Cherry Trade suspended trading. The company no longer accepts new accounts.

Go back to our broker comparison table to search for alternative brokers.

CherryTrade is a relatively new broker, but it is gaining a reputation very quickly. Although offices are located in London, the company has quickly established itself around the world. Running on the SpotOption platform, it became popular with traders in a short time. This supports their goal of providing a brief introduction to trading where stock market experience is not a prerequisite for success. Easy-to-use tools and intuitive design make it a very ‘accessible’ broker, which is further enhanced by customer support.

It has 5 different levels of accounts to meet the different needs of its clients, and it offers a great feature called ‘iFollow’, which is a fantastic tool for novice traders. Details are detailed below.

head straight; payout

Other highlights about CherryTrade include:

- Demo Account – Yes (real money is required to open a demo account)

- Minimum Deposit – £200

- Minimum Deal – £5

- Signal Service – Yes

- Bonus Information – no deposit match bonus (up to 100%) or risk-free trading available.

- Mobile App – Yes. Android and iOS are available.

Trading platform

The trading platform is clear and intuitive, and we anticipate the company should focus on making trading accessible to everyone.

The clear design ensures that all relevant information about the trade is displayed and traders can quickly and easily select all the information they need.

Traders can have more than one trading window open, but each window offers the same display options. At the top left is the Asset List . These are a series of simple drop-lists that allow traders to select the appropriate asset. Next comes the expiration time and again can be modified via the drop down menu. The last row at the top of the trading window above the trading amount. When you complete this field, the potential payout number that appears just above the payout percentage is updated. This percentage is clearly displayed so traders know exactly what the payout will be.

The main section of the trading area on the left contains the price graph. The recent price movement of the selected asset is displayed. This information can be changed by amending the period. This is useful when traders want to see trends over a slightly longer term. Between the price graph and the payout is the current price and all important trade buttons. Here, traders can choose their own currency or put options. The entire trading area is incredibly simple and new traders will be up and running almost immediately.

Choose a trader

CherryTrade offers a variety of binary options types.

- Binary options – traditional high/low options. Do asset values rise or fall?

- Pair – Which of the two assets in a company’s stock usually performs best? Asset pairs are usually associated with, for example, Google and Amazon. This type of trading is not offered by most brokers.

- Long-term – Long-term options follow the same principles as standard binary options, but with a longer expiry period. Expiration times range from a week or two up to 9 or 12 months.

- 60 Seconds – High Octane Deal! Again, real trading is similar to trading in standard binary options, except here the expiry time is 60 seconds or less.

- One touch – A popular and potentially quick launch option type. An asset will ‘touch’ a certain value before expiry. One touch option usually has a high touch value and a low touch value.

- Ladder – CherryTrade offers a ladder through their platform which is not available with many brokers. A ladder is a staggered price that allows traders to make real profits when an asset’s price breaks through many ladder ‘waste’. CherryTrade’s payouts can reach over 1000% with this type of instrument.

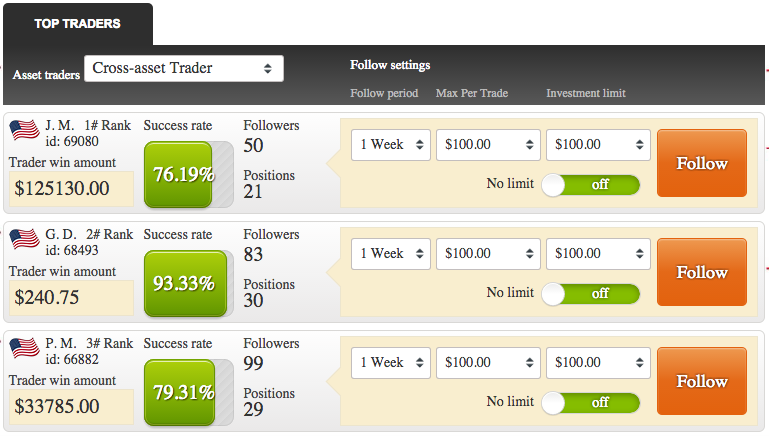

- iFollow – The iFollow feature is listed with the transaction type, but it is not actually a transaction type. It is a tool that allows traders to mimic the trades of other profitable traders. More on this in the ‘Other Features’ section.

CherryTrade has a good list of assets, but some brokers may offer more currency pairs and instruments. That said, there are all assets that trade well, and as a relatively new broker, CherryTrade will add their offerings.

mobile app

CherryTrade makes its trading platform available on mobile on both iOS and Android (version 2.3.3 or higher). The mobile app provides an easy-to-use trading area as a full website. The trading buttons are well positioned and sized, so all information is available, but the screen is not ‘discreetly’ used.

Past trade information is also displayed on the mobile application, with open positions listed and expired positions listed on a similar page. All relevant details of that transaction will be displayed. Account information can also be accessed from the mobile app, including deposit and withdrawal requests. Account balances can be displayed on any screen at any time, allowing traders to stay up to date anytime, anywhere.

The app is a great addition to CherryTrade and has been well received by traders looking for a mobile solution.

Payout

CherryTrade typically offers payouts of around 81%, depending on asset class and expiry time. Their payouts are on the higher end of the spectrum compared to their competitors, and more exotic trade types can offer higher payouts. The ladder can pay off especially (up to 1000%) if the trader believes the asset is approaching a volatile period and the price volatility is large.

Withdrawal and deposit options

CherryTrade offers a variety of deposit and withdrawal options. They also adopt stringent security measures that include a ‘proof of identity’ process (photo ID, proof of address and a copy if using a credit card) that must be met before depositing funds. However, this also makes the withdrawal process seamless.

Deposit can be made via eWallet, CashU, wire transfer, Maestro or credit card (credit cards include Visa, Delta, MasterCard, Diners and Visa Electron). Fees may apply if the bank transfer deposit does not exceed $500.

Withdrawal requires the same proof of identity steps before taking any action. This can be contentious with some traders who see it as an unnecessary delay. However, this is a legal money laundering requirement and actually protects consumers.

There are no fees for withdrawals to credit cards, and traders can make one wire transfer per month for free. However, there is a $30 fee for additional withdrawals via wire transfer each month. Withdrawals can only be returned to the card on which they were deposited. Also, withdrawals cannot exceed the total amount of deposits made to that card. The rest must be transferred via bank transfer. This means you have to withdraw the profits from your trades directly to your bank. Also, the maximum withdrawal amount per withdrawal is $20,000.

If the account needs funds, the trader can cancel the withdrawal. As long as the withdrawal is not processed, you can cancel it directly through CherryTrade by email or phone.

other features

CherryTrade has one additional feature called the ‘iFollow’ option which is a particularly attractive proposition. Here are the details and other features;

- iFollow – This feature allows traders (especially beginners) to follow trades taken by some of the most successful traders on CherryTrade. Users can choose the traders they want to follow, the duration of the trade and the amount they want to trade. CherryTrade automatically opens identical trades, allowing traders with little experience to benefit from knowledgeable and highly profitable traders. There is a growing trend for this kind of functionality, but CherryTrade is ahead of the game.

- Rollover – Delays the expiry of a binary option to the nearest available expiry in exchange for a premium.

- Double Up – Traders can repeat current trades with one click, maximizing profits from sustained price movements or continuing trends.

CherryTrade has grown quickly as it offers great options for new traders. However, they also cater to more experienced traders by offering a great list of assets and a wide range of trade types.