What is Crypto Mining?

Crypto mining is the process of validating transactions on a blockchain network and adding them to the public ledger, known as the blockchain. This process requires powerful computers to solve complex mathematical equations in order to verify and secure transactions. Miners are rewarded with newly minted cryptocurrency binary trading for their efforts, making it an attractive way to earn passive income. The most common form of crypto mining is known as proof-of-work, where miners compete to solve these equations and add new blocks to the blockchain. However, there are also other consensus mechanisms such as proof-of-stake and proof-of-authority that do not require as much computational power.

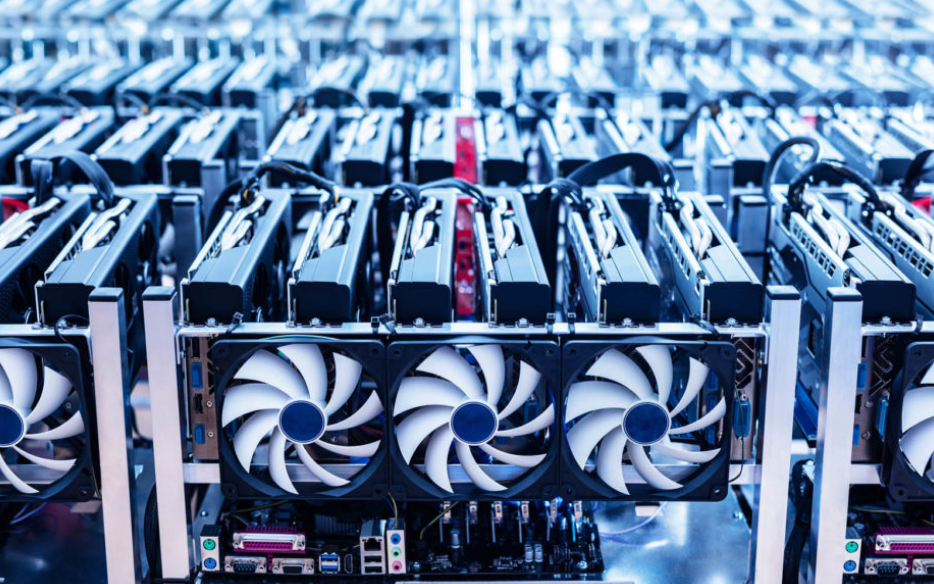

Mining requires specialized hardware, such as ASICs (application-specific integrated circuits) or GPUs (graphics processing units), to efficiently mine cryptocurrencies. The more powerful the hardware, the higher the mining rewards. Additionally, miners need to consider factors such as electricity costs, cooling systems, and internet connectivity to ensure profitability. As the difficulty of mining increases over time and more miners join the network, it becomes more challenging to mine cryptocurrency and requires more resources.

Crypto mining plays a crucial role in maintaining the security and integrity of blockchain networks. By validating transactions and adding them to the blockchain, miners help prevent double-spending and ensure that the network remains decentralized and censorship-resistant. However, mining also has environmental implications, as it requires a significant amount of electricity to power the mining hardware. Some cryptocurrencies, such as Bitcoin, have come under scrutiny for their high energy consumption and carbon footprint.

Overall, free crypto mining is a complex and competitive process that requires specialized hardware, technical expertise, and a significant investment of resources. While it can be a lucrative way to earn passive income, miners need to carefully consider the costs and risks involved in mining cryptocurrency. As the crypto industry continues to evolve, new consensus mechanisms and technologies may offer more sustainable and efficient alternatives to traditional mining methods.

Types of Crypto Mining

Crypto mining is the process of verifying transactions on a blockchain network and adding them to the public ledger. There are several types of crypto mining methods, each with its own unique characteristics and requirements. The most common type of crypto mining is proof of work (PoW), which involves solving complex mathematical puzzles to validate transactions. This method is used by popular cryptocurrencies like Bitcoin and Ethereum. Another type of crypto mining is proof of stake (PoS), where miners are chosen to validate transactions based on the number of coins they hold. This method is considered more energy-efficient than PoW but requires a significant investment in the cryptocurrency being mined.

