Here we look at the best Automated Weekly Trading Software 2020 and explain how to use Automated Trading Strategies successfully. More than 75% of stocks traded on US exchanges come from automated trading system orders. Known by various names, including mechanical trading systems, algorithmic trading, system trading, and expert advisors (EAs), they all work by allowing day traders to enter specific rules for entering and exiting trades.

Once programming is complete, the automatic daily trading software automatically executes trades. Does it sound perfect? You can sit back and wait for a while as you watch the money roll in.

Automated day trading explained

Decide on your strategy and rules. Then the next computer programmed into the automation system works. The software you can get today is very sophisticated.

Trade entry and exit rules can be based on simple conditions such as moving average crossovers.

However, it can also be built on complex strategies, requiring an in-depth understanding of the programming language specific to the platform.

Once the rules are programmed, an automated system can monitor the market to decide whether to buy or sell based on the rules of a specific day trading strategy chosen.

Depending on your specifications, once a trade is initiated, orders for protection stop loss, trailing stop and profit targets are automatically created by daily trading algorithms.

If you are in a fast-moving market, an instant order entry can be the difference between a small loss and being shattered if the trade moves against you.

Some advanced automated weekly trading software helps you trade by monitoring the news.

Strengths Weaknesses

Strengths

- Emotion Reduction – One of the great advantages of automated day trading algorithms is their ability to eliminate human emotions. Many day traders buy and sell based on emotion, and automated weekly trading systems execute trades as soon as specified rules are met.

- Backtesting capabilities – Most automated systems allow you to test your rules and strategies against historical data to test their chances of success. This allows you to devise the perfect strategy and remove the wrinkles before making real money. You can also decide what your expectations of the system are (how much you can win or lose).

- Speed – Automated software provides improved ordering speed. It can automatically change market conditions and create orders based on market conditions. Just a few seconds in the weekly trading game can make a significant difference to your potential win or loss. It can prevent you from reaching your profit target or crossing your stop level before entering your order.

- Consistency – Linked to the emotion component. If you’ve lost in your last four trades, you can go cold in your next one. But if your next trade is a big winner, you just shot yourself a very expensive foot.

- Establish a formula for success – If you spend years perfecting a winning strategy, automating it can make you much more efficient. As a result, it can deliver larger and more consistent profits.

- Variety – Our automated daily trading system allows you to use multiple accounts and multiple strategies simultaneously to increase your hand. This allows you to spread your risk across multiple instruments while avoiding the risk of losing positions.

Weaknesses

- Over-optimization – A focus on curve fitting creates automated daily trading algorithms that should be fantastic in theory but often fall short when it comes to real-time trading. for example; Many people fine-tune their plans with nearly 100% profitable trades. However, when applied to the real market, it may fail completely. That’s why you should stick with low-end deals until you’ve worked out all the wrinkles.

- The System Disappears – Even the best automated day trading software can cause false trends. As prices react to unfolding developments, erroneous trends can spiral out of control. This was demonstrated by the Knight Capital group in August 2012. I lost $445 million in 30 minutes when my trading software was scammed based on my trading terms.

- Updates – Automated daily trading software needs to be updated according to changing market conditions. This means you need people who know exactly what they’re doing. This can put you at the unfortunate mercy of whoever writes and updates your software.

- Monitoring – People mistakenly believe that once they have created an automated daily trading strategy, they can just sit back at their computer and do all the heavy lifting. Please don’t comment on what could be missing or duplicate orders.

Getting started

Even with the best automation software, there are a few things to keep in mind. Keep it simple first as you gain experience, then switch to more complex automated daily trading strategies.

Copy trading can be a solid introduction to auto trading for beginners.

Many automated systems are tailored to specific markets and specific trading styles.

Therefore, applying your automated weekly trading algorithm to several different markets may not give you the desired returns.

Whatever your automated software is, you need to create a purely mechanical strategy. Automated weekly trading systems cannot guess, so remove all discretion.

Copy trading

At its most basic level, copy trading is a very simple form of automated trading.

Copy Trading allows you to copy other traders’ trades. So you can ‘follow’ a trader (or better group of traders) by reviewing their past performance and specific trade details.

As they open and close trades, you will see open trades in your account. You can adjust your investment amount, so someone with $100 can still follow the trades of someone with $1m.

Copy trading means you are not responsible for opening and closing trades. You still have to choose which traders to copy from, but all other trading decisions are taken out of your hands.

Copy trading is probably the most “hands-on” of automated trading.

Finding the best automation software

There is no one size fits all when it comes to automated day trading systems.

It depends on your needs, the market you want to apply it to, and the amount of customization you want.

Experienced traders may want to develop their own trading software from scratch to achieve ultra-fast, automated trading completely customized to their tastes (more on that later).

Below are the most popular ready-made automatic systems.

- AlgoTrader Software

- MetaTrader (MT4 and MT5)

- Tradestation automation software

- Etna Automated Trading Software

- Electronic signal automated trading software

- Option Robot Automation Software (binary trading only)

- robo advisor

Develop your own software

You can also develop your own software if you cannot find commercially available software that provides the functionality you need.

