What is Forex Trading?

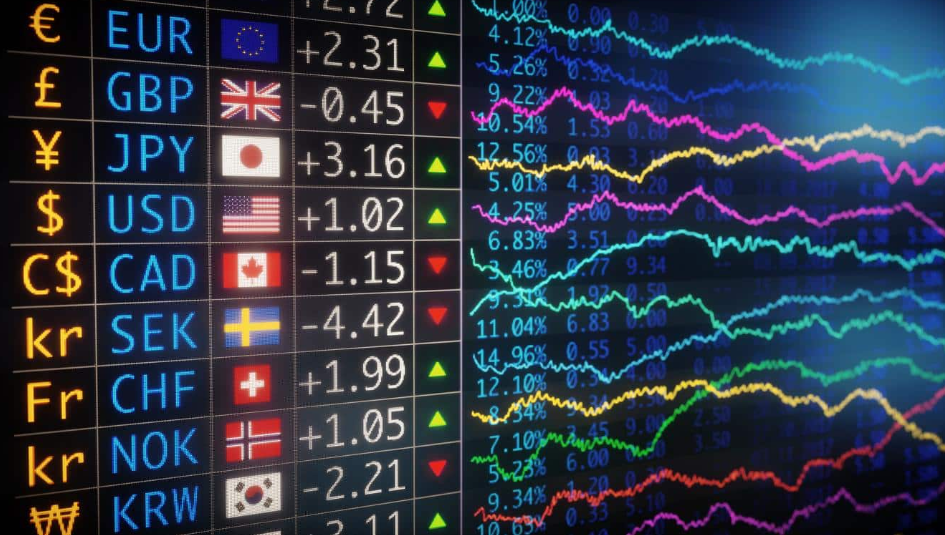

Forex trading, also known as foreign exchange trading or FX trading, is the buying and selling of currencies on the foreign exchange market. The foreign exchange market is the largest and most liquid financial market globally, with a daily trading volume surpassing $6 trillion. What is FX trading? It refers to the process of exchanging one currency for another with the goal of profiting from changes in exchange rates. Traders engage in buying a currency pair when they anticipate that the base currency will appreciate against the quote currency, or selling it if they expect depreciation. Popular pairs frequently traded include EUR/USD, USD/JPY, and GBP/USD.

Forex trading is typically done through a broker or market maker, who provides the platform for traders to access the market. Traders can execute trades using leverage, which allows them to control a larger position with a smaller amount of capital. While leverage can amplify profits, it also increases the risk of losses, making Forex trading a high-risk, high-reward endeavor. Traders must have a solid understanding of market fundamentals, technical analysis, and risk management to be successful in Forex trading robots.

There are several factors that influence exchange rates in the Forex market, including economic indicators, geopolitical events, and central bank policies. Traders must stay informed about these factors and monitor market trends to make informed trading decisions. Forex trading operates 24 hours a day, five days a week, allowing traders to take advantage of opportunities in different time zones. The market is decentralized, meaning there is no central exchange, and trades are conducted electronically over-the-counter.

In conclusion, Forex trading is a dynamic and fast-paced market that offers opportunities for profit but also carries significant risks. Traders must be disciplined, patient, and knowledgeable to succeed in Forex trading. By understanding the market, developing a trading strategy, and managing risk effectively, traders can potentially achieve success in this exciting and lucrative market.

Advantages of Forex Trading

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies on the foreign exchange market. There are several advantages to engaging in Forex trading that make it an attractive option trading for investors looking to diversify their portfolios and potentially earn significant profits.

One of the key advantages of Forex trading is its high liquidity. The Forex market is the most liquid financial market in the world, with trillions of dollars being traded every day. This means that traders can easily enter and exit positions without worrying about market manipulation or price fluctuations. Additionally, the Forex market operates 24 hours a day, five days a week, allowing traders to take advantage of trading opportunities at any time.

Another advantage of Forex trading is the high leverage that is available to traders. Leverage allows traders to control large positions with a relatively small amount of capital. While this can amplify profits, it also increases the risk of losses. It is important for traders to use leverage wisely and implement risk management strategies to protect their investments.

