What is Mobile Trading?

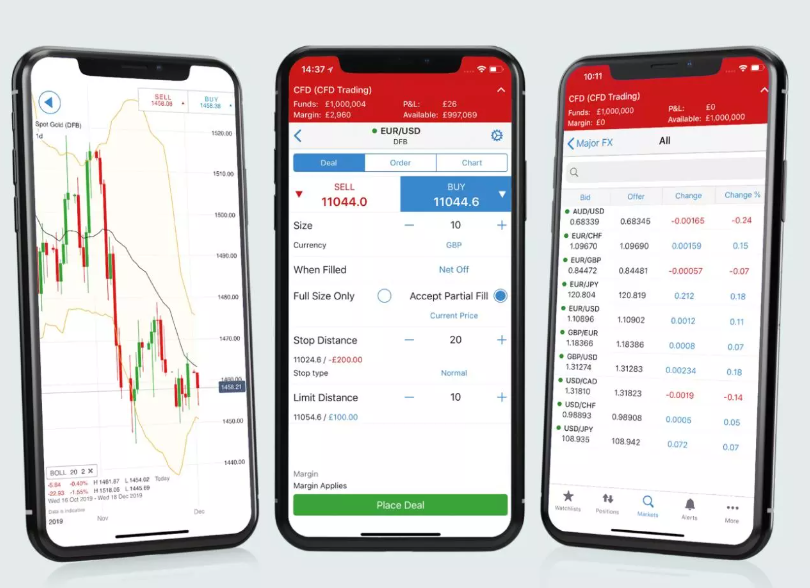

Mobile trading refers to the practice of buying and selling financial securities through a mobile device, such as a smartphone or tablet. This form of trading has become increasingly popular in recent years due to the convenience and flexibility it offers to traders. With mobile trading, investors can access their trading accounts and execute trades from anywhere at any time, as long as they have an internet connection. This means that traders no longer need to be tied to a desktop computer in order to stay on top of the markets and take advantage of trading opportunities. Mobile trading platform also often offer a range of tools and features that make it easier for traders to monitor their investments, analyze market trends, and make informed decisions. Additionally, many mobile trading apps are user-friendly and intuitive, making them accessible to traders of all experience levels. Overall, mobile trading has revolutionized the way people invest in the financial markets, allowing them to stay connected and in control of their investments on the go.

Advantages of Trading via Apps and Mobile Platforms

In today’s fast-paced world, trading via apps and mobile platforms offers numerous advantages for traders. One of the main benefits is the convenience it provides. With just a few taps on their smartphones or tablets, traders can access their accounts and execute trades from anywhere in the world. This flexibility allows traders to take advantage of market opportunities in real-time, even when they are on the go.

Another advantage of trading via apps and mobile platforms is the ease of use. Many social trading app are designed with user-friendly interfaces that make it simple for even beginners to navigate and execute trades. Additionally, these apps often offer a wide range of tools and features that can help traders analyze the market and make informed decisions.

Trading via apps and mobile platforms also allows for greater control over one’s investments. Traders can set up alerts and notifications to keep track of market trends and price movements, allowing them to react quickly to changes in the market. Additionally, many apps offer advanced trading options such as stop-loss orders and limit orders, which can help traders manage risk and protect their investments.

Furthermore, trading via apps and mobile platforms can be cost-effective. Many online brokers offer commission-free trading on their mobile platforms, which can help traders save money on fees and expenses. Additionally, trading via apps and mobile platforms often requires lower minimum account balances, making it more accessible to a wider range of traders.

Overall, trading via apps and mobile platforms offers a convenient, user-friendly, and cost-effective way for traders to access the market and manage their investments. With the ability to trade from anywhere, access a wide range of tools and features, and maintain control over their investments, traders can take advantage of market opportunities and make informed decisions to achieve their financial goals.

Key Features of Mobile Trading Apps

Mobile trading apps have become an essential tool for traders who want to stay connected to the financial markets on the go. These apps offer a range of key features that make it easier for users to monitor their investments and execute trades from anywhere at any time. One of the key features of mobile trading apps is real-time market data. Users can access up-to-date stock prices, market news, and trends, allowing them to make informed decisions about their investments. Another important feature is the ability to place trades directly from the app. This feature allows traders to execute buy and sell orders quickly and efficiently, without having to log in to a desktop platform. Mobile trading apps also offer advanced charting tools, allowing users to analyze price movements and technical indicators to help them make better trading decisions. Additionally, many mobile trading apps offer customizable watchlists, price alerts, and notifications, so users can stay on top of their investments even when they are not actively using the app. Security is also a key feature of mobile trading apps, with many apps offering two-factor authentication and encryption to protect users’ sensitive financial information. Finally, mobile trading apps often integrate with other financial apps and services, making it easy for users to track their overall financial portfolio and manage their investments in one place. Overall, the key features of mobile trading apps make them an indispensable tool for traders who want to stay informed and make smart investment decisions on the go.

