trading decisions. By implementing these strategies and staying disciplined, traders can potentially generate significant profits in the fast-paced world of crypto CFD trading.

Risks and Challenges of Crypto CFD Trading

Crypto CFD trading has gained popularity in recent years as more investors are drawn to the potential for high returns in the volatile cryptocurrency market. However, with the promise of big profits also comes significant risks and challenges that traders must be aware of. One of the main risks of crypto CFD trading is the extreme volatility of the cryptocurrency market. Prices can swing wildly in a short period of time, leading to substantial gains or losses for traders. This volatility can be exacerbated by factors such as regulatory changes, market sentiment, and macroeconomic events, making it difficult to predict price movements accurately.

Another challenge of crypto CFD trading is the lack of regulation in the industry. Unlike traditional financial markets, the cryptocurrency market is largely unregulated, which can expose traders to the risk of fraud and manipulation. Without proper oversight, traders may fall victim to scams, Ponzi schemes, or other fraudulent activities that can result in financial losses. Additionally, the lack of regulation means that there are fewer protections in place for traders, such as insurance or investor compensation schemes, in the event of a dispute with a broker.

Furthermore, the complexity of the cryptocurrency market can pose a challenge for novice traders. Understanding how cryptocurrencies work, the technology behind them, and the factors that influence their prices can be overwhelming for those who are new to the market. Without a solid understanding of these fundamentals, traders may make poor investment decisions or fall prey to scams and fraud.

In conclusion, while crypto CFD trading offers the potential for high profits, it also comes with significant risks and challenges that traders must be aware of. To navigate these risks successfully, traders should conduct thorough research, stay informed about market developments, and use risk management strategies to protect their investments. By approaching crypto CFD trading with caution and diligence, traders can minimize their exposure to potential pitfalls and increase their chances of success in this exciting but volatile market.

Technical and Fundamental Analysis for Crypto CFDs

Technical and fundamental analysis are two key methods used by traders to analyze the performance of cryptocurrencies when trading CFDs. Technical analysis involves studying historical price movements and volume data to identify trends and patterns that can help predict future price movements. Traders use various technical indicators such as moving averages, RSI, and MACD to analyze the market and make informed trading decisions. On the other hand, fundamental analysis focuses on evaluating the intrinsic value of an asset by looking at factors such as market news, economic indicators, and company announcements. For cryptocurrencies, fundamental analysis may involve assessing the technology behind a particular token, its use case, and the team behind the project.

When trading crypto CFDs, it is essential to use a combination of both technical and fundamental analysis to make informed trading decisions. Technical analysis can help traders identify entry and exit points based on price patterns and trends, while fundamental analysis can provide valuable insights into the long-term potential of a cryptocurrency. By combining these two methods, traders can gain a more comprehensive understanding of the market and reduce the risk of making impulsive or uninformed decisions.

One challenge when trading crypto CFDs is the high volatility and unpredictable nature of the market. This is where technical and fundamental analysis can be particularly helpful, as they provide traders with tools to navigate the market and make informed decisions based on data rather than emotions. By staying up to date with market news and developments, conducting thorough research, and using technical indicators to analyze price movements, traders can increase their chances of success when trading crypto CFDs.

In conclusion, technical and fundamental analysis are essential tools for traders looking to trade crypto CFDs successfully. By combining these two methods and using them to inform your trading decisions, you can better navigate the volatile cryptocurrency market and increase your chances of making profitable trades. Whether you are a beginner or experienced trader, incorporating technical and fundamental analysis into your trading strategy can help you achieve your financial goals in the cryptocurrency market.

Tips for Successful Crypto CFD Trading

Crypto CFD trading can be a lucrative but risky endeavor, especially for beginners. However, with the right strategies and CFD trading tips, you can increase your chances of success in the volatile world of cryptocurrency trading. One of the most important tips for successful crypto CFD trading is to do thorough research and stay informed about the market. This includes understanding the underlying technology of the cryptocurrencies you are trading, as well as keeping up to date with news and market trends.

Another tip for successful crypto CFDs trading is to develop a solid trading plan and stick to it. This plan should include your risk management strategy, entry and exit points, and profit targets. By having a clear plan in place, you can avoid making impulsive decisions based on emotions, which can lead to losses. Additionally, it is important to set stop-loss orders to limit your potential losses in case the market goes against you.

Furthermore, it is crucial to diversify your trading portfolio to reduce risk. Instead of putting all your funds into one cryptocurrency, consider investing in a variety of coins to spread out your risk. Diversification can help protect your investments from major market fluctuations and reduce the impact of any losses.

In addition, it is important to use technical analysis tools to help you make informed trading decisions. By analyzing charts and patterns, you can identify potential entry and exit points, as well as trends in the market. This can help you make more accurate predictions about price movements and improve your overall trading strategy.