Forex trading also offers a high level of flexibility and accessibility. Traders can access the Forex market from anywhere in the world through online trading platforms. This allows traders to trade on their own schedule and from the comfort of their own homes. Additionally, the Forex market is open to traders of all experience levels, from beginners to seasoned professionals. With the right education and training, anyone can learn how to trade Forex successfully.

Lastly, Forex trading offers the potential for significant profits. Because of the high volatility in the Forex market, traders can capitalize on small price movements to earn substantial returns. However, it is important for traders to have a solid trading strategy in place to minimize risks and maximize profits.

In conclusion, Forex trading offers numerous advantages to investors looking to diversify their portfolios and potentially earn significant profits. With its high liquidity, leverage, flexibility, and accessibility, automated Forex trading is a popular option for traders of all experience levels. However, it is important for traders to educate themselves about the risks involved and implement sound risk management strategies to protect their investments.

How to Start Forex Trading

Forex trading is a popular way for individuals to make money by trading currencies on the foreign exchange market. If you are interested in getting started with Forex trading, there are a few key steps you will need to take. First, you will need to find a reputable Forex broker to open an account with. It is important to choose a broker that is regulated and has a good reputation in the industry. Once you have opened an account, you will need to deposit funds into it in order to start trading.

Next, you will need to familiarize yourself with the Forex market and learn how it works. This includes understanding how currency pairs are traded, how to trade binary options, and how to analyze market trends. There are many resources available online that can help you learn the basics of Forex trading, including tutorials, webinars, and demo accounts that allow you to practice trading without risking any real money.

Once you have a good understanding of how the Forex market works, you can start placing trades. It is important to start small and only risk a small percentage of your trading account on each trade. This will help you minimize your losses and protect your capital. As you gain experience and become more comfortable with trading, you can increase the size of your trades and take on more risk.

It is also important to have a binary trading strategy in place before you start trading. This will help you make more informed trading decisions and stay disciplined in your Forex trading app. Your trading strategy should outline your goals, risk tolerance, and the criteria you will use to enter and exit trades.

In conclusion, starting Forex trading can be an exciting and potentially profitable venture. By following these steps and taking the time to learn about the Forex market, you can increase your chances of success as a Forex trader. Remember to start small, stay disciplined, and always be willing to learn and adapt to changing market conditions.

Types of Forex Markets

Forex, or foreign exchange, markets are where currencies are traded. There are three main types of Forex markets: spot market, forward market, and futures market. The spot market is where currencies are bought and sold for immediate delivery, typically within two business days. This is the most common and widely traded type of Forex market. In the forward market, contracts are bought and sold for future delivery of a specified currency at a specified price. This allows traders to hedge against currency fluctuations and lock in a future exchange rate. The futures market is similar to the forward market, but contracts are standardized and traded on an exchange. This market is more regulated and transparent than the forward market, making it a popular choice for institutional investors.

Each type of Forex market has its own advantages and disadvantages. The spot market offers immediate liquidity and allows traders to take advantage of short-term price movements. However, it also exposes traders to currency fluctuations and market risk. The forward market allows traders to hedge against currency risk and lock in a future exchange rate, but it can be less liquid and more expensive than the spot market. The futures market offers standardized contracts and greater transparency, but it also carries higher costs and margin requirements.

Overall, the choice of which type of Forex market to trade in depends on a trader’s goals, risk tolerance, and investment strategy. Some traders may prefer the flexibility and liquidity of the spot market, while others may opt for the hedging capabilities of the forward market. Institutional investors may choose the futures market for its regulation and transparency. Regardless of the type of market chosen, Forex trading requires careful research, analysis, and risk management to be successful. Traders should carefully consider their options trading and choose the market that best aligns with their trading objectives.

Spot Forex Market

The Spot Forex Market, also known as the foreign exchange market, is the largest and most liquid financial market in the world. It operates 24 hours a day, five days a week, allowing traders to buy and sell currencies at any time. The spot market is where currencies are bought and sold for immediate delivery, as opposed to the futures market where contracts are bought and sold for delivery at a future date.

Trading in the spot Forex market involves the exchange of one currency for another at the current exchange rate. For example, if a trader believes that the Euro will strengthen against the US Dollar, they would buy Euros and sell US Dollars. If their prediction is correct and the Euro does indeed strengthen, they can sell their Euros for a profit.

