Wondering how to trade penny stocks? Penny stocks are a great option for traders who want to start investing with just $100. The popularity of penny stock trading has skyrocketed because penny stocks are “designed” for investors with little startup capital. Learn how to trade penny stocks for beginners in this step-by-step guide.

If this is your first time on our website, the Trading Strategy Guides team welcomes you. Hit the subscribe button to get your weekly free trading strategies directly into your email box.

Jordan Belfort, also known as “The Wolf of Wall Street,” made millions of dollars as a stockbroker making a name for himself in trading penny stocks. His name has negative connotations as he was convicted in 1999 of manipulating the stock market and running a penny stock boiler room.

We are not here to promote penny stock scams. For our beginners guide, we want to show you what you can achieve if you follow penny stocks.

Before you risk your hard-earned money, let’s find out what penny stocks are and how you can buy them. By the end of this guide, you will know the exact trading tips, methods and strategies to successfully trade penny stocks.

What are penny stocks?

What are Penny Stocks? According to the U.S. Securities and Exchange Commission (SEC), penny stocks are shares of companies that trade for $5 or less. In the past, only stocks worth less than a dollar were considered penny stocks. Penny stock is also called “pink sheet stock”.

Typically, penny stocks operate outside major exchanges such as the NYSE or NASDAQ. They are traded over the counter. However, if the price of a penny stock is consistently between $1 and $5 per share, it can be listed on the NYSE.

Penny Stock Example:

For more information on the OTC market, visit OTC Trading – How to Trade Whales.

The second characteristic of penny stocks is that they have small market caps. These cheap penny stocks typically have a market cap of less than $300 million or $500 million.

Risks and Benefits of Trading Penny Stocks

Trading penny stocks has several advantages. The stock is priced below $5, so the risk is limited. The maximum you can lose is $5. However, if you choose the right stocks, you can get unlimited upside. Although rare, I have never heard of a stock going from $1 to $100 in one month.

Penny stock volatility is also more volatile than regular stock prices. For day traders, this means there are multiple profit opportunities within a given trading period. If the stock only moves from $0.20 to $0.30, that’s still a 50% increase in value.

Another benefit of trading penny stocks is that S& It’s just that penny stocks, unlike stocks listed at P500, are loosely correlated with the market as a whole. Even if the entire economy goes through a recession, several penny stocks will still rise.

Trading penny stocks has its downsides. Many of these companies are very low or negative in value because their prices are so low. Most penny stocks remain penny stocks for life. Also, because they are often over-the-counter and traded with little oversight, these stocks are prime targets for pump and dump or insider trading schemes. Still, trading penny stocks can still be very profitable if managed correctly.

Let’s learn how to find penny stocks using this smart and simple strategy.

How do I find penny stocks?

To find penny stocks you need to use penny stock scanner. The scanner helps you find hot penny stocks that are hidden from general public attention.

Finviz.com Stock Screener is our favorite free penny stock screener. This is the easiest way to find penny stocks.

A good penny stock screen checker can scan stocks under $5 or stocks under $1 with custom parameters. You can find the best penny stocks to buy in 2019 that meet certain parameters and filters. If you are just starting out learning how to trade penny stocks, don’t be afraid to use online stock screen tools to test different filters. This can lead to strong penny stock listings.

If originality is lacking, try searching the free market for some of the most active penny stocks. This provides a list of day trading penny stocks.

Remember – lack of research can lead you to invest in the worst pump and dump scams. Learning how to make money in penny stock trading is an investment of time and effort. There is no secret formula for finding a stock before a pre-spike. However, learning how to find the right penny stocks can definitely increase your chances of success.

Now that you’ve learned how to find the hottest penny stocks, the next big question is where to buy penny stocks?

See below:

Where to buy penny stocks?

Most penny stocks are listed on the Over-the-Counter Bulletin Board (OTCBB), but some can also be found on regular stock exchanges. Professional traders on Wall Street refer to penny stocks as over-the-counter stocks.

More than 10,000 securities are listed on OTCBB. Investors can trade and access these pink sheet stocks through online stock brokers.

Because OTC stocks are highly volatile and illiquid, we recommend investing only in penny stocks listed on the NYSE and NASDAQ.

So, how do you buy penny stocks?

See below:

How to buy penny stocks?

The best way to buy penny stocks is through a regulated stockbroker. The broker gives you access to the market through leverage so you can start trading quickly. Besides using a broker, you need two more things to learn how to buy penny stocks.

- Money to buy penny stocks.

- Penny stock trading strategies to help you choose the best penny stocks.

Never buy penny stocks directly from a dealer who calls you to offer you an investment opportunity. Research low-fee stockbrokers offering OTC stocks and penny stocks listed on the NYSE or NASDAQ. When you want a variety of options, you can find the best performing stocks.

