Are you looking for the best trading volume strategy? The hunt for the Holy Grail is over. With a 77% win rate, this may be one of the best forex trading strategies you can find on the internet. And it’s completely free.

Combining more than 30 years of trading experience, Korea-option.com has put together a step-by-step trading guide to help you analyze the strength of trends based on your trading volume.

The Forex market, like any other market, requires volume to move from one price level to another.

The foreign exchange market is the largest and most liquid market in the world, with $6 trillion of trades taking place every day. If you can master volume analysis, many new trading opportunities can emerge.

Volatility and large movements occur in the market when there is a lot of activity and volume in the market. That is what most traders need to trade for profit on the Forex market or any other market, be it stocks, bonds or cryptocurrencies.

It is possible to make money even in a narrow range market, but most trading strategies require additional trading volume and volatility.

Volume indicator

In the foreign exchange market, there is no centralized exchange of total volume, since we trade over the counter. If you look at trading platforms like TradingView, they have volume attached to their charts. However, since we have a lot of trading volume, our trading volume comes from the feed that TradingView uses. Each retail forex broker has its own aggregate trading volume.

We can see that the volume of the Forex market is segmented. This is why you should use the best volume indicator.

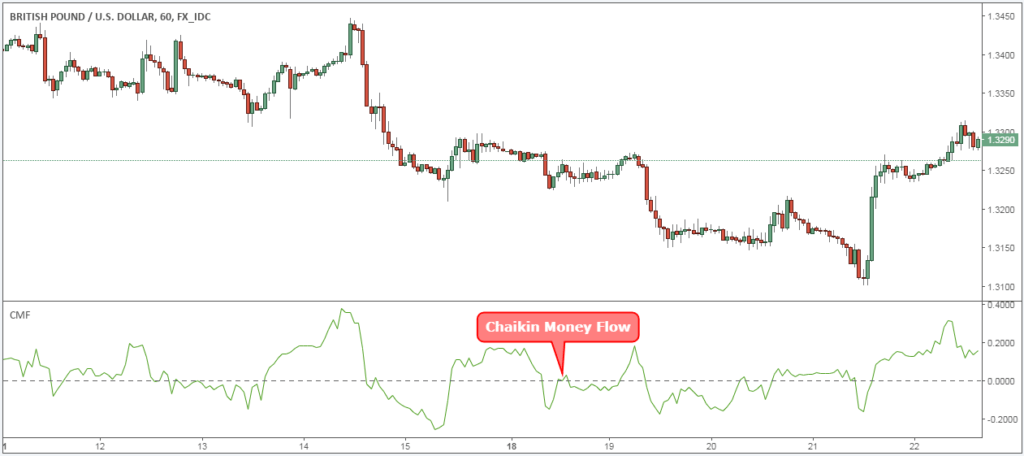

The volume indicator forex used to read volumes in the Forex market is the Chaikin Money Flow Indicator (CMF).

The Chaikin Money Flow indicator was developed by Marc Chaikin, a trading expert coached by some of the world’s most successful institutional investors.

The reason Chaikin Money Flow is the best and classic volume indicator is because it measures institutional cumulative distribution.

Generally in rallies, the Chaikin volume indicator should be above the zero line. Conversely, when selling, the Chaikin volume indicator should be below zero.

Bulk Trading Strategy

This bulk trading strategy uses two powerful techniques not found anywhere else. These are trade secrets that we have only been taught to professional traders.

The Chaikin indicator dramatically improves timing and teaches you how to trade defensively. It is absolutely essential to have a good defense when trading in order to retain the profits you have made.

It is always a good idea to take a piece of paper and a pen and write down the rules of this input method before going any further. You can also read Million Dollar Forex Strategies

In this article, we will look at the buying side.

The Importance of Buying and Selling

High-volume trades require attention to supply, which is in high demand.

High-volume traders look for cases of increased buy or sell orders. It also pays attention to current price trends and potential price movements.

In general, volume growth is highly dependent on buy orders. Traders will open up new positions due to this positive trend.

On the other hand, declining cash flow and trading volume could see a “bearish quarter” and this would be an appropriate time to sell.

You should also pay attention to the relative amount regardless of the number of raw transactions that occurred during the trading period. Ask yourself how your prospective assets are going and what do you anticipate relative to?

Learning how to use Chaikin money flow and other related metrics will make it easier to see if a buyer or seller is currently “in control.”

