As the binary options market has grown, so have the needs and requirements of traders. Experienced clients requested options similar to traditional Rise/Fall binary options, but allowed to trade on volume and market volatility. Brokers also wanted to offer products that allowed them to trade in flat and volatile markets. This is where “Touch/No Touch” options were born, allowing you to limit risk trading on volume and volatility.

Explain touch options

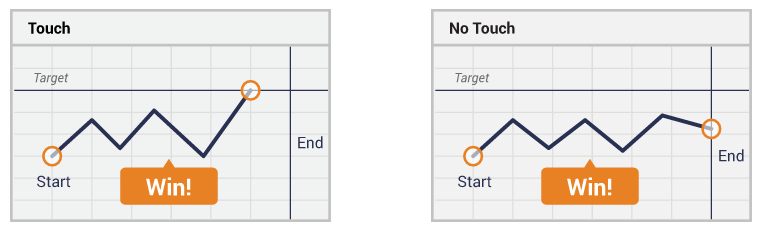

Like limited risk, the ‘binary’ element of One Touch Options remains intact. To complete the “Touch” option for money; The asset’s value must cross or cross the barrier (or ‘target’) level at least once before the option expires.

The “No Touch” option does the opposite. The asset’s value will not touch the barrier (or ‘target’) level at any point prior to maturity.

In most cases, the barrier level is set by the broker. However, in certain brokers, traders can set barriers. It may be higher or lower than the current asset value. The distance between the current asset value and the target price usually determines the payout structure. This image represents a successful Touch and No Touch transaction.

One important difference from Touch options is that they can be completed “to the money” before expiry time. When the touch target is met, the option pays immediately, regardless of what happens to the asset’s value later.

Broker Difference

Traders who want to use Touch options should pay special attention to their trader selection. First, some brokers do not offer any at all. The touch options of certain other brokers are not particularly flexible. Not even at the target level. However, there are some brokers that offer a lot of flexibility. Here traders can set their own target levels (payouts will be adjusted accordingly). This provides tremendous opportunities to use your advanced trading skills. Setting touch options at varying intervals to control risk and return can give you a trading edge. Traders can also create “tunnel” options by setting targets above and below the current value.

When using the touch option

Advanced traders can successfully use one-touch options throughout their trading day, while other traders may specialize. For example, volume and market volatility may change significantly after certain data releases or events. Similarly, the market may be exhausted for a period of time prior to an announcement and may be highly volatile thereafter. If a trader thinks the volume will be particularly low or high, the touch option allows them to position themselves in that view.

Top 5 Brokers: