These options spread strategies help you overcome your risk exposure limits and overcome your fear of loss. This practical guide shares a powerful box spread options strategy example. We cover the basics of bull call spread option strategies to hedge against risk and improve your odds of making a profit.

If this is your first time on our website, the korea-option.com team welcomes you. Hit the subscribe button to get your weekly free trading strategies directly into your email box.

In options spread trading, it’s important to understand the math behind it. The biggest “AHA!” The moment in options trading is when you understand how option spreads work. Options spread trading strategy is an excellent opportunity to improve your profits. Start by reading the Options Spread Strategies PDF.

Unlock options trading on the Robinhood app and buy cheaper, commission-free options using . Robinhood App Trading Guide (Everything You Need to Know). This is one of the easiest places to start trading options for free.

We will break down our introduction to options spreads and explain how to become a successful options trader.

What are options? How do option spreads work?

Spread option trading is the simultaneous buying and selling of options of the same type. Options include call options and put options. A call option provides the right to buy in the future. A put option gives you the right to sell in the future. For example, if you buy a call option on Amazon stock and simultaneously sell another call option on Amazon stock, you have opened a spread trading position.

Typically, spreads consist of either a two-legged order or a multi-legged option sequence, such as the Butterfly Spread Options strategy.

Options spreads can be confusing, but it’s easy to understand if you have a complete options trading guide you can find here. Call Options vs Put Options – An Introduction to Options Trading.

The difference between the expiration dates or strike prices of two options is called the spread.

Key points when building spreads:

- A combination of options is based on the same underlying asset. For example, if you buy calls for Apple stock, you also sell calls for the same stock Apple.

- You need to buy and sell options of the same type. For example, if you buy a call option, you sell another call option

- Various combinations of expiration dates and/or strikes may be used.

Now let’s look at what the simplest combination of options to make up a spread is.

What is a Call Spread Option Strategy?

A call spread is an options strategy used when the price of an underlying asset is expected to rise. A currency spread strategy involves buying fiat currency options and selling non-fiat currency options (higher strike prices). Both options have the same expiration date.

A currency spread is also known as a bull currency spread strategy. Engage in this strategy when the market is bullish.

Option spreads can help you profit in all types of market conditions. It can address both bullish and bearish trends.

For bearish trends, we use the bearish spread strategy. Use this strategy if you see the price going down. The bear call spread is an options strategy in which you buy a money option and sell a non-money option (with a lower strike price). Both options have the same expiration date.

The bear call spread trading strategy is also known as short call spread.

But what if we get stuck in a market with limited scope?

Spread options are the most versatile financial instruments. With the right options trading strategy, your portfolio can become much more diverse and dynamic. You can build complex calendar spread option strategies so you have endless strike prices and expiration dates at your disposal. Therefore, option spreads may be adjusted according to current market conditions, including sideways trading.

Spread options are a double-edged sword. On the one hand, it limits the risks, but on the other hand, it also limits the potential benefits. Option spreads create a limited price range to always make a profit.

Here is more information about the different types of spreads.

Types of option spreads:

In this segment, I’m going to explain how many types of options are spread out and help you understand these concepts better. Options spreads can be grouped into three main categories.

- Vertical Spread Options Trading Strategy.

- Horizontal Spread Options Strategy.

- Diagonal spread options strategy.

Spread option trading is the simultaneous buying and selling of options of the same type. Options include call options and put options. A call option provides the right to buy in the future. A put option gives you the right to sell in the future. For example, if you buy a call option on Amazon stock and simultaneously sell another call option on Amazon stock, you have opened a spread trading position.

Typically, spreads consist of either a two-legged order or a multi-legged option sequence, such as the Butterfly Spread Options strategy.

Options spreads can be confusing, but it’s easy to understand if you have a complete options trading guide you can find here. Call Options vs Put Options – An Introduction to Options Trading.

The difference between the expiration dates or strike prices of two options is called the spread.

Key points when building spreads:

- A combination of options is based on the same underlying asset. For example, if you buy calls for Apple stock, you also sell calls for the same stock Apple.

- You need to buy and sell options of the same type. For example, if you buy a call option, you sell another call option

- Various combinations of expiration dates and/or strikes may be used.

Now let’s look at what the simplest combination of options to make up a spread is.

What is a Call Spread Option Strategy?

A call spread is an options strategy used when the price of an underlying asset is expected to rise. A currency spread strategy involves buying fiat currency options and selling non-fiat currency options (higher strike prices). Both options have the same expiration date.

A currency spread is also known as a bull currency spread strategy. Engage in this strategy when the market is bullish.

Option spreads can help you profit in all types of market conditions. It can address both bullish and bearish trends.

