A currency strength indicator is the secret weapon of successful trading. With this trading guide, our team of industry experts unveils an exclusive pack of currency strength indicators. You will learn why our in-house indicators are excellent along with authentic currency strength trading strategies.

If this is your first time on our website, the Trading Strategy Guides team welcomes you. Hit the subscribe button to get your weekly free trading strategies directly into your email box.

Looking at charts to determine which currencies are strong and which are weak can be quite confusing.

Things can get even more confusing when you factor in intra-day noise or multi-frame analysis. Mixing the behavior of the same currency with a basket of other currencies shows that determining currency strength is not an easy task.

On the 15-minute chart, EUR is sometimes the strongest currency against the US Dollar. However, there is a new revelation when analyzing the same currency pair on the 1-hour and 4-hour charts.

New inputs could tell a different story and EUR/USD could see a serious downtrend.

In the forex market, this type of crash analysis happens all the time.

Conflicting signals for different time zones and different currencies are standard.

When forex charts cannot clearly reveal currency strength, a currency strength indicator is used.

Before disclosing your currency bull trading strategy, lay the groundwork first.

What is a call strength indicator?

As the name implies, the currency strength indicator is an MT4 custom indicator designed to indicate the strength of a specific currency pair against other currencies. At the same time, the relationship between currency pairs is constructed according to strength or weakness.

Currency Strength Indicator MT4 helps you understand conflicting market trends.

However, not all currency strength indicators are created equal.

Some may be based on ROC, RSI, CCI or rate of change of some type of cross-market correlation.

Hence, the formula for calculating the strength of a currency meter.

If the currency strength formula is incorrect, the overall strength indicator value may be incorrect.

Our team of industry experts use more than price movement over a period of time to calculate currency strength. We use a proprietary trading formula that aggregates prices across multiple timeframes and self-weights them to create the most effective currency strength indicator.

Our proprietary formula for calculating currency strength is more effective than all other free currency strength indicators combined.

We’re going to reveal how one of our team members trades with the currency strength meter to show you how that can be done.

Now the question is…

How to use the currency strength indicator to:

- Determine the strongest/weakest currency pair

- What is the most effective way to combine currency strength values

- How to time the market

Here’s how.

How to use Currency Strength Meter

Basically, there are two standard ways to use currency strength tools.

- Trend-following tools

- Trend Inversion Tool

Let me explain…

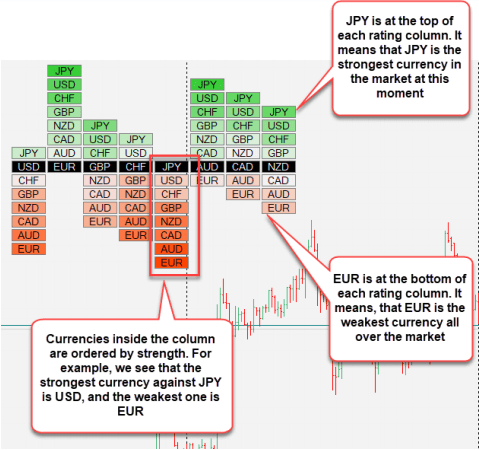

When using a currency strength meter, you analyze individual currencies individually, not currency pairs. The whole idea is to identify the strongest and weakest currencies so you can choose the right currency pair for your trades.

Clearly, the idea behind a currency strength strategy is to buy strength and sell weakness.

In other words:

- Buy the strongest currency against the weakest currency

- Or sell the weakest currency for the strongest currency

See the Currency Heat Map indicator below.

When using a currency strength meter, you analyze individual currencies individually, not currency pairs. The whole idea is to identify the strongest and weakest currencies so you can choose the right currency pair for your trades.

Clearly, the idea behind a currency strength strategy is to buy strength and sell weakness.

In other words:

Buy the strongest currency against the weakest currency

Or sell the weakest currency for the strongest currency

See the Currency Heat Map indicator below.