How to Get Started with Mobile Trading

Mobile trading is a convenient way for investors to stay connected to the stock market and make trades on the go. If you’re interested in getting started with mobile trading, there are a few key steps to follow. The first step is to choose a reputable mobile trading app that is user-friendly and offers the features you need. Look for an app that allows you to research stocks, track your portfolio, and place trades quickly and easily. Once you’ve chosen an app, you’ll need to create an account and fund it with some money to start trading. Make sure to choose a secure password and enable two-factor authentication to protect your account from unauthorized access.

After you’ve set up your account, it’s time to start researching stocks and making trades. Use the app’s research tools to analyze different companies and industries, and keep an eye on market trends and news that could impact your investments. When you’re ready to make a trade, use the app’s trading platform to buy or sell stocks with just a few taps on your phone. Remember to set a budget for your trades and stick to your investment strategy to avoid making impulsive decisions based on emotions.

As you gain experience with mobile trading, consider using advanced features like limit orders, stop-loss orders, and margin trading to maximize your profits and minimize your risk. Keep track of your trades and review your portfolio regularly to make sure your investments are performing as expected. And most importantly, don’t be afraid to seek advice from experienced traders or financial advisors if you have any questions or need guidance. With the right tools and knowledge, mobile trading can be a rewarding and profitable way to grow your wealth and achieve your financial goals.

Choosing the Best Mobile Trading App for Your Needs

In today’s fast-paced world, mobile trading apps have become a popular tool for investors to manage their portfolios on the go. With so many options available in the market, it can be overwhelming to choose the best mobile trading app for your specific needs. When selecting a mobile trading app, there are several factors to consider to ensure that you are making an informed decision.

First and foremost, it is important to assess your trading style and goals. Are you a casual investor looking to make occasional trades, or are you a more active trader who requires real-time data and advanced charting tools? Understanding your trading habits will help narrow down the options and find an app that best suits your needs.

Next, consider the features and functionality offered by different mobile trading apps. Look for apps that provide a user-friendly interface, reliable market data, customizable alerts, and advanced trading tools such as technical analysis and options trading app. Additionally, check if the app offers access to a wide range of markets and financial instruments to ensure you can trade the assets you are interested in.

Security is another crucial aspect to consider when selecting a mobile trading app. Ensure that the app employs robust security measures such as encryption and two-factor authentication to protect your personal and financial information. Additionally, look for apps that are regulated by reputable financial authorities to ensure that your investments are safeguarded.

Lastly, take into account the cost of using the mobile trading app. Some apps may charge commission fees for trades, while others offer commission-free trading. Consider your trading frequency and the fees associated with each app to determine the most cost-effective option for your needs.

Ultimately, choosing the best mobile trading app for your needs requires careful consideration of your trading style, desired features, security measures, and cost. By taking the time to research and compare different options, you can find an app that meets your requirements and helps you achieve your financial goals.

Risk Management on Mobile Trading Apps

Risk management is a crucial aspect of mobile trading apps that cannot be overlooked. With the increasing popularity of mobile trading, users are exposed to a higher level of risk due to the convenience and accessibility of these apps. As such, it is essential for users to be aware of the various risks involved in online mobile trading and take necessary precautions to mitigate them.

One of the main risks associated with mobile trading apps is security. With sensitive financial information being transmitted over mobile networks, there is a high risk of data breaches and hacking. To address this risk, users should ensure that they are using secure and reputable trading apps that offer encryption and other security measures to protect their information. Additionally, users should use strong passwords and enable two-factor authentication to further secure their accounts.

Another risk to consider is market volatility. Prices of stocks and other securities can fluctuate rapidly, leading to potential losses for traders. To manage this risk, users should conduct thorough research and analysis before making trades, set stop-loss orders to limit potential losses, and avoid trading on margin unless they fully understand the risks involved.

Liquidity risk is also a concern when trading on mobile apps. In times of market stress or high volatility, it may be difficult to execute trades at desired prices due to low liquidity. To mitigate this risk, users should be aware of market conditions and be prepared to adjust their trading strategies accordingly.

Overall, risk management is a critical component of successful trading on mobile apps. By being aware of the various risks involved and taking necessary precautions, users can minimize their exposure to potential losses and maximize their chances of success in the fast-paced world of mobile trading.

