In this trading guide, learn how to trade Descending Triangle patterns like a seasoned pro. In the technical trading world, there are many patterns that allow you to make more informed trading decisions. Once you master the Descending Triangle Chart Pattern, a simple chart pattern, you can gain a clear understanding of what goes on behind the price action.

This simple chart pattern can be found on long-term charts and short-term charts. No matter what your trading style is. Whether you are a swing trader or a day trader. Anyone can use the technical analysis descending triangle to find profitable trading opportunities.

This article explains the requirements of the falling triangle and how to discover it in real time. We will also cover the psychology of triangle descending.

Descending triangle pattern

The descending triangle pattern is a continuation chart pattern that develops in the middle of a downtrend. However, in some cases triangles may be played in descending order. Also known as the Bullish Descending Triangle Pattern.

The Descending Triangle Stock Pattern is a versatile chart pattern that can be viewed as both a continuation pattern and a reversal pattern simultaneously.

The opposite version of the descending triangle is the ascending triangle pattern we’ve talked about extensively.

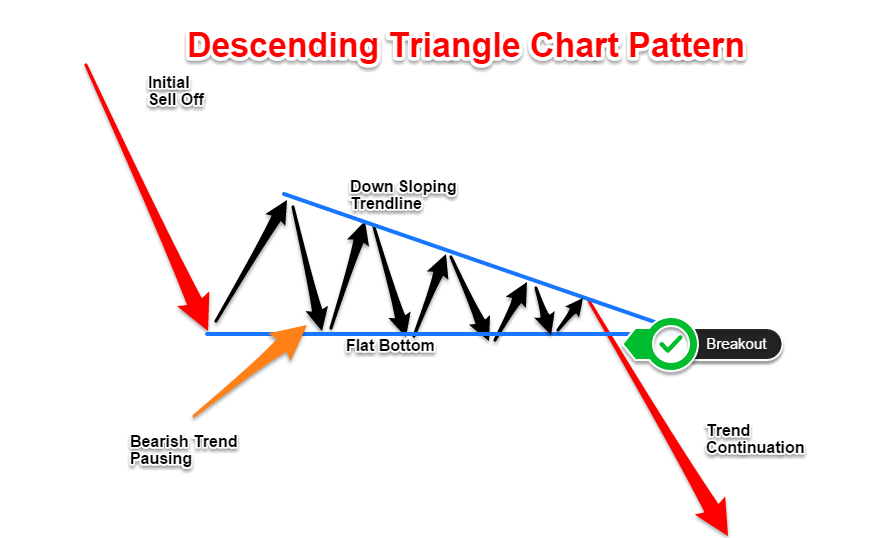

The main characteristics of the descending triangle pattern are:

- Flat support line.

- A downward trend line connecting a series of lower peaks.

- Flat support and downtrend lines converge to a point

Imagine a downward trend consisting of a series of lower highs connected by a downward sloping line at the top of a descending triangle chart pattern. The floor has a solid base that has been tested at least 3-4 times. The support level is the lowest level the price could not have moved lower.

Below you can see an ideal descending triangle chart setup.

As mentioned before, this chart pattern works from 1-minute charts, 5-minute charts to higher time ranges. Whether scalping or swing trading, it can be used on multiple assets. This includes individual stocks, global indices, commodities, forex or cryptocurrencies.

The psychology behind this pattern can be explained as the basis for the supply-demand imbalance. A break in a downtrend can be viewed as a technical analysis descending triangle. While developing a descending triangle, it’s easy to understand how demand burns out.

The downside to this is that compression makes the pattern stronger.

Remember: Bullish flags, square patterns, and all continuation patterns like the ones you can find on our Trading Strategies Guide website must have the context of a trend.