The best brokers we recommend are:

- Fidelity Invest – $4.95 per trade

- Charles Schwab – $4.95 per transaction

- eOption – $3.00 per trade

- TD Ameritrade – $6.95 per trade

- Interactive broker – $.005 per trade

- TradeStation – $5 per trade

What is the difference between OTC and NYSE/NASDAQ penny stocks?

Penny stocks come in two forms: pink sheet stocks and exchangeable penny stocks. “Pink Sheet” penny stocks are traded over the counter. “Exchange” penny stocks are still listed on major exchanges such as the NYSE or NASDAQ, although they are still under $5. Blockbuster is a prime example of an exchange stock that eventually achieved “penny stock” status.

Generally, when people refer to penny stocks, they’re probably referring to stocks that are traded over the counter. These stocks usually have very small market caps and the market itself is very lightly regulated. Right pink sheet stocks can yield lucrative returns, but are generally considered more risky than those listed on major exchanges.

Now that you know about both types of penny stocks, the next step is learning how to trade them.

See below:

How to trade penny stocks?

Have you ever wondered how to trade penny stocks?

Anyone can learn how to trade penny stocks for free. There are no hidden secrets because the game on Wall Street never changes. Penny stocks are characterized by high volatility. They can go from a few cents a share to a few dollars very quickly.

You can make a lot of money with volatility, but you can also lose a lot of money.

Most people who trade penny stocks tend to lose money because they trade incorrectly or use penny stock trading strategies that are not suited to their type of trading environment. That’s what makes penny stocks a high-risk, high-return investment.

It should be borne in mind that at the end of the day, 85% of traders lose money in the stock market.

However, if you learn how to trade penny stocks the right way, you can twist the odds in your favor and become part of an active trader with 15% of profitable daily trading penny stocks.

All you have to do is learn how to buy penny stocks and spot potential winners before they skyrocket.

There are only a handful of hot penny stocks that make big moves on a daily basis. Not all stocks under $5 are hot penny stocks. The trick is to learn which penny stocks to buy before the spike. We developed a penny stock trading strategy that uses some trading rules we found over 20 years ago.

To become a better penny stock trader, learn how to trade penny stocks using our methodology.

See below:

Best Penny Stock Trading Strategies

The best penny stock trading strategy is broken down into three phases: scanning, searching and attacking. The goal is to identify when penny stocks spike. This is very important for penny stock traders. Even the best trading rules in the world can’t tell you what every penny stock will do in every situation.

However, the “secret sauce” allows you to predict with high accuracy when penny stocks will be pumped.

To learn how to trade penny stocks, follow these three S Rules:

- Scan the best penny stocks with 6 filters.

- Search for skill patterns.

- Use a market order to attack.

Step 1: Scan

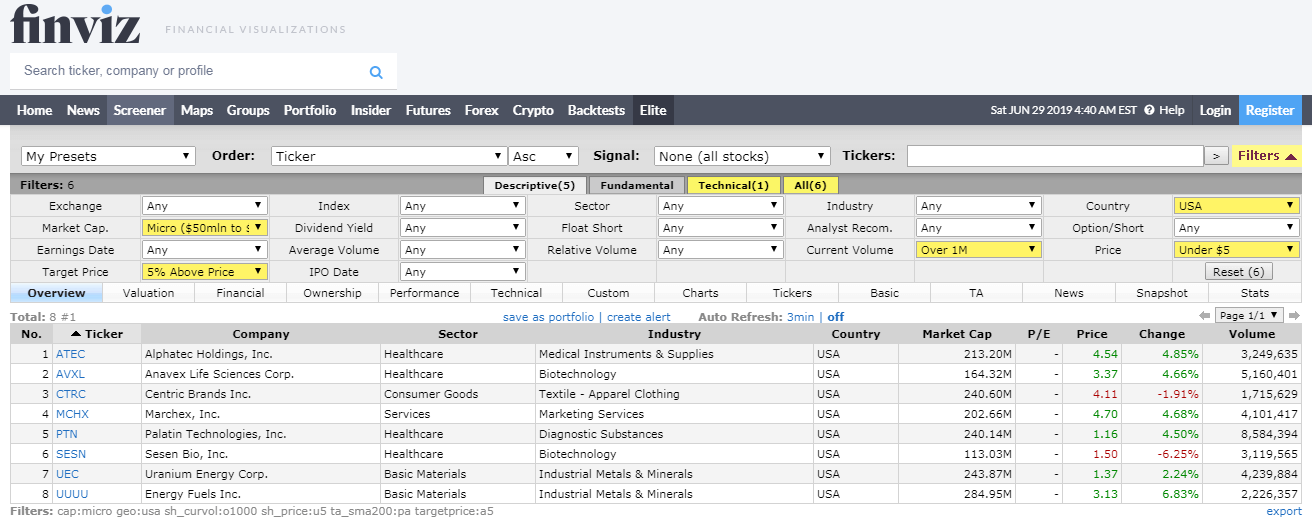

Use our penny stock screener to find hot penny stocks. We recommend using the free inventory scanner provided by Finviz. Customize the penny stock screener to match your parameters and filters. This will give you an edge in the market.

