Forex trading is a huge market. Billions are traded in foreign exchange every day. Whether you are an experienced trader or an absolute beginner in online forex trading, finding the best forex broker and a profitable forex trading strategy or system is complicated. So you to learn the basics before choosing the best route.

With this introduction, you will learn general forex trading tips and strategies that apply to currency trading and online forex. It also highlights potential pitfalls and useful metrics to get you to the facts. Finally, use our list of trusted brokers to compare the best forex platforms for daily trading in South Korea in 2020.

Read on to find out the AZ of forex trading, how to start trading, and how to judge the best platform.

Why trade forex?

The forex currency market offers day traders speculation about the foreign exchange market and the movements of a particular economy or region. Additionally, forex without a central market offers trading opportunities around the clock.

- Liquidity – The foreign exchange market has an average daily trading volume of over $3.2 trillion. So there are many trades and moves you can make.

- Diversity – First, there are pairs derived from eight major global currencies. You can also trade many local currency pairs. More options, more opportunities for profit.

- Accessibility – The forex market is easily accessible 24 hours a day, 7 days a week. As a result, you decide when to trade and how to trade.

- Leverage – A significant amount of forex currency pairs are traded on margin. Leverage allows you to buy and sell large amounts of currency. The higher the quantity, the greater the potential profit or loss.

- Low Fees – Forex offers relatively low fees and fees compared to other markets. In fact, some companies don’t charge any fees at all, you only pay the bid/ask spread. A true ECN company can even offer 0 spreads!

Currencies traded in Forex

major

In the world of international forex trading, the majority of people focus on the 7 most liquid currency pairs on the planet.

- EUR/USD (Euro/Dollar)

- USD / JPY (dollar / yen)

- GBP/USD (British Pound/Dollar)

- USD / CHF (dollar / Swiss franc)

There are also three new pairs.

- AUD / USD (Australian Dollar / USD)

- USD / CAD (dollar / Canadian dollar)

- NZD / USD (New Zealand Dollar / Dollar)

These currency pairs, along with their various combinations, account for more than 95% of all speculative trades in the forex market as well as the forex market.

However, you will find that the US dollar is widely used in major currency pairs. Since it is the world’s leading reserve currency, it participates in around 88% of currency transactions.

minor

When a currency pair does not contain US dollars, it is referred to as a ‘minor currency pair’ or ‘currency currency pair’. So, the most traded minor currency pairs include the British pound, euro or Japanese yen:

- EUR / GBP (Euro / British Pound)

- EUR / AUD (Euro / Australian Dollar)

- GBP/JPY (British Pound/Yen)

- CHF / JPY (Swiss Franc / Japanese Yen)

You can also learn more about trading exotic currencies like Thai Baht, Norwegian or Swedish Krone. However, these exotic extras bring greater risk and volatility.

Find the best forex broker

The “best” forex broker will often be a matter of personal preference. It may depend on the pair you need to trade, platform, trade using the spot market or per point or ease of use requirements.

Here is a list of comparison factors. Some factors are more important to you than others, but they are worth considering when trading online. More details on all these elements for each brand can be found in our individual reviews.

lowest trading costs

Spreads, commissions, lodging costs – everything that reduces your profit on a single trade needs to be considered. High-frequency trading means these costs can add up quickly, so comparing fees will be a big part of choosing a broker. Inactivity or withdrawal fees are noteworthy as they can be another multiplier on your balance.

Trading platform

The trading platform should be right for you. Whether you want a simple cut-down interface or multiple built-in features, widgets and tools, your best choice may be different from others. For more information about our online forex trading platform, please visit here.

A demo account is a great way to try out different platforms and see what works best for you. Also, many platforms are configurable, so no default view is maintained.

Mobile trading

Forex trading on the go is important to some people and less important to others. Most brands offer compatible mobile apps, usually on iOS, Android and Windows.

If this is key to you, make sure the application is the full version of the website and don’t miss any important features. Downloading these apps is usually quick and easy. Brokers want to trade. You can read more about our Forex trading app here.

Customer Service

Is customer service available in your preferred language? Is there live chat, email and phone support? When can I use it? How high a priority this is, only you will know, but it’s worth checking out.

Asset List

Does your broker offer the market or currency pair you want to trade? It’s a pretty basic check. Any broker will do it for you if you are trading major pairs. If you want to trade Thai Baht or Swedish Krone, you will need to double check your asset list and tradable currencies.

