Learn how professional traders implement sound risk management strategies using the Forex Position Size Calculator. Position Size Calculation Method Forex is important for accurately managing your risk. In this guide, we will show you how you can use our exclusive forex position size calculator to calculate your trading position size whenever you need it.

You can find the calculator by heading to the Forex Position Size Calculator download link here.

Position size should always be based on your risk tolerance. However, you still need to know what are the largest positions to take in forex trading to remain profitable. The 2% rule is standard in the hedge fund industry.

The 2% rule is an effective way to control your risk so that you only risk 2% of your account value on a particular trading idea.

So what is the position size in forex trading?

Position sizing is part of a successful risk management strategy.

Position sizing tells you how much to risk each time you execute a trade. The amount of risk you are willing to take based on the amount of pips at risk in the open market. Basically, position size takes three components into account:

- Account size

- How much risk or account risk you are willing to take on each trade. It’s a personal decision about your comfort level and how active your trades are. Everyone has their own level of comfort with their risk tolerance, but most professional traders won’t go more than 1% or 2% of their account balance.

- Stop your losses. In theory, if there is no place where you can limit your maximum losses, any damages can jeopardize your account, and you will be in a position to pay the broker money if unforeseen circumstances arise.

This is a basic model for basic understanding, but position sizing should be used in conjunction with money management to ensure consistency in terms of loss management and to keep account balances intact.

In the coming days we will briefly explain how to use the Forex trading position size calculator.

See below:

Forex Position Size Calculator

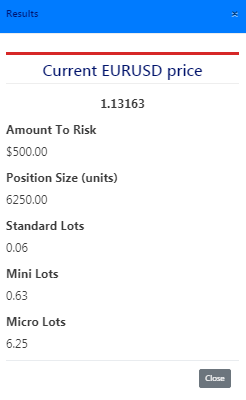

When you find the calculator on the Forex Position Size Calculator download page, it asks for some information. The forex position size calculator formula requires these inputs to calculate how much you should risk on a particular trade.

Our exclusive Forex Position Size Calculator app requires the following inputs:

- Select the currency of the account you are trading in.

- Select a currency pair to trade.

- The current size of your trading account. Round the account balance to the nearest whole number. Entering decimals will result in an error.

- Percentage of accounts willing to risk on trades. You don’t have to type in a percentage sign or anything. Write a number that represents the percentage you want to risk, literally. Enter a risk ratio for your account that you feel comfortable taking. (1 to 2% is usually suggested as a comfortable level of risk that won’t compromise your account.)

- Finally, enter the size of your stop loss in pips. (This is the amount of buffer allowed for price changes in the pair currently being traded).

The position size you need to trade to make the exact amount of money will appear in a pop-up window. Click Calculate to view the results.

When opening a current trade, simply enter the number of lot sizes represented by the Forex Position Size Calculator formula. In this way, you trade within your risk parameters.

For detailed instructions on how to use the Forex Position Size Calculator download page simply hit the command button.

Forex position size calculator formula

To trade within your risk parameters, use the following position sizing formula:

Lot position size = $ at Risk / (Pip Stop Loss x Pip Value)

This represents one of the easiest formulas anyone can remember. But we will give you another method on how to calculate position size forex. This completes your knowledge of Forex size positions mt4.

Amount at risk refers to the amount of your account balance on each trade. Would you risk 2%, 5% or 10% of your account? As mentioned at the beginning, implementing sound risk management requires a risk of 1% or 2% or less.

$ at risk = risk rate x account balance

Stop losses are determined individually based on several factors, such as exit strategy or technical reading skills.

The “pip value” is a known variable. For example, when trading mini lots, each EUR/USD pip move is worth $1. However, if you are an expert mathematician, you can find the value in pips by dividing the risk amount from your stop loss.

Smart position sizing can instantly turn you from a losing trader into a low-risk, high-profit trader. The position sizing concept is designed to help you achieve the following financial goals:

- Maximize your chances of reaching your X% return target.

- Minimize and reduce the chance of a big drop by Y%.

- or a combination of both

Long-term implementation of smart position sizing will likely result in more stable account growth. Also read this guide to forex trading for beginners.

How to Calculate Position Size in Forex

How is Position Size Calculated in Forex?

This is the next important question we will answer. For this, we will assume a real situation facing every trade before opening a trade.

For example, you use a hypothetical account size of $10,000 and a maximum exposure of 2% on one trade. Our risk exposure level in this particular case is $200.

2% * $10,000 = 2/100 * $10,000 = $200 (Risk/Trade)

We are trading based on account size and 2% risk, maximum risk to market technical loss is $200. The third component to consider to determine position size is the stop loss. For simplicity, the maximum stop loss is 50 pips. To find the value per pip, we take a risk with a stop loss.

Value per pip = $200/50 pips = $4/pip

Finally, you should use the following forex position size calculator formula:

Position size = value per pip * [(10K EUR/USD units) / (1 USD per pip)]

You now have all the details you need to calculate your trade’s position size. Applying the position size formula above to our hypothetical example, we would need to place 40,000 units of EUR/USD, or 4 mini-lots, to stay within our initial risk parameters.

Conclusion – Download Forex Position Size Calculator

Besides your own psychology, how to calculate position size forex is by far the most important topic you can learn. Trading the forex market without a forex position size calculator is like riding a roller coaster. If you do not know how to calculate your position size in Forex, you will not be successful in the market.

The forex position size calculator formula is another component of your money management strategy.

Now that you have learned the basics of the Forex position size calculator app, you can control your risk parameters and why? You can get a better night’s sleep knowing your account won’t explode overnight. If you’re not good at math, that’s no longer a problem because we offer you the best Forex position size calculator leverage. This will turn retail traders into reputable risk managers.

Also check out our Forex Power Indicator Tool.