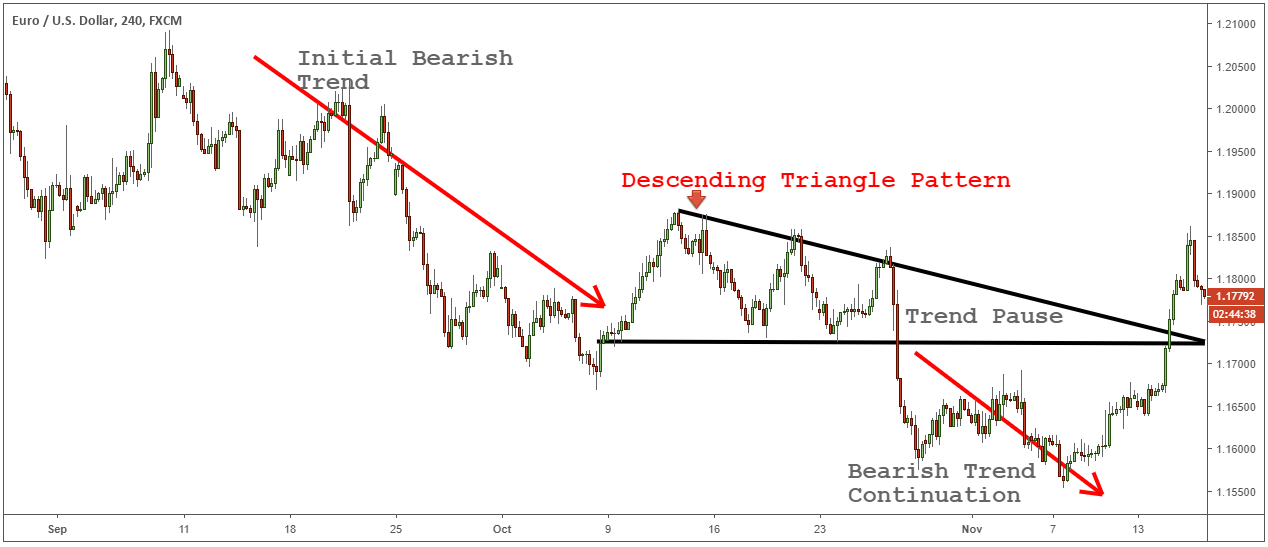

See chart below.

In the next section of this trading guide you will learn how to trade the descending triangle. Let’s see if we can get some trading ideas in descending triangle.

Descending Triangle Inversion

First, let’s look at the case of descending triangle inversion. Generally, descending triangles are stronger when traded against a trend. They are also more powerful when trading in the direction of the general trend.

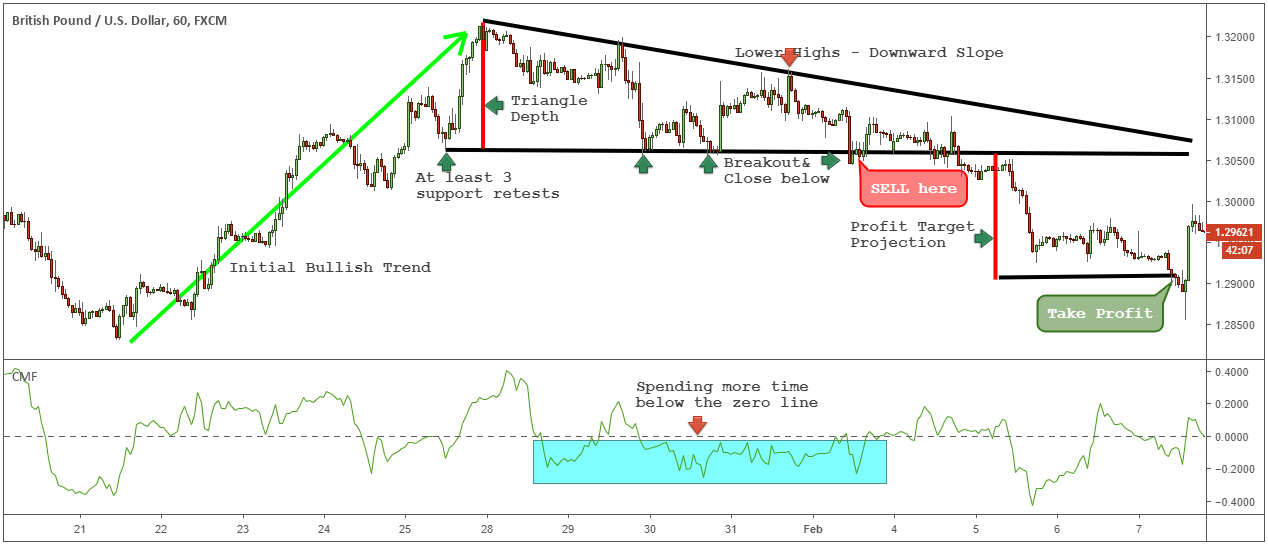

However, the Descending Triangle Reversal Pattern can yield greater gains if traded in the right circumstances. We only trade descending triangle reversal patterns when this price formation develops at the end of a bullish trend and in the context of an uptrend.