Regulation

Do you want a broker regulated by a specific body like FCA, SEC or ASIC? European regulations may affect some leveraged options, so this may affect more than just your peace of mind. We cover the regulations in more detail below.

Spreads or commissions

Some are covered by transaction costs, but spreads are often a comparison factor on their own.

Because you are not tied to one broker. If you trade 3 or 4 different currency pairs and no single broker has the tightest spreads on all of them, shop around. There is nothing wrong with having multiple accounts to take advantage of the best spreads on each trade. Beware of spreading slippery ‘hidden’ too often.

Payment methods

A particular forex broker’s deposit method options may be of interest to you. Would you like to use Paypal, Skrill or Neteller? Did you know that you can withdraw this amount using your credit or debit card?

Some forex brokers now also accept deposits in Bitcoin or other cryptocurrencies.

Security

Most brands segregate customer and company funds as per regulatory requirements, and provide a certain level of user data security.

Some brands can give you more credibility than others, and this often has to do with regulators or where your brand is licensed. Forex trading can attract unregulated operators. Security is a worthy consideration.

Demo accounts

Try before you buy. Most reliable brokers will be more than happy to show you that their platform is risk-free. Trading on a demo account or simulator is a great way to test a strategy, backtest or learn platform nuances. Try as many as you need before choosing. It is recommended to use multiple accounts (although it is recommended).

Account types

There can be different account types from cash, margin or PAMM accounts to Bronze, Silver, Gold and VIP levels. Differences may be reflected in cost, spread reduction, level II data access, consensus or other leverage. For example, smaller accounts may have lower trade size limits.

For example, retail forex and professional accounts are treated very differently by brokers and regulators. An ECN account gives you direct access to the Forex contract market. So, research what you need and what you receive.

Benefit

For European Forex traders, this can have a huge impact. Forex leverage is limited to 1:30 by most brokers regulated in Europe. Assets such as gold, oil or stocks are capped separately.

However, in Australia, traders can utilize leverage of 1:500. This makes a huge difference to your deposit and margin requirements. The Australian brand is open to traders from all over the world, so some users have regulatory protection or the freedom to trade as they please.

Higher leverage increases potential losses as well as potential gains.

Tools or features

Brokers offer a variety of tools to enhance your trading experience, from charts to futures prices or custom trading robots. Again, as a crucial factor in opening an account, their availability is up to the individual. Level 2 data is one such tool, and the brands that offer it may be your favourite.

Education

Newbies in forex trading in particular may be interested in the tutorials the brand offers. It can be in the form of e-books, pdf documents, live webinars, expert advisors (ea), courses or full academy programs. Whatever the source, it’s worth judging the quality before opening an account. Forex companies often encourage you to trade because they want you to trade.

MetaTrader 4 or 5

Integration with popular software packages like Metatrader 4 or 5 (MT4 or MT5) can be important for some traders. Many brands offer automated trading or integration with related software, but you must check it out if you want to use it.

Bonus

From cashback to no deposit, free trades or deposit matches, the broker offered many promotions. Regulatory pressure has changed all of this. Bonuses are few and far between now. Our directory lists where it is offered, but it is not a decisive factor in choosing to trade forex. Also, always check the terms and conditions to avoid over-trading.

Execution speed

Desktop platforms usually offer excellent execution speed for trades. However, mobile apps may not. This isn’t always the fault of the broker or the application itself, but it’s worth testing.

Scams

Our reviews have already filtered out scams, but don’t miss these checks if you’re considering other brands.

- Were you ‘cold cold’? Reputable companies don’t call me out of the blue (including email, Facebook or Instagram channels)

- Are you offering unrealistic benefits? The moment they stop and think – why call or advertise on social media if you can make the money they claim?

- Are they trading on your behalf or offering to use your own managed or automated trading? Don’t let others control your money.

If in doubt, proceed. There are many brokers out there that are legitimate and legit.

Having reviewed all these comparison factors, you can now pick the best forex brokers, take a test drive with a demo account and choose the one that suits you best. We rated the broker based on our own opinion and gave the rating indicated in our table, but only you like it, we can award you ‘5 stars’!

Read who won the DayTrading.com ‘Best Forex Broker 2020’ on our Awards page.

