Ladder options trading is somewhat similar to boundary (or range) options. While boundary options offer two limits – one upper limit and one lower ladder option limit, there are usually five price limits (the exact number will depend on the broker and asset).

These limits are not always distributed symmetrically across current price levels. For example, all 5 limits could be below the current price level, or 3 limits could be above the current price level and 2 could be lower. Limits are usually traded both up and down – although not always.

Every price cap has two options that can be traded. ‘Above’ or ‘Below’ Each limit has a different payout percentage for the ‘Above’ and ‘Below’ options. The percentage depends on the likelihood that the prediction will be completed ‘to the money’ (status correct). If the prediction is likely to be true, the payout percentage is small and vice versa. This is how ladder options can generate payouts that can reach 1000% or more, and higher payouts reflect a lower chance of finishing out of the money.

The limits or ‘rungs’ are defined by the broker and cannot be changed. However, expiration times are subject to change. As the expiry time is modified, the limit and its payability change.

Ladder option – yes

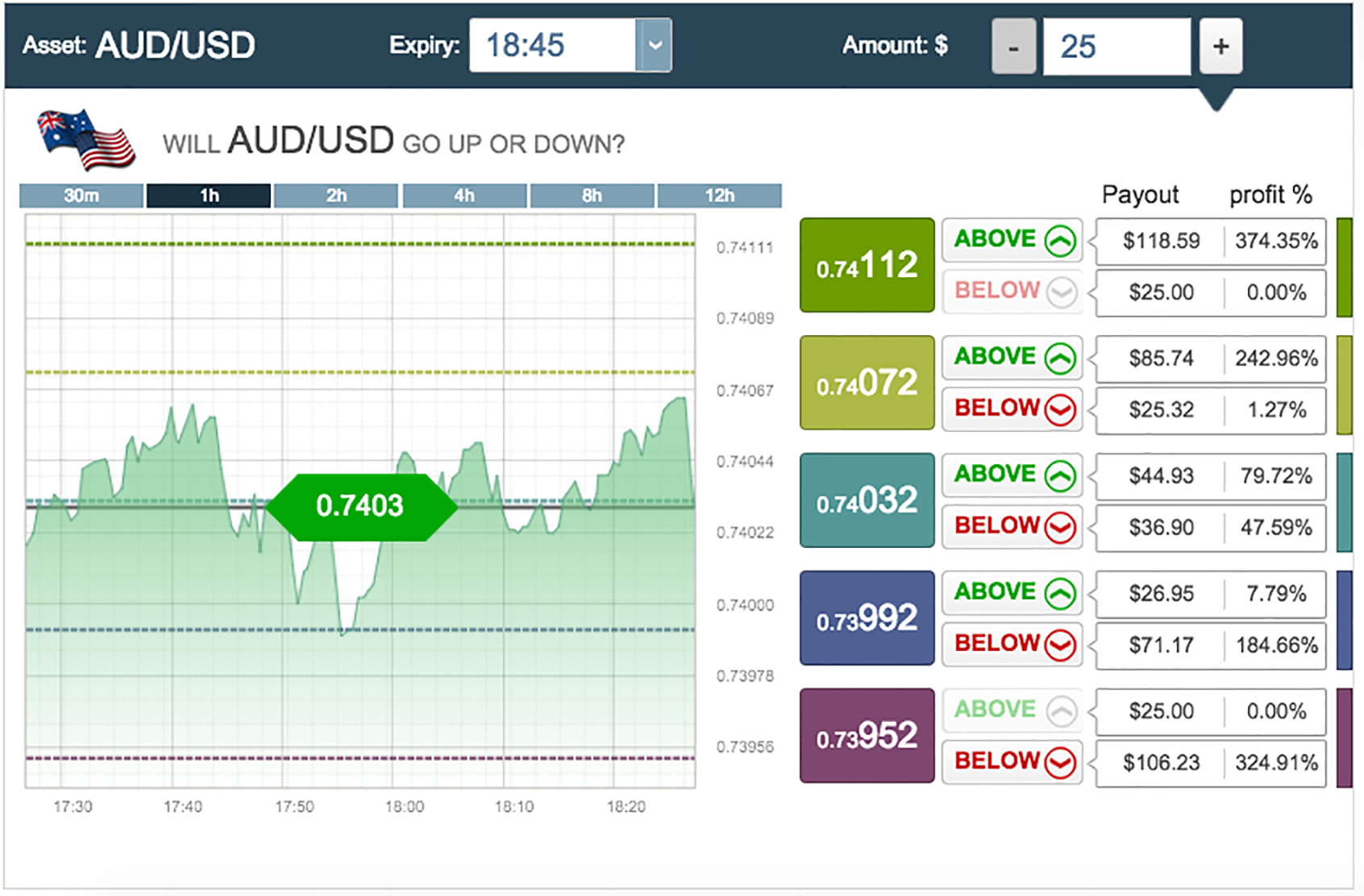

See the screenshot below. On the right are various values. Each has its own ‘Above’ and ‘Below’ payout figures.

