This article explains how to use Bollinger Bands in day trading. This strategy uses two of the most popular trading indicators in the market: Bollinger Bands and RSI. Used to find price “bounces” that occur during major trends.

If you are looking for an effective Bollinger band trading strategy, we want to give you special attention.

This special strategy teaches you how to read Bollinger Bands and Bollinger Band signals. You will also learn about Bollinger Band Squeeze, Double Bollinger Band Strategy, Bollinger Band Secrets and more. We have also been trained on the ADX indicator.

Something like:

How to use the Bollinger Bands indicator

Bollinger Bands are well known in the trading community. A simple trading strategy can give you the awesome Bollinger Band formula.

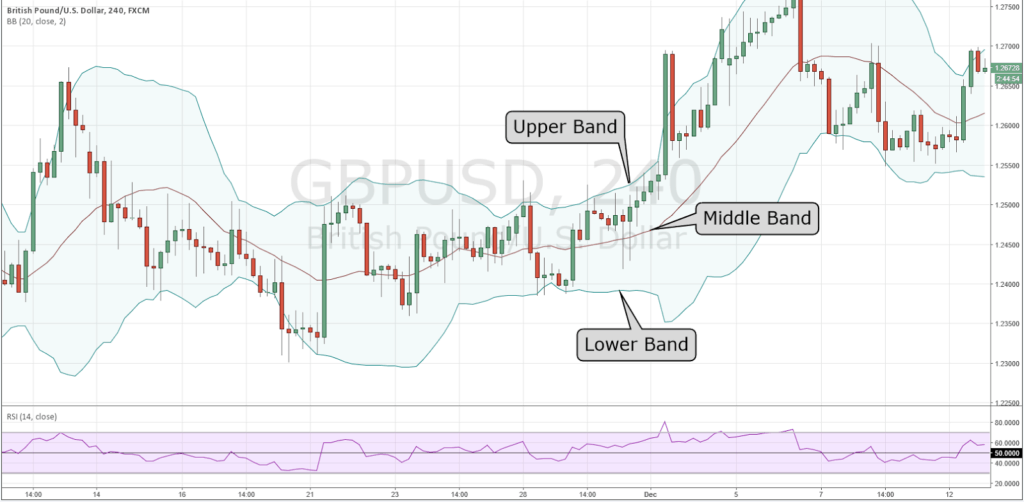

They were created by John Bollinger in the early 1980’s. The purpose of these bands is to define high and low relative to each other. So in theory, the price is high in the upper band and then low in the lower band. Bollinger Bands have three lines. Upper, middle and lower bands. The middle band basically acts as the base for the top and bottom.

It is primarily used to judge oversold or oversold levels. Sell when price touches upper band and buy when price touches lower band

The interval between the lower, upper and middle bands is determined by volatility. The middle band consists of a 20-period moving average. Above and below are the two standard deviations above and below the moving average from the middle. Standard deviation is a statistical measure that largely reflects price volatility.

When the band widens, it means there is volatility at that time. When the price moves very little, the bands narrow and there is little volatility.

I prefer this trading strategy using 1 hour or 4 hour time charts. You can adjust it depending on what style trader you are. However, this example shows that we are using a 4 hour 1 hour timetable.

Before looking at the rules of the strategy, let’s look at Bollinger bands. If you’ve never used this type of indicator in the past, let’s see how it would look on a chart:

After looking at the picture, it might seem prudent to buy whenever the price hits the lower band. On the other hand, sell whenever the price reaches the upper limit. This technically works, but it is a risky trading method using Bollinger Bands. Occasionally strong tendencies can ride these bands and stop many unlucky traders who have used their methods. This is why we use the RSI indicator to help us identify and trade the “bounce” of the upper or lower band. Also read about how bankers trade in the Forex market.

The RSI indicator is used in this strategy to see how a currency is weakening or strengthening. (Click here for other RSI trading strategy articles) .

This indicator should be provided as standard in your trading platform. The default settings are used, so no adjustments are necessary. Here you can learn how to fade momentum in forex trading.

Before starting, I recommend drawing a horizontal line at the 50.00 level on the RSI indicator. You will find out exactly why.

Trading indicators used with the Bollinger Band Bounce trading strategy:

- Bollinger Bands (20, 2)

- RSI (Relative Strength Index) indicator (14)

How to buy low and sell high

In theory, Bollinger Bands include all trading activity that occurs within 2 standard deviations of the expected standard (trend line).

