Over the past 20 years, US-headquartered Oanda has grown from a global online broker stage to an established player. Today they facilitate trading forex and indices/commodities CFDs for clients worldwide.

This detailed review of Oanda will cover everything from fees and trading platforms to accounts and regulation.

Risk warning: CFDs are complex instruments and there is a high risk of losing money quickly due to leverage. 73.5% of retail investor accounts lose money when trading CFDs with this provider. You need to understand how CFDs work and consider whether you can afford to risk losing your money.

A brief history

Before we dive into the facts and figures of this Oanda trader review, it may first help you paint a picture of where the Oanda company started and how far it has come.

Oanda’s humble beginnings date back to 1996, making it one of the earliest online forex brokers. We then gave investors the opportunity to get a grip on Forex and CFDs. Today, however, Oanda is well established in the foreign exchange market, providing 124 traded products, corporate FX services, currency management solutions, and exchange rate data for global companies.

Although headquartered in the United States, it has several global offices, including Tokyo and London. In fact, Oanda operates out of eight global financial centers and has customers in over 196 countries. We have obtained licenses from the following major regulatory jurisdictions:

- UK

- United States

- Canada

- Japan

- Singapore

- Australia

It may not get a mention in many Oanda review forums, but the FxTrade platform launched in 2001 was actually the first fully automated forex trading platform.</p >

You may have seen Oanda spread betting reviews and forums where the company offers spread betting. While this is true, it is only available to Oanda Europe Ltd customers residing in the UK or Ireland.

Minimum initial deposit

Oanda has historically not required a minimum initial deposit. It ensures that aspiring day traders and those with limited capital do not have to deposit more than they can afford when looking for their feet.

Additionally, Oanda’s minimum lot size is one unit of the base currency of the quotation. They also offer nano lot and lot size calculators.

Spreads and Commissions

Whether you are looking for an Oanda Europe Limited, Singapore, Philippines or US price review, Oanda remains competitive no matter where you are located.

Oanda spreads are comparable to other large companies such as FXCM and FxPro.

To provide traders with the best prices, Oanda uses automated machines to monitor prices around the world, and spreads also respond to market liquidity and volatility. Especially high volatility can widen spreads. Current and historical average spreads are clearly outlined, which should alleviate some traders’ concerns about hidden fees.

This transparent approach was echoed by the CEO of OANDA Global Group, Bassa Narasimha, who stated, “We make a statement that the broker doubts his interests I believe the retail trading industry benefits from full will in a more transparent manner that is responsible for making or falsely disclosing ”

There are important things to consider when comparing Oanda spreads to agency brokers (no trading desk). Therefore, comparing only spreads does not always allow us to draw clear conclusions as different conclusions may affect trading costs over a period of time.< /p>

Benefit

Those who want to trade on margin can find leveraged products on Oanda. For retail customers, local regulators determine maximum leverage, but all Oanda users can further reduce leverage limits.

It’s also worth emphasizing that while it can potentially boost your earnings, margin trading can amplify your losses. Therefore, using stop loss orders to limit potential losses with leverage is a technique many people use.

Other fees

Oanda’s transaction fees are simple and competitive. However, Oanda introduced an inactivity fee in September 2016. Fortunately, this effective tax only affects those who haven’t traded in more than 2 years.

No deposit bonus when you sign up for Oanda. It is recommended to keep an eye on the official website for changes in overnight (rollover) rates, finance costs.

Oanda trading platform

FxTrade

Now it’s time to move on to the FxTrade portion of the review, an essential component of Oanda’s offering. Overall, the system is well designed, easy to use, and offers a wealth of tools and analysis capabilities.