Another type of crypto mining is cloud mining, where individuals can rent computing power from a remote data center to mine cryptocurrencies. This method is popular among those who do not have the technical expertise or resources to set up their own mining rig. However, cloud mining services often charge fees and may not always be profitable.

A less common type of crypto mining is browser mining, where individuals can mine cryptocurrencies directly from their web browser. This method utilizes the computing power of website visitors to mine cryptocurrencies without their explicit consent. While browser mining can be a convenient way to earn passive income, it is often seen as unethical and can damage a website’s reputation.

Overall, the type of crypto mining method chosen depends on factors such as technical expertise, investment budget, and environmental considerations. Each method has its own advantages and disadvantages, and individuals should carefully research and consider their options before getting involved in crypto mining. With the growing popularity of crypto trading, the demand for mining services is expected to increase, making it essential for miners to stay informed about the latest developments in the industry.

Proof of Work (PoW) Mining

Proof of Work (PoW) mining is a process that involves solving complex mathematical equations in order to validate transactions on a blockchain network. This process is essential for maintaining the security and integrity of the network, as it helps prevent fraud and ensures that all transactions are legitimate.

The key concept behind PoW mining is that it requires a significant amount of computational power to solve the mathematical puzzles. This ensures that miners must invest time and resources into the process, making it difficult for malicious actors to manipulate the network.

One of the main advantages of PoW mining is that it is a decentralized process, meaning that no single entity has control over the network. This helps to prevent censorship and ensures that the network remains secure and trustworthy.

However, PoW mining also has its drawbacks. One of the main criticisms of PoW mining is that it is energy-intensive, requiring a large amount of electricity to power the computational processes involved. This has led to concerns about the environmental impact of PoW mining, particularly as the popularity of cryptocurrencies has grown.

Despite these concerns, PoW mining remains a popular method for validating transactions on blockchain networks. Its decentralized nature and security features make it an attractive option for many users, and it continues to play a key role in the world of cryptocurrencies.

In conclusion, PoW mining is a complex process that plays a crucial role in maintaining the security and integrity of blockchain networks. While it has its drawbacks, its decentralized nature and security features make it an important tool for ensuring the trustworthiness of transactions on the blockchain.

Proof of Stake (PoS) Mining

Proof of Stake (PoS) mining is a revolutionary concept in the world of cryptocurrency that offers an alternative to the traditional Proof of Work (PoW) mining method. In PoS mining, the process of creating new blocks and validating transactions on the blockchain is carried out by validators who have a stake in the network. This means that the more cryptocurrency trading platform a validator holds, the higher the chances they have of being chosen to create a new block.

One of the key benefits of PoS mining is its energy efficiency. Unlike PoW mining, which requires a significant amount of computational power and electricity to solve complex mathematical puzzles, PoS mining simply requires validators to hold a certain amount of cryptocurrency in a designated wallet. This not only reduces the environmental impact of mining, but also lowers the barrier to entry for individuals who may not have access to expensive mining equipment.

Another advantage of PoS mining is its security and decentralization. Because validators are selected based on the amount of cryptocurrency they hold, it is in their best interest to act honestly and maintain the integrity of the network. If a validator were to try and cheat the system, they would risk losing their stake in the network. This incentivizes validators to act in the best interest of the blockchain, leading to a more secure and decentralized network.

Additionally, PoS mining promotes a more fair distribution of cryptocurrency. In PoW mining, individuals with access to powerful mining rigs often have a competitive advantage over smaller miners. However, in PoS mining, anyone can become a validator as long as they hold a certain amount of cryptocurrency. This levels the playing field and allows for a more equitable distribution of rewards among participants.

