Weekly trading of stocks is an exciting market for investors. Equity is essentially the raising of capital by a company through the issuance and subscription of shares. Stocks and stocks are thought of as long-term investments, but stock trading can still provide opportunities for day traders with the right strategy. Being able to lower prices or trade company news and events means that short-term trading is still profitable.

This page will tell you which stocks to target for short positions to buy or sell. It also provides valuable rules for daily trading stocks to follow. You will learn how to choose and when to trade stocks, and intelligent trading strategies that can help you make a profit.

Check out the best daily trading volume by trading volume and volatility, the main indicators for daily trading in any market.

Why day trade stocks?

Stock trading today is dynamic and vibrant. It is also easy to buy and sell. The world of technology makes it easy to access the market. The liquidity of the market means that it is absolutely possible to estimate prices rising or falling in the short term.

Also, stocks are relatively simple to understand and follow.

Trading in cryptocurrencies or forex in the complicated world of technology can leave you scratching your head all day, but it makes Google and Facebook’s victories and potential pitfalls much easier to catch.

This hopes that identifying stocks suitable for online trading is not as difficult as in other markets.

Weekly trading vs stock trading

Before you start day trading, you should consider if it suits your situation.

For example, daily trading usually requires at least two hours per day. One of these times should start early in the morning when the market is often open. However, investing in long-term stocks usually takes less time. This is because of increased flexibility when conducting research and analysis.

Additionally, returns on stock trading throughout the day may exceed returns on long-term investments. This is partly due to leverage. This allows you to borrow money to take advantage of opportunities (margin trading). However, as the potential for profit increases, so does the risk of loss. Besides, you will also spend more time on daily trading for those returns.

One might argue that short term trading is harder unless you focus solely on trading throughout the day. This is because it is much easier to interpret stock quotes and spot differences in the long run. You also don’t have to rush into making decisions. However, it also means that daily trading can provide a more exciting experience.

One of the main advantages of spread betting over CFDs and traditional stock investments is that you can go “short”. There is no easy way to make money in a falling market using traditional methods. Day traders, however, can trade whether they are thinking of rising or falling in value.

Overall, there is no right answer for day trading versus long-term stocks. Spotting trends and growth stocks can be simpler when investing for the long term. However, intraday trading can bring greater returns.

Trading platforms

The trading platform you use to trade online is a key decision. Need advanced charts? Can you automate your trading strategy? Are you able to trade in the right markets like ETFs or Forex?

There are important decisions to make when choosing a trading platform or stock broker, and most of them depend on you and your trading style. Learn more about choosing a stock broker here.

How to trade stocks

Best day trading stocks to buy offer opportunities through price fluctuations and the abundance of stocks being traded. This allows you to quickly start and close those opportunities. These factors are called volatility and volume. You’ve heard that I once traded volatile stocks and volumes. But what does this actually mean? ‘

Volume

Trading volume relates to the total number of shares traded on a security or market during a particular period of time. Each trade contributes to the total volume. If 20 trades were made that day, the volume for that day is 20.

How Do Day Traders Pick Stocks? Volume serves as an indicator that gives weight to market movements. If you have sharp spikes, the intensity of that workout depends on how much you do over that period.

Simply put, the higher the volume, the more important the move.

Enable volume

If you have significant capital, you will need a significant amount of stock. While your brokerage account will likely provide a list of the top 20-25 stocks, one of the best daily trade stock tips is to broaden your search a bit.

That way you can find opportunities that aren’t on every other trader’s radar. Look for stocks that have surged in volume. If you find that stocks typically trade 2.5 million shares daily, but 6 million shares were traded by 10:00 AM, it’s worth looking into. If your platform of choice doesn’t offer a rigorous screener for high-volume stocks, utilize the following alternatives.

- Bar chart

- Distance

- Yahoo Finance abnormal volume

Volatility

Volatility relates to risk/predictability in the magnitude of change in the value of a security. High volatility can cause values to be spread over a wide range of values. This means that the price of a security can change drastically within a short period of time, making it ideal for fast-moving day traders.