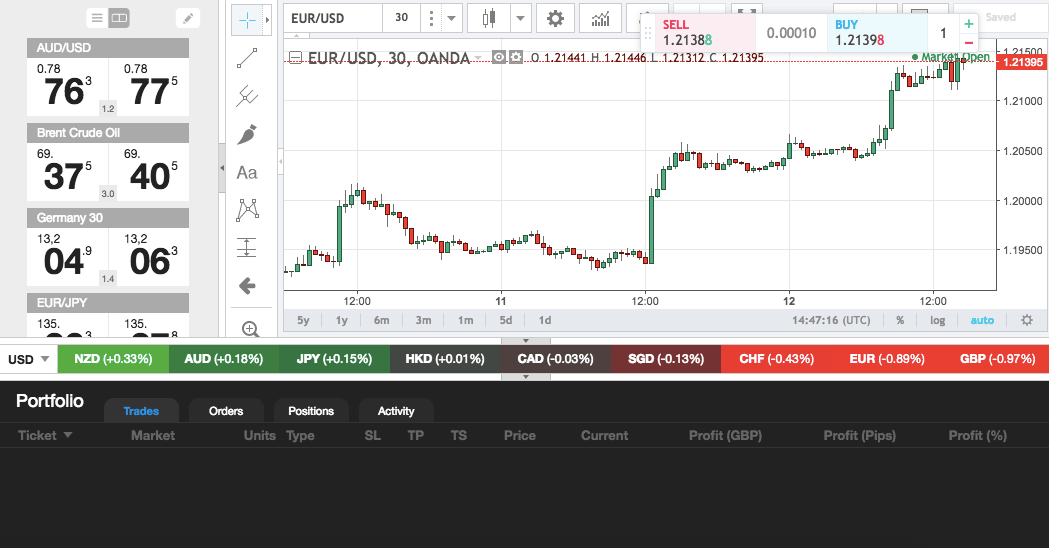

You can trade directly from the chart. Benefit from complex order types such as buy, sell and trailing stops. Account analytics can be handled by you. This financial trading software also includes MultiCharts charts allowing advanced advanced research and display styles. You can also get watchlists, news feeds and economic analysis. Accessing historical and live exchange rates is also simple.

The downside is that the platform doesn’t have an ultra-modern look and some features are awkward to use. Instead of being able to open news, forums, and economic analysis on the platform, they open as web pages in separate browsers. Again, open Oanda’s order book outside the application. This can sometimes prevent a smooth trading experience. According to our speed test, server times and execution speeds are industry standard.

Conclusion – The FxTrade platform meets the needs of traders of all experience levels. It has all the tools to trade in just a few clicks, and needless to mention a whole host of useful extras.

FxTrade API Library

Sign up for Oanda to explore automated trading. API Python tutorials can be found online to help you get the most out of the API tools. Auto trading allows you to do more trades than ever before. You can also be active in multiple markets at once, from gold and oil to binary options and Bitcoin CFDs.

With the help of Algo labs, notifications can be created when entering and exiting a location, and criteria can be pre-programmed. This gives you more time to download historical data, analyze tick data and devise effective strategies.

For experienced traders and technical experts, the FxTrade API library can support all of the following:

- Access current and historical market data

- Stop-loss, take-profit or entry orders

- Access past trading transactions

- Risk-free test

- Transaction request

MetaTrader 4

If Oanda’s desktop platform doesn’t appeal to you, there is a MetaTrader 4 (MT4) download option. In this review, we found that the industry standard includes advanced charting, watchlists, and trade automation through ‘EA (Expert Advisor)’ plugins. You can also save layouts and chart profiles. You can also chart swap exchange rates and live and monthly exchange rates within the platform.

On the negative side, creating or modifying an EA can be difficult. This is especially true for new traders who are unfamiliar with native programming languages. Audible alerts can sound annoying, but there are customization options, not to mention a mute button, so you can get past the downside.

Oanda has a number of fantastic trading tools.

- MotiveWave – This professional charting and technical analysis platform offers over 250 built-in studies/indicators and 30 built-in trading strategies. This high-performance, easy-to-use software is a powerful weapon in your trading arsenal.

- Oanda Market Reports – Powered by Autochartist, this tool provides a brief summary of the market. Emails are actually sent to traders one day prior to starting the analysis. The market report provides a technical outlook for the forex market over the next 48 hours.

Creating forex order books, indicators and potential strategies is also quick and easy. It is not prohibited for those who want to hedge. You can see both long and short positions of the same product on the MT4 platform.

FYI, additional platforms are available for traders on the Oanda marketplace. This includes third-party apps and algorithmic trading platforms such as the Seer trading system.

Note Oanda does not offer MT5 (Metatrader 5).

Mobile App

If you travel frequently, being able to enter and exit locations from your mobile or tablet can be very useful. Those looking for Oanda mobile and iPad reviews will be impressed with the features of the FxTrade mobile trading platform. Not to mention integration with a variety of devices, from iPhone to Windows Phone 8.

After you get your web login details, you can download historical quotes, fight interest rates, and start speculating on the FTSE 100 or Nasdaq. Additionally, the platform is easy to navigate and offers a stress-free environment with a stylish design. You can access Oanda’s trading instruments, spread history, account analysis and complex order types.

You retain the ability to trade directly on the chart and benefit from charts with indicator and price overlays. You also have the option to adjust the display style to find a format that complements your trading style. As an added bonus, news, economic calendars, and financial bulletins all open easily from inside the app. This simplifies market sentiment.

