Developing the right technique for how to read cryptographic charts is an art. Not only does this new technology help you track the price of your favorite coins, crypto candlestick charts can actually tell you a lot about market trends.

The Trading Strategy Guides team strongly advocates the use of charts and technical analysis. Crypto candlestick charts give you an objective view of cryptocurrency prices rather than using your intuition and being a bit more subjective.

Timing the market is a common problem many new traders have. If you want precise start and end points, you should use cryptocurrency charts. You can have really good trading ideas and think that Bitcoin will go up, but if you choose the wrong points you will start losing money left and right.

You might leave money on the table if you leave too early or too late. The use of crypto charts along with technical analysis provides a balance.

In this cryptocurrency guide, we will cover some basic basics on how to read cryptocharts and cryptocurrency analysis tools you need to succeed in this business.

I’ll also outline some of my favorite cryptocurrency analysis tools and resources for trading bitcoin and altcoins.

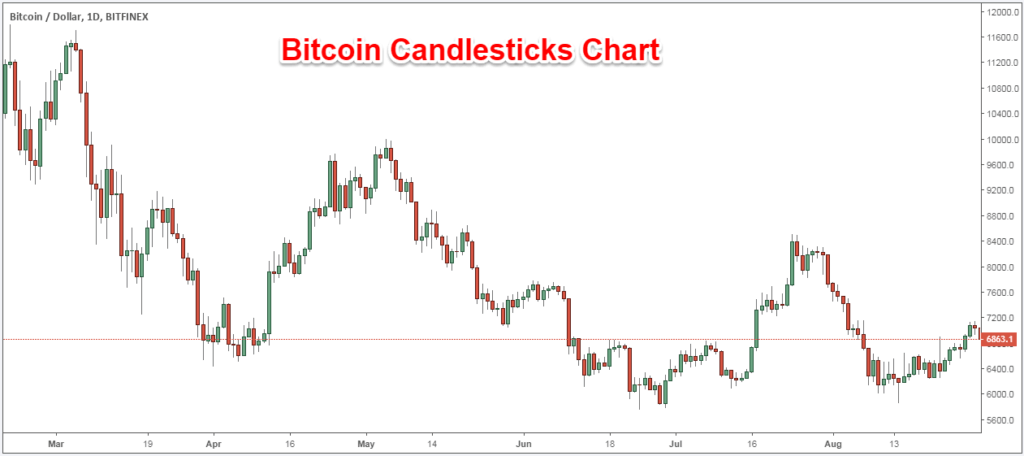

Crypto candlestick chart

There are several different ways to view charts, but our favorite crypto price chart is the candlestick chart.

In the future, we will show you how to navigate cryptocurrency price charts.

Now, here are the key elements of a candlestick candlestick chart:

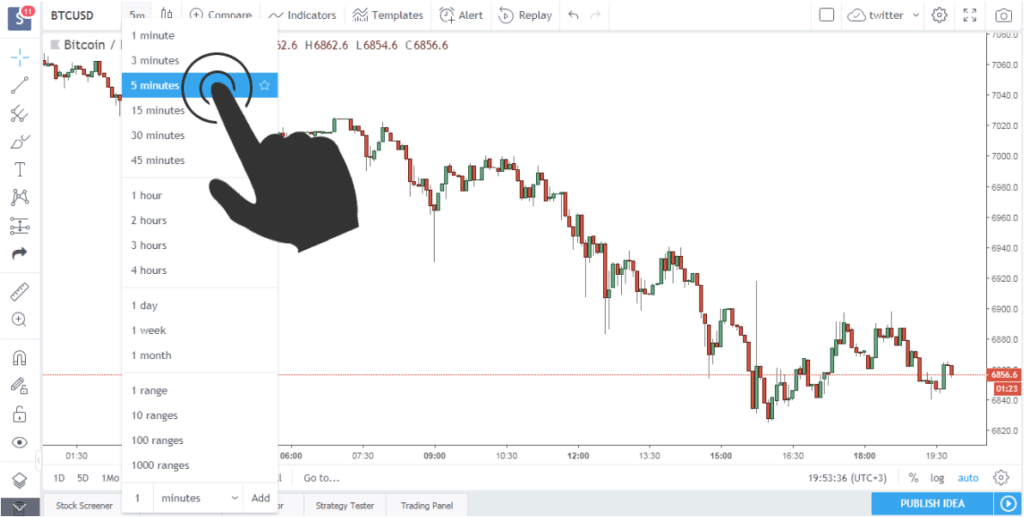

Step 1 Select Time

Crypto charts allow you to choose a time frame to top the candlestick. This means that crypto candlesticks will display all trades that occurred during the selected time period.