This means that approximately 90-95% of price movements occur within this range.

Bollinger Band traders are looking for examples of resistance and support. A support case occurs when demand “concentrates” and a downward trend is likely to lose momentum. An instance of resistance, on the other hand, occurs when an uptrend “collapses” and a downward reversal is likely in the near future.

Bollinger Bands are easy to buy and sell high. Traders open positions when the trend line approaches the bottom of the Bollinger Bands range. Traders should close positions when the trend line reaches the upper end of the range.

Bollinger Band Bounce Trading Strategy Rules

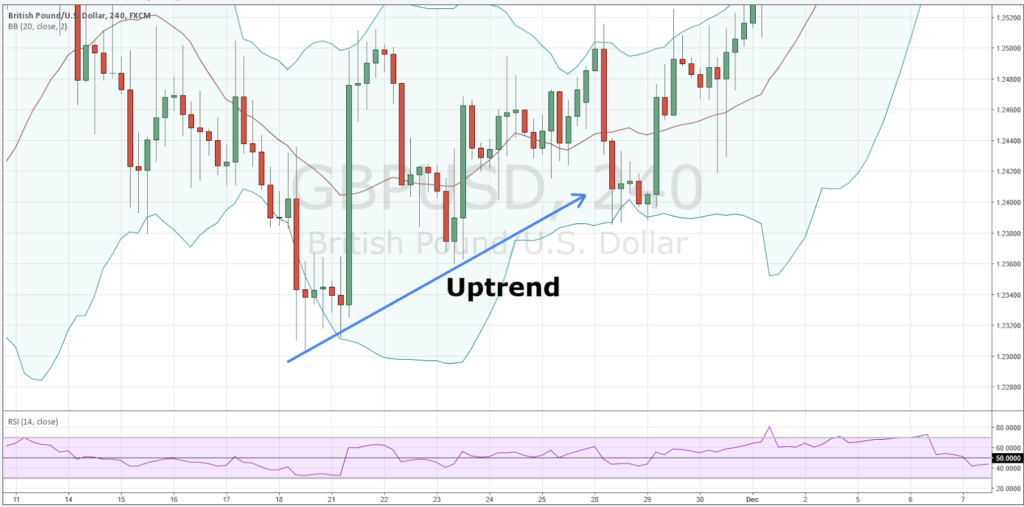

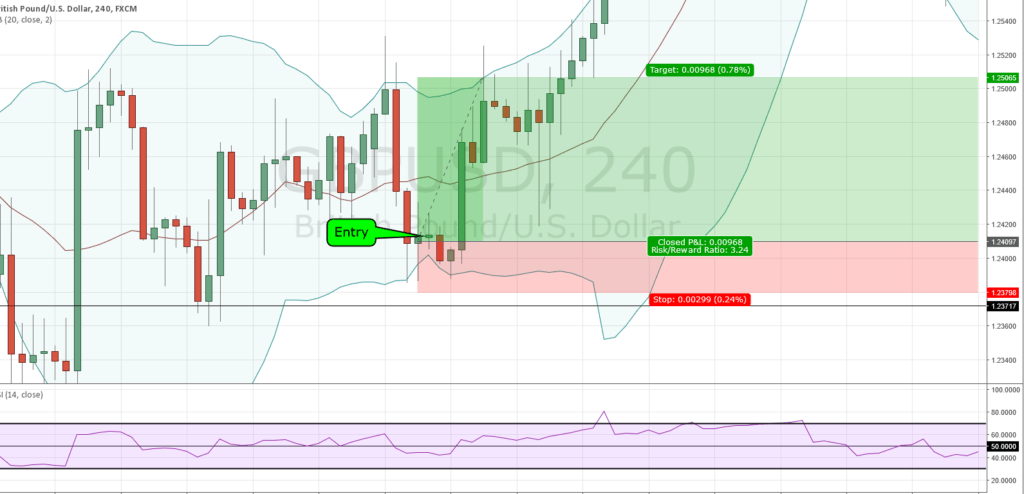

* For simplicity, I will use the same (GBPUSD 4-hour chart) example for each rule. This trade was a “buy” trade. A rule is the exact opposite of a SELL transaction. The currency is trending up and pulling it towards the lower Bollinger Bands. From there, if you follow the rules, you execute the trade.

Rule #1: Look for currencies that are trending up/down.

