The Best Candlestick PDF Guide will teach you how to read candlestick charts and what each candle tells you. Candlestick trading is the most common and easiest to understand form of trading. Candlestick Pattern Strategy Reveals to you the secrets of how banks trade the forex market in this guide.

If this is your first time on our website, the Trading Strategy Guides team welcomes you. Hit the subscribe button to get your weekly free trading strategies directly into your email box.

When you first start your trading journey, you will be bombarded left and right with new concepts. Assimilating it all can be difficult and confusing. This trading tutorial shows you how to read candlestick charts for beginners.

We will explain candlesticks in a way you can remember. If you are an advanced trader, see this Candlestick PDF guide. We will be sharing a powerful candlestick pattern strategy with you.

Stay tuned as we show you some of the best candlestick patterns that only institutional traders know about.

Let’s start with the basics of candlestick trading and how to properly read candlestick charts.

See below:

Understanding Candlestick Charts for Beginners

Remove everything on the chart and you are left with a simple candlestick chart. Shown in the chart below is the underlying price data, also known as a naked price action chart in Forex jargon.

Note #1: Unlike the Renko charts covered in our previous chart trading guides, candlestick charts contain a time component.

As a trader, the most important piece of information you need is current and historical prices. The candlestick price tells you exactly what the price will be at any given time. Candlestick price charts also provide a unique insight into market sentiment.

A candlestick price chart consists of many candles of different shapes forming different candlestick patterns.

There are three types of candelabra candles.

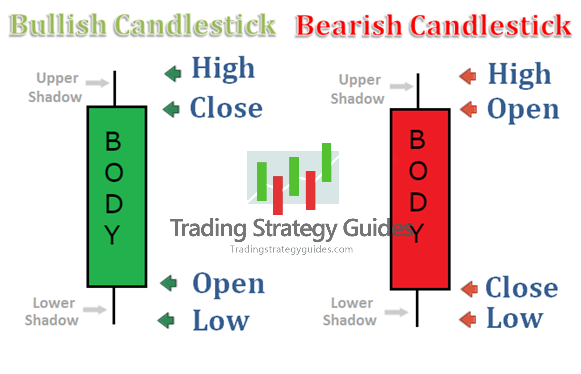

- Bullish Candlestick – These are green candles and indicate that the price has increased over the selected time period. That is, the closing price is higher than the closing price.

- Bear candlestick – This is a red candle and indicates that the price has declined over the selected period. That is, the closing price is lower than the closing price.

- Neutral Candlestick – This is a candle without a body and the opening price is equal to the closing price.

In addition to opening and closing prices, candlestick charts provide information about the highest and lowest prices over the selected time period.

The bars above and below the body are called shadows. In forex jargon, they are also referred to as ‘wicks’ or ‘tails’.

In technical analysis, Japanese candlesticks can indicate different types of price formations that underlie many candlestick pattern strategies. To explore the most popular chart patterns, check out our step-by-step trading guide here: Chart Pattern Trading Strategies Step-by-Step Guide.

For now, we will focus on the best candlestick patterns used by many banks against retail traders.

Candlestick Pattern Strategy

To get the most out of what candlesticks show you, let’s take a look at some of the best candlestick patterns available so far. I will show you the explained candlestick pattern with an example. Understanding the psychology of what candlesticks show can make your life as a trader a lot easier.

Not only that, but you can gain insight into the war between buyers and sellers. You can also start trading using chart patterns.

This Best Candlestick PDF Guide Reveals Secret Candlestick Patterns Used by Bankers. This forex candlestick pattern we are talking about is the ORB Nr4 pattern developed by hedge fund manager Toby Crabel.

Toby Crable is probably one of the lesser known profitable traders. Toby Crabel was described by Financial Time in 2005 as “the most recognizable trader in terms of contrasting tendencies,” yet he remains an unknown name in the retail world.

The reason we mention the Toby Crabel work is because he is the father of the ORB pattern, namely the Opening Range Breakout pattern. The ORB pattern is considered the most powerful trading tool in the last 25 years.

This powerful trading skill helped legendary guru trader Larry Williams turn $10,000 into $1 million in less than a year.

Step 1 How to identify ORB Nr4

An ORB pattern is defined as a trade taken at a fixed value in an opening range.