One of the key features of the spot Forex market is its high liquidity, which means that traders can easily enter and exit positions without causing significant price movements. This makes it an attractive market for traders of all levels, from individual retail traders to large financial institutions.

Another important aspect of the spot Forex market is leverage. Leverage allows traders to control a larger position with a smaller amount of capital, increasing the potential for profits but also the risk of losses. It is important for traders to use leverage wisely and manage their risk effectively to avoid large losses.

The spot Forex market is also known for its high volatility, with exchange rates constantly fluctuating in response to economic indicators, geopolitical events, and market sentiment. Traders must stay informed about these factors and use technical and fundamental analysis to make informed trading decisions.

In conclusion, the spot Forex market offers traders the opportunity to profit from the fluctuations in exchange rates of different currencies. With its high liquidity, leverage, and volatility, it is a dynamic and exciting market for traders looking to take advantage of global economic trends and events.

Forex Forward and Futures Markets

Forex forward and futures markets are two important components of the foreign exchange market that allow traders and investors to hedge against currency risk and speculate on future currency movements. These markets provide a way for participants to lock in exchange rates for future transactions, thereby reducing uncertainty and potential losses due to fluctuating currency values.

In the Forex forward market, two parties agree to exchange a specified amount of one currency for another currency at a predetermined exchange rate at a future date. This allows businesses and individuals to protect themselves against adverse currency movements that could negatively impact their finances. For example, a company that imports goods from a foreign country can use a forward contract to lock in a favorable exchange rate, ensuring that they will not incur losses if the currency depreciates before the transaction is completed.

On the other hand, the Forex futures market involves the trading of standardized contracts that obligate the parties involved to buy or sell a specific amount of a currency at a predetermined price on a specified future date. Futures contracts are traded on organized exchanges, providing liquidity and transparency to the market. Traders can use futures contracts to speculate on currency movements and profit from price fluctuations without actually owning the underlying currencies.

Both the forward and futures markets play a crucial role in the foreign exchange market by providing liquidity, price discovery, and risk management tools for participants. However, it is important to note that trading in these markets carries risks, including the potential for losses due to unexpected currency movements or counterparty default.

In conclusion, Forex forward and futures markets offer valuable tools for managing currency risk and speculating on future exchange rate movements. By understanding how these markets work and utilizing them effectively, traders and investors can protect their finances and take advantage of opportunities in the dynamic world of foreign exchange trading.

Forex Options and CFDs

Forex Options and CFDs are two popular financial instruments that are commonly used by traders to speculate on the price movements of various assets in the financial markets. While both options and CFDs offer opportunities for traders to profit from market fluctuations, they have distinct differences in terms of how they work and the risks involved.

Forex binary Options are financial derivatives that give traders the right, but not the obligation, to buy or sell a currency pair at a specified price within a certain time frame. This gives traders the flexibility to take advantage of market movements without actually owning the underlying asset. Options can be used to hedge against currency risk or to speculate on the direction of a currency pair. However, binary options trading also come with a cost, known as the premium, which must be paid upfront.

On the other hand, CFDs, or Contracts for Difference, are derivative contracts that allow traders to speculate on the price movements of various assets, such as stocks, commodities, and indices, without actually owning the underlying asset. CFDs offer leverage, which means that traders can control a larger position with a smaller amount of capital. This can amplify both profits and losses, making CFDs a high-risk, high-reward investment.

Both Forex Options and CFDs carry risks that traders should be aware of. Options can expire worthless if the price does not move in the desired direction, resulting in a loss of the premium paid. CFDs are subject to market volatility and can result in significant losses if the market moves against the trader. It is important for traders to carefully consider their risk tolerance and investment goals before trading options or CFDs.

In conclusion, Forex Options and CFDs are powerful financial instruments that offer traders the opportunity to profit from market movements. However, they also come with risks that traders should be aware of. By understanding how these instruments work and managing risk effectively, traders can maximize their potential for success in the financial markets.

Forex Major and Minor Currency Pairs

In the world of Forex swing trading, currency pairs are categorized into two main groups: major and minor pairs. Major currency pairs are the most heavily traded pairs in the Forex market and include the most liquid currencies in the world, such as the US dollar, euro, Japanese yen, British pound, Swiss franc, Canadian dollar, and Australian dollar. These pairs are considered to be the most stable and have the highest trading volume, making them attractive to both beginners and experienced traders alike.