Finding popular markets is very simple. You can use price channels to determine trends, trend lines, and Fibonacci lines. Place a trend line by finding higher highs or lower lows. If the line goes up, it’s an uptrend, if it goes down, it’s a downtrend. It should be an up or down trend, not a sideways trend.

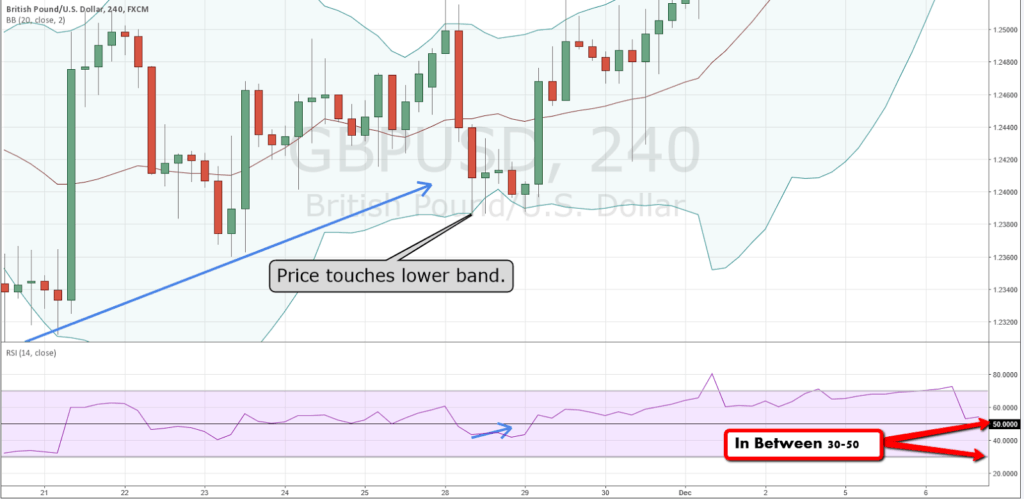

Rule #2: Currencies should fall in an uptrend and touch or nearly touch the lower band.

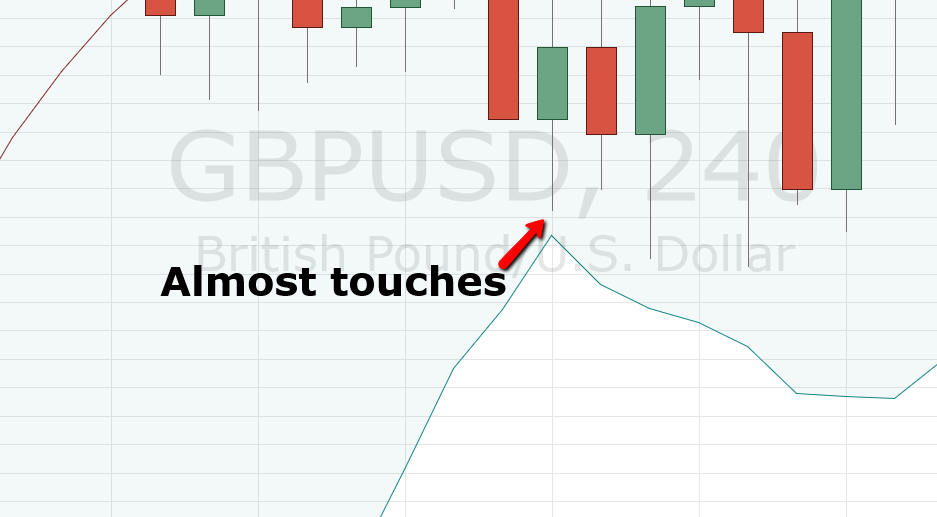

When we say “almost a touch”, here is an example:

** Bollinger Bands Trading Tip: If you are more than 5 pips away, we will not consider this as valid, we will wait for you to come closer to the lower/top bands.

As you can see in the example, in an uptrend, the price continued to move down and touched the bottom band.

When price touches the lower or upper band, check the RSI indicator.