For bearish trends, we use the bearish spread strategy. Use this strategy if you see the price going down. The bear call spread is an options strategy in which you buy a money option and sell a non-money option (with a lower strike price). Both options have the same expiration date.

The bear call spread trading strategy is also known as short call spread.

But what if we get stuck in a market with limited scope?

Spread options are the most versatile financial instruments. With the right options trading strategy, your portfolio can become much more diverse and dynamic. You can build complex calendar spread option strategies so you have endless strike prices and expiration dates at your disposal. Therefore, option spreads may be adjusted according to current market conditions, including sideways trading.

Spread options are a double-edged sword. On the one hand, it limits the risks, but on the other hand, it also limits the potential benefits. Option spreads create a limited price range to always make a profit.

Here is more information about the different types of spreads.

Types of option spreads:

In this segment, I’m going to explain how many types of options are spread out and help you understand these concepts better. Options spreads can be grouped into three main categories.

- Vertical Spread Options Trading Strategy.

- Horizontal Spread Options Strategy.

- Diagonal spread options strategy.

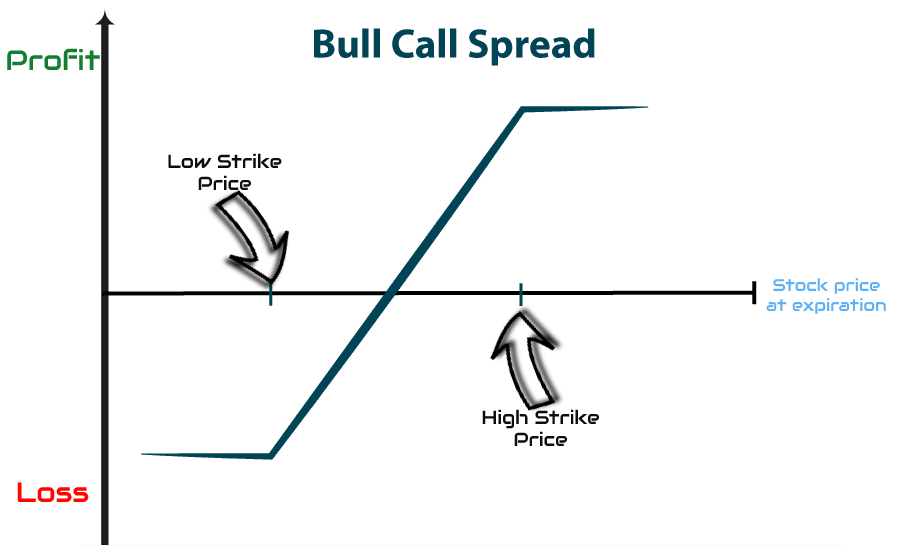

How to Profit from Trading Bull Spreads?As the name suggests (BULL call), you profit from a bull call spread when the value of the underlying asset rises. Market sentiment should rise.Bull + Call = Bull indicates a higher market. + Call represents an option you buy if you think the market will go higher.A key element of the fire spread is the assumption that the market price will rise.

How to Profit from Trading Bull Spreads?As the name suggests (BULL call), you profit from a bull call spread when the value of the underlying asset rises. Market sentiment should rise.Bull + Call = Bull indicates a higher market. + Call represents an option you buy if you think the market will go higher.A key element of the fire spread is the assumption that the market price will rise.What is the maximum risk associated with bull currency spreads?

The maximum loss you can incur on a bull call spread is the premium price paid for the option plus the fee. Potential losses will always be known prior to trading.

Now, what is the maximum profit you can make on a bull call spread options trading strategy?

Profit can be calculated by subtracting the previously calculated maximum risk from the strike price (ATM calls and OTM calls).

Bull Call Spread Option Profit = Strike Price – Max Risk

You can put options trading theory into practice by looking at a simple example.

For this example, we will use Apple stock option prices.

At the time of writing this options spread strategy PDF, Apple stock is trading at about $223 per share.

The first step in building a bull call spread is to buy the ATM call at $223. Second, we call the OTM call at $250 because we assume that APPL stock will rise. Our profit will be capped at $250.

For simplicity, assume you pay $2 for ATM calls and receive $1 for selling OTM calls. The cost associated with this trade is just $1 ($2 long call premium – $1 short call profit = $1 x 100 contract size = $100).

There is a “limited risk” expression because the final cost of $1 is less than simply buying and buying ATM currency.

The correct way to buy cheap options is to use the bull call spread options strategy. However, this options trading strategy is more suitable when you think the underlying asset will only increase slightly.

In the next part, we will take the box spread option strategy and create a practical example to create a risk-free arbitrage opportunity.