On the other hand, minor currency pairs, also known as cross pairs, consist of currencies from smaller economies and are not as widely traded as major pairs. Examples of minor pairs include the euro/Japanese yen, British pound/Swiss franc, and Australian dollar/Canadian dollar. While minor pairs may have lower liquidity and wider spreads compared to major pairs, they can still offer profitable trading opportunities for those willing to take on a bit more risk.

When trading Forex, it is important to understand the characteristics of both major and minor currency pairs in order to make informed trading decisions. Major pairs are typically less volatile and more predictable, making them a good choice for beginners or those looking for more stable investments. On the other hand, minor pairs can offer higher potential returns but also come with higher risks due to their lower liquidity and wider spreads.

Ultimately, whether you choose to trade major or minor currency pairs will depend on your trading style, risk tolerance, and investment goals. By diversifying your portfolio with a mix of major and minor pairs, you can take advantage of different trading opportunities and potentially increase your overall profitability in the Forex market. It is important to conduct thorough research and analysis before entering any trades, regardless of whether you are trading fx major or minor currency pairs, in order to maximize your chances of success in the competitive world of Forex day trading.

Technical Analysis in Forex Trading

Technical analysis is a popular method used by traders in the Forex market to make informed decisions about when to buy or sell currency pairs. This method involves analyzing historical price data and using various technical indicators to identify patterns and trends that may help predict future price movements. By studying charts and patterns, traders can gain insights into market sentiment and potential entry and exit points for their trades.

One of the key principles of technical analysis is the idea that historical price movements tend to repeat themselves. This is based on the belief that market participants often exhibit similar behaviors in response to certain events or conditions, leading to recognizable patterns in price charts. By identifying and interpreting these patterns, traders can make educated guesses about where prices may be headed next.

Technical analysis also involves the use of various technical indicators, such as moving averages, oscillators, and trend lines, to help confirm trading signals and provide additional insights into market conditions. These indicators can help traders identify potential support and resistance levels, trend reversals, and other important market dynamics.

While technical analysis can be a valuable tool for traders, it is important to note that it is not foolproof. Market conditions can change rapidly, and unexpected events can cause prices to move in unpredictable ways. Additionally, technical analysis is just one of many tools that traders can use to make decisions in the Forex market. It is often used in conjunction with fundamental analysis, which involves analyzing economic indicators and news events to assess the overall health of an economy and its currency.

Overall, technical analysis can be a powerful tool for traders looking to make informed decisions in the Forex market. By studying price charts, patterns, and indicators, traders can gain valuable insights into market trends and potential trading opportunities. However, it is important for traders to use technical analysis as part of a comprehensive trading strategy that takes into account all available information and market conditions.

Fundamental Analysis in Forex Trading

Fundamental analysis is a key component in Forex trading, as it involves evaluating various economic indicators and data to determine the intrinsic value of a currency. This analysis is crucial in understanding the underlying factors that drive the value of a currency in the Forex market. By examining factors such as interest rates, inflation, unemployment rates, GDP growth, and geopolitical events, traders can make informed decisions on when to buy or sell a particular currency pair.

One of the main principles of fundamental analysis is that a country’s economic health and performance directly impact the value of its currency. For example, if a country has strong economic growth, low inflation, and stable interest rates, its currency is likely to appreciate in value. On the other hand, if a country is experiencing economic turmoil, high inflation, or political instability, its currency may depreciate. Understanding these economic indicators and their impact on a currency’s value is essential for successful Forex trading.

In addition to economic indicators, fundamental analysis also takes into account market sentiment and news events that can influence currency prices. Traders must stay informed about global economic developments, central bank announcements, and geopolitical tensions that can impact the Forex market. By staying abreast of current events and market dynamics, traders can better anticipate potential market movements and adjust their Forex trading strategies accordingly.

Overall, fundamental analysis plays a crucial role in Forex trading by providing traders with valuable insights into the factors that drive currency prices. By incorporating fundamental analysis into their trading strategies, traders can make more informed decisions and improve their chances of success in the Forex market. While technical analysis is also important in Forex trading, a combination of both fundamental and technical analysis can provide traders with a comprehensive understanding of market trends and opportunities.