Mobile Trading Strategies

Mobile trading has become increasingly popular in recent years, as technology has advanced and made it easier for traders to access the markets from anywhere at any time. With the rise of smartphones and Forex trading mobile app, traders now have the ability to execute trades, monitor their positions, and stay up-to-date on market news and trends all from the palm of their hand.

There are a variety of mobile trading strategies that traders can use to maximize their profits and minimize their risks. One common strategy is trend following, where traders look for patterns in price movements and try to capitalize on them by buying or selling at the right time. Another popular strategy is momentum trading, where traders focus on stocks that are showing strong upward or downward momentum and try to ride the wave for as long as possible.

Day trading is also a popular strategy among mobile traders, where they buy and sell stocks within the same trading day in order to take advantage of short-term price fluctuations. Scalping is a similar strategy, where traders make multiple quick trades throughout the day to capture small profits.

Risk management is a crucial aspect of mobile trading strategies, as the fast-paced nature of the markets can lead to significant losses if traders are not careful. Setting stop-loss orders and limiting the size of trades can help traders protect their capital and minimize their losses.

Ultimately, the key to successful mobile trading is to have a solid strategy in place and to stick to it, even when emotions are running high. By staying disciplined and following a well-thought-out plan, traders can increase their chances of success in the fast-paced world of mobile trading.

Day Trading with Mobile Apps

Day trading with mobile apps has become increasingly popular in recent years as more and more people are turning to the stock market for investment opportunities. With the advancement of technology, day trading app can now be done conveniently and efficiently using just a smartphone or tablet.

One of the key benefits of day trading with mobile apps is the flexibility it offers. Traders can access the stock market anytime, anywhere, allowing them to make quick decisions and take advantage of market opportunities as they arise. This flexibility is especially beneficial for those who have busy schedules or cannot be tied to a computer all day.

Another advantage of day trading with mobile apps is the speed at which trades can be executed. With just a few taps on the screen, traders can buy or sell stocks instantly, without having to wait for a computer to load or a broker to place the trade. This speed is crucial in day trading, where every second counts and the ability to act quickly can make a significant difference in profits.

Additionally, many mobile trading apps offer advanced features and tools that can help traders analyze the market, track their investments, and make informed decisions. These apps often provide real-time market data, customizable charts, and technical indicators that can help traders identify trends and patterns in the market.

Despite the convenience and benefits of day trading with mobile apps, it is important for traders to exercise caution and practice risk management. The stock market can be volatile and unpredictable, and it is easy to get caught up in the excitement of day trading. Traders should set clear goals, establish a trading plan, and stick to their strategy to avoid making impulsive decisions that can lead to losses.

In conclusion, day trading with mobile apps has revolutionized the way people trade stocks, offering convenience, speed, and advanced tools at their fingertips. By using these apps responsibly and staying disciplined, traders can potentially achieve success in the fast-paced world of day trading.

Swing Trading via Mobile Platforms

Swing trading has become increasingly popular among investors and traders who are looking to take advantage of short-term price movements in the stock market. With the rise of best mobile trading platform, swing trading has become more accessible than ever before.

Swing trading involves holding onto a stock or other financial instrument for a period of days or weeks, as opposed to day trading which involves buying and selling within the same trading day. This strategy allows traders to take advantage of medium-term trends in the market and potentially profit from price fluctuations.

One of the key advantages of swing trading via mobile platforms is the ability to trade on the go. With the convenience of being able to access your trading account from anywhere with an internet connection, traders can take advantage of opportunities as they arise, without being tied to a desktop computer. This flexibility is especially important in the fast-paced world of swing trading, where timing is crucial.

Mobile trading platforms also offer a range of features that make swing trading easier and more efficient. Traders can set up alerts and notifications to stay informed about market developments and price movements, and execute trades quickly and easily with just a few taps on their smartphone or tablet. These platforms also provide access to a wealth of market data and analysis tools, allowing traders to make informed decisions about their trades.

While swing trading via mobile platforms offers many benefits, it is important for traders to exercise caution and practice proper risk management. The volatility of the market can lead to significant losses if trades are not carefully planned and executed. It is also important to stay informed about market trends and developments, and to continuously monitor your trades to ensure that they are on track.

In conclusion, swing trading via mobile platforms offers a convenient and efficient way for traders to take advantage of short-term market trends and potentially profit from price movements. By utilizing the features and tools available on mobile trading platforms, traders can stay informed, execute trades quickly, and manage their risk effectively.

Scalping on the Go: Fast Trading Strategies

In today’s fast-paced world, traders are constantly looking for ways to capitalize on quick market movements and make profits on the go. One popular trading strategy that has gained popularity in recent years is scalping.