Overall, Proof of Stake mining is a promising alternative to traditional mining methods that offers a more energy-efficient, secure, and decentralized approach to creating and validating blocks on the blockchain. As the crypto options trading industry continues to evolve, PoS mining is likely to play a significant role in shaping the future of digital currencies.

Other Consensus Mechanisms in Crypto Mining

In addition to Proof of Work (PoW), there are several other consensus mechanisms used in crypto mining. These alternative methods have been developed to address some of the limitations and drawbacks of PoW, such as high energy consumption and centralization of mining power.

One popular alternative consensus mechanism is Proof of Stake (PoS). In a PoS system, validators are chosen to create new blocks based on the amount of crypto trading platforms they hold and are willing to “stake” as collateral. This means that validators are incentivized to act honestly, as they have a financial interest in the success of the network. PoS is often touted as a more energy-efficient and environmentally friendly alternative to PoW.

Another consensus mechanism gaining popularity is Delegated Proof of Stake (DPoS). In this system, token holders elect a group of delegates tasked with validating transactions and producing new blocks. Understanding how to trade binary options effectively shares a similar need for selecting the right strategies and decision-makers, as both require careful delegation and timely actions to maximize speed, scalability, and success while minimizing risks./p>

Proof of Authority (PoA) is another consensus mechanism that relies on a group of approved validators to create new blocks. Validators are often required to be known and trusted members of the network, such as reputable organizations or individuals. PoA is lauded for its security and efficiency, as well as its ability to prevent malicious actors from gaining control of the network.

Other consensus mechanisms in crypto mining include Proof of Space, Proof of Elapsed Time, and Proof of Burn, each with its own unique approach to validating transactions and creating new blocks. As the crypto industry continues to evolve, it is likely that new consensus mechanisms will be developed to address the ever-changing needs and challenges of the market. Ultimately, the choice of consensus mechanism will depend on the specific goals and requirements of the network in question.

Mining Cryptocurrencies: Which Ones Are Profitable?

Mining cryptocurrencies can be a lucrative endeavor, but not all cryptocurrencies are created equal when it comes to profitability. With so many different digital currencies available on the market, it can be overwhelming to determine which ones are worth investing time and resources into mining. One of the most important factors to consider when choosing a cryptocurrency to mine is its market value. Cryptocurrencies with a higher market value typically yield higher profits for miners. Bitcoin, for example, is one of the most well-known and widely accepted cryptocurrencies, making it a popular choice for miners looking to turn a profit. However, as the mining difficulty for Bitcoin continues to increase, some miners are turning to alternative cryptocurrencies such as Ethereum, Litecoin, and Monero. These cryptocurrencies offer lower mining difficulty levels and can be more profitable for smaller-scale miners.

Another important aspect to consider in the world of cryptocurrency investments is CFD crypto trading, which allows traders to speculate on the price movements of digital assets without owning them directly. While some cryptocurrencies may currently have a lower market value, those with promising technology and strong development teams—like Ripple, known for its fast transaction speeds and low fees—could experience significant growth. This makes both mining and CFD crypto trading attractive strategies for capitalizing on the future potential of such cryptocurrencies.

It’s also important to consider the energy costs associated with mining cryptocurrencies. As the mining process requires significant computational power, it can be costly to run the necessary hardware and keep it cool. Some cryptocurrencies, such as Bitcoin, require more energy-intensive mining processes than others, which can eat into profits. Miners should take into account their energy costs and the potential environmental impact of mining before selecting a cryptocurrency to mine.

In conclusion, the profitability of mining cryptocurrencies depends on a variety of factors, including market value, potential for growth, and energy costs. It’s important for miners to carefully research and evaluate different cryptocurrencies before making a decision on which ones to mine. By staying informed and adapting to changes in the market, miners can maximize their profits and find success in the world of cryptocurrency mining.

Bitcoin Mining

Bitcoin mining is the process by which new Bitcoins are created and added to the digital currency’s circulation. It is a crucial component of the Bitcoin network, as it ensures the security and integrity of transactions on the blockchain.