Risk Management in Forex Trading

Risk management is essential in Forex trading as it helps traders protect their capital and minimize losses in the volatile foreign exchange market. Forex trading involves the exchange of currencies from different countries, and prices can fluctuate rapidly due to various economic and geopolitical factors. Without fx prop trading risk management strategies in place, traders can easily lose all of their investment in a single trade.

One of the key principles of risk management in Forex trading is using stop-loss orders. A stop-loss order is a predetermined price at which a trader will exit a trade to limit their losses. By setting a stop-loss order, traders can protect their capital and prevent significant losses if the market moves against them. Another important risk management strategy is diversification. By spreading out their investments across different currency pairs, traders can reduce their overall risk exposure.

Additionally, traders should always use proper position sizing to manage their risk. Position sizing involves determining the amount of capital to risk on each trade based on factors such as account size, risk tolerance, and the size of the stop-loss order. By carefully calculating position sizes, traders can ensure that they are not risking too much capital on a single trade.

Risk management also involves being aware of market conditions and staying informed about economic events that could impact currency prices. Traders should always have a trading plan in place that includes entry and exit points, stop-loss orders, and profit targets. By sticking to their trading plan and being disciplined in their approach, traders can minimize emotional decision-making and avoid impulsive trades that could lead to significant losses.

In conclusion, risk management is crucial in Forex trading to protect capital and maximize profits. By using strategies such as stop-loss orders, diversification, proper position sizing, and staying informed about market conditions, traders can navigate the volatile foreign exchange market with confidence and reduce the likelihood of substantial losses.

How Leverage Works in Forex Trading

Leverage is a powerful tool in Forex trading that allows traders to control larger positions with a smaller amount of capital. Essentially, leverage enables traders to amplify their trading potential by borrowing money from their broker. For example, with a leverage ratio of 50:1, a trader can control a position worth $50,000 with only $1,000 in their trading account. This means that for every dollar the trader invests, they can trade $50.

While leverage can greatly increase potential profits, it also comes with significant risks. One of the key risks of using leverage in Forex trading is the potential for magnified losses. If a trade goes against a trader, their losses can exceed their initial investment, leading to margin calls and potentially wiping out their entire account. It is crucial for traders to use leverage wisely and manage risk effectively to avoid catastrophic losses.

It is important for traders to understand the concept of leverage and how it works before using it in their trading strategy. Traders should carefully consider their risk tolerance, trading style, and financial goals before deciding on an appropriate leverage ratio. It is also essential to have a solid risk management plan in place to protect against potential losses. Traders should never risk more than they can afford to lose and should always be aware of the risks involved in trading with leverage.

In conclusion, leverage can be a powerful tool in Forex trading, allowing traders to control larger positions with a smaller amount of capital. However, it also comes with significant risks and should be used carefully and responsibly. By understanding how leverage works, managing risk effectively, and having a solid risk management plan in place, traders can harness the potential of leverage while minimizing the potential downsides.

Essential Forex Trading Tools (Economic Calendar, News Feeds)

In the fast-paced world of Forex trading, having the right tools at your disposal can make all the difference between success and failure. Two essential tools that every Forex trader should have in their arsenal are an economic calendar and news feeds. An economic calendar is a key tool for any Forex trader as it provides a schedule of important economic events and announcements that can impact currency markets. By keeping track of these events, traders can anticipate market movements and make informed decisions on when to enter or exit trades. News feeds are also crucial for staying up-to-date with the latest market developments and trends. By monitoring news feeds from reputable sources, traders can stay ahead of the curve and react quickly to market-moving events.

The economic calendar is an indispensable tool for Forex traders as it provides a comprehensive overview of key economic indicators and events that can impact currency prices. These events can include central bank announcements, economic data releases, and geopolitical developments. By keeping track of these events, traders can anticipate market movements and adjust their Forex trading strategies accordingly. For example, if a central bank announces an interest rate hike, this can lead to a strengthening of the currency in question. By staying informed about such events through the economic calendar, traders can capitalize on these opportunities and make profitable trades.