When buying activity decreases and the market does not make new highs, a reversal chart pattern emerges. This shows that the supply-demand imbalance is shifting in favor of sellers as buyers burn out.

In this case, we will be looking for a flat bottom to be conquered by bears. A potential support break indicates a strong trend reversal.

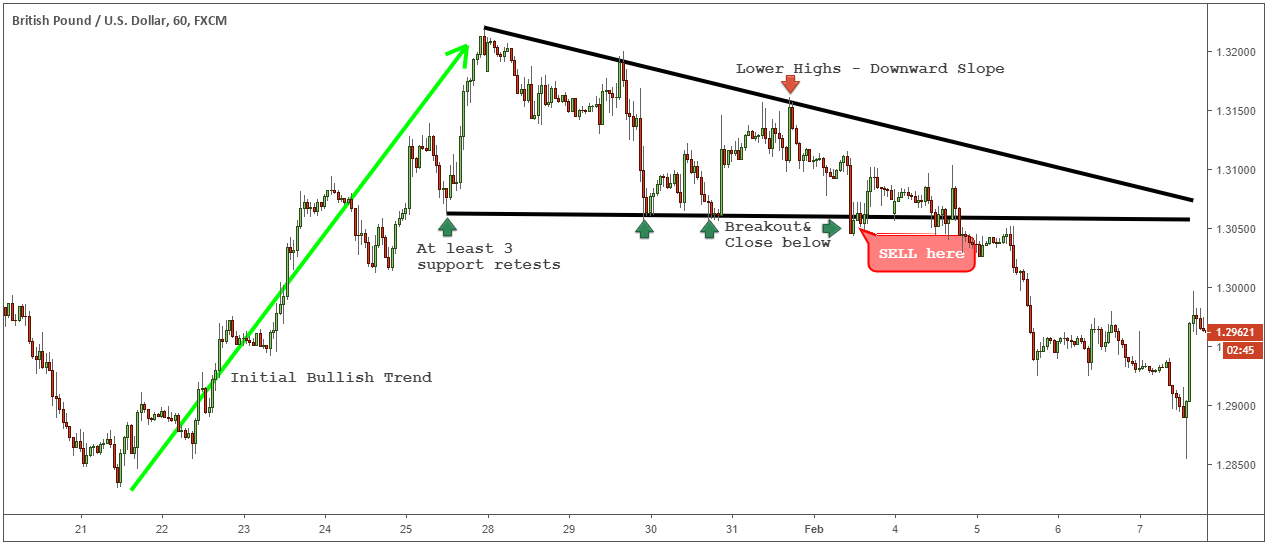

Let’s look at an example of a daily trading opportunity to catch a reversal using a descending triangle on the daily timeframe.

See the forex GBP/USD chart below:

When trading the Descending Triangle Pattern, we are always looking for a support breakout to provide a potential entry point. Unlike textbooks that teach traders that support or resistance levels get stronger when we retest them multiple times; Quite the contrary.

Note: As support levels are tested, they become weaker.

Additionally, a breakout candle must also produce a close volume below a flat support level for a valid trade setup.

But that’s not all.