Mining involves solving complex mathematical puzzles using powerful computers. Miners compete with each other to solve these puzzles and validate transactions on the network. The first miner to solve the puzzle is rewarded with a certain number of Bitcoins. This process is known as proof-of-work.

To mine Bitcoins, miners need specialized hardware, such as ASIC (Application-Specific Integrated Circuit) miners, which are designed specifically for mining cryptocurrencies. These machines are highly efficient at solving the mathematical puzzles required for mining Bitcoins. In addition to hardware, miners also need access to cheap electricity, as mining can be very energy-intensive.

As the number of Bitcoins in circulation approaches its limit of 21 million, the difficulty of mining increases. This is because the Bitcoin network is designed to release new Bitcoins at a decreasing rate over time. As a result, miners need to invest in more powerful hardware to stay competitive and continue to mine Bitcoins profitably.

Mining Bitcoins can be a lucrative business for those who have the resources and technical expertise to do so. However, it is not without its risks. The price of Bitcoin is highly volatile, and mining profitability can fluctuate depending on market conditions. Additionally, the energy consumption associated with mining has raised concerns about its environmental impact.

Despite these challenges, Bitcoin mining continues to be an essential part of the cryptocurrency ecosystem. It plays a crucial role in securing the network and ensuring the integrity of transactions. As the demand for cryptocurrencies continues to grow, mining will likely remain a profitable and important industry for years to come.

Ethereum Mining

Ethereum mining has become a popular way for individuals to earn cryptocurrency by confirming transactions and securing the network. Ethereum is a decentralized trading platform that enables developers to build and deploy smart contracts and decentralized applications (DApps). In order to keep the network running smoothly, miners use their computational power to solve complex mathematical problems, known as proof of work.

To start mining Ethereum, a miner needs a computer with a strong graphics processing unit (GPU) or an application-specific integrated circuit (ASIC) miner. These devices are used to process the algorithms necessary to validate transactions and create new blocks on the blockchain. Miners are rewarded with Ether, the native cryptocurrency of the Ethereum network, for their efforts.

Mining Ethereum can be a profitable venture, but it requires a significant investment in hardware, electricity, and cooling systems. As the network has grown in popularity, competition among miners has increased, making it more challenging to earn rewards. Some miners join mining pools, where they combine their computational power to increase their chances of earning Ether. While this can decrease the risk of long periods without rewards, it also means sharing the profits with other members of the pool.

One of the main criticisms of Ethereum mining is its environmental impact. The process requires a large amount of electricity, leading to concerns about carbon emissions and energy consumption. In response to these concerns, Ethereum developers are working on transitioning the network from proof of work to proof of stake, a more energy-efficient consensus mechanism.

Overall, Ethereum mining is a complex and competitive process that requires both technical knowledge and financial resources. While it can be a lucrative venture for those who are willing to invest the time and effort, it is important to consider the environmental impact and potential changes to the network in the future.

Cryptocurrencies for Mining: Litecoin, Monero, etc.

Cryptocurrencies have emerged as a favored investment choice for many, with Bitcoin leading the way in recognition. Alongside traditional mining, crypto CFD trading offers an alternative method to gain exposure to digital assets like Litecoin and Monero, enabling investors to potentially profit from their price fluctuations without directly owning the coins.

Litecoin, often referred to as the silver to Bitcoin’s gold, was created by Charlie Lee in 2011. It is a peer-to-peer cryptocurrency that enables instant, near-zero cost payments to anyone in the world. Litecoin is based on the Scrypt algorithm, which is more memory-intensive than Bitcoin’s SHA-256 algorithm. This means that Litecoin mining can be more accessible to those with lower-end hardware, as it doesn’t require as much processing power.

Monero, on the other hand, is a privacy-focused cryptocurrency that was launched in 2014. Monero uses the CryptoNight proof-of-work algorithm, which is designed to be resistant to ASIC mining. This means that Monero mining can be done using a regular CPU or GPU, making it accessible to a wider range of people.