A currency heat map (part of the 1 in 3 currency indicator) helps you gauge when a currency loses strength and when a reversal is coming.

More detailed below.

Currency Strength Trading Strategy

Our currency strength trading strategies can make you a better trader.

It can be used as a standalone trading strategy or simply as a confirmation tool.

Now the question is…

How to identify strong and weak currencies in forex trading?

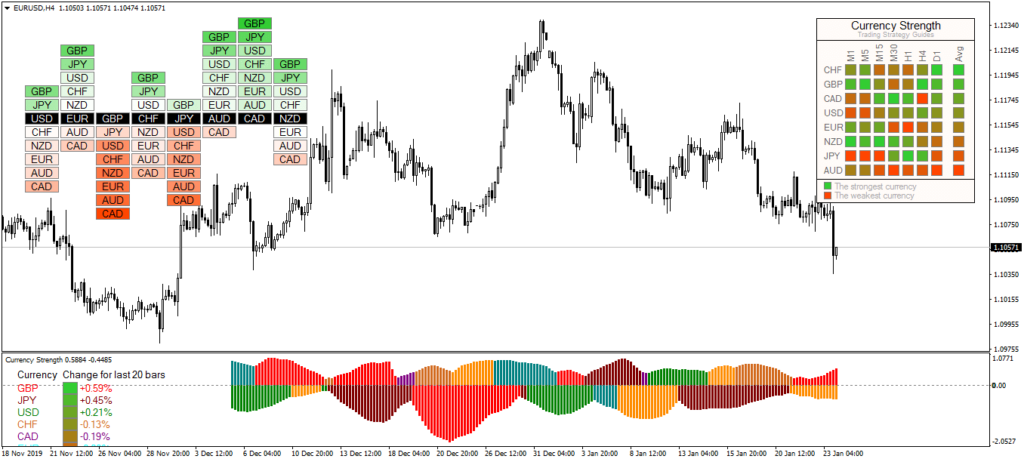

We want to use the complex mathematical formula behind the currency strength indicator pack to measure the strength and weakness of a currency.

We use currency strength indicators to match the strongest and weakest currencies, so we can capitalize on the momentum of both sides.

For example, according to the current currency heat map indicator, GBP is the strongest currency and CAD is the weakest.

See the currency heat map below.

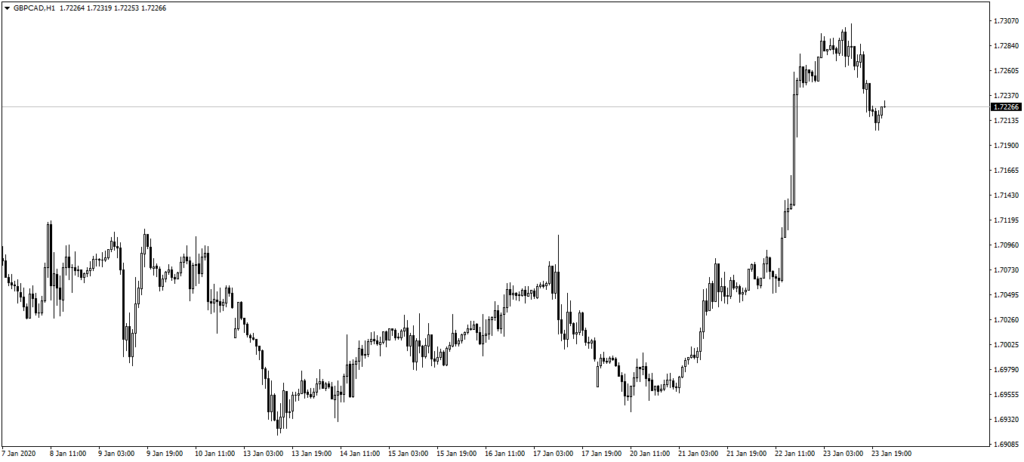

If you pair the two currencies, you end up with a GBP/CAD pair.

See the forex chart below:

Being able to buy GBP/CAD is a big mistake.

why?