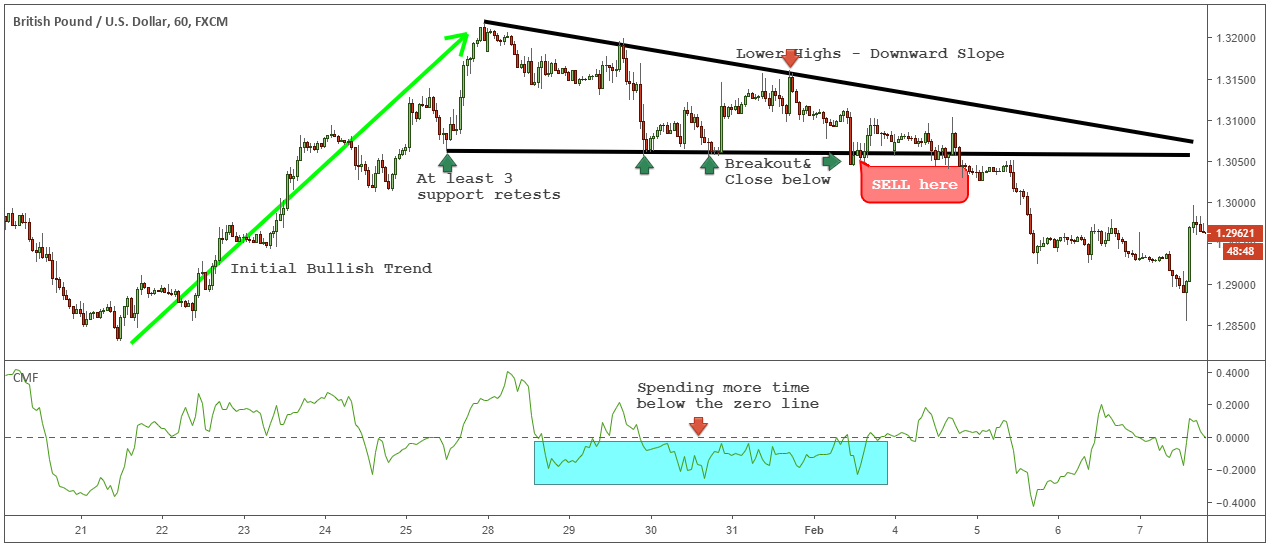

We need to go a step further and use the Chaikin Money Flow indicator to identify a supply-demand imbalance to confirm a breakout. The information you get from Chaikin Money Flow will tell you whether or not the seller has entered.

During the time the descending triangle appears, you need to make sure that the Chaikin Money Flow line spends more time below the zero line. A number below the zero line indicates selling pressure.

See intraday chart below.

For our exit strategy, we will be using one of our favorite trading techniques. Instead of focusing on static and random profit targets, we will use the dynamics of price action to get more accurate profit targets.

To get your profit target simply measure the depth of the triangle. Calculate how many pips are from the flat support line to the highest point of the triangle. Once that measurement is done, project downward starting from a flat support level.

See chart below.

You can see how the projected triangle depth measure can be a very accurate profit target. This is a powerful exit strategy that can maximize your returns.

Now let’s pause and see how to properly trade the Descending Triangle as a continuation pattern.