Mining cryptocurrencies like Litecoin and Monero can be a profitable venture, as miners are rewarded with newly minted coins for verifying transactions on the network. However, it’s important to note that mining can also be energy-intensive and costly, especially as the competition for block rewards increases.

There are also risks involved in mining cryptocurrencies, such as market volatility and regulatory uncertainty. It’s important for miners to stay informed about the latest developments in the cryptocurrency space and to carefully consider their investment decisions.

Overall, cryptocurrencies such as Litecoin and Monero provide investors with alternative opportunities to diversify their portfolios. By utilizing reliable crypto trading signals alongside proper hardware and expertise, traders can make informed decisions that enhance the potential profitability of mining and broker trading these digital assets.

The Mining Process

The mining process is a crucial step in extracting valuable minerals and metals from the earth. It involves various stages, each with its own set of challenges and requirements. The first step in the mining process is exploration, where geologists study the land to determine the potential presence of valuable resources. Once a suitable site is identified, the next step is to obtain the necessary permits and licenses. This is followed by the construction of infrastructure such as roads, power lines, and processing plants to support mining operations.

The actual mining process begins with the extraction of the ore from the ground. This can be done through open-pit mining, where large amounts of earth are removed to access the ore, or through underground mining, where tunnels are dug deep into the earth to reach the ore deposits. Once the ore is extracted, it is transported to a processing plant where it is crushed, ground, and separated from the waste rock.

The final step in the mining process is the refining of the ore to extract the valuable minerals and metals. This is often done through a series of chemical and physical processes that separate the desired materials from the rest of the ore. The final product is then shipped to customers for further processing or use in various industries.

While mining is essential for the production of many materials we use in our everyday lives, it can also have negative environmental impacts. Mining operations can lead to deforestation, soil erosion, and water pollution, affecting local ecosystems and communities. To mitigate these impacts, mining companies are increasingly adopting sustainable practices and technologies to reduce their environmental footprint.

In conclusion, the mining process is a complex and challenging endeavor that plays a crucial role in supplying the materials we need for modern life. By following best practices and minimizing environmental impacts, the mining industry can continue to meet the demand for valuable resources while protecting the planet for future generations.

Setting Up Your Crypto Mining Operation

Setting up a crypto mining app operation can be a complex and time-consuming process, but with the right knowledge and resources, it can also be a lucrative venture. The first step in setting up your mining operation is to choose the right location. You will need a space with ample ventilation and cooling to prevent your mining rigs from overheating. Additionally, you will need to consider the cost of electricity in your chosen location, as mining can consume a significant amount of power. Once you have found the right location, you will need to invest in the necessary hardware. This includes graphics processing units (GPUs) or application-specific integrated circuits (ASICs), which are specialized hardware designed specifically for mining cryptocurrencies. You will also need a reliable internet connection to ensure uninterrupted mining operations.

After setting up your hardware, you will need to choose a mining pool to join. Mining pools are groups of miners who work together to solve complex mathematical algorithms and share the rewards. Joining a mining pool can increase your chances of earning a steady income from mining, as it allows you to combine your computing power with other miners. Once you have joined a mining pool, you will need to set up your mining crypto mining software. There are several mining software options available, each with its own features and capabilities. It is important to choose a software that is compatible with your hardware and offers the features you need to optimize your mining operations.

Finally, you will need to monitor your mining operation regularly to ensure that everything is running smoothly. This includes checking your hardware for any issues, monitoring your mining pool for updates and changes, and tracking your earnings to ensure that your operation remains profitable. By following these steps and staying up to date on the latest developments in the crypto mining industry, you can set up a successful and profitable mining operation.

Choosing Mining Hardware: ASIC vs. GPU

When it comes to choosing mining hardware for cryptocurrency mining, two popular options trading are ASIC (Application-Specific Integrated Circuit) and GPU (Graphics Processing Unit) miners. Each type of hardware has its own advantages and disadvantages, and understanding these differences is crucial for miners looking to maximize their profits.