To be honest, buying here is like chasing the market after a big rally.

As you can see, currency strength indicators are meaningless if you don’t know how to use them properly.

Well, that’s what we’re going to reveal next, so stay tuned…

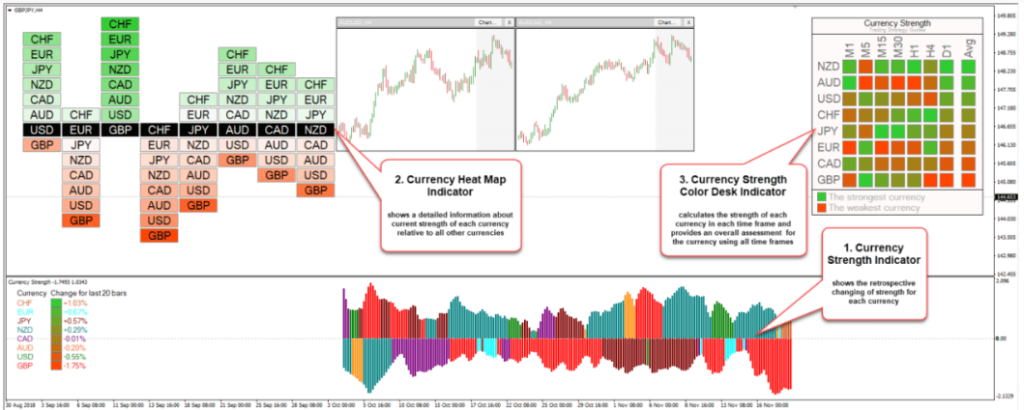

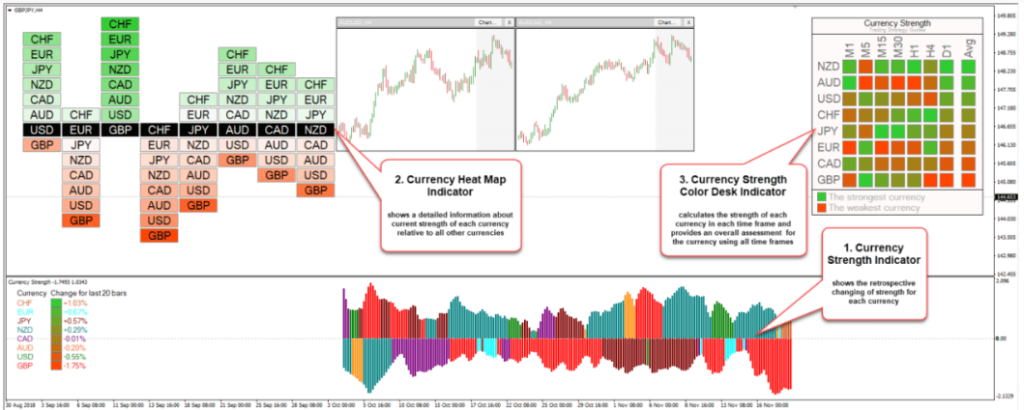

To learn more about our proprietary currency strength indicator, take a quick look at its 3 key features:

- Currency Strength Indicator – This indicator is placed in a separate panel and shows a strength diagram for each currency in the current time frame. Shows historical changes in currency strength and current strength.

- Currency heat map indicator – very useful for checking market conditions around the world. It shows all possible relationships between pairs, sorted and colored according to their strengths or weaknesses.

- Currency Strength Color Desk – See the entire market at a glance. Compared to the other 2 indicators, this indicator works with all TFs and paints the calls in different colors to show summarized resulting information. We also use all time periods for evaluation to provide a final recommendation for each currency.

Now what’s next?

Obviously, we will show you how to combine all 3 main features and trade like a pro.

At this point, we are going to show you three trading strategies you can use to properly read the pros and cons of major currencies.

Note * Our proprietary indicators can be used for a wide variety of purposes.