The payout amount is based on the $25 entered in the Amount field. Each ‘rung’ of the ladder is a different value and requires a specific price movement in the real asset price. The larger the price movement, the larger the payout. In the image, AUD/USD is trading at 0.7403. If you expect the price to surge, you can pick “above” at the 0.74112 level and get a whopping 374% return if correct.

A mid-level option pays 47% for ‘below’ and 79% for ‘above’. At the top and at the bottom, only one option is available: above at the peak and at the bottom. The broker thinks it’s likely they’ve seen different results, and they won’t trade at all.

Why Trade Ladder Options?

One of the attractions of binary options is their simplicity. Some traders may argue that ladder options take away from ‘ease of use’ and thus introduce a layer of complexity that should be avoided. That view is missing some key points.

- Ladder options offer larger payouts compared to other trade types

- Ladders provide options in volatile markets

- Ladders offer higher profitability than standard binary options when traders expect large price movements

- Ladders are no more complicated than traditional options by default.

- Ladders allow for high-frequency, low-risk/payout trading.

The last point is worth expanding on. In the screenshot above, the price level of 0.73992 can be traded over 7.79%. While not a huge payout, it is a quick, low-risk path to returns if traders are confident that an upside to this resistance level is guaranteed.

Trade the winning ladder

Trading ladder options require market awareness and some research. As with other trading styles, these factors are very important for ladder trading. You will only get the biggest payout if you can get a low-probability forecast. Extreme predictions require steep ascent/descent to be accurate. This can happen when a significant event related to an asset occurs. For example, interest rate announcements or profit warnings from major companies can cause sharp price corrections. Traders need to be aware of all events to win high payout trades.

Similarly, high frequency trades for low payouts rely on reduced volatility. A high strike rate means you should make fewer mistakes and stay away.

Ladder binary options provide another path for traders to make a profit, but must be fully understood. They can be used as hedging tools or specialized on their own. Binary options brokers never offer ladders. Prices and payouts must be constantly updated. So choose your potential brokers wisely, and if the ladder looks like an exciting path to profits, choose the right one.

Ladder option strategy

Ladder options offer the highest payouts of all binary options types. Trading effectively requires a good strategy. This article introduces you to three great strategies for ladder options.

The three strategies you will learn in this article are:

- Trading ladder based on ATR and moving average crossovers

- Using ATR and ADX for negative predictions

- Trading Resistance and Support Levels with Ladder Options

With these three strategies, you get to know three very different approaches to ladder options. By understanding the spectrum of possibilities, you learn to tailor our strategies according to your preferences and create the ideal strategy.

Strategy 1: Ladder Trading with ATR and Moving Average

When trading ladder options, you face two challenges.

- Predict the direction of the market

- Predict the range of the market.

It’s difficult to solve both problems with the same tool. That’s why this strategy uses two tools, one for each prediction.

Predicting the direction of the market with a moving average

Moving average crossovers are perfect for predicting market direction. A moving average calculates the average price of the last period and repeats this process for all periods in the chart. Then draw the result directly on the chart to create a line.

This line moves slower than the market.

- When the market is in an uptrend, the moving average is based on a period below the current market price. The moving average will also be higher than the market.

- When the market is in a downtrend, the moving average is based on a period above the current market price. The moving average will also be higher than the market.

When the market changes direction, it moves from one side of the moving average to the other, so it must cross the moving average. As a result, a market’s moving average crossover is an important event that indicates a change in market direction.

This is the perfect event for our strategy.

- Invest in Ladder Options that predict a price increase when the market is above a moving average.

- Invest in ladder options that predict price declines when markets fall below moving averages.

Now that the direction has been determined, we only need to forecast the potential scope of the market. This is why ATR is needed.

Predict market coverage with ATR

ATR (Average True Range) is an indicator of volatility. It measures the actual average distance the market has moved over the past period.

