Nadex is a regulated US exchange designated by the CFTC (Commodity Futures Trading Commission) and accepting US residents as members is legally permitted. Based in the US but part of the IG group, Nadex offers a true exchange with all of its trading floors fully open to traders. (Read how the Nadex spread works later in this article).

Offering a state-of-the-art trading environment and advanced features, Nadex provides a high-quality trading experience. Disclosed exchange fees illustrate the transparency Nadex takes to provide its services.

” provides the ability to match contract buyers and sellers in an unbiased manner (Nadex does not profit from the P&L of a transaction, it simply receives a fully disclosed exchange fee)”

- Demo account – yes

- Minimum deposit – $250

- Minimum transaction – $1

- Signal service – no

- Bonus Information – 10 free trading days. (by deposit)

- Mobile App – e.g. NadexGo.

Trading platform

Nadex provides true exchange. This means traders can buy and sell on either side of the market, but crucially, they can also set their own prices. If the other party is willing to take the other side of the option, that price is affected.

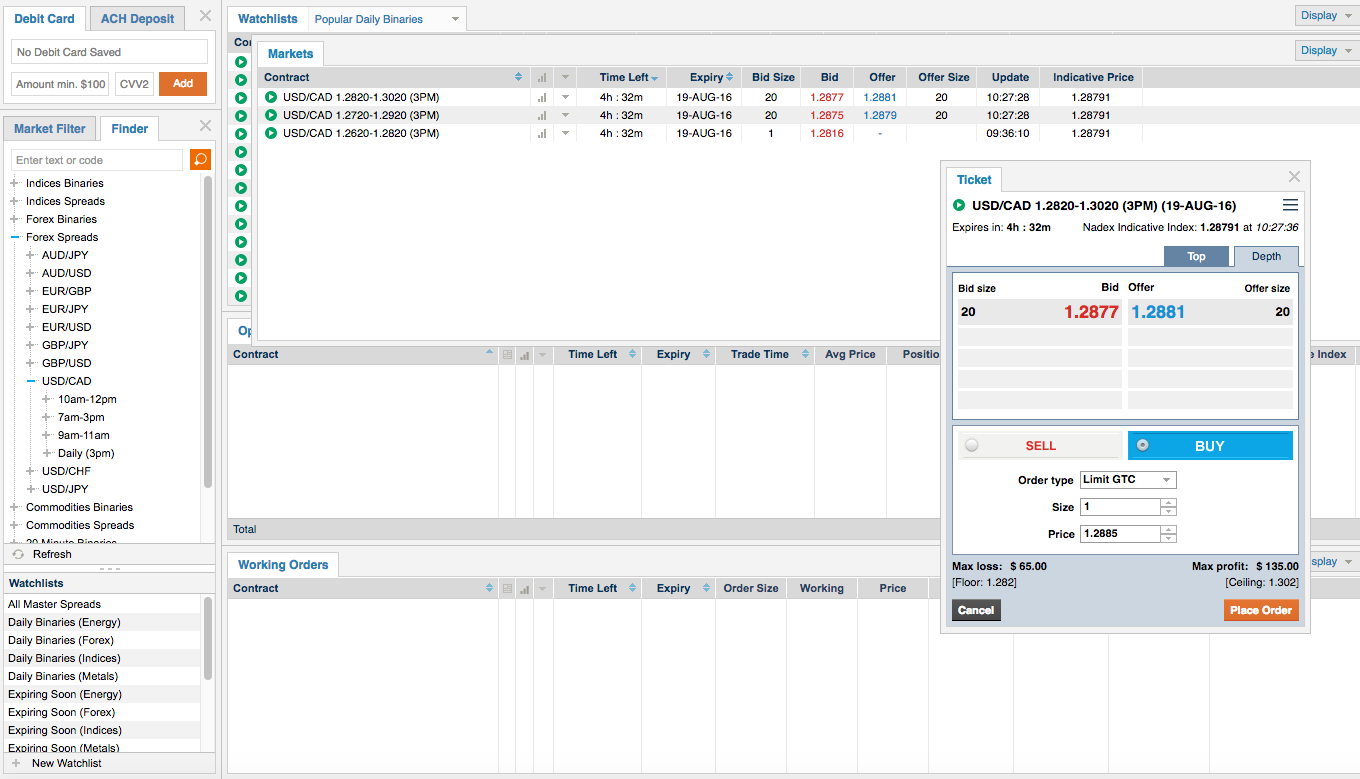

The first choice a trader makes is choosing which asset to trade. This is done through the ‘Finder‘ window on the left side of the trading platform. Selecting the relevant market opens the time range available for options expiry (times are listed in ET).

