It is a form of exponential moving average technical analysis. It is one of the most popular trading indicators used by thousands of traders. Learn a simple exponential moving average strategy in this step-by-step guide. Use what you learn to change your trades and become a successful long term trader! Moving averages can be very effective indicators. Many traders use an exponential moving average, an effective type of moving average indicator, to trade in different types of markets.

The exponential moving average strategy or EMA strategy is used to identify major trends in the market. They can also provide support and resistance levels to place trades on.

The Trading Strategy Guides team has already covered the following system topics: You can review the trend here. MACD Trend Tracking Strategy – A simple trading strategy. You will also learn the basics of support and resistance, support and resistance areas – the road to successful trades.

Take a look at our recommended articles to get a better understanding of how the market works. Building a foundation of understanding will help you dramatically improve your results as a trader.

The exponential moving average EMA strategy is a universal trading strategy that works in all markets. This includes markets for stocks, indices, forex, currencies and cryptocurrencies such as virtual currency Bitcoin. If an exponential moving average strategy works in any type of market, it will work over a period of time. Simply put, you can trade on your preferred chart. Also read The Hidden Secrets of Moving Averages.

First, let’s see what a moving average is and what the exponential moving average formula is. We will then look at some key rules of the exponential moving average strategy and

Exponential Moving Average Formula and Exponential Moving Average Description

An exponential moving average is a line on a price chart that uses a mathematical formula to smooth the price equation. Shows the average price over a specific time period. The EMA formula gives more weight to recent prices. This means that it is more stable as it reacts more quickly to the latest changes in price data.

Exponential Moving Averages work to reduce the chaos and noise of everyday price action. Second, moving averages smooth prices and indicate trends. Sometimes invisible patterns are revealed. Averages are more reliable and accurate in predicting future changes in market prices.

There are 3 steps to the exponential moving average formula and EMA calculation. The formula uses the simple moving average SMA as the starting point for the EMA value. To calculate the SMA, take the sum of the number of periods and divide by 20.

We need a multiplier that allows the moving average to focus more on the most recent price.

The moving average formula brings all of these values together. They constitute a moving average.

The exponential moving average formula below is for the 20-day EMA.

Initial SMA = 20 Period Total / 20

Multiplier = (2 / (Period + 1)) = (2 / (20 + 1)) = 0.0952 (9.52%)

EMA = {close – EMA (previous date)} x multiplier + EMA (previous date).

Generally, when the price is trading above its moving average, it is in an uptrend. As long as it stays above the exponential moving average, higher prices are expected. Conversely, if we trade below we are in a downtrend. As long as we are trading below our moving average, we should expect lower prices.

It’s always a good idea to write down your trading rules on paper before you go any further. This practice will strengthen your learning curve and make you a better trader.

Let’s begin…

Exponential Moving Average Strategy

(Trade Rules – Trade Trade)

An exponential moving average strategy consists of two elements. The first step in capturing new trends is to use two exponential moving averages as entry filters.

Automate strategies using longer-period moving averages and shorter-period moving averages. This removes all forms of subjectivity from our trading process.

