Compare the best daily trading brokers and online trading platforms in Ukraine and choose the one that best suits your needs. Compare spreads, market coverage and platform features to determine what will help you maximize your profits. I can’t say it’s always the best broker for everyone. Where you should open a trading account is an individual choice.

Here we list and compare the best brokers for day traders in 2020 along with full reviews of interactive trading platforms. So, whether you are a forex trader or just want to speculate on cryptocurrencies, stocks or indices, use our broker comparison list to find the best trading platform for day traders.

How to Compare Brokers

Before looking for the best interactive brokerage for day trading, you need to decide on your investment style and individual needs: how often you trade, in what hours, how much money and which financial instruments you use.

Then there are several factors to consider when choosing a top-rated daily trading broker. You may have to compromise on platform features if you choose the cheapest one.

There is no one size fits all broker and trading platform. The best brokerage will check all your individual needs and details.

Key points and areas to compare in this competitive market include:

costs

- Do they offer low fees? – When day traders make numerous trades throughout the day, low commissions bolster overall returns.

- Do they offer attractive margin rates? – If you can expect a higher return than the interest on your loan, the generous margin rate will allow you to trade heavily with capital you may not have to get your hands on.

- Do you have a complex fee structure? – Broker fees can pile up quickly. Be sure to look at the fine print to avoid hidden charges later on the line, such as when trying to withdraw money. However, the cheapest brokers for day trading usually make up that money in other areas such as customer service.

- Is a minimum deposit required? – Some brokers require a significant deposit of capital to open an account and start trading. For example, if you day trade at Interactive Brokers, you will need to withdraw some serious cash before you start working.

- Do brokers have daily trade limits? – Some restrictions apply to prevent extreme volatility and market manipulation. However, you can set Interactive Brokers daily trading limits to avoid losing too much capital per day.

- Do you offer different account types? – Various costs and attractive benefits are provided for each account. For example, choosing from our Interactive Brokers day trading accounts will allow you to lower fees, increase leverage and improve technical analysis tools. For more information on account types, see here.

Trading platform features

- Do you have advanced technology information tools for research and analysis? – You need real-time price quotes and access to detailed charts and historical data. All of the top 10 online brokers offer a range of tools and resources.

- How fast and efficient is order execution? This is very important if you are trading in one day. Just a few seconds can cost you some serious cash. Many virtual brokers offer real-time execution, but concerns still remain. This highlights the need to test your broker first.

- How user-friendly is the platform? – The trading platform provided by your broker should work for you. Most brokers offer a few to choose from, some tick the box for the average day trader, while others offer more advanced platforms for veteran traders. Likewise, is it suitable for your hardware? Is the platform compatible on any platform, Mac, PC, Linux?

- Do you have a mobile platform? – It is rare that a broker does not offer a mobile trading app, but the quality is different. If mobile phone deals are important to you, it’s important to check app compatibility (like Android, iOS or Windows).

customer service

- How good is their customer service? – Can you quickly reach out to someone when you need support or advice? This is especially important if you are experiencing problems like computer crashes. Some brokerages offer 24/7 customer support with less than one minute call latency.

- Do they have a ‘deal desk’? – The best brokers provide direct access. You don’t want to start ordering from the market without sending it to the train desk. It will take a long time and may be quoted again. The opportunity may have disappeared when you confirmed to proceed.

Extras

- Do they offer attractive additional features? – Are there any ‘open an account’ promotions? £100 in free trade may not be everything, but it does mean you can get the wrinkles out of your strategy before putting your money online. Trading without a broker means free deduction for trial and error.

- Is there an account level? Do VIP accounts get free Level II data or reduced spreads?

- What returns do you get with cash? – You can usually see something lying around in your brokerage account. Some brokerages won’t give you a penny on that balance, but some will give you 3-5%.

- Trading Strategies – Can I implement a trading strategy on this broker or use automated trading, signals or copy trading?

Final Words on Broker Comparison

Do your homework and see if your day trading broker can meet your specific needs. We recommend giving potential daily trading brokers a test. Set up a demo account, send us some questions to see if you like the platform and measure how good our customer service is. If you get this choice right, I appreciate your conclusions.