For example, if your preferred cryptocurrency timeframe is a 5-minute chart, each candle represents 5 minutes.

You can adjust the time frame to make it more customizable or simply choose from default time frames (5 minutes, 15 minutes, 1 hour, 4 hours, daily, weekly, monthly).

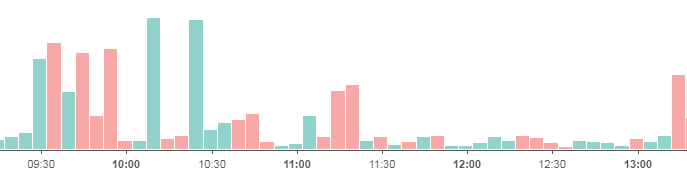

2nd level volume

The second standard cryptocurrency chart is volume. Volume shows the amount of trading activity that occurred during the selected time period. You can read more about our block trading strategy here.

The longer the volume bar, the higher the buying or selling pressure. The green volume bar highlights the growing interest in the coin and buying pressure. On the other hand, the red volume bar highlights declining interest in the coin and selling pressure.

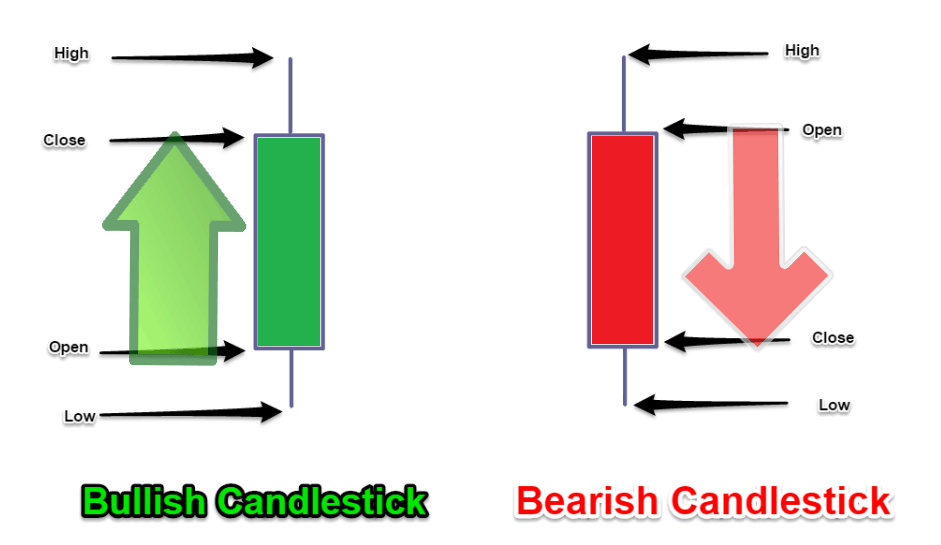

3 stage bearish and bullish candlesticks

Third, we must distinguish that there are two types of candlesticks.

- bearish candlestick

- bullish candlestick

By default, bullish candlesticks are marked with green candles, which indicate that the price has increased during the selected time period. For example, if the close price at the beginning of the 5th minute is above the open price, it is a bullish candlestick.

For bullish candlesticks, the bottom of the thick section represents the opening price and the top of the body represents the closing price. Candlestick wicks indicate the highest and lowest prices over the selected time period.

*Note: Apply the same rule in reverse for bearish candlesticks.

Candlesticks come in different shapes and forms. This candlestick price construction is a good way to predict future market trends. There are many candlestick combinations that can predict what will happen next, and these are called chart patterns.

You need the right tools to identify the information you get from crypto candlestick charts.

Cryptocurrency Analysis Tool

Now we will share the best 4 cryptocurrency analysis tools to start trading bitcoin and other coins. This section is not for crypto beginners, but for experienced traders.

There are many technical tools out there and you will want to use a combination of different tools. We believe these trading tools will help you avoid sh*t coins and lose some of your money or trade better overall. Learn about the best cryptocurrencies to invest in here.