Scalping is a trading strategy that involves making multiple trades throughout the day to profit from small price movements. Traders who employ this strategy typically hold positions for a very short amount of time, sometimes just a few seconds or minutes, in order to capture small profits repeatedly.

One of the key advantages of scalping is its ability to generate profits quickly. By taking advantage of small price fluctuations, traders can make multiple trades in a short amount of time and accumulate profits throughout the day. This strategy is particularly popular among day traders who are looking to make quick profits without holding positions overnight.

To successfully scalp on the go, traders need to have a fast and reliable trading platform that allows them to execute trades quickly. Many traders use mobile trading apps that allow them to monitor the markets and place trades from anywhere, whether they are at home, in the office, or on the go. These apps provide real-time market data, charting tools, and order execution capabilities, making it easy for traders to take advantage of fast-moving markets.

In addition to having the right tools, successful scalpers also need to have a solid trading plan and risk management strategy in place. Scalping can be a high-risk strategy, as it involves making quick decisions and taking on multiple positions throughout the day. Traders need to be disciplined and patient, and be prepared to cut losses quickly if a trade goes against them.

Overall, scalping on the go can be a profitable trading strategy for those who are able to execute trades quickly and effectively. By staying informed, using the right tools, and managing risk carefully, traders can take advantage of fast market movements and generate profits on the go.

Mobile Trading for Cryptocurrency

Mobile trading for cryptocurrency has become increasingly popular in recent years as digital currencies continue to gain widespread adoption. With the rise of smartphones and mobile devices, traders now have the ability to buy, sell, and trade cryptocurrencies on the go, anytime and anywhere. This convenience has made it easier for people to participate in the cryptocurrency market, even if they are not sitting at a computer. Mobile trading apps allow users to access their accounts, monitor their portfolios, and execute trades quickly and efficiently. This accessibility has opened up new opportunities for both experienced traders and newcomers to the world of cryptocurrencies.

One of the key advantages of mobile trading for cryptocurrency is the ability to react quickly to market changes. Cryptocurrency prices can be highly volatile, and being able to access your trading platform from your mobile device means you can respond to price movements in real-time. This can be particularly important for day traders who rely on quick decisions to capitalize on short-term price fluctuations. Additionally, mobile trading apps often come equipped with advanced charting tools and technical analysis features, allowing users to make informed decisions based on market trends and data.

Another benefit of mobile trading is the flexibility it offers. Whether you are at home, at work, or on the go, you can easily manage your cryptocurrency portfolio and execute trades with just a few taps on your smartphone. This level of convenience has democratized the trading process, making it more accessible to a wider range of people. Additionally, mobile trading apps often provide a user-friendly interface, making it easier for beginners to navigate the world of cryptocurrency trading.

Overall, mobile trading for cryptocurrency has revolutionized the way people participate in the digital asset market. With the ability to trade anytime and anywhere, users can take advantage of market opportunities and stay on top of their investments with ease. As technology continues to evolve, mobile trading apps are likely to become even more sophisticated, offering users even more tools and features to enhance their trading experience.

Security Considerations for Mobile Traders

Security considerations are paramount for mobile traders who conduct business on the go. With the rise of mobile trading apps and platforms, traders must be vigilant in protecting their sensitive financial information and transactions from potential cyber threats. One of the key security considerations for mobile traders is the use of secure and encrypted networks when conducting transactions. Public Wi-Fi networks are often unsecured and can leave traders vulnerable to hacking and data breaches. It is important for traders to use virtual private networks (VPNs) or secure mobile hotspots to ensure their data is protected. Additionally, traders should enable two-factor authentication on their trading accounts to add an extra layer of security. This requires traders to input a second form of verification, such as a code sent to their mobile device, in addition to their password. Regularly updating passwords and using strong, unique passwords for each account is also essential for protecting sensitive financial information. Mobile traders should also be cautious of phishing scams and fraudulent emails that may attempt to steal their login credentials or personal information. It is important to verify the legitimacy of any emails or messages before clicking on any links or providing any information. Finally, mobile traders should regularly monitor their accounts for any suspicious activity and report any unauthorized transactions immediately. By staying vigilant and implementing strong security measures, mobile traders can better protect their financial information and transactions while conducting business on the go.