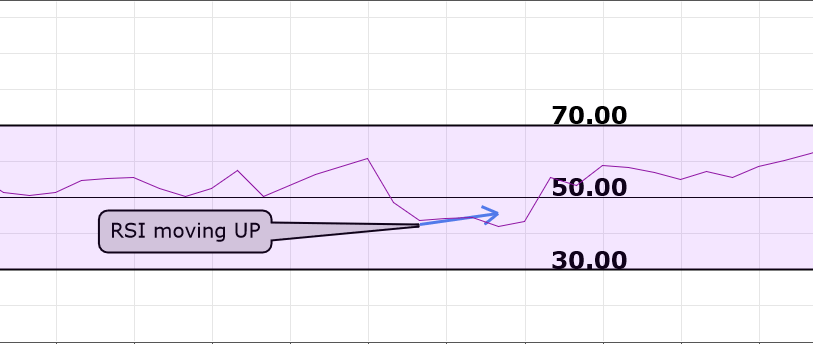

Rule #3: When price hits the lower Bollinger Bands, look at the RSI indicator, it should be between 30 and 50.

When price hits the Bollinger Band, the RSI (when price touches the lower band) should be between 50 and 30. If it’s not here, let’s say you hit 80 points. I am interested in trade.

In this case, we want the RSI to move up in the direction of the trade. It should be between the 30-50 mark. (In a sell trade, the RSI is between 50-70 and should go down.)

If you see this movement, go ahead and find the item.

Rule #4: If Price Hits Lower Bollinger Bands and RSI Moves Up…

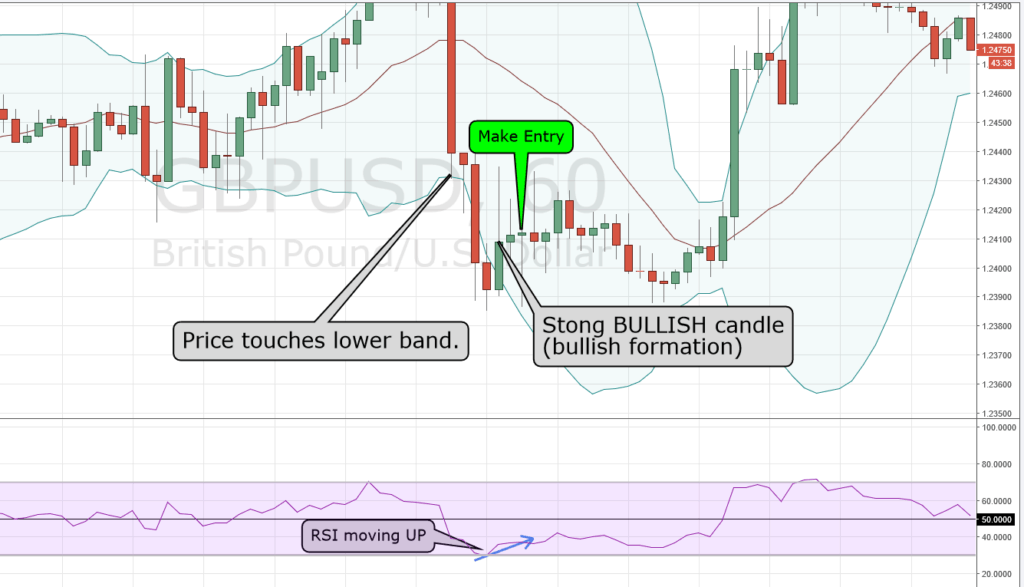

You can enter when you see a strong flashing upside down candle, a series of upside down reversal candles, or a bullish pattern forming. In this case, you should confirm that the trend is moving upwards before entering the trade.

If the candlestick moves to a point where it is making new lows, this may not be a good time to enter the trade. But once I don’t make the new clock low to see if the candles form a bullish trend. Here is an example of Master Candle Settings.

In this example, a 1-hour chart was created to create an entry. This is perfectly fine. This makes the entry point more precise. As I said, the 4 hour and 1 minute time frames are the preferred time frames for this strategy. That’s right. The trading opportunities are small, but the signals are very strong when on the higher timeframes.

Rule #5: Hit Stop Loss/Profit Target

Always record a stop loss and have a good target area. A 30-50 pip stop is recommended for this strategy.

If the price touches another Bollinger Band, you can profit.

conclusion

Bollinger Bands are a great indicator to use in any market. Combining this with the RSI indicator provides a great entry point. Here is another strategy called Forex trading volume.

There are things to consider when the price touches the middle band. A second entry can be made to press the winner. This could potentially give you a double benefit. With this strategy, we only use one trade at the beginning. However, if your rules allow you to make multiple trades at once on the same currency pair, you might consider adding a second position on the middle line.