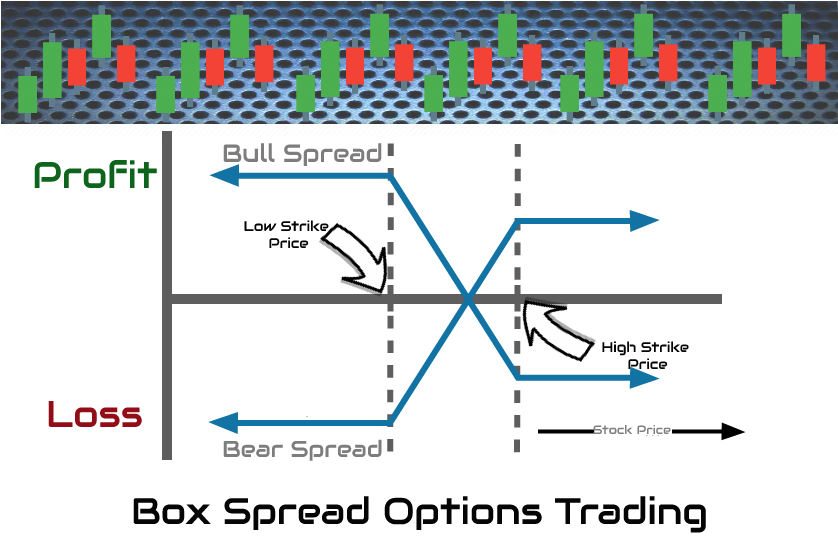

Box Spread Option Strategy Example (Long Box)

The box spread is a complex arbitrage strategy that exploits the price inefficiency of option pricing. When an option spread is undervalued with respect to its expiration value, it creates a risk-free arbitrage trading opportunity.

The box spread option strategy is also known as the long box strategy.

To build a box spread option, you need to construct a four leg options trading strategy or combine two vertical spreads as follows:

- Buy the Bull Call Spread option (1 ITM call and 1 OTM call).

- Buy a bear put spread option (1 ITM put and 1 OTM put).

A short box options strategy is the opposite of a long box strategy.

The way to profit from a box spread option and create a risk-free position is to use the same expiration date and strike price for the vertical spread. The downside of box spreads is that they eliminate risk while still generating small returns.

Example of a box spread

Let’s look at a simple example of an Alibaba stock ticker BABA trade at $180. The following options premium pricing is available:

- October 175 phone – $5

- October 185 Call – $1

- Oct 175 put – $50

- October 185 put – $5

To execute a box spread, an investor must purchase both vertical spreads.

- Buy Bull Call Spread = Buy Oct 175 calls + Sell Oct 185 calls = ($5 x 100 contract size) – ($1 x $100 contract size) = $400.

- Buy bare put spread = Sell Oct 175 put + Sell Oct 185 put = ($1.5 x 100 contract size) – ($5 x $100 contract size) = $350.

Not including fees, the total cost of opening the box spread is $400 + $350 = $750.

The expiration value of the strike spread is $185 – $175 = $10 x $100 stock = $1,000.

Total profit, not including option fees, is calculated as follows: $1,000 – $750 = $250.

Potential profits generated by box spreads can be offset by large commissions if you use the wrong options trading broker. Invest in options with Robinhood, a commission-free options trading platform.

When should I use the Butterfly Spread Option Strategy?

The Butterfly Spread is a neutral trading strategy that can be used when expecting low trading volatility in the underlying asset. Butterfly spreads use a combination of bull and bear spreads, but with only three legs. If you plan to go long, you can construct a three-step options strategy as follows.

- Buy money

- Sell 2 currency currencies

- Buy 1 off-the-money currency

Long call butterfly risk is limited to the premium cost paid for opening a 3-leg position. Butterflies are sold with straddles combined, and strangles can also be purchased and constructed.

Learn the art of spotting the next big move by trading the Straddle Option Strategy: Straddle Option Strategy – Profit from the Big Moves.

The short butterfly strategy is a dialogue strategy for the long butterfly.

Final Words – Options Spread Strategies

A stock trader has to be 100% right to make a profit, but options spread strategies can make money even if you are only partially right about your trades. Options spreads can help you develop non-directional trading strategies, such as the box spread options strategy example explained through this options spreads course.

Many options traders start their careers simply by buying puts or calls. However, at some point with the evolution of options traders they quickly move to trading option spreads. For example, implementing a bull call option spread strategy allows for better risk management.

Here are 10 optional blogs and websites to follow in 2019.

There are many alternatives to risk management methods in spread options trading. Most options trading platforms today make it easy to deploy complex options strategies in one step. Try our demo options platform before making your hard-earned money.