Forex Broker Reviews

Compare all the FX brokers we reviewed using this table along with our reviews of the top forex brokers. Some of these forex brokers may not accept trading accounts opened in your country. If it is determined that the broker will not accept your position, it will be grayed out in the table.

| Broker | Demo | Min Dep. | MT4 | Bonus |

|---|---|---|---|---|

| 24 options | yes | $250 | yes | no |

| Al fly | yes | From $/£/€ | yes | yes |

| ATFX | yes | 100 $/€/£ | yes | no |

| Avatar Day | yes | $ 100 | yes | no |

| AxiTrader | yes | 0 $/€/£ | yes | no |

| Ai Yondo | yes | £ 1 | yes | no |

| BDSwiss | yes | 100 $/€/£ | no | no |

| Binary.com | yes | $ 5 | yes | no |

| Capital.com | yes | £/$/€100 | no | no |

| CityIndex | yes | £/$100 | yes | yes |

| CMC market | yes | £ 0 | yes | no |

| Deriv.com | yes | €/£/$5 | yes | no |

| Easy Market | yes | € 100 | yes | no |

| itoro | yes | $200 ($50 in the US) | yes | no |

| ETX Capital | yes | £ 250 | yes | no |

| Finq.com | yes | $ 100 | yes | yes |

| Forex.com | yes | $50 | yes | no |

| Fusion Market | yes | no minimum | yes | no |

| FXCM | yes | £ 300 | yes | no |

| FXPro | yes | $ 100 | yes | no |

| FXTM | yes | From $10 | yes | yes |

| IC Market | yes | $200 | yes | no |

| IG group | yes | £ 250 | yes | no |

| InstaForex | yes | $1 to $10 (depending on account selection) | yes | no |

| Interactive Broker | yes | $ 10000 | no | no |

| Invest.com | yes | £ 0 | yes | yes |

| Invest | yes | $250 | yes | no |

| IQ Options | yes | $ 10 | no | no |

| Just2Trade | yes | £ 2500 | yes | no |

| LCG | yes | 0 $/€/£ | yes | no |

| Libertex | yes | £/€10 | yes | no |

| Markets.com | yes | $ 100 | yes | no |

| or dex | yes | $250 | no | no |

| Ninja Trader | yes | $50 | yes | no |

| NordFX | yes | $ 10 | yes | no |

| Oh I know | yes | $0 | yes | no |

| Pepper Stone | yes | £200 / $200 | yes | no |

| plus 500 | yes | $ 100 | no | yes |

| Pig Bank | yes | $ 10000 | yes | no |

| Skilling.com | yes | 100 £/€/$ or 1000 NOK, SEK | no | no |

| Spreadex | no | $ 1 | no | no |

| TD American Trade | yes | none | no | yes |

| Trading 212 | yes | €/£/$100 | no | no |

| UFX | yes | $ 100 | yes | no |

| VantageFX | yes | $200 | yes | yes |

| Bidet Po Rex | yes | $250 | no | yes |

| XM | yes | 5 $/€/£ | yes | yes |

| XTB | yes | $250 | yes | no |

| Zulu Trade | yes | $1 – $300 (depending on your broker choice) | yes | no |

Forex regulation

Regulation should be an important consideration. Whether the regulator is inside or outside Europe has a serious impact on trading. The European Securities and Markets Authority (ESMA) has imposed strict rules on forex companies regulated in Europe. This includes regulators such as:

- CySec (Cyprus Securities and Exchange Commission)

- Financial Conduct Authority (FCA)

- BaFin – (bundle for Finanzdienstleistungsaufsicht)

- Swiss Financial Market Supervisory Authority (Switzerland)

ESMA governs all regulatory agencies within the EEA.

These rules include leverage limits or limits and vary by financial instrument. Forex leverage is limited to 1:30 (or x30). Outside of Europe, leverage can reach 1:500 (x500).

Traders in Europe can apply for specialist status. This removes regulatory protections and allows brokers to offer a high level of leverage among other things.Outside of Europe, the largest regulators are:

- SEC – Securities and Exchange Commission (US)

- CFTC – Commodity Futures Trading Commission (English)

- CSA – Canadian Securities Administration

- ASIC – Australian Securities and Investments Commission

This includes countries outside of Europe. Forex brokers that cater to the likes of India, Hong Kong, and Qatar are likely to be regulated in one of the above, but not all countries they support. Some brands are regulated all over the world (one brand is even regulated in 5 continents). Some agencies issue licenses and others hold law firm registrations.

ASIC forex brokers are therefore able to offer high leverage to traders in Europe.

Which currency should I trade in?

Investors should initially stick with major and minor pairs. This is because trades are easy to find and lower spreads allow you to expand.

