This simple and profitable trading guide teaches stock options trading for beginners. This strategy applies to stock markets, forex currencies and commodities. In this article, you will learn what options are, how to buy put and call options, how to trade options, and more. If options trading is not for you, try the harmonic pattern trading strategy. It’s a step-by-step guide that’s easy to get your readers interested in.

We will focus on BUYING Put and Call options throughout this options trading tutorial. Selling options are a different animal. More experience is needed to fully understand the inherited risks. why? You cannot control the downside in the same way you can when buying a Put and Call option.

This is the most successful options strategy because it consistently provides profitable trading signals. Not because there is no loss. Preferred Timeframes The best options trading strategy is the 15-minute timeframe.

First, let’s define what buying a put and call option is. After that, we will give you the rules for the best options trading strategies. There is another strategy called the PPG Forex Trading Strategy.

What are the options?

An option is a specific type of derivative contract . The underlying securities can be stocks, indices, ETFs or commodities. For derivative contracts, you do not directly own the underlying asset. Instead, you own related assets whose value is affected by price fluctuations.

When you enter into an options contract, you have the right to buy or sell an asset at a predetermined price at a later date. At that point, you can choose to exercise or expire the option.

Here is an example. Assuming the asset is selling for $110, the contract granting the right to buy at $100 will have intrinsic value. As the expiration date approaches, the value of the option contract is adjusted.

There are two types of options: call options and put options. When used correctly, options trading makes your strategy much more dynamic. Let’s move on to the next section.

What is a call option?

A call option provides the right to purchase an asset in the future. If exercised, this purchase will be made on a pre-determined date. It also occurs with a predetermined value. If you are unsure of an asset’s future value, call options can protect you. Call options are usually purchased by stock traders. However, it can also be found in many other markets. In fact, call options are the most commonly traded option contracts.

What is a put option?

A Put Option gives you the right to sell an asset in the future. Like call options, these contracts have a predetermined price and sale date. Put and call options are often purchased together to create a put hedge position. The different types of option selling are discussed below. We will then discuss how you can incorporate these sales into your trading strategy. You may also enjoy this article on options vs futures.

Different types of option sales

It should be remembered that an option is a contract that allows you to purchase an asset at a specific price in the future. There are four types of option selling that can occur. The difference between short and long sales and puts and calls is very important.

- A long call option will give you the right to buy an asset at a specific price in the future. Holders of long term call options benefit from price increases over time.

- A long put option will give you the right to sell at a specific price in the future. Unlike a call option, the holder of a long put option is hoping that the market price will decline.

- Short call options give you the right not to sell the underlying asset, but the option itself in the future. Because the “logic” of the short position is reversed, short call option holders are in a similar position to long put option holders.

- Short put options will hopefully become less valuable than long put options, so that the owner will cheer them up over time.

Once you can understand the different kinds of options selling, you can engage in more complex trading strategies. These strategies usually involve buying several different options to manage risk and increase your chances of making high returns.

Why use options?

Options are used for speculation or hedging. Hedge fund managers are known for using advanced risk management strategies to hedge market risks.

Options offer high leverage, giving you the opportunity to trade large contracts and make more money. This is the same as Forex. It requires a smaller initial investment than buying the stock directly. Your risk when buying an option is limited to the initial premium price.

When using options, the risk is limited, but the potential gains are theoretically unlimited. Clearly, we speak theoretically unlimited profits. However, option prices are limited in range within certain parameters. There is no stock price that will rise indefinitely. Also read this article on Paper Trading Options – The Secret to Wealth.

Types of Option Strategies

You can trade more than base currencies and put options. This is the beauty of options trading. Other trading strategies include applied currencies, married puts, bull call spreads and bear put spreads. It helps you better manage your risk and find new trading opportunities.

If you are a versatile trader, take advantage of the flexibility options trading can provide. Study the 10 stock options trading strategies below.

- Covered Call Strategy or Buy-Write Strategy – means buying stock. At the same time, you want to sell call options on the same stock. The number of shares purchased must equal the number of call option contracts sold.

- Marriage Put Strategy – means buying stock. At the same time, you will be buying a put option on an equal number of shares. A married put works like an insurance policy against short-term losses.

- Bull Call Spread Strategy – This means buying a call option at a specific strike price. Simultaneously sell the same number of call options at a higher strike price.

- Bear Put Spread Strategy – Similar to the Bull Bull spread, but involves buying and selling put options. In this option strategy, you buy a put option with a specific strike price. Simultaneously sell the same number of put options at a lower strike price.

- The protective collar strategy – means buying an out-of-the-money option. Sell or write an out-of-the-money call option on the same stock at the same time.

- Long Straddle strategy – means buying both a call option and a put option at the same time. Both options must have the same strike price and expiration date.

- Long Strangle strategy – means buying an out-of-the-money option and a put option at the same time. The validity period is the same, but the strike price is different. Put strike prices are generally lower than call strike prices.