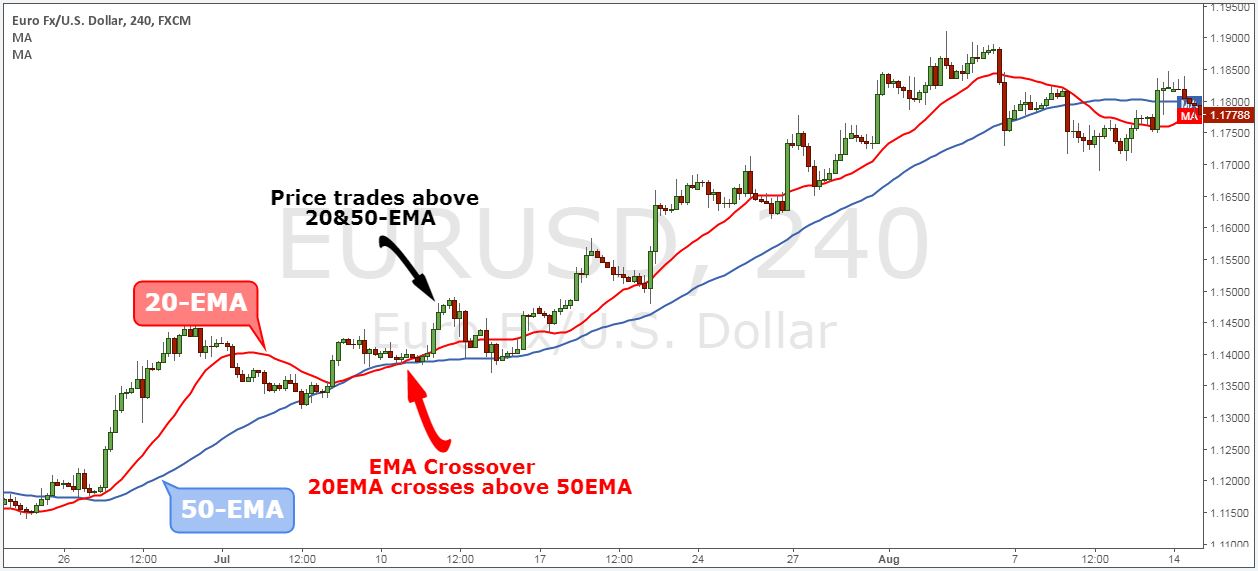

Step 1: Plot the 20 and 50 EMA on the chart

The first step is to properly set up the chart with the correct moving average. EMA crossovers can be identified in a later step. The exponential moving average strategy uses 20 and 50 period EMAs.

Most standard trading platforms come with a default moving average indicator. Finding EMAs on the MT4 platform or Tradingview is not a problem.

Now it’s time to take a closer look at the pricing structure. This moves you to the next step in your strategy.

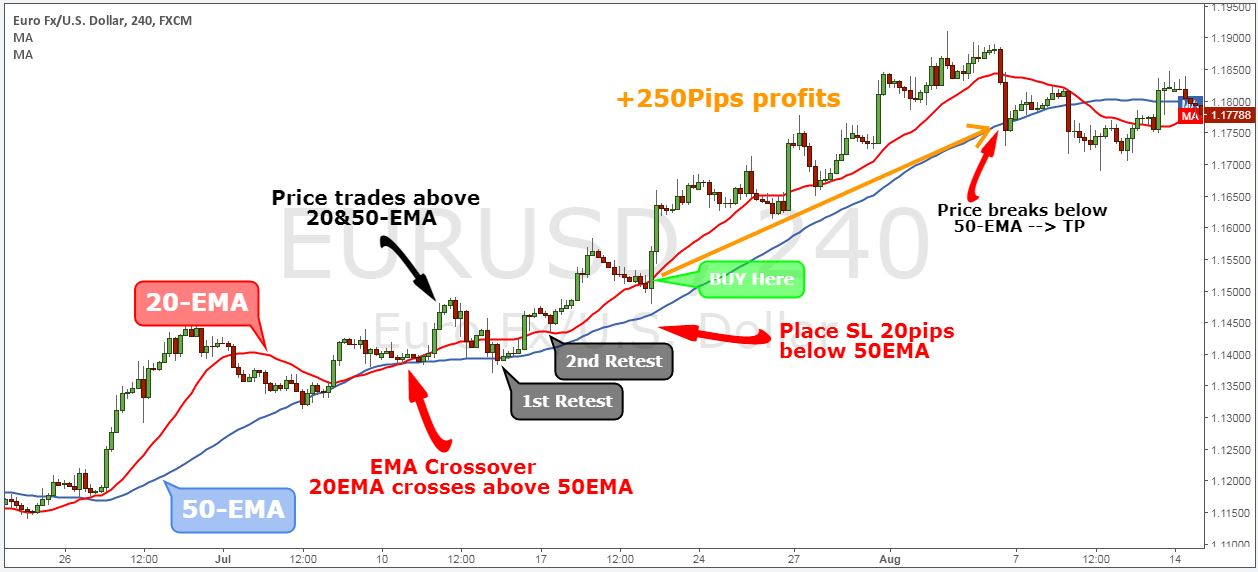

Step 2: Wait for the EMA crossover and price to trade above the 20 and 50 EMA.

The second rule of this moving average strategy is that the price must be trading above the 20 and 50 EMA. Second, we’ll have to wait for the EMA crossover.