Exotic pairs, however, have much more illiquidity and spreads. In fact, you can make some serious cash with exotic pairs because they are risky. Even a single session can lead to huge losses.

See live forex rates here.

How is Forex traded?

The logistics of Forex trading are pretty much the same as all other markets. However, there is one important difference to highlight. On a forex trading day, you are trading a currency while simultaneously selling another currency. Hence, that is why currencies are sold in pairs. Therefore, the exchange rate price you see in your forex trading account represents the purchase price between the two currencies.

For example, the rates you find for GBP/USD indicate how many US dollars a pound of pound will buy. So, if you have reason to believe that the pound will appreciate more than the US dollar, it makes sense to buy pounds in US dollars. However, when the exchange rate rises, the pound is sold back to make a profit. Similarly, Euro, Yen, etc.

Contracts

Forex contracts are available in the following types:

- Spot Forex Contract

- Existing contracts. Shipping and payment are instant.

- Forex contracts for futures

- Delivery and payment are in the future. A price is agreed upon directly, but the actual exchange will occur in the future.

- Currency Swap

- When two parties can exchange currencies, often in the form of loans, or exchange loan payments in different currencies.

- Option Forex contract

- An option gives the trader the option (but not the obligation) to exchange a currency for a specified price on a future date.

Forex orders

There are various Forex orders. Some are common, others less so. Using the right one can be important.

The two main types of Forex orders are:

1. Instant order or market order

2. Pending orders

Instant Orders / Market Orders

These are immediately executed at market prices.

Buy is a ‘going long’ or profit order in a rising market. Sell means opening a short position at a falling expected value.

Pending orders

A stop loss is a preset level at which a trader would like to place a close trade (stop out replacement) if the price moves against them. It is an important risk management tool. You tell your broker to close the trade at that level. A guaranteed stop means a firm guarantee that you will close the deal at the requested price.

Non-guaranteed stop-losses can ‘slip’ in volatile market conditions, and trades close to, but not close to, close levels. The shock of the Swiss franc (CHF) being ‘unpegged’ was one such event.

A trailing stop asks that the broker move the stop loss level along with the actual price – but only in one direction. So a long position will raise your stop in a rising market, but stay there if the price declines. This allows traders to reduce potential losses and ‘lock in’ their profits at good times while maintaining a safety net.

A take profit or limit order is the point at which a trader wishes to close a trade. It is a good tool for discipline (planned trade closing) and key to certain strategies. It is also very useful for traders who may not be able to see and keep tabs on their trades all the time.

One cancels the other

An order to cancel another order (OCO) order is a combination of a stop and limit order, but when one order is triggered, the other order is removed or cancelled. This is an important type of strategic deal.

Cryptocurrency

Major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and Ripple (XRP) are often traded in currency pairs against the US dollar. These can be traded like any other FX pair. Exchange values such as BTC/ETH or ETH/LTC are also sometimes available.

Charts

Charts play an important role in technical analysis. So, you need to find a time period in which opportunities can be easily identified. In fact, the chart on the right will paint a picture of where the price is heading forward. For example, daily trading forex with daily candlestick price patterns is popular.

See the chart page for detailed instructions.

Strategy

An effective forex strategy should focus on two main factors: liquidity and volatility. These are some of the best indicators for any forex trader, but short-term traders especially rely on them.

Forex trading is very specific. The average long-term futures trader can place a 12-pip hedge (the minimum price movement is usually 1%) and cut 12, but a day trader simply cannot. Because those 12 pips can be the entirety of your expected profit on the trade.

Precision in forex comes from the trader, but liquidity is also important. Illiquidity means that orders will not close at the ideal price no matter how good the trader is. As a result, this limits day traders to specific trading instruments and times.

Volatility is the magnitude of a market movement. Thus, firm volatility for traders reduces instrument selection for currency pairs depending on the session. Volatility varies from session to session, giving important components such as when to trade, summarized below.

When to trade

You can trade 24 hours a day, 5 days a week, but forex trading is not 24.7. You should only trade when the forex trading pair is active and the volume is sufficient. Forex trading on weekends will see small volumes. If you consider GBP/USD for example, there are certain times when there is enough volatility to generate a profit that can negate the bid price spread and fee costs.