Need a shortcut? Check out the winners of this year’s DayTrading.com Awards.

Broker Reviews

Use this table along with our trading broker reviews to compare all the brokers we reviewed. Some of these brokers may not accept trading accounts opened in your country. If the broker believes that it will not accept an account at your location, it will be grayed out in the table.

| Broker | Demo | Min Dep. | MT4 | Bonus |

|---|---|---|---|---|

| 24 options | yes | $250 | yes | No |

| Al fly | yes | From $/£/€ | yes | yes |

| ATFX | yes | 100 $/€/£ | yes | No |

| Avatar Day | yes | $ 100 | yes | No |

| AxiTrader | yes | 0 $/€/£ | yes | No |

| Ai Yondo | yes | £ 1 | yes | No |

| BDSwiss | yes | 100 $/€/£ | No | No |

| Binary.com | yes | $ 5 | yes | no |

| BinaryCent | yes | $250 | no | yes |

| Non-mom | yes | €/£/$10 | no | No |

| bit mex | yes | 0.0001 XBT | No | No |

| Capital.com | yes | £/$/€100 | no | no |

| CityIndex | yes | £/$100 | yes | yes |

| CMC market | yes | £ 0 | yes | no |

| Dero | no | 0 $/€/£ | no | no |

| Deriv.com | yes | €/£/$5 | yes | no |

| Electronic Transactions | yes | $500 | yes | yes |

| Easy Market | yes | € 100 | yes | no |

| itoro | yes | $200 ($50 in the US) | yes | no |

| ETX Capital | yes | £ 250 | yes | no |

| Expert Options | yes | 10 $/€/£ | yes | yes |

| Finq.com | yes | $ 100 | yes | yes |

| Forex.com | yes | $50 | yes | No |

| Fusion Market | yes | no minimum | yes | no |

| FXCM | yes | £ 300 | yes | No |

| FXPro | yes | $ 100 | yes | No |

| FXTM | yes | From $10 | yes | yes |

| low high | yes | $50 | yes | No |

| IC Market | yes | $200 | yes | No |

| IG group | yes | £ 250 | yes | no |

| InstaForex | yes | $1 to $10 (depending on account selection) | yes | No |

| Interactive Broker | yes | $ 10000 | no | no |

| Invest.com | yes | £ 0 | yes | yes |

| Invest | yes | $250 | yes | no |

| IQ Options | yes | $ 10 | No | No |

| Just2Trade | yes | £ 2500 | yes | No |

| LCG | yes | 0 $/€/£ | yes | No |

| Markets.com | yes | $ 100 | yes | No |

| or dex | yes | $250 | No | no |

| Ninja Trader | yes | $50 | yes | no |

| NordFX | yes | $ 10 | yes | No |

| Oh I know | yes | $0 | yes | No |

| Pepper Stone | yes | £200 / $200 | yes | No |

| plus 500 | yes | $ 100 | no | yes |

| Robin Hood | no | no | No | No |

| Pig Bank | yes | $ 10000 | yes | No |

| Skilling.com | yes | 100 £/€/$ or 1000 NOK, SEK | No | No |

| Spreadex | No | $ 1 | no | No |

| TD American Trade | yes | none | no | yes |

| TradeStation | yes | $500 | yes | No |

| Trading 212 | yes | €/£/$100 | No | No |

| UFX | yes | $ 100 | yes | no |

| VantageFX | yes | $200 | yes | yes |

| Bidet Po Rex | yes | $250 | no | yes |

| XM | yes | 5 $/€/£ | yes | yes |

| XTB | yes | $250 | yes | No |

| Jack’s Trade | No | $2500 | No | No |

| Zulu Trade | yes | $1 – $300 (depending on your broker choice) | yes | No |

What is a trading platform?