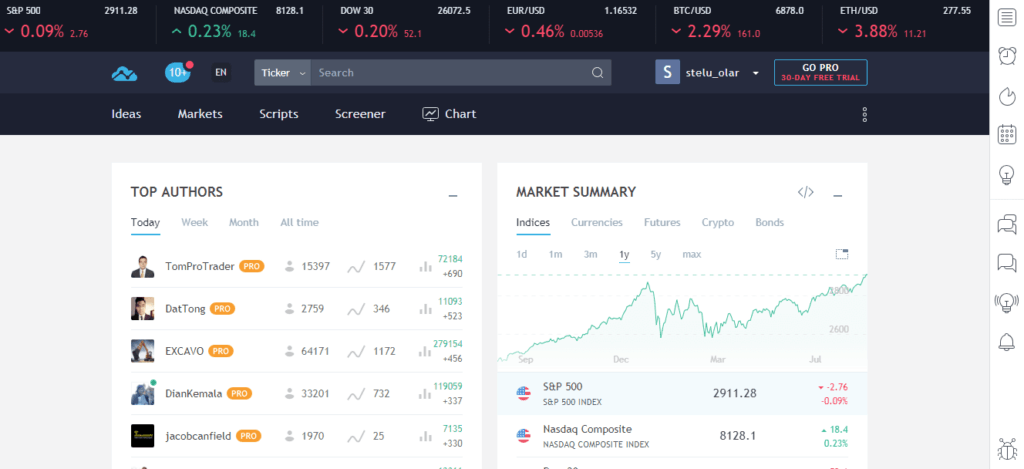

Cryptocurrency Analysis Tool # 1 TradingView

The best cryptocurrency analysis tool we like to use is the FREE TradingView charting software. This charting platform has many features and hidden features to make your trading run smoothly.

It’s just a good tool, but it’s not that important because there are other tools you can use at your discretion.

Setting up and using tradingview is very easy. Abundant resources, tools, and more importantly tools to follow

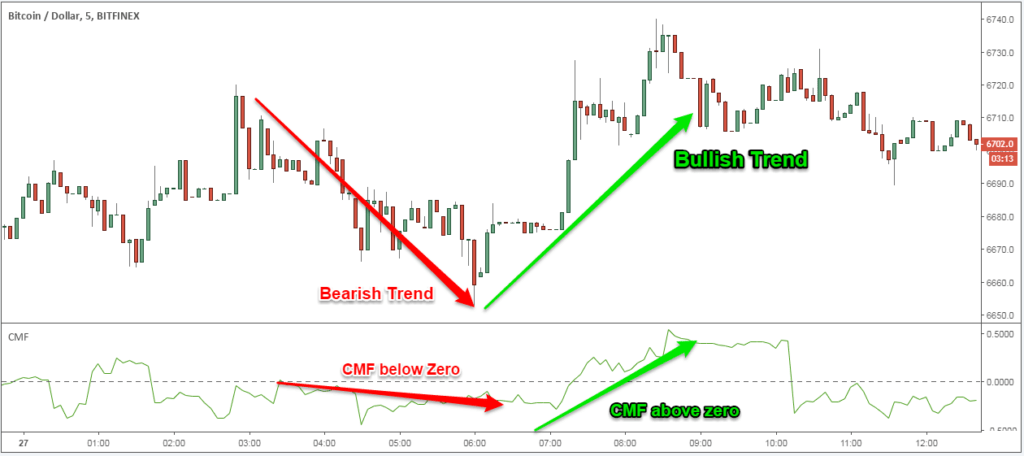

Cryptocurrency Analysis Tool #2 Money Flow Indicator

Our favorite cryptocurrency analysis tool is the Chaikin Money Flow Indicator.

The Chaikin Money Flow indicator was developed by Marc Chaikin, a trading expert coached by some of the world’s most successful institutional investors.

What makes Chaikin Money Flow the best volume indicator and better than classic volume indicators is that it measures the distribution of institutional stocks. Naturally, institutional traders show you when to buy or sell.

Generally in rallies, the Chaikin volume indicator should be above the zero line. Conversely, when selling, the Chaikin volume indicator should be below zero.