Penny stock parameters to find the best penny stocks:

- Market cap: between $50 million and $300 million

- Target price: 5% below price

- Current amount: over 1M

- Country: USA

- Price: less than $5

- Tech: Price above the 200-Day Simple Moving Average

List of penny stocks to buy:

The penny stock filter helps you find penny stocks that will give you great returns. As you can see, the penny stock screener only displays a handful of penny stock examples.

Once you have your penny stock watchlist, it’s time to search for technical patterns.

See below:

Step 2: Search

If your penny stock screener is only showing a handful of stocks, you want to go through all of them and see which one exhibits the clearest technical pattern. If you are an experienced technical trader, you can use your skills to pick the best patterns.

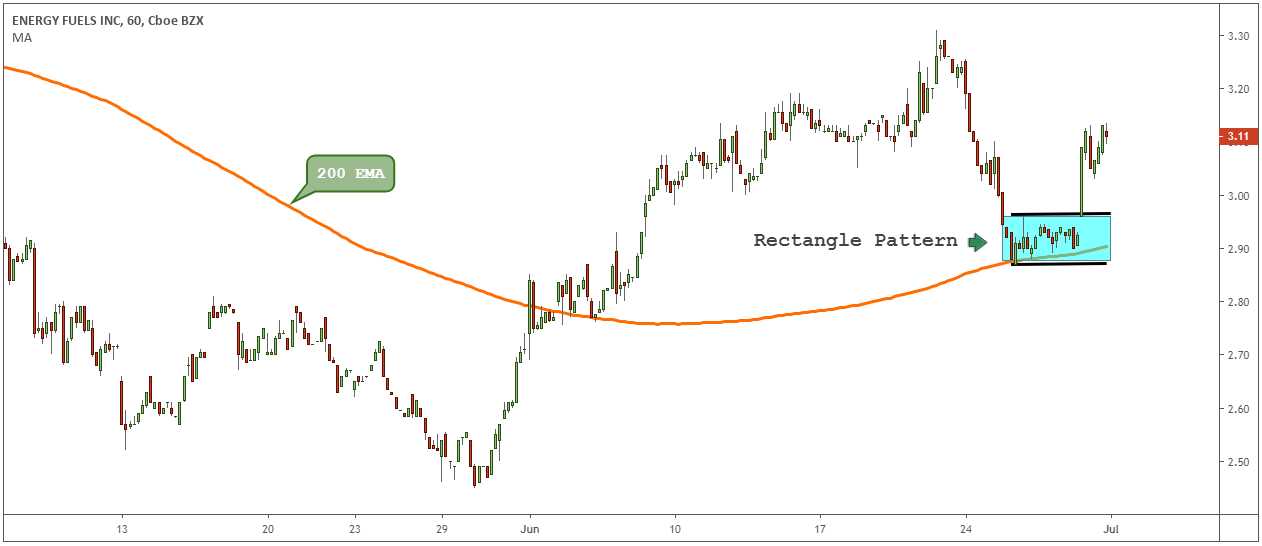

After going through the watchlist, penny stock UUUU (Energy Fuels INC) presents the clearest price pattern.

You can find a neat square pattern on the chart of this hot penny stock. When you have a clear pattern, you cannot make wrong trades.

After picking up penny stocks that show the clearest price action, it’s time to pull the trigger.

See below:

Step 3: Stand Out

Wait until a rectangular pattern is confirmed for input. When it crosses the rectangular resistance line, I pull the trigger and buy the UUUU penny stock.

The square pattern is a very easy chart pattern to trade because it provides very precise entry and risk points.

The key to trading a breakout of a chart pattern is to see volume increase as smart money pumps penny stocks.

Best penny stocks to invest in 2019

This list of the best penny stocks to invest in is ever-changing. Most penny stock trading trends evolve quickly. However, here is our list of the best penny stocks with the largest daily gains in July 2019:

- SG block (57.77% increase)

- FTE Networks Inc. (22.44% increase)

- Synthetic energy system (up 19.48%)

- Innodata (up 17.39%)

- Taronis Technologies (up 16.28%)

- Iconix Brand Group (up 14.71%)

- Reserve remarks (12.20% increase)

- Sierra Oncology (up 11.04%)

Pro Tip – To reduce risk on a particular stock, it is a good idea to diversify your holdings and buy several stocks at once.

Final Thoughts – How to Trade Penny Stocks

Penny stocks present opportunities that are independent of the performance of the overall market. Trading penny stocks can be an important part of a diversified stock portfolio. But before you start making your hard money, you need to find penny stocks that are more tradable and more liquid than average.

Penny stocks are highly speculative in nature, but this market can offer you the possibility of making money if you learn how to trade correctly. Proper preparation, research, and research are required to be successful. Always be vigilant and try the suggested penny stock scanner settings for best results. We hope you enjoy this beginner’s guide to penny stocks.