Even with low volatility, the security’s value remains relatively stable, reducing your chances of making a quick profit.

beta

One way to establish the volatility of a particular stock is to use a beta. Beta predicts the total volatility of a security’s returns relative to the returns of an appropriate benchmark (usually the S&P 500).

A stock with a beta of 1.2 has moved about 120% for every 100% in the benchmark, depending on the price level. Conversely, a stock with a beta of 0.8 has moved 80% for every 100% in the comparative index.

How to Find Stocks in Daily Trading

So, finding the best stocks for daily trading is a matter of searching for assets with large or recent spikes in volume and a beta higher than 1.0 (the higher the better). Stocks that lack these things will be very difficult to trade successfully.

How you use these factors will affect your potential profits and will depend on your day trading strategy. It is impossible to profit from a price that does not change. Buyers and sellers cause price fluctuations, and a shortage of quantity indicates a shortage of buyers and sellers.

Defensive volatility stocks generally have lower volatility if you fly into safer investments due to market panic, but they can come in sharp demand, so volume and volatility don’t always come from obvious places.

Best day trading stocks 2020

Now you have an idea of what to look for in stock and where to find it. Below are some of our most popular day trading stock picks. The most popular exchange-traded funds (ETFs) are S & P 500 (SPY). With regular trading volume in excess of 100 million shares per day, both small and large positions can be traded depending on volatility.

With trading volume being such a key factor in finding the best stocks, it’s no surprise that the US market is where you’ll find better stock picks.

US stocks

| Stock | symbol | strength |

|---|---|---|

| Apple | APPL | Volume |

| FB | Volume + Volatility | |

| Microsoft | MSFT | Volume |

| Pod | F | Volume |

| Tesla | TSLA | Volatile |

| Google (Alphabet) | GOOG | Volume + Volatility |

| S and P | US 500 | Volume + Volatility |

The UK’s highest-traded stocks offer the best trading opportunities

UK stocks

| Stock | symbol | strength |

|---|---|---|

| Barclay | BARC | Volume + Volatility |

| Lloyd Bank | Roy | Volume + Volatility |

| Vodafone | VOD | Volume |

| BP | BP | Volume |

The UK often sees high beta (volatility) across sectors. Homebuilders, for example, have all seen increased beta numbers in recent years due to Brexit fears. Mining companies and related services are another sector that may see greater price fluctuations than the broader FTSE market.

Alternatives

However, in addition to the popular options above, there are many other popular exchanges to consider including the Toronto Stock Exchange, Karachi Stock Exchange, Philippine Stock Exchange, Tokyo Stock Exchange and London Stock Exchange.

You can also start trading Australian stocks, Chinese stocks, Japanese stocks, Canadian stocks, Indian stocks, European stocks and more.

As such, there are numerous daily traded stock indices and classes for you to explore. You can also find everything from cheap foreign stocks to expensive picks. All of the strategies and tips below can be utilized no matter where you choose to spend your stock trading days.

Penny stocks

“Which penny stocks are best for day trading? ” is a popular question we face. However, reading the above, that volume and volatility could be the key to successful daily trading. You will understand that penny stocks are not the best choice for day traders. It lacks volatility in the short term because of the low volume (buys and sells).

Volatility in penny stocks is often misleading as small price changes are large in percentage terms. But in fact most penny stocks end exactly the day they started with no movement. It is impossible to profit from it.

Keep an eye on the volume of these stocks as sharp spikes can cause price fluctuations. However, low liquidity and trading volume mean that penny stocks are not a good option for day trading.

Utilizing leverage is one way to make trading stocks more affordable.

Stocks to trade today

Now we know that trading volume and volatility are very important. How does this help you find the best stocks to trade today? The ‘Risers and Fallers’ table is a great shortcut for finding active markets. It means something is happening and creates opportunities.

Most brokers, whether called ‘Risers/Fallers’ or ‘Most Traded Shares’, are required to tell you which opportunities are best for stock trading.

Stock trading days

Timing is everything in the day trading game. You can struggle with day trading stocks for a living if you don’t know the best time to trade. With that in mind:

- Start early – If you want to start trading after being lied to generously, don’t be surprised when you try to take a profit. As trading volume increases, the market is getting faster. You have to wake up at 8am the day before. This allows you to do your research and configure your monitor with the stocks you want to track actively for the day.

- Keep it short – You can make more money by trading all day, but day traders will see the best returns if you trade for one to three hours. You can make £750 in 2 hours and £1000 in 5 hours trading. So if you’re looking at day trading stocks for a living, trading in short bursts will give you the highest hourly returns.

Patterns

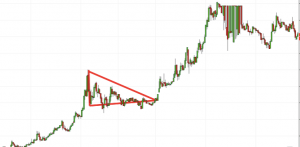

Pennant

Pennants are often the first thing you see when opening a pdf chart pattern. This is created simply by significant stock movement and consolidation. Converging lines bring the pennant shape to life. You can see a breakout movement happen with a big stock move.

Then when the stock first starts to move you will see a significant amount. Finally, the volume of the pennant section decreases and then the breakout volume spikes.

ascending triangle

A triangle usually appears during an uptrend and is considered a continuation pattern. When a downtrend ends, it is produced less frequently in response to a reversal. Whenever it happens, the ascending triangle is a bullish pattern (when there is a small black candlestick behind it, a large white candlestick completely overshadowing the previous candlestick).

descending triangle

Although often a bearish pattern, the descending triangle is a continuation of a downtrend. Less frequently it can be observed as a reversal during an uptrend.

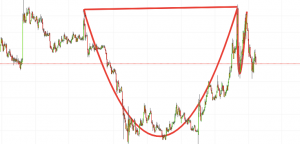

cup & handle

A quick look at the chart will give you a measure of the name of this pattern. The cup has a curved U-shape and the handle angles down slightly. Generally, the right side of the chart has low trading volume, which can last for a significant amount of time.

head & shoulder top

The shape comes to life as the two trend lines converge. They congregate in peaks and valleys. Lines create clear barriers. When prices fall, we expect rapid price fluctuations.

You can find different stock patterns for daily trading in every PDF. Instead of using everyone you find, just make good use of a few.

Strategy

The patterns and strategies above can be applied to everything from small and microcap stocks to Microsoft and Tesla stocks.

Heikin-ashi

If you like candlestick trading strategies, you must love this twist. Candlestick charts represent four numbers: open, close, high and low. However, it uses the information from the previous candle to create a Heikin-Ashi chart.

- Closing price – Heikin-Ashi candles average the open, close, low and high prices.

- Opening price – The candle will be the average of the opening and closing prices of the previous candles.

- High Price – The high price displayed on the Heikin-Ashi candle is selected from the highest of High, Open, and Open.

- Low – This time the candle’s high price is chosen from High, Open and Close, but this time it is the lowest value.

These charts are slower than average candlestick charts and have delayed signals. This is part of their popularity because they come in handy when prices fluctuate.

This strategy also uses momentum indicators. A simple stochastic oscillator in the setting (14,7,3) should do the trick. If you see that both bearish or bullish candles have completed on the daily chart, you will know the pattern is valid.

- Short Setup – If the price creates two red candles in a row after several green candles, the uptrend is exhausted and a reversal is in the cards. Short positions should be used.

- Long setup – If the price creates two green candles in a row after a series of red candles, the downtrend is exhausted and there is a chance it will reverse again. Long positions should be considered.

- Filters – You should also use other filters to prevent false signals and improve performance.

All of these charts, patterns, and strategies can be useful for buying and selling traditional stocks. However, it can also be useful if you are interested in the lesser known forms of stock trading discussed below.

Penny stocks

Thousands of people turn on their computers every single day to trade penny stocks online. But what exactly are they? The Securities and Exchange Commission (SEC) defines penny stocks as priced at $5 or less. However, the majority of the trading community agrees that ‘penny stocks’ are stocks that are traded on an over-the-counter board (OTCBB) or pink sheet.