- Butterfly Spread Strategy – A combination of Bull Spread and Bear Spread strategies. The classic butterfly spread involves buying one call option at the lowest strike price. At the same time, sell two call options at high strike prices. And sell one last call option at a higher strike price.

- Iron Condor Strategy – This involves holding a long and short position in two different strangling strategies.

- Iron Butterfly Strategy – Use a combination of long or short straddle strategies. Buy or sell a strangle strategy at the same time.

Let’s now turn our focus back to the most successful option strategies.

Let’s define the indicators you need for the best options trading strategy. How to use stochastic indicators.

The only indicator needed is the RSI or Relative Strength Index.

Options trading is limited by the expiration date factor. Therefore, it is important to choose the right technical indicators for options trading. The RSI indicator is a momentum indicator that makes it a perfect candidate for options trading. This is due to its ability to detect overbought and oversold conditions in the market.

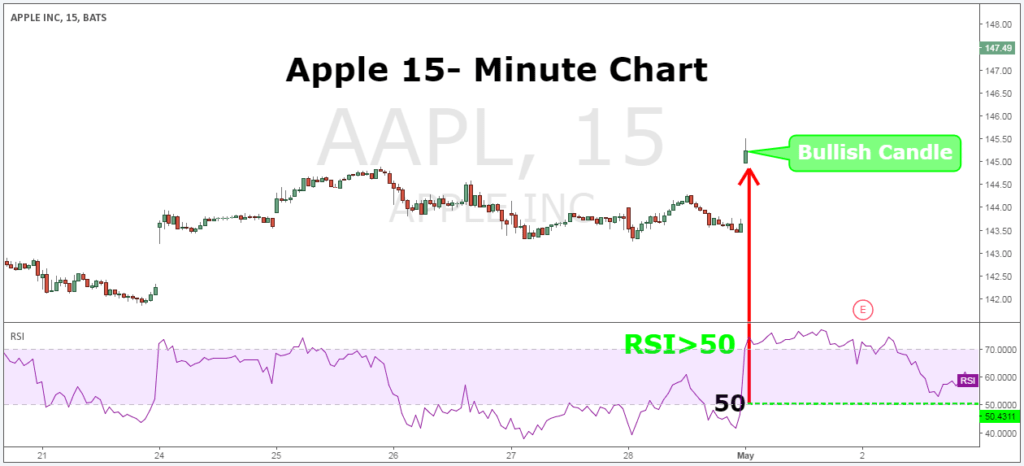

The location of the RSI indicator is on most FX trading platforms (MT4, TradingView). You can find it in the indicator library.

So how does the RSI indicator actually work?

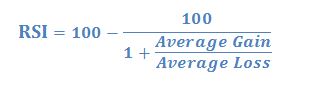

RSI uses a simple mathematical formula to calculate the oscillator.

There is no need to go deeper into the math behind the RSI indicator. All we need to know is how to interpret RSI oscillations. Basically, an RSI reading below 30 indicates that the market is oversold. An RSI reading above 70 indicates that the market is overbought. At the same time, figures above 50 are considered optimistic. On the other hand, a reading below 50 is considered bearish.

The default RSI indicator setting is the default setting of 14 cycles.

It’s always a good idea to take a paper and pen and stick to the rules before going any further.

Let’s learn about options trading tutorial… .

Most successful options strategy

(Rules for Buy Call Options)

Options Trading Tutorial Step 1: After the stock market opens, wait 15 minutes to set your market bias.

The most successful options strategies don’t just focus on price. But they also use the same time factor we do here.

The stock market opening price is usually the most important price. In the first minutes after the stock opens, we can notice a lot of trading activity. Because the time has come for major investors to establish their positions in the stock market.

Read Daily Trade Price Action – Simple Price Action Strategies. Learn about strategies that are not limited to the time factor and focus on price action. One of the most comprehensive guides to successfully trading stocks or other assets based on price action alone.

The Trading Strategy Guides team wants to develop the best options trading strategy for you. You have to think smarter to do that. We need to track how smart money operates in the market.

The best options trading strategies won’t be glued to your screen all day. You just need to know when the stock market opens.

The NYSE opens at 9:30 EST or 1:30 PM GMT for those trading in Europe.

Proceed to the next step in our options trading tutorial.

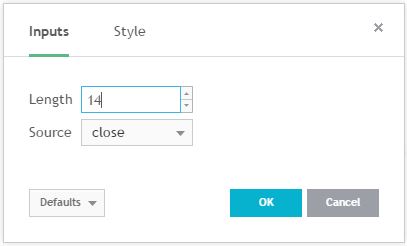

Options Trading Tutorial Step 2: Check the 15-minute candle after the opening bell (9:30 EST) is bullish.

As we established earlier, we only want to trade in the direction where there is smart money. If we are looking for call options opportunities, we want to make sure smart money is being bought after they open. Conversely, if you want to buy Put Options, the ticks will appear immediately after opening.

IMPORTANT NOTE*: If we had an open gap, the purchasing power would be stronger and we should place more weight on this trade setup.