When the 50-EMA crosses the 50-EMA, it refers to the EMA crossover for buy trades.

Looking at the EMA crossover, it creates automatic buy and sell signals.

Since markets are prone to false breakouts, we need more proof than a simple EMA crossover. At this stage, we don’t know if the bullish sentiment is strong enough to drive the price higher after buying to make a profit.

To avoid false breakouts, we added a new confluence to support our views. This moves you to the next step in your strategy.

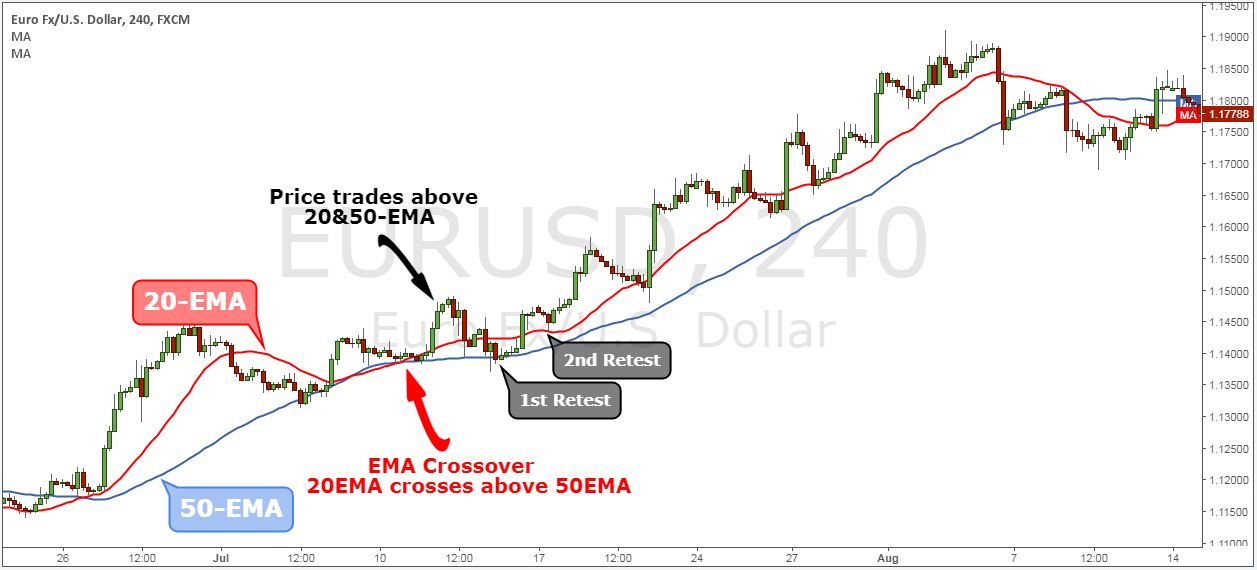

Step 3: Wait until the area between the 20 and 50 EMA has been tested at least twice, then look for buying opportunities.

The confidence of this moving average strategy depends on several factors. After the EMA crossover has occurred, we need to exercise more patience. We will wait for two successful retests for zones between 20 and 50 EMA.

Two successful retests of this area between the 20 and 50 EMA give the market plenty of time to develop a trend.

Don’t forget that no price is too high to buy on the deal. And the price isn’t too low to sell.

Note * When we refer to the “area between the 20 and 50 EMA”, we do not actually mean that the price should be trading in the space between the two moving averages.

We wanted to cover the entire price spectrum between the two EMAs. This is because price only affects the shorter moving average (20-EMA). However, this is still a successful retest.

Now we still have to define where exactly we will live. This moves you to the next step in your strategy.