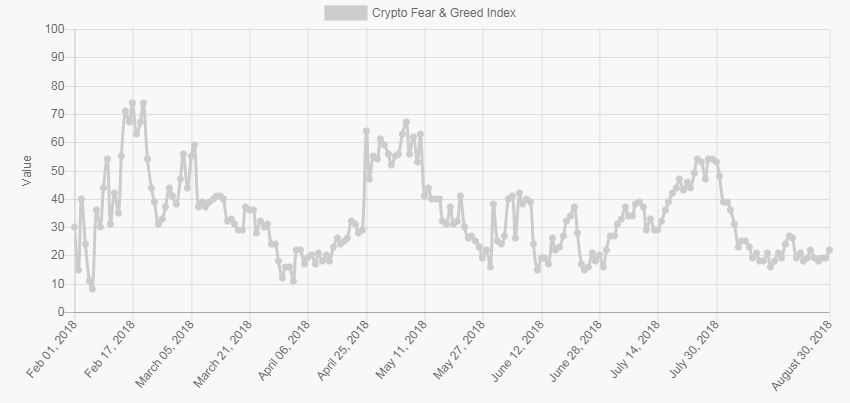

Cryptocurrency Analysis Tool #3 Cryptocurrency and Greed Index

The Crypto Fear and Greed Index uses a lot of information, it collects all the data and graphs the scores and ratings.

When the emotion shows a reading below 20, it is extreme fear. In general, cryptocurrency prices have declined and indicate a possible bullish reversal. Conversely, market sentiment above 80 shows extreme greed. In this case, the cryptocurrency is in play and the Fear and Greed Index indicates a bearish reversal. Read this guide on Crypto Signals to learn more.

Basically, we use the fear and greed indices as opposite indicators. Market sentiment is a powerful factor driving markets, and when we take extreme readings on market sentiment, it’s time to look for a reversal. Also read this guide on Crypto Trading Bots.

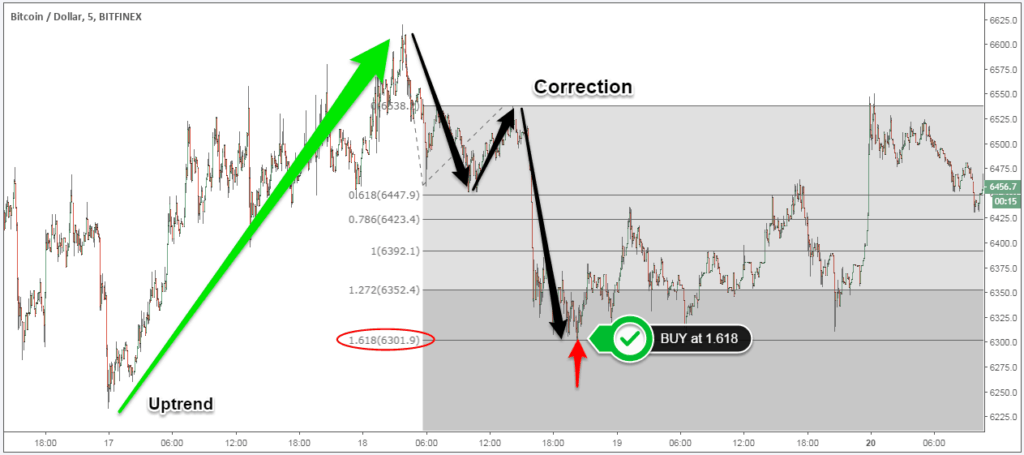

Cryptocurrency Analysis Tool #4 Fibonacci Expansion

Fibonacci extension is a very useful tool that can be sued to spot reversal trades as well as reversal trades. We focus on the 1.618 level or golden ratio.

There are all kinds of rules, but basically there are only two things you are looking for when using Fibonacci extension levels. The first is a trend, the second is a correction with 3 swing points. We use these swing points to draw Fibonacci extension levels and find possible reversal points in the market. Read Fibonacci trades here.

The golden ratio can be found everywhere, and it is also the “magic number” you can use in your trading. One way or another, many professional traders include the golden ratio in their trading because the market responds to this particular level with a high degree of accuracy.

Conclusion – Crypto Candlestick Chart

Reading crypto candlestick charts is a practical skill that everyone should acquire if they want to try their hand at today’s tricky crypto market. In the meantime, cryptocurrency analysis tools can be an important weapon in your trading arsenal, and you need to apply them properly to gain any insight from them.

Crypto candlestick charts can help you better time the market so you can use it as a complementary tool for your research.

This guide only explains the basic concepts of technical analysis. We recommend that you strengthen your knowledge and use these tools to build a cryptocurrency strategy that suits your needs. TSG Blog is rich with trading strategies to help you reach your financial goals, so check out our Best Bitcoin Trading Strategies.

Thanks for reading!