Use examples of basic text for ladder options. Suppose you are trading the AUD to JPY currency pair at the current price of 91.226. Ladder options have an expiration of 1 hour. On the 10-minute chart, the ATR has a value of 0.1, indicating that the asset has moved by an average of 0.05 over the last period. You can use this value to predict how far the market can move and what target price you should use for ladder options.

Let’s say an asset has broken above its moving average and you want to invest in rising prices. Brokers offer the following target prices for ladder options:

| name | price limit | Payout | Less than payout |

| Price Level 1 | 91.200 | 54.23 % | 92.62 % |

| Price Level 2 | 91.245 | 90.89 % | 55.44 % |

| Price Level 3 | 91.291 | 158.29 % | 31.47 % |

| Price Level 4 | 91.337 | 280.34 % | 11.32 % |

| Price level 5 | 91.382 | 530.43 % | 1.00 % |

| Price level 6 | 91.425 | 1011.23 % | 0.00 % |

What is the best target price for a ladder option? Let’s go through them one by one.

- Price level 1 (91.2) is below the current market price (91.226). Since we are predicting an upward movement, this is a very safe prediction. However, it also caps the payout at 54.23%. This is not profitable enough.

- Price level 2 (91.245) is above the current market price (91.226), but not significantly. In a market moving at a rate of 0.05 per period, it would take the market less than one period to reach this price. Since we are projecting an upward move, this is still a very safe prediction. It will get you a payout of 90.89% which is better than price level 1, but still not much.

- Price level 3 (91.291) is approximately 1.5 times the ATR value (0.05) at the current market price (91.226). Remember this is interesting: To Win Your Ladder Options; The market should break above the target price an hour from now. There are 6 timeframes until this happens (60 min expiration, 10 min chart). Since not all periods of the move go in the same direction, it is unlikely that the market will reach the target price 6x further than the value of the ATR. However, with a payout of 158.29%, the target price of 1.5x the ATR value seems like a relatively safe bet for good profits.

- Price level 4 (91.337) is twice the ATR value over the current market price (91.226). In an uptrend, the market is still likely to reach this target price. This bet is slightly riskier than price level 3, but gets you almost double the payout – 280.34%. Most traders prefer this investment.

- Price level 5 (91.382) is more than 3x the ATR value above the current market price (91.226). This is a risky prediction. The market should move in the right direction for 4 out of 5 time periods. If you’re right, you get an insane payoff of 530.43%. This means that winning 1/4 of your trades will still benefit you. Risk managers prefer this target price.

- Price level 6 (91.425) is more than 4x the ATR value above the current market price (91.226). This prediction is too risky. It will pay off 1011.23%, but it is highly unlikely that the market will reach this target. You should be moving in the right direction for an hour. Stay away from this prediction.

With these assessments, ATR helped differentiate target prices.

- Use price level 3 to play it safe.

- If you want to take the risk, use price level 5.

- Traders looking for a good mix of risk and potential take price level 4.

Trade this strategy for a while and monitor your success. You will find that you prefer a specific percentage of your target price distance and ATR. In this example, the ATR has a value of 0.05 and there are 6 periods until the option expires. If all timeframes point in the same direction, the market moves by about 0.3. Some traders prefer a target price that is about half this distance from the current open price. They will invest at price level 5. Other traders may invest at price level 3, preferring a one-third price target at this distance.

Once you find your perfect ratio, you can quickly and easily use ATR to select the right price level for your ladder option.

Strategy 2: Using ATR and ADX

In the previous example, ATR was used to give a positive endorsement. Predicted price levels that could reach the current move. With this strategy, we want to go in the opposite direction. You are trying to predict what level the current price will reach.

You can achieve this goal without moving averages. No signal needed. We just want to know if the price level is currently out of reach. Instead, you need a little more precision, so you need the Average Directional Movement Index (ADX).

Use the same example as before. AUD at the current price of 91.226 vs. You are looking at the 10 minute chart of the JPY currency pair. Brokers offer the following target prices for ladder options with 60 minute expiry:

| name | price limit | proceeds from sale | under payout |

| price level 1 | 91.200 | 54.23 % | 92.62 % |

| price level 2 | 91.245 | 90.89 % | 55.44 % |

| price level 3 | 91.291 | 158.29 % | 31.47 % |

| price level 4 | 91.337 | 280.34 % | 11.32 % |

| price level 5 | 91.382 | 530.43 % | 1.00 % |

| price level 6 | 91.425 | 1011.23 % | 0.00 % |

Since we are currently making negative forecasts, we should focus on the payouts below. The important question is at what price level can the market reach and what price is worth investing in. Let’s take a look at each price level.