Strategy #1: Using Currency Strength Indicators

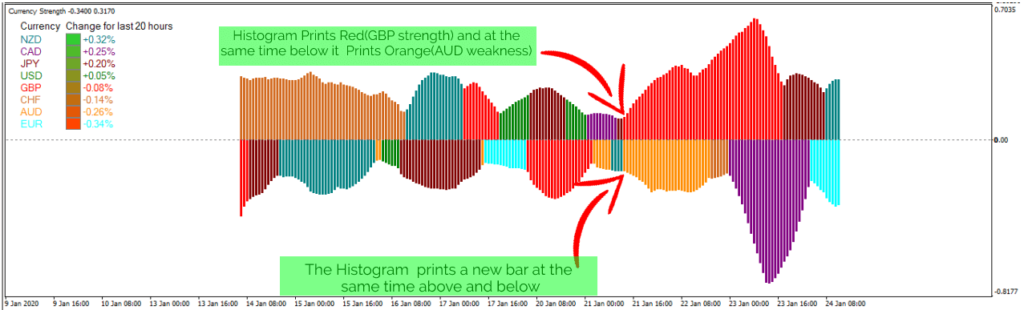

We start with the currency strength diagram below the chart.

Here’s how to use the diagram.

Typically, you want the call strength to print new histogram bars in different colors within up to 2-3 histogram bars above and below the zero line at the same time.

There is no better way to describe this than by plotting it directly on a currency strength histogram.

See below:

Note * Each color is associated with a specific currency.

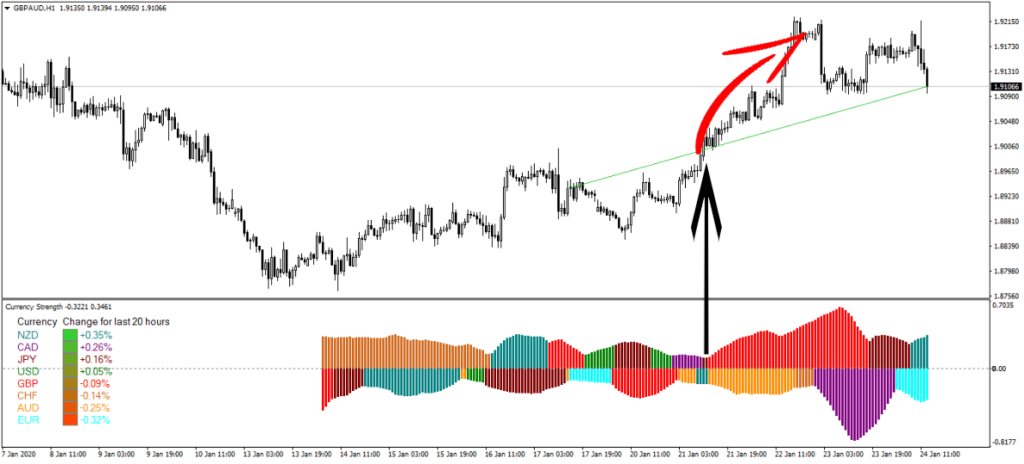

The technical figures on the GBP/AUD chart confirmed that buying the currency pair is a good deal.

See chart below.

According to our proprietary currency strength current measurement, the following can be distinguished:

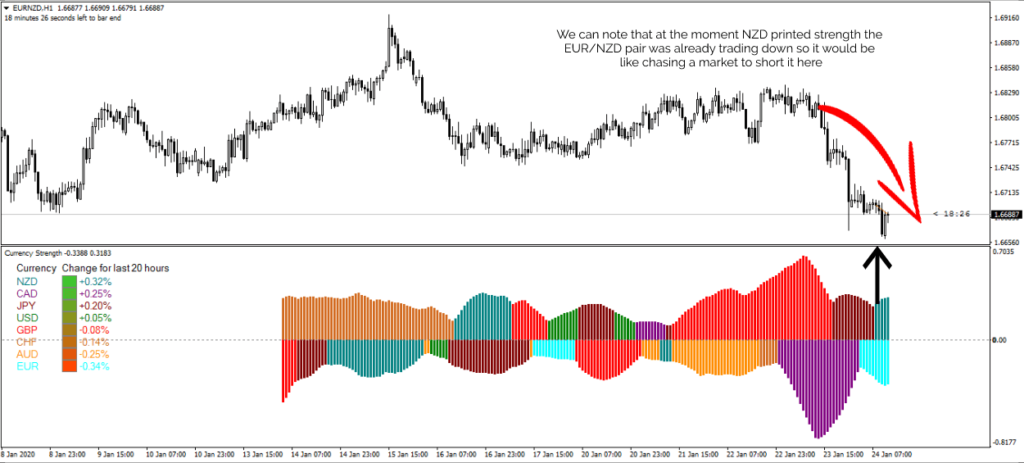

- NZD (turquoise) is the strongest currency

- And EUR (light blue) is the weakest currency

However, there is a problem. We can see that it breaks the first trading rule.

The strength histogram does not print NZD strength and EUR weakness simultaneously or at least within the first 3 bar graph bars. NZD strength comes only after EUR has already printed about 6 histogram bars.

There are lessons to be learned here.

A currency strength indicator can only help you if you know how to read it correctly.

next…

Strategy #2: How to Trade with Currency Strength Heatmaps

We want to trade to scalp short-term momentum using a currency strength heat map.

A heat map can be used as a good barometer for gauging a currency’s short-term strengths and weaknesses.