ASIC miners are specifically designed to mine a specific cryptocurrency algorithm, such as Bitcoin’s SHA-256 algorithm. These miners are highly efficient and offer a higher hash rate compared to GPU miners. This means that ASIC miners can mine cryptocurrency at a much faster rate, resulting in higher profits. However, ASIC miners are also more expensive to purchase and operate, and they are not as versatile as GPU miners. Once an ASIC miner becomes obsolete for a particular algorithm, it cannot be repurposed for other mining operations.

On the other hand, GPU miners are more versatile and can be used to mine a variety of cryptocurrencies. They are also more affordable and readily available compared to ASIC miners. GPU miners are also easier to upgrade and maintain, making them a popular choice for hobbyist miners. However, GPU miners have a lower hash rate compared to ASIC miners, which means they may not be as profitable in the long run.

In the end, the choice between ASIC and GPU mining hardware depends on several factors, including budget, mining goals, and the cryptocurrency being mined. Miners who are looking to maximize their profits and are willing to invest in expensive hardware may opt for ASIC miners. On the other hand, miners who are more budget-conscious and are looking for a versatile option trading may prefer GPU miners.

Regardless of the type of mining hardware chosen, it is important for miners to stay informed about the latest developments in the cryptocurrency mining industry. By staying up to date on hardware advancements and algorithm changes, miners can ensure that they are using the most efficient and profitable mining hardware available.

Building Your Own Mining Rig

Building your own mining rig can be a rewarding and profitable endeavor for those interested in cryptocurrency mining. With the rise in popularity of digital currencies like Bitcoin and Ethereum, many individuals are looking to get involved in the mining process to earn some extra income.

One of the first steps in building your own mining rig is to research and understand the hardware components needed for mining. The key components include a powerful graphics processing unit (GPU), a motherboard, a power supply unit (PSU), memory (RAM), a processor (CPU), and storage (SSD or HDD). Additionally, you will need a cooling system to prevent overheating of the components during operation.

Next, you will need to choose the right GPU for your mining rig. The most popular GPUs for mining are from Nvidia and AMD, with models like the Nvidia GeForce RTX 3060 and AMD Radeon RX 580 being commonly used by miners. It’s important to consider factors like hash rate, power consumption, and price when selecting a GPU for your rig.

After selecting the hardware components, you will need to assemble them into a mining rig frame. There are pre-made mining rig frames available for purchase, or you can build your own using materials like aluminum or steel. Make sure to properly secure the components in the frame to prevent any damage during operation.

Once your mining rig is assembled, the next step is to install and configure the mining software to begin operations. Just as choosing the best broker for trading is crucial in financial markets, selecting the right mining software—such as NiceHash, Claymore, or Ethminer—with the features that best suit your needs is essential for efficient and profitable mining.

Building your own mining rig requires time, effort, and some technical knowledge, but the potential rewards can be significant. With the right hardware components and software, you can start mining cryptocurrencies and potentially earn a passive income. Just remember to stay informed about the latest developments in the cryptocurrency market to maximize your mining profits.

Setting Up a Mining Farm

Setting up a mining farm requires careful planning and consideration of various factors to ensure success in the long run. A mining farm is a facility where a large number of mining rigs are set up to mine cryptocurrencies such as Bitcoin, Ethereum, or Litecoin. These rigs consist of powerful computers equipped with specialized hardware designed to solve complex mathematical algorithms required to validate transactions on the blockchain network.

One of the initial steps in establishing a mining farm is selecting the optimal location. Just as finding the best online broker trading platform is essential for successful trading, choosing a site with affordable electricity, a cool climate to avoid overheating, and a stable internet connection is crucial for maintaining efficient and continuous mining operations.

Next, it is important to consider the hardware needed for mining. This includes purchasing mining rigs, power supplies, cooling systems, and other necessary equipment. It is crucial to invest in high-quality hardware to maximize mining efficiency and profitability.