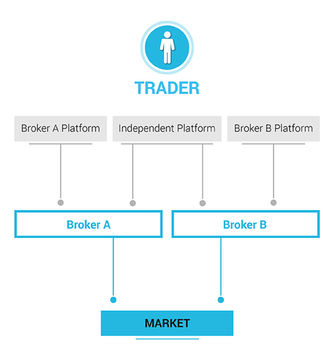

A trading platform is software that traders use to view price data in the market and place trading orders with their broker. Market data can be retrieved from the broker in question or independent data providers such as Thomson Reuters. This section details how to choose the best trading platform for day traders.

Typically, brokers offer their clients branded trading platforms unique to individual brokers, but there are also independent platforms that can connect to multiple brokers. Independent platforms can be a good option for experienced traders, but using the broker’s own platform is the easiest option for beginners.

Trading platform features

The best day trading platforms have a combination of features that help traders analyze financial markets and place trading orders quickly. In particular, the top-rated trading platform offers excellent implementation of the following features:

- Access to current and historical market data – Traders should be notified of market price movements as soon as possible, before opportunities disappear or losses materialize. Historical data is required for technical analysis and backtesting of trading strategies. Not all platforms have backtesting capabilities, so check before using any particular software.

- Charts and other visual aids – Trends and market sentiment are best visualized through different charts and plots of related technical indicators.

- Order Execution – When you decide to place a trade, you must immediately execute it on the market. Great platforms and brokers run in less than a second. Traders using automated trading want faster execution in milliseconds depending on the strategy used and price sensitivity.

- Automated trading – Platforms that offer automation capabilities allow traders to move the markets without using a computer at the time. The classic “stop loss” feature is a simple form of automation, but there are much more advanced platforms that allow you to program your own trading robot to perform more sophisticated strategies or react much faster than you can.

- Broker independence (optional) – You want to be an expert in all features of your trading platform, but still have the option to change the broker you are using. This solution is an independent trading platform (listed below) and can connect to multiple brokers.

Comparison of independent trading platforms

Independent trading platforms are used to visualize market data and manage trades, but you need to connect to one or more brokers to actually place trades on the market. These specialized day trading platforms usually offer a more advanced interface than your average brokerage and help you find and trade with one or more brokers of your choice. With an independent trading platform, changing to a different broker will not require you to relearn a whole new software.

Independent platforms often come with advanced features such as enhanced charting and pattern analysis, automated trading, and trading alerts/signals. Different platforms have different advantages. Note – not all brokers support integration with this kind of independent platform, so use our review to find one.

Trading account

When choosing a broker, you should also consider the account types offered. For example:

- Do you offer cash and/or margin accounts?

- Can I get a managed account?

- Do you offer a single standard account or different account levels?

The account that is right for you will depend on several factors such as your appetite for risk, your initial capital and your trading time. We describe the different options below, including their advantages and disadvantages.

Cash accounts

Most day trading brokers offer standard cash accounts. This is when you buy and sell securities with the capital you already have, instead of simply using borrowed money or margin. Most brokers offer cash accounts as a standard default option.

Benefits

A cash account has several advantages. First, cash accounts are relatively simple to open and maintain, as there is no available margin. It is also less risky than a margin account because all you can lose is your initial capital. Lastly, you don’t have to pay the interest charges that come with margin accounts.

Disadvantages

Trading in a cash account means that upside potential is low as there is no leverage. For example, equal gains on cash and margin accounts may represent a 50% difference in returns. This is because a profit account requires much less capital.

Also, you will have to wait for the funds to settle into your cash account before trading again. With some brokers, this process can take several days.

Overall, no margin means that these accounts may not be suitable for most active day traders.

Margin Accounts

Most brokers offer margin accounts. Essentially, you can borrow capital to increase your position size. For example, you pay only half of the value of your purchase, and your broker will loan you the rest.

Note Brokers often apply margin limits on certain securities during periods of high volatility and low interest.

Benefits

A margin account has several benefits. First, you can choose when to repay your loan as long as you maintain your maintenance margin requirements. Second, you can leverage your assets to expand your position size and potentially increase your returns.

Also, interest rates are usually lower than credit card or bank loans. Finally, if your portfolio is concentrated, you can use existing securities as collateral for margin loans.