And here’s how we use it…

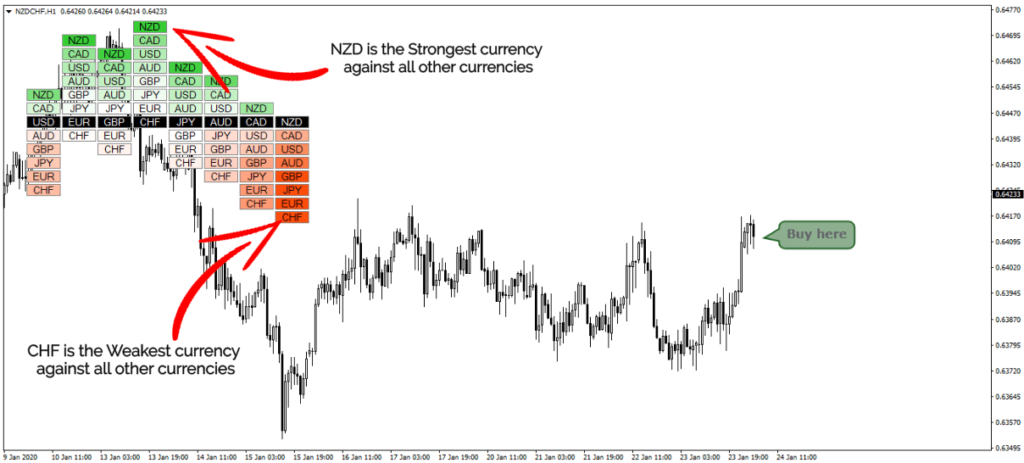

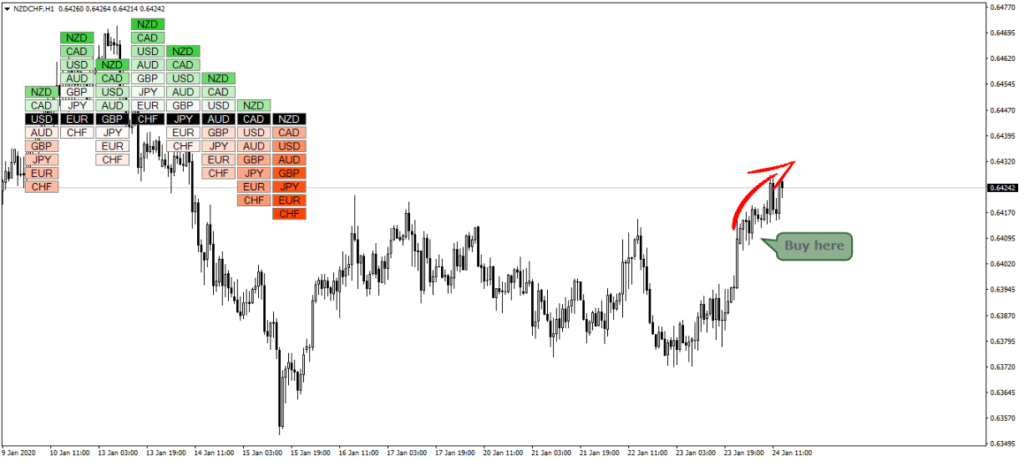

Current heat map figures show that NZD is the strongest against all other major currencies, while CHF is the weakest.

As a result, you can pair both currencies and trade against NZD/CHF, which has potential buying opportunities.

After a few hours of trading activity, here are the results of those trades:

The strongest currencies continued to strengthen and the weakest currencies continued to weaken.

next…

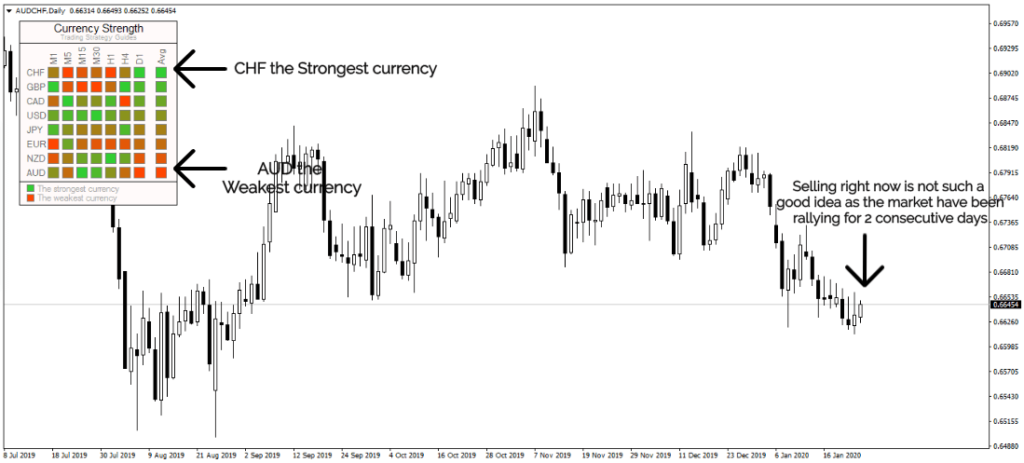

Strategy #3: How to Trade with the Currency Strength Matrix

The currency strength matrix is based on the correlation between price action and currencies.

Compared to the other two strategies, the currency matrix provides detailed information about the strength of currencies across different timeframes.

The matrix also represents the average intensity over all time frames.

This gives us a brief overview of overall currency strengths and weaknesses.

The forex chart below shows what the currency strength matrix looks like right now.

A closer look reveals a different story at different times of the day, even though CHF is the strongest currency.

Here’s how it works.

A good reading of currency strength and weakness is when all time frames converge and point in the same direction.

Let me explain…

Looking back at the currency matrix, we can see that USD has been showing consistently throughout all time periods.

Green shading on all USD timeframes indicates actual strength. At the same time, EUR displays different shades of red across all timeframes. This means it is the weakest currency.

Here’s how it looks on the chart.

See below:

Final Words – Best Currency Strength Meter

Currency strength indicators can be very appealing especially to novice traders who are still in the process of learning how to trade. This is the best currency strength meter that uses 56 charts simultaneously on proprietary charts to get accurate currency strength readings.

Here are the secrets every forex trader should know. Instead of trading currency pairs, trade individual currencies as a whole. To do this, you need to determine the strongest and weakest currencies to trade. And here comes our exclusive Currency Strength Indicator Pack.

Get your hands on the Currency Strength Indicator to learn how to find the strongest and weakest currencies to trade.

Thanks for reading!