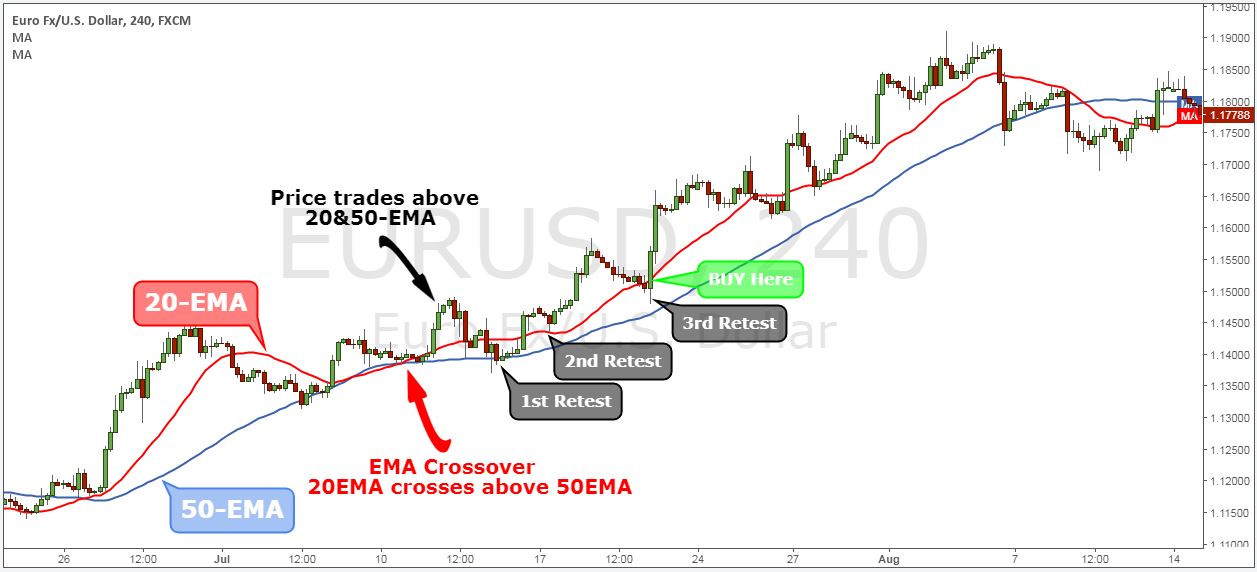

Step 4: Buy in the market as it retests the area between the 20 and 50 EMA for the third time.

If the price successfully retests the area between the 20 and 50 EMA for the third time, you buy at the market price. We have ample evidence that the current bullish momentum is strong to continue driving this market higher.

Now we still have to define where to place our protective stop losses and where to take our profits. This moves you to the next step in your strategy.

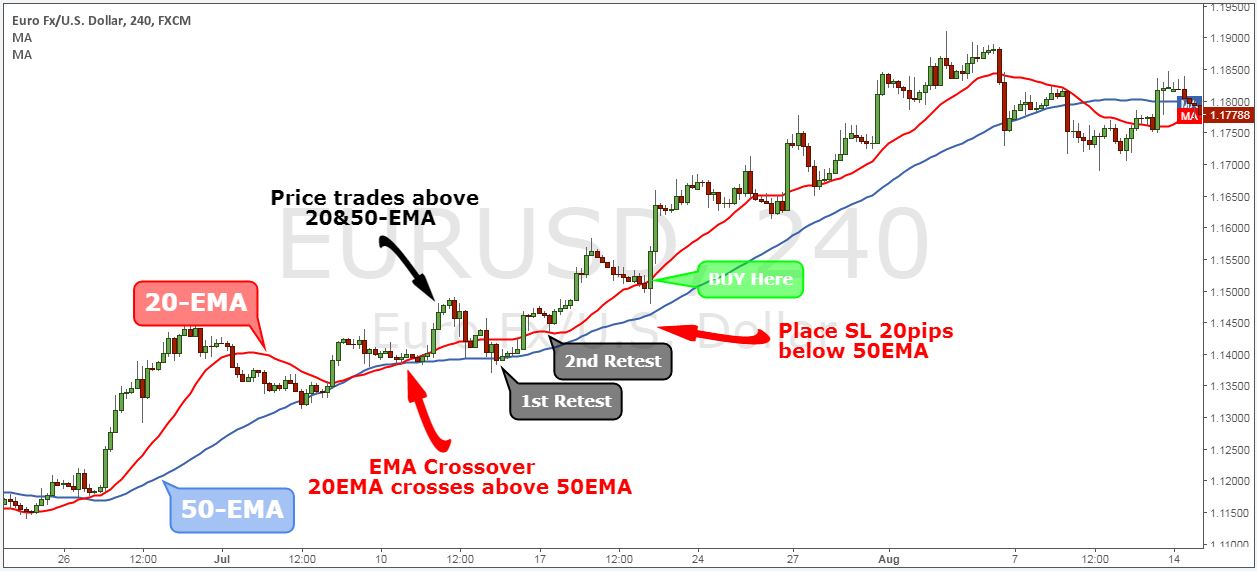

Step 5: Place your protected stop loss 20 pips below the 50 EMA.