Pros and Cons

Benefits

Consider the benefits and downsides listed below to help you decide if day trading on penny stocks is for you.

- Excitement – Fraudulent trading with penny stocks can’t be exciting. The potential for big wins and big losses makes for an attractive market.

- Speed – While many on a penny stock list can remain relatively stable, some prices will fluctuate significantly in a short amount of time. This could lead to significant gains for switched-on day traders.

- Startup Capital – Under $1,000, you can buy just a few shares of a large company. However, you can purchase thousands of shares of any penny stock you are interested in.

Disadvantages

Unfortunately, most of the day’s worth of video trading advertising videos fail to point out a number of potential pitfalls.

- Low Quality Companies – No matter how effective a strategy is, it must account for the low quality of the majority of penny stocks. This means a company in dire financial shape, with its balance sheet worrying and causing serious losses.

- Risk Markets – There are regulated penny stocks on the New York Stock Exchange, US Stock Exchange, and NASDAQ. However, those who trade on the pink sheets, OTC or OTCQX often lack sufficient oversight. Unfortunately, there are no strict penny stock rules. This means listing costs, requirements and reporting regulations may be virtually non-existent.

- Broker Fees – For traditional day trading versus penny stocks, you should consider the favorable pricing structure offered by brokers. Many people will charge higher fees if you offer penny stocks. Also, Sufficient Loss does not allow special trading orders such as Stop Loss.

- Low Volume – Volume is essential to generating quality returns. However, penny stocks see thousands of shares traded every day, some much less. However, large companies can trade tens of millions of shares per day.

- Scam – Go to any penny stock trading forum and you will quickly come across stories of lies, scams, pumps and dumps. Unfortunately, due to the lack of information available, making the right investment decisions can be very difficult.

- Selling – Finding buyers willing to sell can be difficult as a result of the small volume traded. This is a particularly serious problem if you rely on buying and selling precisely at the time in question.

Spotting a winner

As you can see above, our penny stock review highlights many serious problems when these instruments are used for intraday trading. Perhaps a more prudent investment decision would be to focus on traditional stocks.

However, there are people who make a profit from penny stocks. So, to join this minority club, you need to know what good penny stocks look like.

To do so, consider the following.

- Is your company profitable?

- How many stocks do you currently have?

- Do stock splits and stock options dilute stocks?

- Can the company realistically turn a profit based on its current business structure?

- Does current management rely on issuing new shares to raise capital?

- Can the company compete effectively in its sector?

Best of all, you know in advance where to look when it comes to penny stocks for dummies. For example, the metals and mining sector is well known for many companies that trade in pennies.

Penny Stock Trading Day Last Words

Overall, penny stocks may not be suitable for active day traders. Because even the best trading stocks under $5 lack the volume, regulation, and accurate information needed to make good enough investment decisions. However, if you want to learn more, daily trading penny stocks and instructional videos are available.

Stocks for kids

This is a popular niche. Picking stocks for kids. The focus here is on growth over the long term. “Day trading” does not apply in practice. When looking for long-term ‘buy-and-grow’ growth (and passing it on to future generations), the key test for any stock is time.

Time filters almost everything, great ideas, great books, and great music. A stock (or company) is similar. If you want to buy stock and you don’t want to worry about it again until you give it to your children, find the oldest business. Tech stocks are too new to know if they are ‘classic’ yet. A company that has been operating for 100 years has experienced more booms and booms than hotshot traders. Let time be your guide.

Day trading stock tips

From above, you need to plan out when to trade and what to trade. However, it is worth figuring out how much you can risk per trade and assigning a maximum or cap loss per day. This discipline prevents you from losing more than you can afford while optimizing your potential gains. So, consider the following as a general rule when trading stocks.

