In this guide, you will learn how to place trades using the ascending triangle pattern. This is a breakout trading strategy that can pre-emphasize breakout trading. Just learn the right trading techniques and you will be able to recognize the structure of a trading breakout in real time.

The cool thing about this chart pattern is that you can use it on a 5-minute chart, a 1-hour chart, or any time frame you want. No matter what your trading style is, be it scalp trading, weekly trading or swing trading. What makes price chart patterns work is the theory of supply-demand imbalance.

Let’s drill down into it!

Let’s understand how it forms and how we can trade ascending triangle formations.

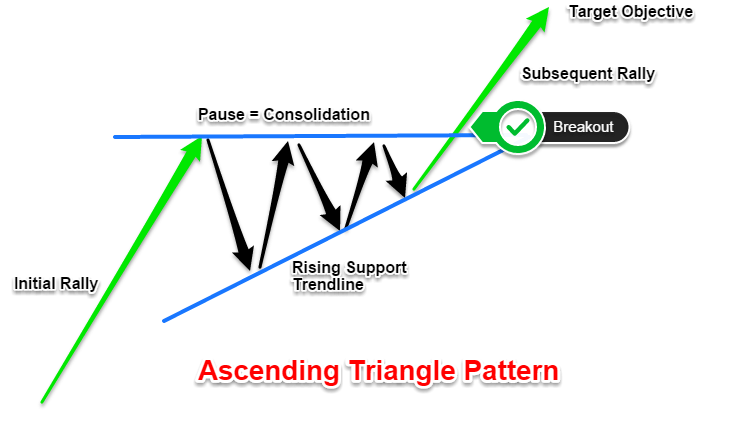

See below:

Ascending triangle pattern

The rising triangle formation is a continuous pattern and, as the name suggests, has the shape of a triangle. The ascending triangle is also known as the bullish triangle because it causes stress.

Triangle chart patterns are generally considered bullish patterns.

Note: The opposite direction of the ascending triangle is also called the descending triangle.

What does an ascending triangle look like?

The first component of this price pattern is an upward slope and a flat top.

This shows that the market has tried many times to break through the resistance line and cannot fail. Therefore, we developed a resistance line.

The second element of the ascending triangle is the slope or rising trend line that moves upward. This is what makes the pattern optimistic.

See the chart below.

All continuation patterns such as bull flags, square patterns and many other patterns that can be found through the trading strategy guide website must have the context of the trend.

For a bullish ascending triangle, a previous uptrend is needed to support a breakout. The easiest way to remember it is:

- A rising triangle occurs within a rising triangle.

- Ascending triangle occurs within a bearish trend.

Now we have learned what an ascending triangle looks like.

The first little trick we learned is that triangle patterns rarely have perfect shapes on price charts.

You will often see a rising wedge pattern that can break a resistance line, but there is no real momentum behind the breakout. In other cases, the pattern may create a spiky bar and cause a false breakout.

All you have to do is wait for the triangle pattern to break out above the resistance line. Only then start buying on the next candle opening.

Trying to buy all the swing highs can get you stuck in the puzzle when trading this pattern

Next we move on to a simple breakout trading strategy that will teach you how to identify and trade ascending triangle formations.

Ascending triangle chart

Now let’s look at some things that make the triangle pattern easier to understand.

You have to think about what’s actually going on behind the scenes. We don’t just look at prices, we also like what market participants are doing.

As the price rises, it starts to develop classic highs. Whatever the reason, buyers may be a bit more aggressive with each new successive high low. Alternatively, you can say that sellers are not too aggressive when the market is falling within an ascending triangle chart pattern.

Either side of the coin, that’s what causes the triangle price formation.

When the price reaches the climax point of the triangle with nowhere to go, you should anticipate the very moment.

When a triangle breakout occurs, you can trade long distances by increasing your trading volume.