The ‘ Market ‘ window will be updated as the asset and maturity are selected. Potential tradeable price levels are displayed. There are 10 or so different price levels for any given expiration period. For example S & P index trading offers 10 different levels. Each level trades depending on whether the closing price (or expiry price) is above or below the stated level. Nadex binary options consist of either 0 or 100, so the exchange price fluctuates between the two. 100 indicates the result did it happen (e.g. assets did where the settlement options and make up will be 0, finishing above 1878) didn’t finish with money do.

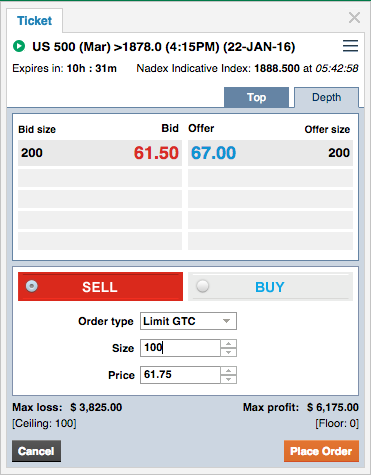

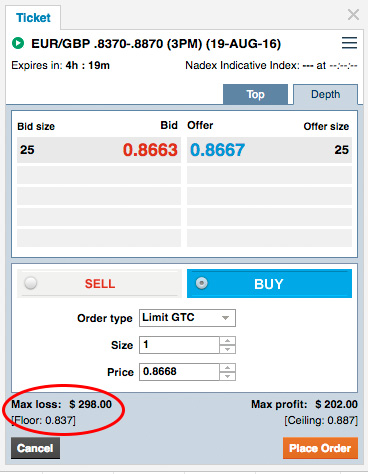

Clicking on an asset in the market list or clicking on the ‘Bid’ or ‘Offer’ figures will open a trading ticket. Clicking on a bid or offer opens the ticket with the ‘Sell’ or ‘Buy’ option pre-selected.

Trade tickets check expiration times, price levels, bid sizes, and current bid and offer prices. Traders must select the sell or buy button (if not already selected) and enter a size (or investment level). At the bottom of the ticket there are figures where you can see your maximum loss and maximum payout based on the trade size entered. Traders can also modify prices – this is the exchange element of a trade. Traders can set a price slightly above or below the current level to see if a position is ‘matched’.

With each option freely tradable, traders can close open trades at any time, allowing them to take profits or cut their losses. If the option is left to expire without further trade, the ticket’s maximum and minimum value will have two outcomes.

Once the trade is configured to their liking, the trader clicks the ‘Place Order‘ button. When a trade is matched, it will appear in the Open Positions window. If some or all of your trades are ‘unmatched’, you will be taken to the Work Orders screen. Both windows are updated when the order is matched. In addition to this window, the platform will send you an email confirming your transaction details. A confirmation email will also be sent once your order is confirmed.

Choose a trader

Nadex offers binary options on forex, commodities and indices, as well as specific ‘events’ (e.g. rising interest rates). It also offers spread markets on a range of similar assets. Each asset has a different price range, so whether traders are looking for quick price movement in a particular index or long-term trades in a currency pair, this company has it covered.

The list of available trading types and assets is the largest of any binary options company you can trade in the US. You can trade over 500 contracts.

Bitcoin Spreads

Bitcoin spreads allow you to trade Bitcoin prices (based on the trustworthy TeraBit IndexSM) between the lowest and lowest price. As the price of Bitcoin goes up and down, the value of the Bitcoin spread is also limited. When the underlying price of Bitcoin moves above the ceiling or below the floor, the spread value stops moving and stays at the upper or lower bound depending on whether you are a buyer or a seller. In this way, the risk reward is always limited and within the limits defined by the user. The limit is the profit target. Another is guaranteed protection against unlimited losses. The contract period is 1 week.

mobile app

Nadex offers the most comprehensive mobile trading app on the market. The application is free and optimized for various platforms. Android and iOS versions are available, as are specific versions for tablets (both Android and iPad) and Windows Phone.

The application is slick and most importantly, it contains all the features available on the full website. Everything from account maintenance to charting is provided by the trading app.

The layout is clear and concise, making trading very simple. The deal ticket deal area looks almost the same as on the website, as it is optimized for ease of use.

The mobile trading app is one of the best in its segment, never complains and has no flaws.