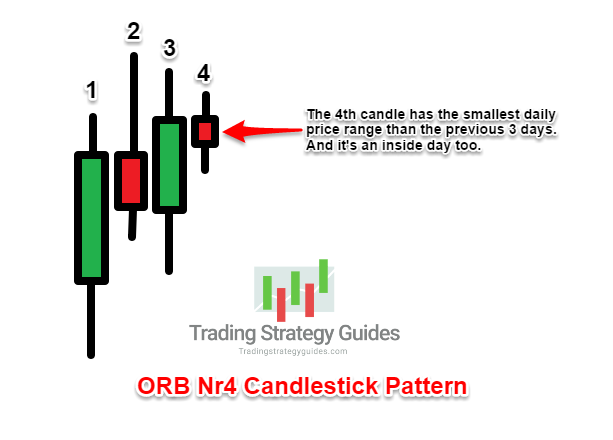

An opening range breakout trade is more effective if it is taken after an inside date where the daily range is less than the previous 3 days. This is the abbreviation for Nr4. There are 3 candles and another candle with a narrower daily range than the previous 3 days.

Note #2: The fourth day does not necessarily have to be tomorrow, the daily range must be less than the previous 3 days. However, it tends to have a high success rate within a few days.

The actual ORB Nr4 pattern on the Forex candlestick chart is:

The ORB Nr4 pattern might be one of the best candlestick patterns for day trading. Simply apply the same rules outlined in this guide to your favorite daily charts.

What if we could tell you 40% of the time, the first trading hour the highs and lows of the day? Our candlestick pattern strategies incorporate this price action so you can better manage your risk and set your targets.

Basically, you can become a competent trader.

As with all trading strategies, we first give you trading rules with real live trading examples using the best candlestick patterns mentioned in this PDF guide.

Step 2: Identify the best candlestick pattern and mark the high and low of the 4th candle

When searching for ORB Nr4 candlestick chart patterns, keep two things in mind:

- The daily range of the 4th candle should be narrower and smaller than the previous 3 candles.

- The fourth candle price range should also be within candle number 3.

The ORB Nr4 pattern on the chart above is a bullish candlestick pattern because it triggers a bullish move.

A narrow daily trading range suggests a contraction. And contraction always leads to expansion. This is kind of a general rule because markets move from contraction periods to expansion periods.

That’s why this ORB Nr4 candlestick pattern is so powerful.

Step #3: Switch to the 1 hour TF, buy when we break the high, sell when we break the low of the Nr4 candle

Our trades are made the day after the Nr4 pattern appears. To clearly see short-term price action, we need to shift our focus to hourly timeframes.

Note #3: Buy or sell only if a breakout occurs in the first 5 hours of a new trading day.

We use our Opening Range Breakout technique to time the market and initiate effective trades.

ORB – Trades based on the Nr4 candlestick chart pattern show immediate profits.

Now, if your trades don’t show you profits right away, your trades become even more vulnerable. Generally, if the trade is not green after the first trading hour, the market can safely close the trade.

Of course, you can only do so if you haven’t had any stop losses in the meantime.

Now, let me explain where to place a protection stop loss and where to exit a profitable trade.

See below:

Step 4: Lower SL below NR4 days. Profit using the trailing SL below each 1 hour second.

For buy trades, hide your stop loss below the Nr4 day low. ORB – The Nr4 pattern precedes strong trend-day activity, so stop losses are rare.

Our profit strategy is very easy and has been slightly modified from the original strategy highlighted in the book “Day Trading with Short Term Price Patterns and Open Range Breakouts” by Toby Crabel.

Conclusion – The Best Candlestick Patterns

The Best Candlestick PDF Guide is the result of a series of studies that lead us to find tradable market trends. Having some rules that can be defined based on candlestick patterns can actually help traders.

If a framework is developed around these chart patterns, some of the best candlestick patterns will become more predictable. As a trader, you must apply these trading concepts within your understanding of the market. Read our Shooting Star Candle Guide!

Combining the two allows you to develop a candlestick pattern strategy.

Thanks for reading!

Please leave your comments below. We read and respond to everything.

Also, if you were satisfied with this strategy, please give it a 5 star!