We have regular maintenance to keep our list of devices up to date. This also means that all problems and glitches are quickly resolved.

Overall, the mobile service provides a hassle-free transition from the desktop application.

Payment methods

Unsurprisingly, an increasing number of traders are looking for deposit and withdrawal systems.

You can deposit and withdraw money to your Oanda account using either:

- Paypal

- Bank transfer

- Credit and debit cards

Their website guides them through the process and their customer service should be able to help with withdrawal issues.

Other options are available depending on your location. For example, people in China can use China UnionPay and Bpay. So go to their website and see where you are now.

It’s worth noting that there may be withdrawal fees. If you choose bank transfer, it can be between 20 and 35 euros. With that said, you get one free card withdrawal per month.

Overall, Oanda customer reviews indicate that traders are satisfied with the current fund transfer mechanism.

Account types

Oanda offers a single standard account with no minimum deposit required. Unfortunately, bulk traders with a lot of pockets may be disappointed by the lack of additional benefits that some brokers offer to traders with significant capital. But that means everyone benefits from trades of all sizes, including over 70 currency and precious metal pairs.

Demo account

Our Oanda demo account review is quick to highlight the impressive perks of an Oanda practice account. While many forex brokers offer practice downloads for a limited period of time, Oanda’s FxTrade demo account can be used for as long as traders need to hone their strategies and build confidence.

With your demo login details, you have almost the same functionality as a real account holder. Their practice account, funded with simulated funds, is an ideal way to familiarize yourself with market conditions and test drive Oanda as a potential broker.

As you grow more confident with volume indicators, currency heat maps and backtesting, you can easily upgrade to a live account.

Additional features

If you’re asking how to separate Oanda from the rest for this review, our extensive research and trading tools can do the job. Their offer exceeds many retail trading platforms.

For example, Oanda’s Academy offers:

- Webinars – These online videos cover topics ranging from ‘Getting Started Trading’ to advanced topics such as ‘Fibonacci Retracements and Clusters: Advanced Reporting on Trend Formation’.

- Interviews – Get input from experienced traders as they discuss topics ranging from trading plans to strategies.

- Article – This detailed article appeals to traders of all experience levels.

- Tutorials – Tutorials help cover all topics, including how to trade Bitcoin, read data feeds, and identify correlations. You can also start scalping and learn how to compare recent live spreads. All of these can help increase your daily trading paycheck.

Moreover, Oanda has a simple approach to historical average exchange rates. It’s also quick and easy to view open versus short position ratios. You can also check monthly and annual averages and historical classic interest rates. This can all make conducting in-depth research hassle-free.

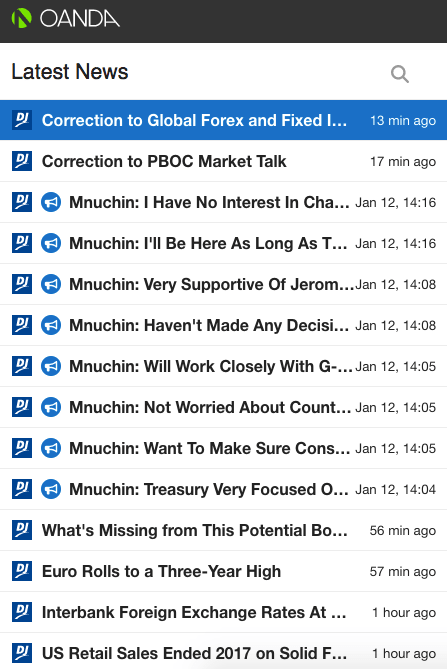

You can also utilize news reports about Oanda from various sources. These include MarketPulse, 4Cast and Dow Jones FX Select, where you will find the latest news, trend analysis and policy statements. Additionally, you get direct access to margin and leverage calculators to help you establish your potential profit or loss.

The only downside is that there are so many resources available that finding them can be a bit of a minefield.

Safety Security

With cybercrime on the rise, digital security has become a major concern in broker reviews in 2017. So, is Oanda a reliable broker? Fortunately, your personal data and trading activities are kept safe. They do this using advanced and sophisticated encryption techniques.

Oanda regulation

Too many traders have fallen victim to unscrupulous brokers in recent days. Therefore, choosing a licensed and regulated broker is all the more important. Oanda’s pro-active approach to regulation will bring peace of mind to its customers.