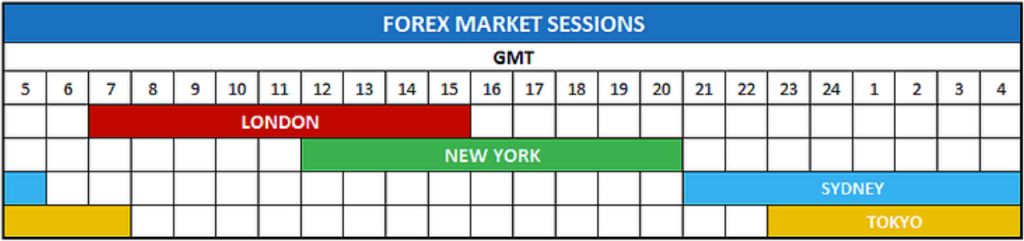

Due to different time zones, the foreign exchange market is alive 24 hours a day because the world markets are always open somewhere. Nonetheless, not all markets actively trade all currencies. As a result, different forex pairs are actively traded at different times of the day.

For example, when the UK and Europe open, pairs comprising the Euro and Pound will have difficulty trading activity. However, pairs containing the US Dollar and Canadian Dollar are actively traded when New York (US and Canada) is on the desk.

So if you are trading the EUR/USD pair, you will find the most trading activity when New York and London are open, Tokyo is JPY and Sydney is AUD.

You can use the forex daily chart to view key market hours in your own time zone. The image below shows opening hours and session end times for London, New York, Sydney and Tokyo. A crossover period represents a session with the most activity, volume, and price action.

Forex Trading Session

Each session has its own ‘feel’.

- Asia Session: Consists of Asian markets, opening in New Zealand and Australia and moving west. These sessions produce less volume and smaller coverage. JPY, NZD and AUD are popular markets and news events can move prices significantly.

- The London (‘European’ Session): It actually starts in Frankfurt, an hour later in London. The UK opening will see more trading volume in the forex market and will see the most volatility in this session. European institutions, banks and account managers are active and macroeconomic data are open.

- New York (US) session: Starts at 9:30 AM New York time, but US base data may be off at 8:30 AM. This could create an initial volume before the ‘official’ 9:30 opening.

The ‘crossover’ between London and New York shows the greatest volatility and liquidity. Key fundamental data are released, financial institutions trigger foreign exchange contracts, and ‘smart money’ is included.

Trading alerts or signals

Forex Alerts or Signals come in a variety of ways. User-generated alerts can be created to ‘pop up’ via simple broker trading platform tools, or more sophisticated third-party signal providers can send alerts to traders via SMS, email or direct message. Whatever the mechanism, the goal is to start trading as soon as certain criteria are met, even if the goal is the same.

These criteria usually rely on chart patterns and/or candlestick configurations. Our Charts and Patterns page covers these topics in more detail and is a good starting point. Paying for signal services without understanding the technical analysis that provides them is risky.

You can’t judge a service if you don’t understand it.

Traders who understand indicators such as Bollinger Bands or MACD can set their own alerts.

However, during the poor period, paid services can prove beneficial. Of course, you need enough time to actually make a deal, and you have to have confidence in your supplier.

It is unlikely that anyone with a profitable signal strategy will share it cheaply (or at all). Beware of promises that are too good to be true. You can read more about Automated Forex Trading here.

50 Pips a Day

You will be the first to see it when you download a pdf with forex trading strategies. Even beginners can benefit from this simple yet powerful technique as it is not an advanced trading strategy. However, it’s worth keeping pace with the major pairs before breaking through to the more exotic ones.

So, when the 07:00 (GMT) candlestick closes, you should place two contrasting pending orders. First, place a buy stop order 2 pips above. Then place a sell stop order 2 pips or less from the bottom of the candlestick. As soon as the price activates one of the orders, cancel the non-activated order.

You should also place a stop loss order 5-10 pips above the 07:00 high/low. This helps you deal with trading risks. Now set your profit target to 50 pips. At this point, you can kick back and take a break while the market works.

If by the end of the day your trades reach or exceed your profit targets, you have all your plans and you can repeat them the next day. However, if your trade has a variable loss, wait until the end of the day before the trade closes.

Forex trading software

There are various software for forex traders. Cost and benefits will be your main considerations and we take a closer look at a few software platforms on this website.

MetaTrader 4

AlgoTrader

TradingView

ninja trader

The platform is available for Mac or Windows users, and there are also specific applications for Linux.

Social trading (or ‘copy trading’) platforms are another variety of software related to forex trading. Pioneers of this kind of service:

itoro

Zulu Trade

We expand our selection on our software trading platform page and our software page.