- Price level 1 (91.200) is below the current market price (91.226). This is a bad investment. Upon receiving a payout like this, the broker expects the market to rise. Otherwise, we will not offer high payouts for the predictions below. Therefore, it makes no sense to invest in falling prices.

- Price level 2 (91.245) is above the current market price (91.226), but not significantly. Predicting that the market will trade below this price level only makes sense when the reading of the ATR is surprisingly low (e.g. 01). Anything else, and this prediction is too risky. With a payout of 55.44% you need to win over 65% of your trades, so this price level is not worth the risk.

- Price level 3 (91.291) is far from the current market price (91.226), but still very close. This price level would be a viable investment if the value of the ATR is very low (e.g. 02). The 31.47% payout is interesting for a negative bet, but you should know that you are making a safe bet here.

- Price level 4 (91.337) makes it safe to predict in most market environments. Even if the ATR reads 0.3, the market is unlikely to trade above this price level when the option expires. Some traders may trade this value with an ATR of 0.4, but the relatively low 11.32% payout calls for a safe bet to win high percentage trades.

- Price levels 5 and 6 (91.382 and 91.425) offer payouts of 1% and 0%, respectively. It makes no sense to trade such payouts.

The point is, it’s hard to choose the perfect price level with ATR alone. In most market environments, you can safely trade 5-6 price levels, but low payouts make these price levels less profitable. All other price levels require a mix of risk and potential. You need other tools to know how to blend these elements together. This tool is the Average Directional Movement Index (ADX).

ADX rates the directional strength of the market on a scale of 0 to 100. Most traders interpret readings below 20 as lacking direction and readings above 40 as strong direction. This value will help you estimate the target price you should use for ladder options.

- Watch out if ADX reads above 40. When the market has such a strong direction, you have to plan for the worst. Assume that all periods before the option expires point in the same direction and outside of this reach you choose the price level with the highest payout. In this example, there are 6 periods until the option expires. For example, price level 3 (91.291) is 0.65 off the current market price (91.226). The price level to select if the ATR is less than 0.1.

- Read if ADX is less than 20. When the market lacks direction, it’s time for high payouts. Risk managers can only invest in price levels as long as they read the ATR at the current market price, and traders with moderate risk tolerance should use a target price twice the ATR. In this example, this means that when the ATR is 0.05, risk takers can invest at price level 2, which is a relatively high value. Everyone else has to decide between price levels 3 and 4. A low reading of the ATR allows any trader to choose price level 2.

- If ADX reads between 20 and 40, take medium risk. If the market is moderately directional, your risk should also be moderate. Choose an approach between the two examples above. For example, if the ATR reads 0.02, most traders will invest at price level 3. That’s a solid prediction, but you still get a 31.47% payout.

You can also exclude one or both of these market environments from your strategy. Risk averse traders can only invest in this strategy when ADX is below 20.

Strategy 3: Trade Resistance/Support via Ladder Options

This strategy is ideal for traders who prefer visual cues to mathematical calculations. Resistance and support levels are important price levels that an asset price cannot break.

For example, suppose the asset traded around £99. It tested the £100 barrier a few times but always failed to get past it. In this case, the £100 barrier becomes resistance. Similarly, if an asset trades around £101 but does not break below £100, the £100 barrier becomes a support level.

In either case, it appears to prevent the asset from breaking through the £100 wall. You’ll never know what exactly stops the market, but this doesn’t matter. Obviously, traders are no longer looking to buy £100 of an asset (in case of resistance) or sell an asset (in case of support).

This is all you need to trade ladder options. When the market approaches the resistance line, wait for the first target price with a reasonable payout to be reached. Your definition of a reasonable payout is up to you. Most traders will want at least a 30%, and even better a 50% payout before investing.

If the market is closer to resistance/support, you can invest in the same resistance/support with a higher payout. Most traders use this opportunity to make more money with the same predictions.

If the market breaks through resistance or support, all options are lost. You can make up for lost money though. When the market breaks resistance/support, the market has broken free and will move strongly. This is an ideal environment to invest in ladder options that predict strong moves. With a 200% payout, you can easily beat Ladder Option to cover your losses.

Ladder – Summary

Ladder options allow for a variety of potential strategies. Depending on your risk tolerance and whether you prefer positive or negative predictions, you should tailor your strategy according to the three strategies we have presented. The possibilities are endless, but now you know where to start.