In fact, volume trading strategies can produce wins in your portfolio 77% of the time!

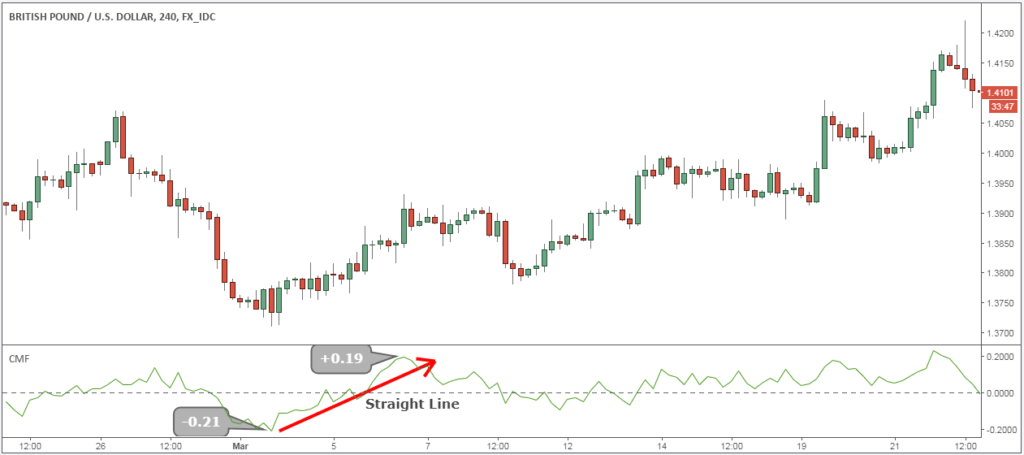

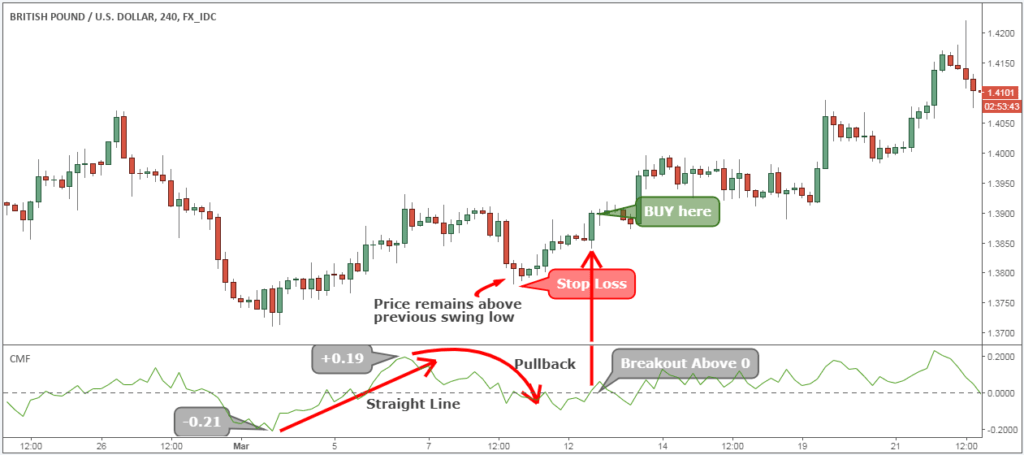

Step 1: The Chaikin Volume Indicator should shoot in a straight line from zero (min -0.15) to zero (min +0.15).

When volume goes from negative to positive in a strong way, it is likely to indicate strong institutional purchasing power. These are the basic heavy lifting signals!

Basically, I’ll let the market reveal its intentions.

When big money enters the market, it leaves a mark because the orders are too large to hide. When the volume indicator Forex moves straight from the zero line to above the zero line, you accumulate smart money.

We are firm believers in getting the maximum bang for your buck when you trade side by side with smart money. Institutions have more money and more resources at their disposal. The odds can be stacked against you, so follow your smart money if you want to change that.

There is one more condition that must be met in order for the transaction entry to be validated.