After two retests after the EMA crossover, we can see that the trend has gone up. As long as it trades above both exponential moving averages, the trend stays in place.

In this regard, we set our protection stop loss at 20 pips below the 50 EMA. We added a buffer of 20 pips because we understand that we do not live in a perfect world. Markets are prone to false breakouts.

The final piece of the EMA strategy is the exit strategy. Again based on an exponential moving average.

Step 6: Take Profit After Breaking Below 50-EMA

In this particular case, we do not use the same exit technique as the input technique based on the EMA crossover.

Had we waited for the EMA crossover to occur on the other side, it would have given us back some of the potential returns. You have to consider the fact that the exponential moving average is a lagging indicator.

The exponential moving average formula used to denote the EMA allows you to still profit when the market reverses.

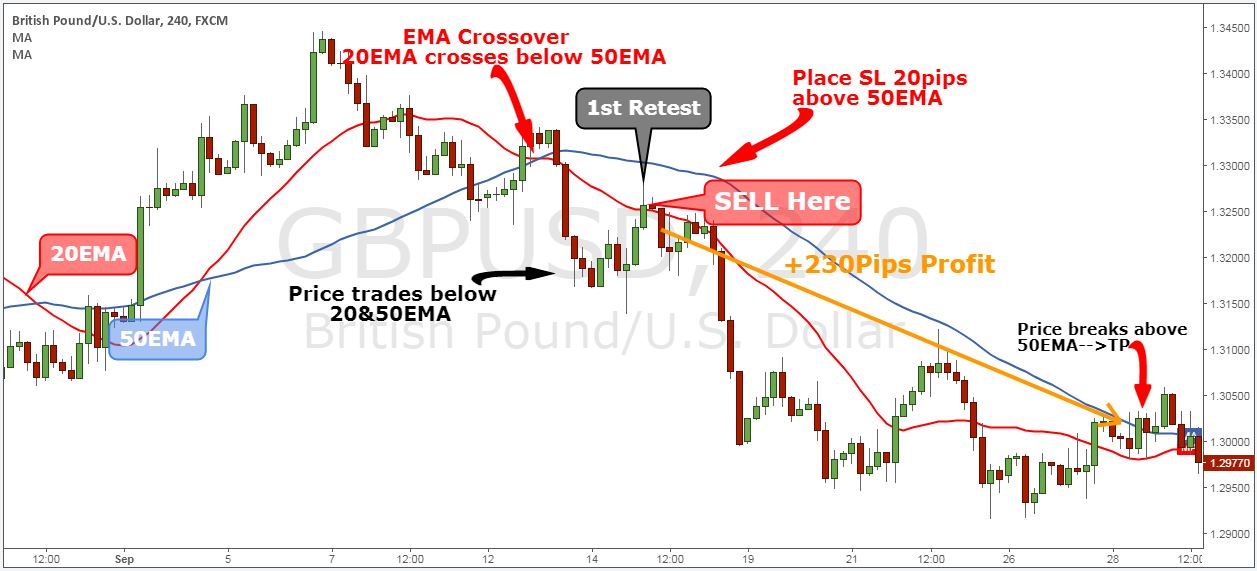

Note ** The above is an example of a BUY transaction. Use the same rules for SELL transactions. However, we sell on the 1st retest between 20 and 50 because the market goes down much faster. After the EMA crossover occurred.

In the picture below you can see an example of a real sale transaction using the strategy.

summary

The exponential moving average strategy is a classic example of how a simple EMA crossover system can be constructed. This exponential moving average system does not attempt to predict the market. We are trying to respond to current market conditions.

The advantage of the trading strategy lies in the exponential moving average formula. Plot a much smoother EMA that provides better entry and exit.

We understand that there are different trading styles. If the following terms do not apply to you, read Best Short Trading Strategies – Profitable Short Trading Tips. Demonstrates short-term trading tricks used by institutional traders.