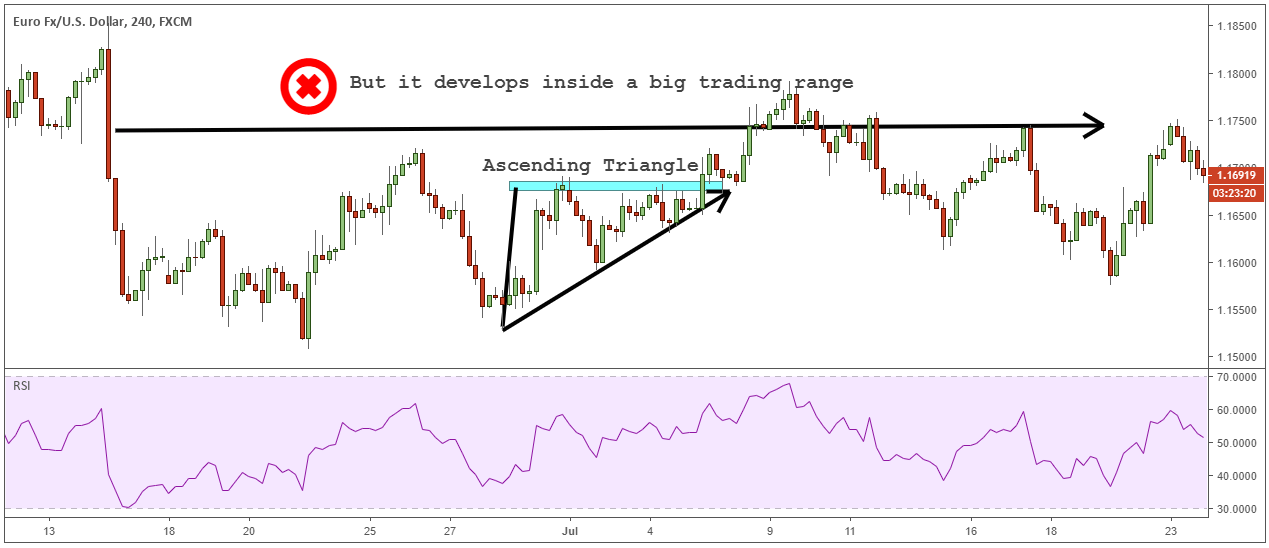

The location of the pattern is also important!

If the triangle pattern is within a large trading range, a solid resistance level may not matter as much. However, if the price of the triangle rises amidst an uptrend, the pattern will be weighted.

If an ascending triangle develops within the trend, we would be interested in buying a breakout.

Rising Triangle Trading Strategy

The ascending triangle trading strategy is an easy way to spot breakouts within a trend. To confirm a breakout, we use the RSI tool, which is a momentum-based indicator.

The price usually contracts within an ascending triangle pattern, so at one point either the bulls or the bears should win. With the RSI indicator in your trading arsenal, you can decide ahead of time who will win this battle.

How does it work?

Let’s go through it step by step.