FAQ

FAQ stands for Frequently Asked Questions, and it is a common feature on websites, product packaging, and customer service materials. The purpose of an FAQ section is to provide answers to common queries that customers may have about a product, service, or company. By addressing these questions proactively, companies can save time and resources by reducing the number of inquiries they receive. FAQ sections typically cover a range of topics, such as product specifications, pricing, shipping information, and troubleshooting tips. They are designed to be user-friendly and easy to navigate, with questions organized into categories or searchable by keywords. FAQ sections can also help build trust and credibility with customers, as they demonstrate that a company is transparent and responsive to customer needs. Overall, having an FAQ section is a valuable tool for businesses to improve customer satisfaction and streamline their customer support processes.

What are the best mobile trading apps for beginners?

As the world of investing becomes more accessible to the general public, many beginners are turning to mobile trading apps to start building their investment portfolios. With a plethora of options available, it can be overwhelming to choose the best app for beginners. To help narrow down the choices, here are some of the top mobile trading apps that are beginner-friendly.

One of the most popular mobile trading apps for beginners is Robinhood. Known for its user-friendly interface and commission-free trading, Robinhood allows users to trade stocks, ETFs, options, and cryptocurrencies with ease. The app also offers educational resources and tools to help beginners learn the basics of investing.

Another great option for beginners is Acorns. This app is ideal for those who want to start investing but may not have a lot of money to spare. Acorns rounds up users’ everyday purchases to the nearest dollar and invests the spare change into a diversified portfolio of ETFs. This hands-off approach is perfect for beginners who want to start investing without having to actively manage their investments.

For those interested in trading cryptocurrencies, Coinbase is a popular choice among beginners. Coinbase allows users to buy, sell, and store a variety of cryptocurrencies, making it easy for beginners to get started in the world of digital assets. The app also provides educational resources to help users learn more about cryptocurrencies and blockchain technology.

No matter which mobile trading app beginners choose, it is important to do thorough research and understand the risks involved in investing. It is also recommended to start with small investments and gradually increase exposure as one becomes more comfortable with trading. With the right app and a solid understanding of investing principles, beginners can start building their investment portfolios and working towards their financial goals.

Are mobile trading apps secure to use?

Mobile trading apps have become increasingly popular in recent years, allowing users to trade stocks, cryptocurrencies, and other financial instruments on the go. However, with the rise of cyber threats and hacking incidents, many people are concerned about the security of these apps.

One of the main concerns with mobile trading apps is the risk of data breaches and theft. These apps store sensitive financial information, such as bank account details and investment portfolios, making them an attractive target for cybercriminals. If a hacker were to gain access to this information, it could lead to financial loss and identity theft for the user.

To combat this threat, developers of mobile trading apps have implemented various security measures to protect user data. These measures include encryption, two-factor authentication, biometric authentication, and regular security updates. Additionally, many apps use secure communication protocols to ensure that data transmitted between the app and the server is encrypted and cannot be intercepted by hackers.

Despite these security measures, no system is completely foolproof, and there is always a risk of a security breach. Users can take steps to protect themselves by choosing a reputable app from a trusted developer, using strong and unique passwords, and enabling security features such as biometric authentication.

In conclusion, mobile trading apps can be secure to use if proper security measures are in place. However, users should remain vigilant and take precautions to protect their data and financial information. By staying informed about potential threats and following best practices for mobile security, users can minimize the risk of falling victim to cyber attacks while using mobile trading apps.

Can I trade stocks and crypto on the same mobile app?

In recent years, trading stocks and cryptocurrencies has become increasingly popular among investors. With the rise of digital platforms and mobile apps, individuals now have the opportunity to easily buy and sell assets from the comfort of their own homes. One common question that many traders have is whether they can trade both stocks and cryptocurrencies on the same mobile app.

The good news is that there are several mobile apps available that allow users to trade both stocks and cryptocurrencies. These apps offer a convenient and user-friendly interface that makes it easy for individuals to manage their investments in one place. By using a single app, traders can access a wide range of financial instruments and diversify their portfolios with ease.

One of the main advantages of using a etf trading mobile app to trade both stocks and cryptocurrencies is the convenience it offers. Instead of having to switch between multiple platforms, users can simply log into one app to access all of their investments. This saves time and makes it easier for individuals to track their portfolios and make informed decisions about their trades.

Additionally, trading stocks and cryptocurrencies on the same app can help investors take advantage of market trends and opportunities. By having access to a diverse range of assets, traders can make strategic decisions based on the performance of different markets. This can help them maximize their profits and minimize their risks in the long run.

Overall, trading stocks and cryptocurrencies on the same mobile app can be a convenient and efficient way for investors to manage their portfolios. By using a single platform, individuals can easily access a wide range of financial instruments and make informed decisions about their investments. As the digital trading landscape continues to evolve, having access to a versatile mobile app can give traders a competitive edge in the market.