Payout

Operating a true exchange model in which traders match each other means that traders can buy and sell options at any point between 0 and 100. Actual trading costs come from spreads.

Spread

Nadex’s payouts are hard to compare to other brokers (except IG). No other binary options broker true exchange offers you. Binary options pay based on the level at which the trader was able to open a trade. For example, if a trader brings in 50 and the makeup is 100, the payout is effectively 100% (e.g. you risked $50 and got $100 when the trade was settled). At 100, the payout is reduced to about 50% (more risk amount, less profit). There is a fee of $0.09 per lot (up to $9). These rates are clear and well-documented, giving them more value than traditional options.

Withdrawal and deposit options

Nadex allows US residents to fund their accounts via debit card, ACH wire transfer. Non-US residents can only use debit cards or landlines.

For bank transfers of $5000 or more, our payment department will refund a $20 bank fee to your trading account.

Withdrawal is only possible via ACH or wire transfer. Non-US residents can only use wire transfer. The withdrawal option can be found in the ‘ Fund your account ‘ menu in ‘ My Account ‘. ACH transfers are free and take about 3 to 5 days, whereas wire transfers require a $25 fee but are usually processed the next day.

If deposited via a debt card, Nadex requires certain security information before processing the withdrawal (withdrawals cannot be reversed to a debit card). The company also requires 7 days after receiving security information before accepting withdrawals, so it’s worth clearing this up well before you need to withdraw.

Withdrawal details are not straight-forward with this operator, so it’s worth clarifying this before retrieving money. Many of these steps are required due to CFTC regulations, but delays are a regular point of contention between traders and brokers. You should always do your research thoroughly before funding. This ensures that there are no surprises and that traders know exactly what to expect when requesting a withdrawal.

Complaints

One of only two brokerages that allow US residents to trade binaries through the CFTC, the company runs an honest business with high levels of transparency and customer service. So there are very few complaints.

In a volatile market, traders can sometimes “stop” (where a stop loss is made only to recover the price). Some assume this is some kind of shrewd practice by the broker, but in reality the cause is simply volatility and the setup is too close. So while these accusations are sometimes made, they are not genuine concerns.

other features

Nadex offers its customers the following features and benefits:

- Transparent transaction costs – brands are clear about how they are funded.

- Legal for US residents – CFTC regulated, so trader funds are segregated and traders can be confident with their broker.

- Advanced Charting – Charting and technical analysis tools are the best in binary options.

- Education – This broker takes trader education a step further. There are regular free webinars on how to use the platform as well as how to make consistent money. You must be highly educated as this platform is unique.

More Details

What does Nadex mean?

: Nadex means change before N North American D erivatives

Demo Account

This broker offers a no-deposit demo account, allowing traders to use the same platform as a real account. However, demo accounts are limited to 15 days. However, traders can discuss expansion directly with the company.

A demo account is a risk-free way to try out a trading platform and discover if it suits your particular style of trader.

regulation

Nadex is regulated by the US Commodity Futures Trading Commission (CFTC). They are one of only two regulated brokers in the US that are highly regulated and strong.

Company Details

Nadex is owned by IG Group. They are a London-based company and are listed on the London Stock Exchange. IG Index is a British business brand, IG Markets.

Trading Hours

Nadex trading hours are the same as the asset being traded. The website is available 24 hours a day, but assets are only open when a specific market is available. Therefore, European assets are only available during European trading hours. You can trade US assets and more during relevant trading hours in the US.

How do they make money?

Nadex operates on an exchange model. They pay less per trade, and these costs are obvious to traders. Nadex does not take counterparty risk on the transactions its clients make. Read our article on How Brokers Make Money for more details.

robot

Currently, the company does not support any form of robot or car trading facility. Exchanges allow traders to open positions at a price of their choice. That is, when the price is reached, you can fill that open order (provided that the price has not been reached).

This allows certain elements of automated trading, but absolute control of the trader.

signal

There are no specific signaling services as part of the platform. As the exchange rate itself is entirely driven by the market, trader sentiment is ‘built’.

Its charting tools are among the best on the market, allowing for advanced technical analysis. A combination of preset patterns to use for price tags (e.g. RSI or stochastic) allows traders to derive their own ‘signals’ more reliably than elsewhere.

More about Nadex Spreads

Nadex is a simple platform for trading different types of binaries. From energy, agricultural and index futures to FX rates and forex, there is a lot to do on the Nadex platform. What makes binaries attractive to many investors is their low risk. You can lose $20 and make $80, always capped at $100.