Once the hardware is in place, it is essential to set up a mining pool. A mining pool is a group of miners who work together to solve algorithms and share the rewards. Joining a mining pool can increase the chances of earning a steady income from mining.

Security is another important aspect to consider when setting up a mining farm. Cryptocurrency mining can attract hackers and cybercriminals who may attempt to steal mining rewards or compromise the mining operation. Implementing robust security measures such as firewalls, encryption, and regular security audits can help protect the mining farm from potential threats.

In conclusion, setting up a mining farm requires careful planning and investment in the right hardware, location, and security measures. By following these steps, miners can increase their chances of success and profitability in the competitive cryptocurrency mining industry.

Mining Pools: What Are They and How Do They Work?

Mining pools are a crucial aspect of the cryptocurrency mining industry, enabling miners to combine their computing power and resources to increase their chances of successfully mining a block and receiving rewards. In simple terms, a mining pool is a group of miners who come together to pool their resources and share the rewards equally based on the amount of work contributed by each miner.

The way mining pools work is relatively straightforward. When a miner joins a mining pool, they are given a portion of the pool’s computing power to mine cryptocurrency. The pool then collectively works to solve complex mathematical equations necessary to mine new blocks of the cryptocurrency. Once a block is successfully mined, the rewards are distributed among the miners in the pool based on their individual contributions. This ensures that smaller miners have a fair chance of receiving rewards, even if they do not have the computing power and resources of larger mining operations.

Mining pools also help to reduce the variance in mining rewards, as individual miners may experience long periods without receiving any rewards due to the unpredictable nature of mining difficulty. By pooling their resources together, miners can receive more consistent rewards, which can help to offset the costs of mining equipment and electricity. Additionally, mining pools can help to decentralize the mining industry by allowing smaller miners to compete with larger mining operations.

Overall, mining pools play a crucial role in the cryptocurrency mining ecosystem by providing a fair and efficient way for miners to collaborate and share in the rewards of mining. As the cryptocurrency industry continues to grow and evolve, mining pools will likely remain an essential part of the mining process, enabling miners of all sizes to participate in the mining of new blocks and the validation of transactions on the blockchain.

Best Mining Software for Beginners

When it comes to cryptocurrency mining, choosing the right software can make all the difference, especially for beginners. There are several mining software options available, each with its own set of features and capabilities. For beginners, it is important to choose software that is user-friendly, easy to set up, and offers good support and documentation. One of the best mining software options for beginners is NiceHash. NiceHash is a popular mining software that allows users to mine various cryptocurrencies with ease. It offers a simple and intuitive interface, making it easy for beginners to get started. Additionally, NiceHash offers a marketplace where users can buy and sell hashing power, providing a convenient way to maximize profits. Another good option trading for beginners is MinerGate. MinerGate is a user-friendly mining software that supports a variety of cryptocurrencies. It offers a simple setup process and a clean interface, making it ideal for those who are new to mining. MinerGate also provides a mining calculator and other helpful tools to help users optimize their mining efforts. For those who prefer a more customizable mining experience, CGMiner is a great option. CGMiner is a powerful mining software that offers a wide range of features and options for advanced users. While it may be more complex to set up compared to other options trading, CGMiner provides excellent performance and flexibility, making it a top choice for experienced miners. Overall, when choosing mining software for beginners, it is important to consider factors such as ease of use, support, and features. NiceHash, MinerGate, and CGMiner are all excellent options that cater to different skill levels and preferences, providing a solid foundation for beginners to start their mining journey.

FAQ

Do I need expensive hardware to mine cryptocurrency?

Cryptocurrency mining has gained popularity as a method for individuals to earn digital currencies such as Bitcoin and Ethereum. However, many beginners mistakenly believe that having costly equipment is essential to succeed in mining—just as choosing the right online trading broker is important in the world of digital asset online trading, success in mining also depends on knowledge and strategy, not just expensive hardware.