In addition to the economic calendar, news feeds are another essential tool for Forex traders. News feeds provide real-time updates on market developments, economic data releases, and geopolitical events that can impact currency prices. By staying informed about these developments, traders can react quickly to market-moving events and make timely trading decisions. For example, if a major economic data release comes in better or worse than expected, this can lead to significant price movements in the currency markets. By monitoring news feeds from reputable sources, traders can stay ahead of the curve and capitalize on these opportunities.

In conclusion, an economic calendar and news feeds are essential tools for Forex traders looking to succeed in the fast-paced world of currency trading. By staying informed about key economic events and market developments, traders can make informed decisions and capitalize on profitable trading opportunities. By utilizing these tools effectively, traders can enhance their trading performance and achieve success in the competitive world of Forex trading.

Tax Implications of Forex Trading

Forex trading, also known as foreign exchange trading, involves buying and selling currencies on the foreign exchange market with the goal of making a profit. While many individuals are drawn to Forex trading for its potential to generate significant returns, it is important to understand the tax implications of engaging in this type of trading activity. In the United States, Forex trading is subject to capital gains tax, which is a tax on the profit made from selling an asset for more than it was purchased for. This means that any gains made from Forex trading are considered taxable income and must be reported to the Internal Revenue Service (IRS) at tax time. Additionally, Forex traders are also required to pay self-employment tax on their trading profits if they are considered to be running a business as a sole proprietor or independent contractor.

It is essential for Forex traders to keep detailed records of all their trading activity, including profits and losses, as well as any fees or expenses incurred during the trading process. This information will be crucial when it comes time to report income to the IRS and calculate tax liability. Additionally, traders should be aware of the difference between short-term and long-term capital gains, as the tax rate varies depending on how long the asset was held before being sold. Short-term capital gains are taxed at the individual’s ordinary income tax rate, while long-term capital gains are subject to a lower tax rate.

In order to stay compliant with tax laws and regulations, Forex traders may want to consider working with a tax professional who specializes in investment and trading activities. A tax advisor can help traders navigate the complex tax rules surrounding Forex trading and ensure that they are maximizing their tax deductions and minimizing their tax liability. By staying informed and proactive about their tax obligations, Forex traders can avoid potential penalties and fines from the IRS and focus on their Forex day trading strategies and financial goals.

Impact of Cryptocurrencies on the Forex Market

Cryptocurrencies have had a significant impact on the foreign exchange (Forex) market since their inception. The emergence of cryptocurrencies, such as Bitcoin and Ethereum, has introduced a new asset class that operates independently of traditional financial institutions. This has led to increased volatility in the Forex market as traders and investors incorporate cryptocurrencies into their Forex trading strategies.

One of the key ways in which cryptocurrencies have impacted the Forex market is through increased market liquidity. Cryptocurrencies are traded 24/7, unlike traditional fiat currencies which are only traded during specific market hours. This has led to a more liquid market overall, with increased trading volumes and tighter spreads. Additionally, the introduction of cryptocurrencies has provided Forex traders with new opportunities for diversification and hedging against market risk.

Furthermore, cryptocurrencies have also introduced a new level of transparency and security to the Forex market. The blockchain technology that underpins cryptocurrencies allows for transparent and secure transactions, reducing the risk of fraud and manipulation. This has helped to improve trust and confidence in the Forex market, attracting new traders and investors who may have been hesitant to participate in the market previously.

However, the impact of cryptocurrencies on the Forex market has not been entirely positive. The increased volatility associated with cryptocurrencies has made the Forex market more unpredictable and challenging to navigate for traders. Additionally, the decentralized nature of cryptocurrencies means that they are not subject to the same regulatory oversight as traditional fiat currencies, leading to concerns about market manipulation and fraud.

Overall, the impact of cryptocurrencies on the Forex market has been both positive and negative. While they have introduced new opportunities for diversification and transparency, they have also added a new layer of complexity and risk to an already volatile market. As cryptocurrencies continue to evolve and gain mainstream acceptance, it will be important for traders and investors to stay informed and adapt their strategies accordingly.

FAQ

How much capital do I need to start Forex trading?

Forex trading is a popular way for individuals to invest in the foreign exchange market and potentially earn profits from currency fluctuations. However, one of the most common questions that beginners have is how much capital is needed to start trading Forex.