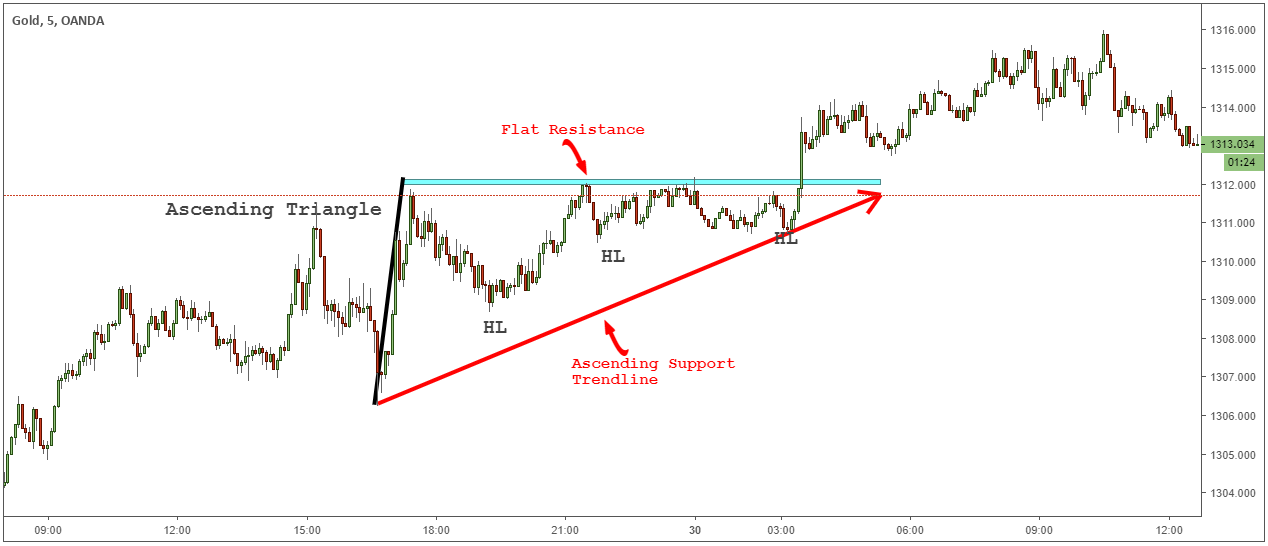

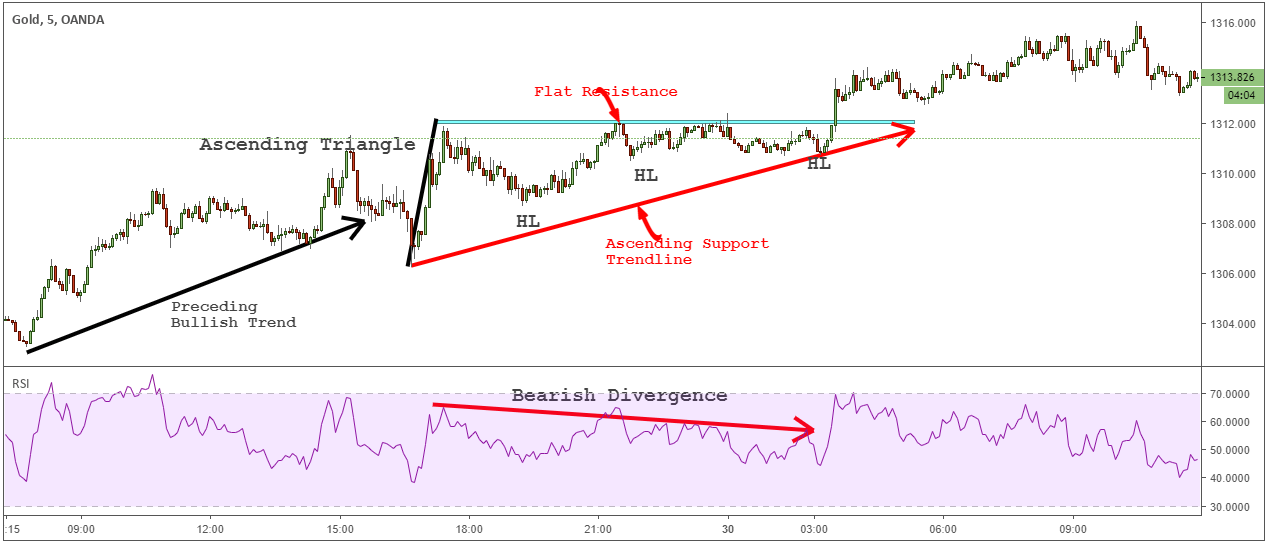

Step 1: An ascending triangle should have a flat resistance and rising support trend line

The two elements of a good ascending triangle pattern are:

- Multiple hit flat resistors. The more you test a resistance line, the more likely it won’t stay at that resistance level in the end.

- The second element is an uptrend support trend line connecting successive high lows within an ascending triangle formation.

See the ascending triangle chart below.

Next we will use the RSI technical indicator.

See below:

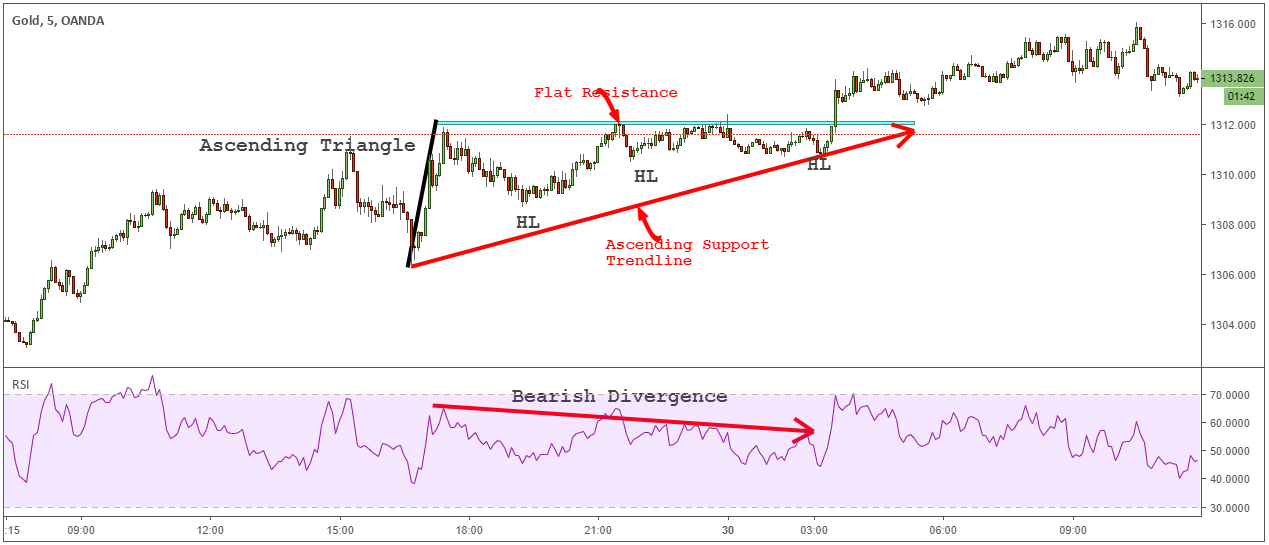

Step 2: Apply the RSI 20 period to your chart

Typically, price action is consolidated inside an ascending triangle formation. This means there is an ongoing battle between bull and bear. Check out the RSI readings to assess who will win this battle.