Education

If you want to increase your forex trading salary, you should take advantage of various educational resources such as:

- Books – Get profitable strategy books, books on scalping, regulations, pricing, technical indicators and more. There are also many niche books available. For example, you can find the best books for beginners or two-step trend analysis strategies.

- Chat Rooms and Forums – Weekly trading forex live forums are a fantastic way to learn from experienced traders. Some even share the best free trading systems. Beware the quality of advice.

- Blog – If you want to hear success stories from forex millionaires, you should visit our forex trading blog. Again, seek advice.

- Forex websites – There are a number of specific forex websites. Some offer techniques for spotting free signals, trend lines and setting platforms.

- PDF – You can find PDFs of many forex trading systems online. Unlike live chat rooms, charts are often provided to support written evidence.

Tips

Money Management

The most profitable forex strategy requires an effective money management system. One technique many suggest is to never trade more than 1-2% of your account in a single trade. So if you have $10,000 in your account, there is no risk of exceeding $100 to $200 in individual trades. As a result, temporary bad results do not hit all capital.

Then developing a coherent strategy can increase your risk parameter. The Kelly Criterion is a specific plan worth looking into.

Automation

Automated forex trading can improve your profits if you have consistently developed an effective strategy. This is because instead of entering trades manually, an algorithm or bot automatically enters and exits positions when predetermined criteria are met. Additionally, there is often no minimum account balance required to set up an automated system.

However, those looking for a way to start trading from home will have to wait until they first hone an effective strategy.

For further instructions, see the Automated Trading page.

Taxes

If you read blogs about forex traders like ‘Everyday Life’, they are often unaffected by taxes. It’s important to check the rules and regulations you actually trade with. Failure to do so may result in legal issues.

Please see our Tax page for details.

Webinars and training videos

They are the perfect place to get help from an experienced trader. Because forex webinars can guide you through setup, price action analysis, and the best signals and charts for your strategy. In fact, webinars are in many ways the best place to get a first-hand guide to the basics of currency day trading.

3 mistakes to avoid

1. Averaging

You may not do that at first, but many traders eventually fall into this trap. The biggest problem is that you are taking a losing position at the cost of both money and time. A trend can go down many times, but eventually it will lead to a margin call because the trend can last longer than liquidity can hold.

This is especially problematic for day traders, as opportunities arise over a limited period of time that quickly lead to bad trades and you have to take advantage of the opportunities as you go out.

2. Deal soon after news

Big news comes out and markets start to skyrocket or plummet quickly. While you may be tempted to jump on the easy money train at this point, doing so without you having a disciplined trading plan in place can be just as damaging as gambling before the news breaks. This is because trades can quickly lead to large losses as liquidity drops and prices move rapidly, resulting in large fluctuations or ‘whips’.

Solution – Wait for the volatility to subside so you can see the trend.

3. interest day

It is recommended to have an effective trading method and system once a day. However, even consistent strategies can go wrong when faced with the unusual volumes and volatility seen on any given day. For example, holidays such as Christmas and New Years or days with a lot of breaking news can lead to unpredictable price movements.

Countries

There may be specific issues in countries or regions where you do Forex trading. For example, US and Canadian forex traders should read Pattern Trading Rules (slightly easier for Canadian traders).

Trading in South Africa is safest with FSA regulated (or registered) brands. Areas classified as ‘non-regulated’ by European brokers have a much lower level of ‘basic’ protection. So local regulators can give you extra confidence.This is similar in Singapore, Philippines or Hong Kong. Therefore, the selection of the ‘best forex brokers’ varies from region to region.

Forex trading in less regulated countries like Nigeria and Pakistan means focusing on more established European or Australian regulated brands.

Forex trading; Is it profitable?

Many people ask what a trader’s salary is. But the truth is that it varies greatly. The vast majority of people will try to turn a profit and eventually give up. On the other hand, a small minority proves that it can not only make a profit, but also make a huge profit. So while you can trade forex, there are no guarantees. 75-80% of retail traders lose money.

Conclusion

Currencies are larger and more liquid markets than the US stock and bond markets combined. Indeed, surplus opportunities and financial leverage make it attractive to anyone looking to trade day-to-day.

Unfortunately, there is no universal best strategy for forex trading. But trade at the right time and keep volatility and liquidity at the forefront of your decision-making process. Please follow these general rules for FX Day trading:

Further reading