While it is true that having high-end hardware can potentially increase your mining efficiency and profitability, it is not a strict requirement to have expensive equipment to mine cryptocurrency. In fact, there are several ways to get started with cryptocurrency mining without breaking the bank.

One option for those looking to mine cryptocurrency on a budget is to use a personal computer or laptop that you already own. While these devices may not have the same hashing power as specialized mining rigs, they can still be used to mine certain cryptocurrencies, especially those with lower mining difficulty levels.

Another cost-effective option for cryptocurrency mining is to use a mining pool. Mining pools allow multiple miners to combine their resources and share the rewards based on their contribution. By joining a mining pool, you can leverage the collective power of the group to increase your chances of earning a steady income from mining.

Furthermore, there are also cloud mining services available that allow individuals to rent mining equipment and hashing power from third-party providers. While this option may involve some upfront costs, it can be a more affordable way to get started with cryptocurrency mining without having to invest in expensive hardware.

In conclusion, while having expensive hardware can certainly give you an edge in cryptocurrency mining, it is not a strict requirement to be successful in this field. By exploring alternative binary options such as using personal devices, joining mining pools, or utilizing cloud mining services, individuals can still participate in cryptocurrency mining and potentially earn digital currencies without breaking the bank.

How long does it take to start making a profit from mining?

Mining is a process that involves extracting valuable minerals or other geological materials from the earth. It can be a lucrative business, but it also requires a significant investment of time, money, and resources. One of the most common questions that people have about mining is how long it takes to start making a profit.

The answer to this question can vary depending on a number of factors, including the type of mining operation, the location of the mine, and the current market conditions. In general, it can take anywhere from a few months to several years before a mining operation becomes profitable.

One of the main factors that can impact the timeline for profitability is the initial investment required to start the mining operation. This can include the cost of purchasing or leasing land, equipment, and other necessary resources. In some cases, companies may also need to secure permits or licenses before they can begin mining, which can add to the startup costs.

Once the mining operation is up and running, there are a number of other factors that can influence how quickly it becomes profitable. These can include the quality and quantity of the minerals being extracted, the efficiency of the mining process, and the market price for the minerals.

In some cases, mining operations can start making a profit relatively quickly, especially if they are able to extract high-value minerals in large quantities. However, in other cases, it may take longer for a mining operation to become profitable, particularly if the market price for the minerals is low or if there are challenges with the mining process.

Overall, the timeline for profitability in mining can vary widely depending on a number of factors. While some operations may start making a profit within a few months, others may take several years to become profitable. It is important for companies considering a mining operation to carefully evaluate the potential costs and benefits before investing in such a venture.

Is crypto mining legal in all countries?

Cryptocurrency mining has become a popular way for individuals to earn digital currencies like Bitcoin and Ethereum. However, the legality of crypto mining container varies from country to country. While some countries have embraced cryptocurrency mining and have clear regulations in place, others have banned or restricted it due to concerns about its environmental impact, potential for fraud, and use in illegal activities.

In countries like the United States, Canada, and many European nations, cryptocurrency mining is legal and regulated. Miners must comply with crypto mining tax laws and adhere to environmental regulations, but they are free to operate within the boundaries of the law. These countries see cryptocurrency mining as a legitimate business activity and have taken steps to support the industry’s growth.

On the other hand, countries like China, Iran, and Algeria have banned or restricted cryptocurrency mining due to various reasons. China, for example, has cracked down on mining operations in recent years due to concerns about energy consumption and financial risks. Iran has banned mining due to concerns about electricity shortages, while Algeria has prohibited mining due to its potential for use in illegal activities.

Overall, the legality of cryptocurrency mining is a complex and evolving issue that varies from country to country. While some nations have embraced mining as a legitimate business activity, others have taken a more cautious approach due to concerns about its impact on the environment and potential for misuse. As the cryptocurrency industry continues to grow and evolve, it is likely that more countries will establish clear regulations around mining to ensure its legality and sustainability.