The amount of capital required to start Forex trading can vary depending on a number of factors, including the broker you choose, the trading platform you use, and your trading strategy. In general, it is recommended to start with a minimum of $1000 to $2000 in order to have enough capital to trade comfortably and effectively.

Having a larger amount of capital to start with can provide you with more flexibility and allow you to take advantage of more trading opportunities. It can also help to mitigate the risks associated with Forex trading, as you will have more funds available to cover potential losses.

It is important to remember that Forex trading is a high-risk investment and there is always the possibility of losing money. Therefore, it is crucial to only invest money that you can afford to lose and to have a solid trading plan in place.

In addition to the initial capital needed to start trading Forex, you should also consider other costs such as trading fees, spreads, and potential margin requirements. These costs can add up over time and impact your overall profitability, so it is important to factor them into your trading plan.

Ultimately, the amount of capital needed to start trading Forex will depend on your individual financial situation and trading goals. It is important to do thorough research, seek advice from experienced traders, and practice with a demo account before committing real funds to trading. By starting with a reasonable amount of capital and being disciplined in your trading approach, you can increase your chances of success in the Forex market.

What are the best Forex strategies for beginners?

Forex trading can be a daunting task for beginners, but with the right strategies in place, it can become a profitable and rewarding venture. Here are some of the best Forex strategies for beginners to help them navigate the complexities of the foreign exchange market:

- Start with a Forex trading demo account: Before diving into live trading, beginners should practice with a demo account. This allows them to familiarize themselves with the fx trading platform, test different strategies, and gain confidence in their trading abilities without risking real money.

- Learn the basics: It’s essential for beginners to have a solid understanding of the Forex market, including how it works, the major currency pairs, and the factors that influence exchange rates. Education is key to success in Forex trading for beginners should take the time to study and learn as much as they can.

- Choose a simple strategy: When starting out, it’s best for beginners to stick to a simple trading strategy. This could involve following trends, using technical indicators, or implementing a basic trading system. Keeping it simple can help beginners avoid making costly mistakes and build a solid foundation for their trading career.

- Practice risk management: Risk management is crucial in Forex trading, especially for beginners. It’s important to set stop-loss orders, limit the size of trades, and avoid overleveraging. By practicing good risk management, beginners can protect their capital and minimize potential losses.

- Stay disciplined: Discipline is key to successful Forex trading tips. Beginners should have a trading plan in place and stick to it, even when emotions are running high. By staying disciplined and following their plan, beginners can avoid impulsive decisions and stay on track towards their trading goals.

In conclusion, Forex trading can be a rewarding endeavor for beginners, but it requires patience, education, and the right strategies. By starting with a demo account, learning the basics, choosing a simple strategy, practicing risk management, and staying disciplined, beginners can increase their chances of success in the Forex market.

How do I manage risk in Forex trading?

Forex trading can be an exciting and potentially profitable venture, but it also comes with its fair share of risks. As a Forex trader, managing these risks is crucial in order to protect your capital and ensure long-term success in the market.

One of the key ways to manage risk in Forex trading is through proper risk management techniques. This includes setting stop-loss orders to limit potential losses on a trade, as well as using leverage wisely to avoid overexposure to the market. It is important to have a clear risk management strategy in place before entering any trade, and to stick to it no matter what.

Another important aspect of managing risk in Forex trading is diversification. By spreading your investments across different currency pairs and asset classes, you can reduce the impact of any one trade on your overall portfolio. Diversifying your trades can help mitigate the risk of significant losses in the event that one trade goes sour.

Additionally, staying informed about the latest market trends and events can help you make more informed trading decisions and reduce your exposure to unexpected market movements. Keeping up-to-date with economic indicators, political developments, and other factors that can impact currency prices will help you anticipate potential risks and adjust your trading strategy accordingly.

Finally, it is important to maintain a disciplined approach to trading and avoid emotional decision-making. Fear and greed can lead to impulsive trades and unnecessary risks, so it is essential to stick to your trading plan and avoid making decisions based on emotions.

In conclusion, managing risk in Forex trading requires a combination of proper risk management techniques, diversification, staying informed, and maintaining discipline. By following these principles, you can mitigate the risks associated with Forex trading and increase your chances of long-term success in the market.