Before breaking out, we can look at the action inside the consolidation to decide if it’s worth leaving or if it’s better to wait for another deal.

What we want to see is a decrease in momentum after successive retests of flat resistance levels. Basically, we see a bearish divergence in the RSI indicator.

See the ascending triangle chart below.

Now, before you buy a breakout, you need to check one more thing.

See below:

Step 3: Check if there is a bullish trend before the ascending triangle

As a continuation pattern, of course we need a preceding trend. For an ascending pattern, an ascending triangle, a prior uptrend is required.

If we have an uptrend before, it indicates that an uptrend is more likely.

See the ascending triangle chart below.

The final step is to define entry trigger points and measure profit targets.

See below:

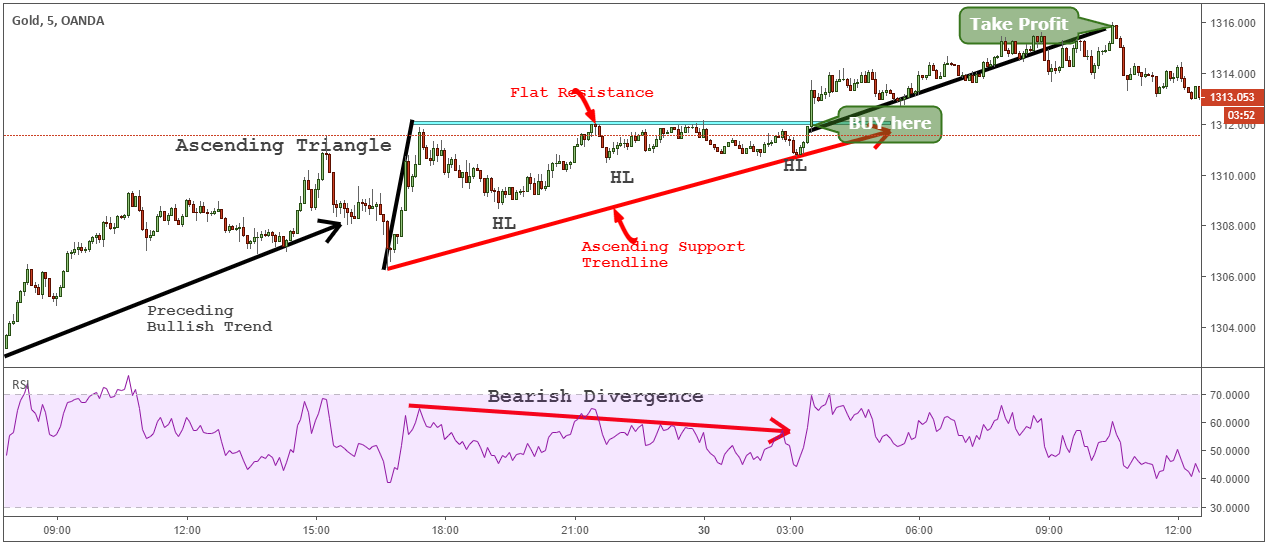

Step 4: Buy as soon as it rises above the flat resistance level

With a continuation pattern, the best strategy is to buy right into the breakout. If you wait too long, you’ll leave some of your available revenue on the table.

We already have a lot of confluence factors confirming the breakout for which it is useless to wait for confirmation. After all, we want to anticipate breakouts and get ahead of the crowd.

For the take profit strategy, we will use our preferred measurement technique. This is a dynamic strategy based on real prices rather than random numbers.

To find the profit target, take the high and low of the ascending triangle formation and add those measurements to the breakout level. This makes it an ideal target for this continuation pattern.

Conclusion – Ascending Triangle Formation

The rising triangle formation is a very powerful chart pattern that exploits an imbalance in market supply and demand. Time your trades with this simple pattern and get yourself on the trend if you missed the start of the trend.

Many technical analysts trade breakouts without first taking the time to understand what is behind them. An ascending triangle gives you a perfect start and allows you to see trading opportunities before they occur. So being able to recognize an ascending triangle pattern can be a useful tool you can use to identify profitable trades.