See below:

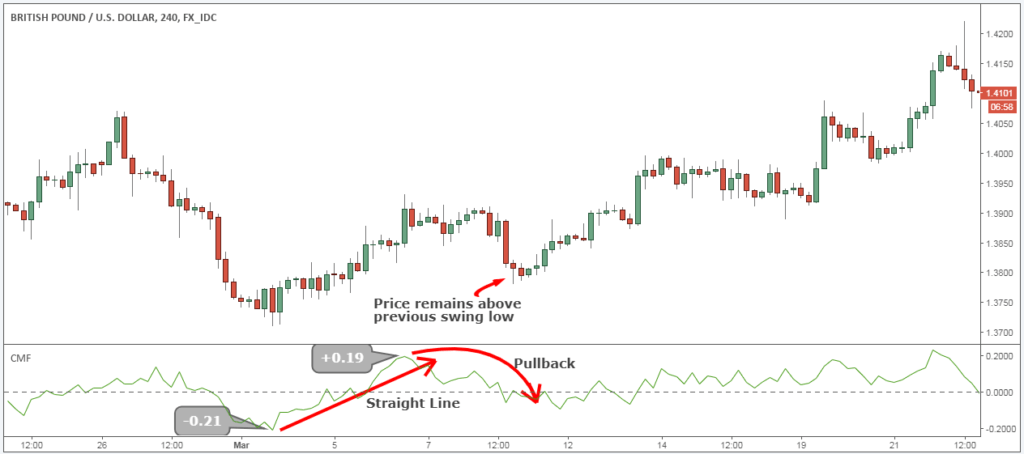

Step 2: Wait for the Volume Indicator Forex to slowly pull back below the zero line. The price should hold the previous swing low.

Once you find an elephant in a room called institutional players, you start looking for the first signs of market weakness. Here’s how to identify the right swings to increase your profits.

We will see the Chaikin Money Flow indicator slowly drop below the zero line. The keyword here is “slow”. We don’t want the volume to drop quickly because it negates the buildup we mentioned earlier.

Second, it ensures that the price stays above the previous swing glow when volume declines and drops below zero. This confirms smart money accumulation.

The trading volume strategy meets all the necessary trading conditions. That is, what are the trigger conditions for the entry strategy to move forward.

See below:

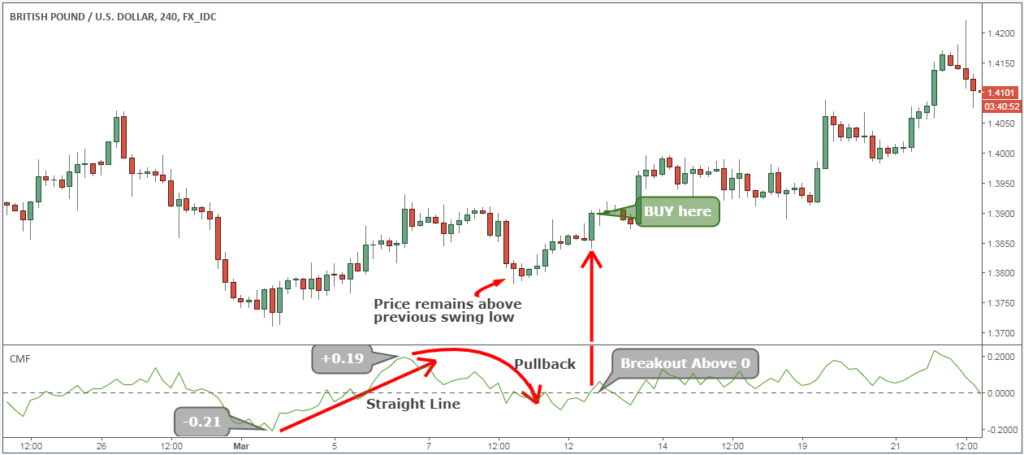

Step 3: Buy when the Chaikin Forex indicator breaks above the zero line. Wait for the candle to close before pulling the trigger.

Now we have observed real institutional money coming into the market, and we wait for them to withdraw their money and restore the market.

A breakout of the Chaikin indicator above zero indicates an imminent rally as the smart currency tries to raise its price again.

We’ll have to wait until the candle closes to see Chaikin cross the zero line. Once everything is aligned, we are free to open our long positions. Here is an example of Master Candle Settings.

*Note: The closing price of the trigger candle must be at least 25%.

This brings us to the next important step. We need to create a Chaikin trading strategy that identifies where we can place our protective stop losses.

See below:

Step 4: Hide Protection Stop Loss at Lower Levels of Previous Fullbacks

It is important to use a stop loss if you want to have an idea of how much you will lose on a trade. Do not underestimate the power of creating a stop loss as it can save lives.

If the previous pullback is low, you just hide your protective stop loss. Never use mental loss and always commit SL the moment you enter a trade.