Lastly, it is essential to practice good money management techniques when trading crypto CFDs. This includes only investing money that you can afford to lose, as well as setting realistic profit targets and not being greedy. By following these tips and strategies, you can increase your chances of success in the exciting world of crypto CFD trading.

FAQ

Can beginners trade crypto CFDs safely?

Trading crypto CFDs can be an exciting and potentially profitable venture for beginners, but it also comes with its own set of risks. It is important for those new to trading to approach the market with caution and make informed decisions to ensure their safety.

One of the key factors to consider when trading crypto CFDs as a beginner is choosing a reputable and regulated broker. It is essential to do thorough research and check the credentials of the broker before opening an account. A licensed broker will provide a level of security and protection for traders, reducing the risk of falling victim to scams or fraudulent activities.

Additionally, beginners should take the time to educate themselves about the market and understand the basics of trading before diving in. It is important to familiarize oneself with the different types of cryptocurrencies, their price movements, and the factors that can impact their value. This knowledge will help beginners make more informed decisions and minimize the risk of making costly mistakes.

Risk management is also crucial when trading crypto CFDs. Beginners should never invest more money than they can afford to lose and should set stop-loss orders to limit potential losses. It is also advisable to start with a small investment and gradually increase the size of trades as confidence and experience grow.

Furthermore, beginners should be wary of trading on margin, as it can significantly increase the risk of losing money. It is important to understand how leverage works and to only use it when fully grasping the potential risks involved.

In conclusion, options trading crypto CFDs can be a rewarding experience for beginners, but it is essential to approach the market with caution and diligence. By choosing a reputable broker, educating oneself about the market, practicing risk management, and avoiding excessive leverage, beginners can trade crypto CFDs safely and increase their chances of success in the market.

Are crypto CFDs regulated?

Crypto CFDs, or Contracts for Difference, have gained popularity in recent years as a way for traders to speculate on the price movements of cryptocurrencies without actually owning the underlying asset. However, the regulatory status of crypto CFDs is a topic of much debate and confusion.

In many countries, CFDs are classified as derivatives and are subject to regulation by financial authorities. This means that brokers offering crypto CFDs must adhere to certain rules and guidelines to protect investors and ensure fair and transparent binary trading. For example, brokers may be required to maintain a minimum capital level, segregate client funds, and provide clear disclosures about the risks associated with trading CFDs.

However, the regulatory status of crypto CFDs varies from country to country. In some jurisdictions, such as the United Kingdom and Australia, regulators have taken steps to regulate crypto CFDs and protect investors from potential risks. In other countries, such as the United States, crypto CFDs are not regulated at all, leaving investors vulnerable to fraud and manipulation.

The lack of consistent regulation for crypto CFDs has raised concerns among investors and industry experts. Without proper oversight, brokers offering crypto CFDs may engage in unethical practices, such as price manipulation or misrepresentation of risks. This can result in significant losses for investors and damage the reputation of the cryptocurrency market as a whole.

To navigate the regulatory landscape of crypto CFDs, investors should do their due diligence and research the regulations in their country before binary options trading. They should also choose reputable brokers that are licensed and regulated by a trusted financial authority. By taking these precautions, investors can mitigate the risks associated with trading crypto CFDs and protect their investments.

What platforms offer crypto CFD trading?

Crypto CFD trading has become increasingly popular in recent years as more and more people look to capitalize on the volatile nature of cryptocurrencies. There are several platforms that offer crypto CFD trading, each with its own unique features and benefits.

One of the most well-known platforms for crypto CFD trading is eToro. eToro is a social trading platform that allows users to trade a wide range of assets, including cryptocurrencies, through CFDs. One of the key features of eToro is its social trading aspect, which allows users to see and copy the trades of successful traders. This can be especially helpful for those new to trading or looking to learn from more experienced traders.

Another popular platform for crypto CFD trading is Plus500. Plus500 is a CFD trading platform that offers a wide range of assets, including cryptocurrencies like Bitcoin, Ethereum, and Litecoin. One of the key benefits of using Plus500 for crypto CFD trading is its user-friendly interface and intuitive platform. Plus500 also offers a range of educational resources and tools to help traders make informed decisions.

AvaTrade is another platform that offers crypto CFD trading. AvaTrade is known for its user-friendly platform, low fees, and wide range of assets. In addition to cryptocurrencies, AvaTrade also offers CFD trading on Forex, commodities, and indices. AvaTrade also provides a range of educational resources and tools to help traders improve their trading skills.

Overall, there are several platforms that offer crypto CFD trading, each with its own unique features and benefits. Whether you’re looking for a social trading platform like eToro, a user-friendly platform like Plus500, or a wide range of assets like AvaTrade, there are plenty of binary options to choose from. It’s important to do your research and choose a platform that suits your trading style and preferences.