After receiving a number of international awards, it is not surprising to find that customer reviews are satisfied with the standards of regulatory oversight. Oanda is regulated in the following countries:

- United States – Commodity Futures Trading Commission (CFTC)

- Canada – Investment Industry Regulatory Authority (IIROC)

- United Kingdom – Fiscal Conduct Authority (FCA)

- Australia – Australian Securities and Investments Commission (ASIC)

- Singapore – Monetary Authority of Singapore (MAS)

- Japan – Financial Services Authority (FSA)

Despite extensive regulatory oversight, account protection in case of default may vary depending on where the account is held.

Benefits

This Oanda review found the following key benefits:

- Product Diversity – As a day trader, a variety of products can mean greater opportunities. Oanda gives you access to 71 currency pairs, 16 stock index CFDs, 23 metals CFDs, 8 commodity CFDs and 6 CFD bonds.

- Applications – You can use Oanda’s proprietary desktop software and platforms such as MetaTrader 4. Developers are working to implement updates regularly.

- Direct Chart Trading – Traders can enter and close positions directly on the chart. This feature can be found on both the Oanda and MetaTrader 4 trading platforms.

- No minimum account size – Open an account with as little as $1, ideal for testing and developing daily strategies.

- Regulatory – As described above, Oanda has been impressed with the regulatory oversight of various agencies around the world. This requires Oanda to abide by rules and regulations designed to protect traders. This can help reduce concerns about scams and scams.

- Demo Account – Long free trial is available and you can easily download the MetaTrader 4 demo account. You can then open a position and get your head around the average exchange rate. Also, you get more practice with guaranteed stop loss and full load.

For all these reasons, Oanda is widely regarded as one of the top 100 traders.

Cons

Despite its numerous benefits, we will end up with some Oanda negatives to highlight in this review.

- Missing Appliances – Oanda does a good job of facilitating the instruments they offer. However, if you are looking to trade cryptocurrencies and single stock CFDs, you will be disappointed.

- Limited Additional Protection – While Oanda complies with regulatory standards, additional slippage and deposit protection can benefit aspiring day traders, especially in rapidly changing markets. It can also do more in terms of negative balance protection.

- Slow Customer Service – In a business where time costs money, Oanda’s slow customer service can hinder and frustrate active traders.

- Disorder Resources – On the positive side, Oanda offers a variety of educational and trading resources, from webinars to news outlets. However, these resources are rather well-organized and are only used after launching an external web page.can be tolerated. This can slow down your trading experience.

- ECN – Oanda is not an ECN broker, he is a market maker and some people believe the spreads with ECN brokers are smaller.

Oanda trading hours

Oanda’s trading hours are consistent with many global financial markets. Trading is available from Sunday approximately 17:00 until Friday 17:00 UTC – UTC – 5

Oanda’s business hours vary depending on which department you have an account with. Traders in Asia Pacific can relax knowing that every major market they wish to access will be open for business on the Oanda trading platform.

Contact & Customer Support

In the day trading business, every second is money. This means that any platform glitches and account issues can reduce your revenue. Therefore, fast and effective customer support is essential. Fortunately, Oanda trade review offers 24/7 multilingual support.

Outside of holiday trading hours, you can always reach the Oanda customer support team via email. Alternatively, live online chat and phone support are also available during trading hours. Please refer to the official website for contact phone numbers for your region.

You can find support in the following languages.

- English

- German

- Spanish

- Italian

- French

- Portuguese

- Russians

Some negative Oanda customer reviews have highlighted that customer service response times can be slow. However, the direct line staff are courteous and helpful, and strive to fully answer your questions with their support website and archives.

Therefore, users can trade with confidence knowing that effective support is available regardless of location and time of day.

verdict

Is Oanda a good forex broker? Well, they score very high in ratings and reviews, and it’s not hard to see why. It offers simple setup, competitive pricing, and a wide product offering, not to mention a sophisticated trading platform. So, even if we compare Oanda with FXCM and other well-known brokers, Oanda is still impressive.

However, there is definitely room for improvement in terms of customer service. Traders who prioritize fast and reliable support may want to look elsewhere.

Ultimately, this Oanda review finds the company remains an attractive proposition for customers worldwide.

Accepted countries

Oanda accepts traders from Australia, Thailand, Canada, UK, South Africa, Singapore, Hong Kong, India, Germany, Norway, Sweden, Italy, Denmark, UAE, Saudi Arabia, Kuwait, Luxembourg, Qatar and many other countries.

Merchants are not allowed to use Oanda in Belgium, France, Netherlands, Cyprus and USA.