It’s easier than ever thanks to code editing tools like VIM and online marketplaces that make it easy to find freelancers with the skills you need.

Developing your own software comes with several benefits and risks:

Benefits:

- You have full control over how your software works, looks and feels.

- You can include only the features you need, so you can optimize your software to work faster than available commercial software.

- You can build software around complex algorithms.

danger :

- Can be expensive if you don’t know how to do it yourself. As with most construction projects, final costs are usually higher than initial estimates.

- This software has not been tested and may contain bugs. Commercial software has been tested by thousands of hours, is used by thousands of traders, and encounters many problems. The software may perform in unexpected ways. Even large commercial operations have problems with trading robots that either perform amazing trades or drive large sell-offs due to the actions of other robots.

Before deciding to develop your own software, research all software available on the market.

There are two main ways to build your own trading software. Design it yourself or hire someone else to design it for you.

Program your own software

Designing your own trading software requires a basic knowledge of programming and how to code trading algorithms.

Numerous software packages make the process easier, but they all require basic programming knowledge.

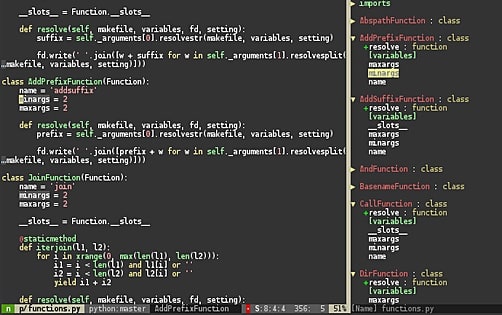

No tool can help the lack of programming skills, but for knowledgeable coders, one of the best editors for building automated trading bots is Vim.

Vim is a general-purpose text editor specifically designed to make developing your own software easy. It was created in 1991 by Bram Moolenaar, the founder of Vim.

Vim is based on Bill Joy’s vi text editor. Vim is a “charity program”. All proceeds go to help children in Uganda. Vim makes it easy to create and edit software.

Vim is a command-based editor. You can activate other features using text commands rather than menus.

The command-based interface allows the software to offer a wide selection of features while maintaining a very lightweight and clean interface.

Vim is suitable for beginners and experienced developers alike.

This platform is very popular with software developers because the tools make it easy to get a grip on the code and find bugs before they cause problems.

It can be customized to handle hundreds of programming languages and supports a wide range of plugins for added functionality.

API

If you decide to develop your own software, you are free to create it any way you like.

However, your freedom is limited by the API (Application Programming Interface) provided by the trading platform.

An API is what allows trading software to communicate with a trading platform to place orders.

The trading software can only trade supported by third-party trading platform APIs.

If a specific feature is important to you, you should choose a platform with an API that provides that feature.

If the trading algorithm needs to react to what is happening in the market in some way, then the bot needs to get the market data in some way (in real time).

If your trading decisions are based on fundamental factors and you are waiting for the “right price”, getting market data with millisecond delays may not matter.

Hiring a software builder

If you don’t know how to create software yourself, or don’t have the time to do so, you’ll need to hire a third-party freelancer or company.

You can choose a local developer or freelancer online. Communicate more easily and get the results you want by using a local developer you can see for yourself.

However, it may be cheaper to use an online freelancer. Also, since this is a very rare skill, you can also choose a developer with a lot of experience in trading software.

Hire experienced developers who can develop reliable software that works well. Don’t try to get it done as cheaply as possible.

Good trading software is worth its weight in gold. A poorly designed robot can cost a lot of money and money.

You should give the developer a detailed explanation of what to expect from your trading software. Include all desired features in the job description.

Don’t assume anything is a given. Developers can’t read your mind and may not know or presume things like you do.

final verdict

Automated weekly trading is becoming increasingly popular. But if you’re going that route, you’ll need to test your strategy back and forth often. There is no substitute for carefully executed manual trades.

Don’t be complacent if you trust automation.

Jack Schwager highlighted this in his ‘Market Wizards’ book series in which he interviewed successful automated day traders.

Everyone has had a lot of interest in automated strategies, so don’t take a backseat to trading.

Further reading

- Quantopian.com – A website that researches historical stock price data and builds trading algorithms that can be backtested against that data.

Research

- “Exploring Automated Trades: Modeling Financial Systems with Varying Degrees of Automation, Display Design and Valuation”, Yeti Li, November 2017

- “Performance evaluation of automated trading systems based on non-parametric methods”, TN Batova, TM Sizova, AV Khomkov, December 2017

Books

- “Professional Auto Trading: Theory and Practice”, Eugene A. Durenard

- “Automated Options Trading: Creating, Optimizing and Testing Automated Trading Systems”, Sergey Izraylevich Ph.D., Vadim Tsudikman

- “Electronic and Algorithmic Trading Technology: The Complete Guide”, Kimdall Kim