Trades with large stop-losses offer a higher risk to reward ratio as well as an opportunity to trade with larger lot sizes.

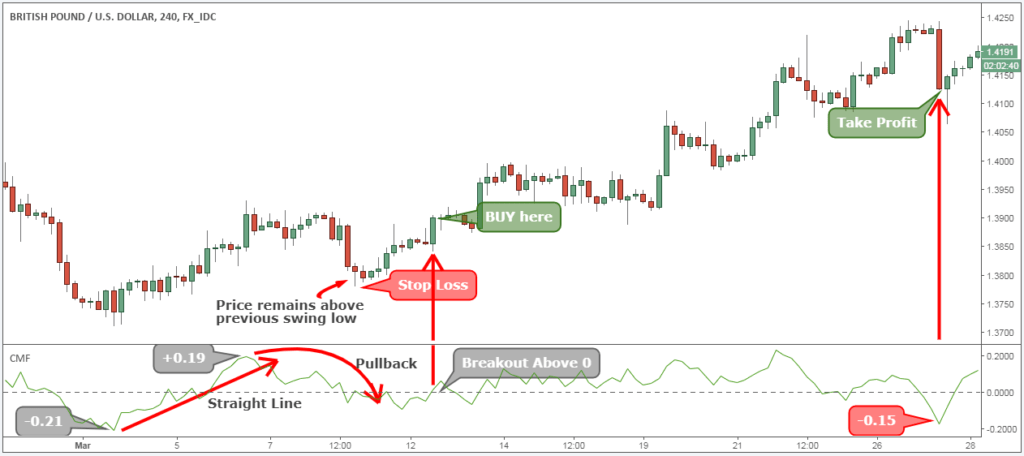

You should also learn how to maximize your profits with the Chaikin trading strategy.

See below:

Step 5: Take Profit When Chaikin Volume Falls Below -0.15

When Chaikin volume falls below -0.15, it indicates that sellers want to step in and take a profit. We do not want to risk returning some of our profits, so we liquidate our positions at the first sign of smart money on the other side of the market.

When the smart money buyers show up again, we can always come back to the market later.

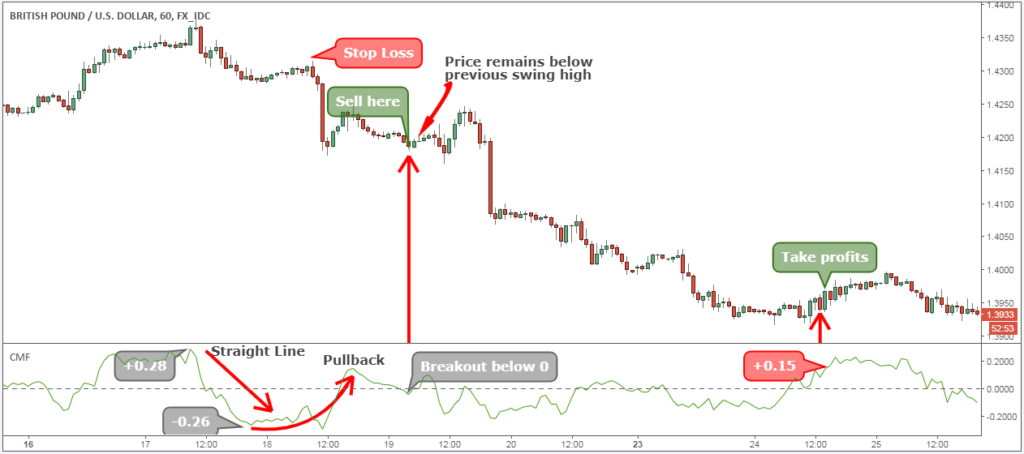

** Note: The above is an example of a BUY trade using the best volume indicator. Use the same rules for SELL transactions. In the picture below you can see an example of a real sale transaction.

Conclusion – Best Volume Indicator

Volume trading strategies will continue to work going forward because they are based on how the market moves down. All markets move from accumulation (distribution) or base to breakout and so on. This is how the market has been moving for over 100 years.

Smart money always tries to mask your trading activity, but the footprints are still visible. The mark can be read using an appropriate tool. Here’s another strategy on how to apply technical analysis step by step:

Follow this step-by-step guide to properly read Forex volumes. The Chaikin indicator adds extra value to your trading because it gives you the opportunity to view your trading volumes the same way you would when trading stocks.