- Keep it simple – If you’re new to the game, just focus on one or two securities. This simple approach won’t take you 16 hours a day, making it ideal for those glued to their screens. You will become an expert much faster if you trade the same securities every day.

- Know your costs – Day traders often pay a lot of fees through their trading volume. Import taxes can be different costs depending on your location and whether daily trading is your ‘job’. You’re competing with sophisticated algorithms that can get in and out of positions in seconds, and realize the importance of an effective money management strategy for day trading stocks.

tools

Education

To get ahead of tomorrow, you need to know about the range of resources available to you. It is especially important for beginners to utilize the tools below.

- Blogs and forums – providing fantastic opportunities to learn from experienced traders. Traders can provide techniques to scan potential stocks. You can also learn the secrets of profit from short, sharp price movements. You can also get daily trading instruments for free.

- Courses – Online and face-to-face courses abound. They can teach you everything from the basics of day trading stocks to in-depth technical stock market analysis. You’ll also often discover the risks of certain strategies and how to avoid them. All can help you avoid the most common mistakes made by all-day stock traders.

- Tutorials – can be provided in the form of learning videos, PDFs or other written documents. We will walk you through setting up the new software for stock selection and creating stock alerts. All of this can help you take advantage of the most volatile stocks and increase your overall payroll.

- Newsletter – An online stock picks newsletter can be useful. They often scan potential stocks for you, and display stock charts to back up their findings. If you’re looking for the best stocks right now, it’s often worth looking into.

- Stock Website – This site is another great place to get popular stocks and recommendations. It also provides useful definitions for beginners and helps define criteria when searching for opportunities.

- Books – Weekly trading stock market books are another fantastic resource. We can do everything from identifying hot oil stocks to preventing illiquid stocks. There are also niche books. For example, if you are interested in day trading penny stocks, the right book can help you identify the best daily trading stocks under $5.

Stock Picking Software

However, you may want to start trading stocks full-time all day with a wide range of securities and markets. How do I know which one to choose? Do you want to start trading gold stocks, bank stocks, cheap stocks or Hong Kong stocks?

This is where stock picking services can come in handy. But what exactly do they do and how exactly can they help? It is essentially a computer program that helps you select the best stocks in the market, especially in your scenario. Then the following ways can help.

- This software simplifies the process of finding potential opportunities that fit certain criteria, usually by dumping large amounts of data.

- You often receive real-time email and text alerts when new trading opportunities arise.

- Many stock selectors have active and helpful chat rooms where you can learn how to pick stocks that interest you.

- Many vendors provide market forecasts at the beginning of the day and provide stock ideas and techniques on the most active stock trading days.

- Software is often multipurpose. So, it can help you start trading dividend stocks, IPO stocks and blue chip stocks.

Overall, these software can be useful if used correctly. Quickly create an inventory watchlist so you can focus your time on strategy creation. However, these systems should only be used as a supplement to your strategies and not as comprehensive day trading stock advisors.

Demo Account

Our free weekly trading stock simulator is a fantastic way to learn about the markets. How does it work? Funding with virtual currency gives you a choice of stocks, so you can practice buying and selling your favorite Apple or Biotech stocks. This allows you to practice handling inventory liquidity and develop your inventory analysis skills.

It exercises on real historical data, so you can develop a specific strategy that works best for NASDAQ or NYSE, for example. All of this can help you find the right day trading formula for the stock market. Not to mention, predicting future stocks can be much easier as a result of the time spent on the demo account.

For more information on how a practice simulator can help, please see our Demo Accounts page.

Remember – whether you are from Canada, India, Singapore, Australia or the Philippines, if you want to trade $100 in stocks per day, you will need to make the most of many of the above resources.

final word

Millions of stocks are traded every day for hundreds of millions of stocks. This makes the stock market an exciting and action-packed place. If you are day trading, look for stock patterns that encourage volume and opportunity volatility. There are several user-friendly screeners that can help you view weekly trading stocks and identify stocks to buy. Even savvy stock traders will have clear strategies. They also follow their own rules to maximize profits and reduce losses.

Further reading