Disadvantages

Despite the benefits, there are serious risks. With a cash account you can only lose your initial capital, but a margin call can see you lose more than your initial deposit. There are also interest charges to consider.

You should also check your maintenance margin requirements. If not, a short squeeze could result in a forced liquidation on the margin call.

Overall, margin accounts are a reasonable choice for active traders with a reasonable tolerance for risk.

Managed trading accounts

Some brokers also offer managed accounts. A managed account is simply your asset as the capital is the trader, but investment decisions are made by professionals. They may be referred to as advisors in the account. These advisors have complete control over your transactions. There are two standard types of managed accounts.

- Pooled Fund – With this type of account, your capital goes into a mutual fund along with the capital of other traders. Profits are then distributed among investors. Typically, brokers divide these accounts based on their risk appetite. For example, those looking for big returns might put their funds into a pool account with a high risk/reward ratio. Those looking for more consistent profits will probably choose a safer fund. The minimum investment for a pooling account is approximately $2000.

- Individual Account – With this account, your broker manages your capital individually and makes investment decisions on an as-needed basis. The main advantage is that experienced professionals are on your side. However, you will pay for that privilege with account maintenance fees and fees. Also, some brokers will charge a high minimum investment of at least $10,000 or more.

Overall, managed accounts are suitable for those who have a lot of capital but don’t have the time to trade actively. However, for those with little capital and those who have the time or tend to direct access to and from positions, unmanaged accounts are a good choice.

Account Levels

Some discount brokers for day trading only offer standard live accounts. However, others offer different account levels with different requirements and different additional benefits.

For example, a Bronze account can be an entry-level account. Here you can access our chat room, weekly newsletter, and some financial announcements and commentary. These entry level accounts usually have lower deposit requirements.

If you deposit more deposits, say $1000 or more, and make a certain number of transactions each month, you’ll get a Silver account. This gives you access to courses, personal account representatives, and more in-depth market commentary.

For example, if you deposit a little more $5,000, you can get a gold account. For this you can get:

- 10% Deposit Bonus

- Daily market research

- Referral Incentive

- Dedicated Trading Mentor

- Phone access to an active trading community

Finally, some brokers offer top-level accounts such as VIP accounts. You must deposit at least $20,000 to use this account. For example, you may need to trade 500 lots per quarter.

However, the larger the deposit, the more real help you get, as well as deposit bonuses, free trades and other financial incentives. You also have full access to a wide range of educational and technical resources.

Therefore, the best trading discount brokers offer several different account types to meet individual capital and trading requirements. It should also be borne in mind that generally, the more invested, the greater the perks and trading experience.

Final Words About Your Account

When choosing a broker, you should consider whether the account is right for your needs. The main factors to consider are your risk tolerance, initial capital and trading amount.

You can also open other accounts if you want to use several different strategies.

Regulation and licensing

A key thing to consider when comparing brokers is regulation. There are several regulatory bodies around the world. The reputation of these authorities varies, but almost all of them can give consumers a high degree of confidence in the brokers they license. Here are some of the main regulators.

Financial Conduct Authority (FCA) – The UK regulator responsible for all forms of trading and market speculation.

CFTC (Commodity Futures Trading Commission) – US regulatory oversight body.

SEC (Securities and Exchange Commission) – US regulator for exchanges and markets.

Financial Services Board (FSB) – South African regulatory body

CySEC (Cyprus Securities and Exchange Commission) – Cyprus regulator, often used to ‘pass’ regulated brands across Europe.

BaFin (Federal Financial Supervisory Authority for Finanzdienstleistungsaufsicht / Bundesanstalt) – German regulator

Financial Supervisory Authority Denmark ( Finanstilsynet)

The European Securities and Markets Authority (ESMA) provides a comprehensive guide to all European regulators and imposes specific rules across Europe, including lever caps, negative balance protections and blanket bans on binary options. This rule only applies to retail stores, not professional accounts.

How to use a free broker

A demo account is a great way for beginners to practice trading and test a broker or trading platform without using real money. Demo accounts are funded with mock money, so you can try out the features of your broker’s platform and become familiar with its behavior in the market. However, even the best practice platforms can’t really replicate the pressures of making money, but it’s a great way to learn the basics and avoid taking any risks at all.