Descending Triangle Trading Strategy

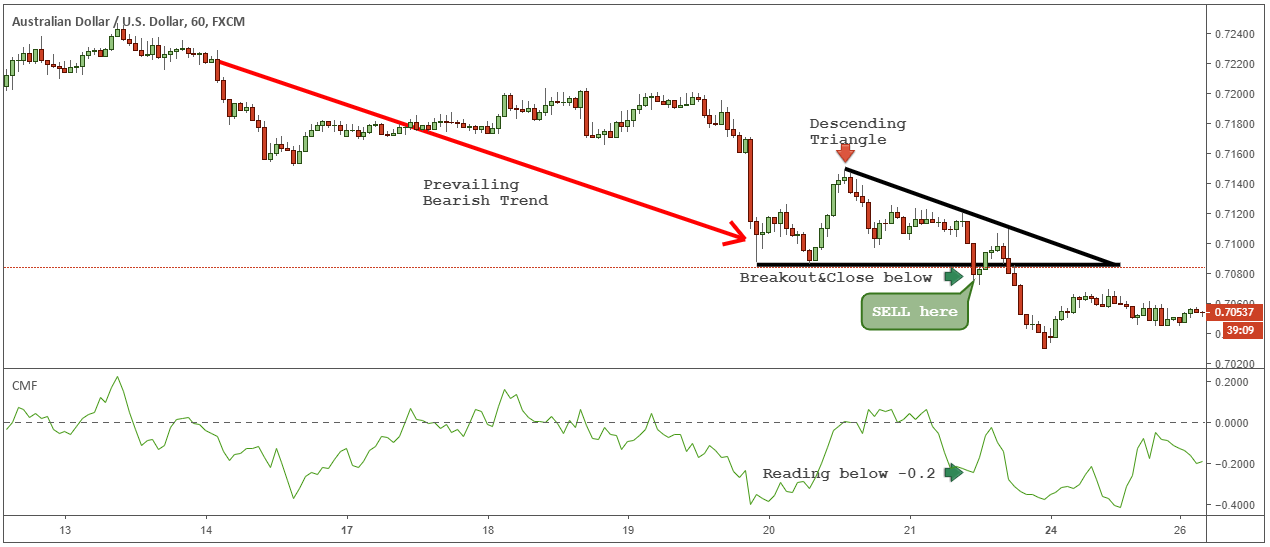

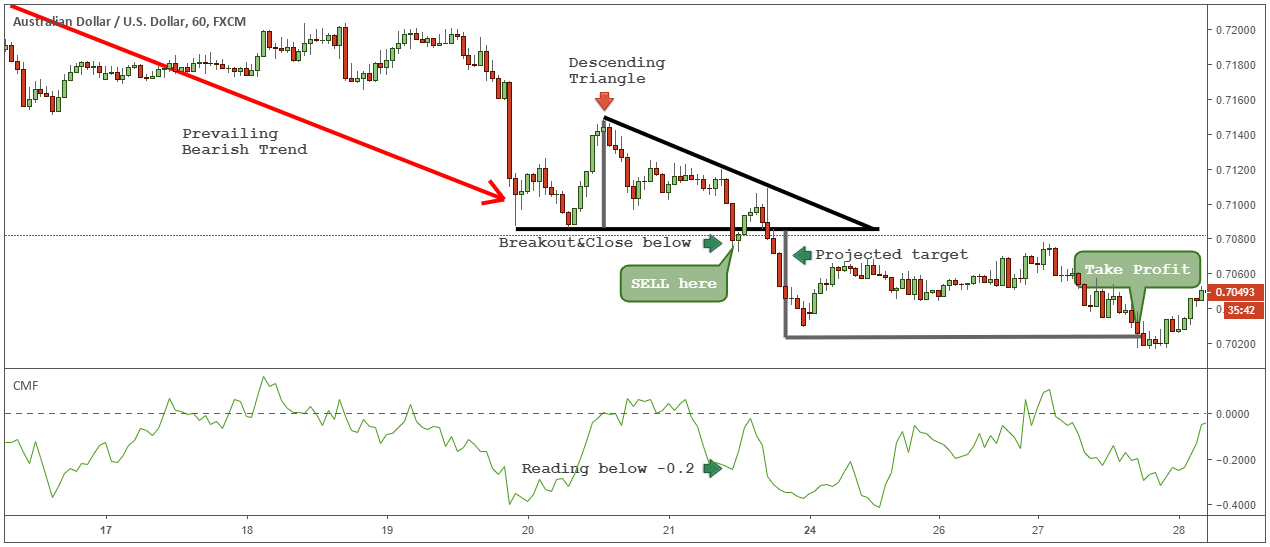

It is important to remember that the descending triangle chart pattern is traditionally used to predict a potential breakout in the direction of a bearish trend. In the following example, we combine the descending triangle with the power of the technical indicator.

Using the Chaikin Money Flow indicator with a descending triangle breakout creates a very powerful trading strategy. One of the key features unique to the Chaikin Money Flow indicator is its ability to measure buying and selling power.

Most retail traders struggle to gauge the supply and demand equation in the market. Switching to Chaikin Money Flow can help you overcome these difficulties.

In this strategy, traders simply need to see a contract between the support breakout and the Chaikin Money Flow reading. When a triangle descending occurs, a Chaikin Money Flow reading below the -0.2 level is required.

Profit target forecasting is based on the same exit strategy used previously. Measure the triangle depth and project equal price distances starting from a flat floor.

Conclusion – Descending Triangle Chart Pattern

Trading involves risk and effort. Before making money with this chart pattern, you should first familiarize yourself with the descending triangle pattern. Stop looking for the Holy Grail and learn how to trade like a pro. Use these simple trading tricks that are very powerful when used in the right context. Read our latest article on Technical Analysis Strategies.

The descending triangle chart pattern can be combined with your preferred trading strategy. As you identify them and train your eyes to see them in real time, it will help you better understand price action. A supply/demand imbalance inside a descending triangle reversal will almost always result in a quick and violent breakout.

Also learn about the Symmetric Triangle Trading Strategy.

Thanks for reading!