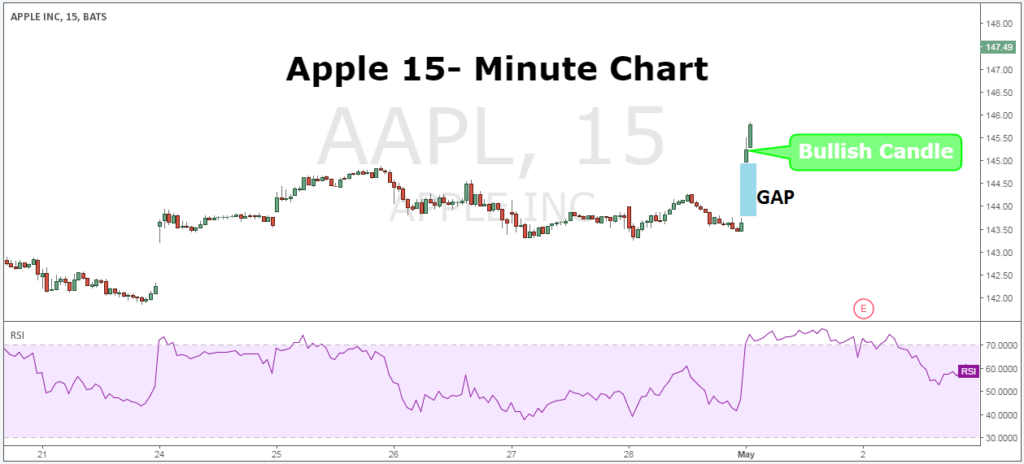

Options Trading Tutorial Step 3: Check if RSI is above 50 level – This is a bullish momentum signal.

We only use the RSI indicator for confirmation purposes. After confirming bullish price action, the momentum of the move is confirmed by the RSI indicator. I am not concerned about overbought and oversold conditions as the market can stay in these conditions longer than it can stay solvent.

In the chart above, we can see that the RSI is well above 50 for the first 15 minutes of the trade. Price action is confirmed by RSI momentum figures.

Now let’s go to and define exactly where we want to enter our purchase option.

Option Trading Tutorial Step #4: Buy a call option as soon as the second 15-minute candle opens after the opening bell.

Now that we have confirmed that smart money is being bought, we don’t want to lose any more time and want to buy a call option at the beginning of the 15th minute following the opening bell.

As easy as this strategy is, you only need to invest 15 minutes of your time each day. You may or may not receive a signal, but it takes discipline to utilize the best options trading strategies and you should avoid taking trades if there are no signals.

So, at this point, our trade is in progress and we take a profit, but we need to define when to exercise the call option and take a profit.

Options Trading Tutorial Step #5: Choose the closest expiry cycle. For weekly trading, choose a weekly cycle.

When you buy a call option, you must also settle the expiration date as part of that contract.

How to choose the right expiration cycle, you may be asking yourself?

Choosing a weekly cycle is more appropriate because you are more likely to sell a call option on the same day you bought it.

Time to shift our focus to the most important part: Where to Sell Call Options at Profit?

Option Trading Tutorial Step 6: Take Profit and Sell Call Options as soon as the 15-minute bearish candle is placed in a row.

Knowing when to take a profit is just as important as knowing when to start trading. We want sellers to step out of our shoes as soon as they step in. We measure this by counting two consecutive bearish candles as the presence of bearish sentiment in the market.

I don’t want to use long call options because I don’t want to own the stock, I just want to make a quick profit.

Note ** The above is an example of buying currency options using options trading tutorial. Use the same rules as when buying a put option trade. In the picture below you can see an example of an option to buy option in action using options trading tutorial.

We have applied the same Step 1 through Step # 4 through Step # 5 to help us establish our trade bias and identify buying put option trades and then Step # 6 through Step # 6 to identify when you sell your call option. there is.

Selecting the right options contract for you

Now that you understand how to successfully trade options, you’ll want to know how to choose the right contract for you. All options contracts carry some degree of risk. This is especially true when trading binary options. This is because the option may be potentially worthless on its expiration date. You can manage the risk of trading options.

When choosing an option, keep the following in mind:

- Personal risk tolerance

- Preferred trading period (day trading, long trading)

- Volatility of each expected asset

- Past earnings on options contracts

Options contracts also exhibit high levels of volatility. During the first 30 minutes of trading, the value of an option contract fluctuates significantly. Higher volatility increases both the risk level and potential reward. Your trading strategy should be much more active during this period. Risk can be managed by issuing a stop order. You can also manage by avoiding positions and diversifying your positions.

Both call and put options are very rewarding. To prepare yourself as an options trader, practice is a good idea. Fortunately, our trading strategy guide makes it easy to hone your skills and enter new markets. A careful combination of the steps mentioned above will give you the best option trading strategy.

Conclusion – Options Trading Tutorial

This is one of the most successful options strategies because when trading stocks it is important to understand market sentiment and how you place yourself at large in the market. Another important reason this is the best options trading strategy is that you don’t have to be glued to your screen all day.