Read more about demo accounts

How brokers make money

Even one of the best brokers for day trading can find contrasting business models. However, there are two main types.

- Market Maker

- Over the counter (OTC) brokers

Market Makers

The best brokers for online day trading are market makers. A market maker is ready to buy or sell continuously as long as you pay a certain price. This means that price fluctuations can be eliminated before a buyer/seller is found.

But, of course, you demand a reward for taking that risk. Therefore, we set the bid price slightly below the list price while setting the ask price slightly higher. Those small margins are where they make money.

Now, it may not seem that important. However, tens of thousands of trades are made every day through good brokers for daily trades using this system. Unsurprisingly, that fine margin can add up quickly.

Interstate trading brokers using this model usually offer fixed or variable spreads.

- Fixed spreads – never change no matter what happens in the market. Due to the added risk, fixed spreads tend to be wider than floating spreads.

- Floating spreads – fluctuates according to market conditions. For example, while London and New York overlap, increased liquidity will tighten the spread.

Let’s take an example. If you want to sell 50 shares of Tesla, good market makers will buy your shares whether or not there is a seller in line. However, they may purchase Tesla shares for $300 each (the bid price) and may offer to sell to another trader for $300.05 (the bid price). That $0.05 is where your online broker is making money.

OTC Brokers

Many of the best discount brokers for day traders follow an OTC business model. In fact, they are the most popular type of day trading broker. The immediate allure is the apparent lack of transaction costs and fees. However, it is not that simple with the best trading platforms.

Essentially, an OTC day trading broker acts as your counterpart. They will take the other side of your position. As a result, you don’t have to pay fees or commissions the same way. You are simply trading with the broker.

For example, the best OTC futures or CFD brokers can cover both sides of a trade, which promises significant margins. However, even the best brokers for day trading can hedge to offset the risk.

Compare

There are several key differences between online day trading platforms using these systems.

- Increasing Liquidity – In practice, the best brokers following the market maker model act as wholesale, buy and sell to meet the needs of the market.

- Cost – Without a market maker, it may take longer to find buyers and sellers. As a result, liquidity may be reduced and transaction fees may be higher as entry and exit locations become more difficult.

- Motivation – Market makers will make money regardless of the outcome of their trades. OTC brokers are interested in losing.

Top brokers in day trading often use variations of one of these models. Check out our review to see which models potential brokers use to get a feel for where and how to make money.

Intermediary Payment Method

Different trading brokers support different deposit and withdrawal options. The availability of one or more specific payment methods can be important to traders as fees and transit times vary from method to method. For some traders, instant deposits or withdrawals are important, while others may be fine with a processing time of several days. Any trader who makes frequent deposits or withdrawals will surely want to find low trading costs. Below are different payment methods, and the broker supports them with tutorials that cover everything a trader needs to know.

Trade in other regions

As the world moves online, you could in theory choose a day trading broker in India or anywhere else on the planet. However, there are tax considerations and regulations to consider before choosing a day trading platform in Australia, Singapore or outside of your country of residence.

- Tax considerations – Where you trade and where your intermediary is located can affect the type of tax and the amount of tax you must pay. Will you pay capital gains tax? Do you want to pay net income tax? Will you pay your foreign and domestic taxes once you start day trading with a broker in Canada? If you intend to contract with a distant broker, check the tax implications first.

- Regulations – Regulations are important for many reasons, but financial security is one of them. Choose a broker that is regulated in a well-established financial system such as the EU, US or UK. A regulated broker in Bermuda is better than unregulated, but you can still run into problems.

Canada and the US also have pattern day trading rules, but both are quite different. Learn more about this on our Rules page. Interstate trading platforms in Canada may differ significantly from their US or European versions, and platforms in South Africa may also differ.

Conclusion

The broker you choose is probably your most important investment decision. Everyone’s needs are different, so there’s no clear universal winner. Instead, you can consider the most important of the factors listed above when comparing and then find the broker that best suits your needs.