Spreads work differently than binary .

Binaries are based on ‘yes/no’ statements. At expiration, Nasdaq or Wall St 30 (DJIA) is greater than this number. If you buy the binary for $40 and the contract expires, you get $60 if you’re correct about the contract. Otherwise you lose $40. It’s simple and direct.

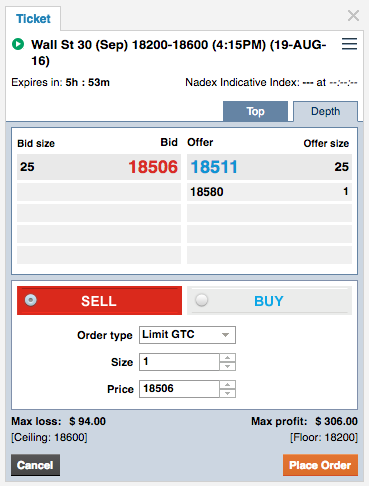

However, the spread is in the high/low range, also known as floor or ceiling. For DJIA it can be 18200-18600 where 18200 is floor and 18600 is ceiling. The 400 range is called the spread. If you stop trading and sell a contract due to an accident in 18506, the contract has a lower expiry date than the one you sold. There is no need to break price barriers or floors. You make money depending on where it ends.

Example of Nadex Spread Trade

For the Nadex spread, 1 tick equals $1. The trade ‘size’ defaults to 1, so you can increase this number to get bigger trades. So a size of 2 means $2 per tick. If you entered the trade at 18506 and ended at 18311 by expiry you would have made $195. This is the basis of Nadex spreads.

Visiting many investors on Nadex spreads is treating them as binary. They assume that the spread should go over the limit or take the floor if they cut the trade. The money you earn or lose depends on 3 things (as explained in the screenshot).

- Where they started trading – in example, 18506

- whether they buy long or short or short or ‘sell’ in the image

- When the price expires – in this case 18311

That’s the bare bones of Nadex spreads. When it comes to trading strategies, things are much more complicated. But let’s keep it simple.

Another scary thought that discourages many Nadex investors from trying spreads is the maximum loss they see. Another example is when the floor is at 17400 and the contract is bought at 17600 so the investor risks $200. It scares investors especially when the risk comes from a much more tolerable binary.

But that money is limited and you can control your risk. Keep an eye on the market and if it drops below 17600, say you like 17550. If you don’t like the way it goes, you can walk away from the trade and you will only lose $50.

Many investors familiar with binary trading treat spreads like binaries. They have similar limited risk, but $100 in binary, spread everywhere you buy a contract with respect to floors or ceilings. You can always exit a trade before expiry.

Investors from all walks of life will benefit from spreads. But you need to know how they are constructed first. They know there are floors and ceilings. They know they can trade a variety of contracts, from indices to commodities and currencies.

But first you need to know the three components that make up a spread.

- The underlying asset. It is a market like a commodity or index.

- Spread Range – The floor or ceiling of a spread contract. Choose from a variety of spreads depending on your trading scenario. On the Nadex platform, you can see different coverage for different markets. There may be 5 ranges for Nasdaq or US 100 and only 3 for GBP/USD.

- The third component is the expiration date and time. Nadex spreads have a shelf life of 1 hour to 1 day, while binaries are 5 minutes to 1 week.

Nadex bull spread

Another thing that confuses investors new to Nadex spreads is how floor and ceiling work. It’s simple that you entered a bull spread contract to where you have a ceiling. If the contract’s market is above the cap at expiration, only the cap is payable. Same as floor and bear spread contracts. So, to maximize your profit potential, buy the contract at the price closest to the floor. Alternatively, as the expiration time approaches, the contract may be sold at a price closest to the lowest price. Your risk is limited and so are your rewards. That’s the beauty of Nadex spreads. The opposite is another potential strategy – trade a buy close to a buy (or sell near a bottom). This risks a huge downside for a small profit, but the odds of success are much better. Everything comes down to risk and reward.

Beginner traders – those who have just opened an account and have never traded binaries or spreads before. You should start with the spread. The learning curve is easy and once you get the hang of it, you can enjoy so much more with binaries alone.

Since the spread is on the Nadex platform, investors will be protected and it is completely legal in the US. What makes spreads attractive to many investors is that, if you play your cards right, you can profit from one trade. It is a good vehicle to start investing with limited risk and reward spreads. Even novice investors. Once you know how Nadex spreads work, it will become one of your favorite trading instruments.