Following last week’s price movement, we’ve updated this article to take advantage of this price action.

Today’s article is about Cryptocurrency Trading Strategies and Daily Trading Bitcoin. You’ve probably been hearing too much about it. There are many cryptocurrency trading strategies that promise to make you rich. The Trading Strategy Guides team now understands that everyone wants some pie. That’s why we’ve put together the best Bitcoin trading strategies PDF.

We also have a complete strategy article with a list of all the best trading strategies we have created.

The truth is that Bitcoin is currently the hottest trading market. At this point, it is hotter than stock trading, oil trading, gold trading and other markets. The reason people believe this will continue to be a hot market is because of blockchain technology. This is what allows transactions to take place without a central exchange. Here is another strategy on how to draw trend lines using fractals.

Trading bitcoin for profit is actually a popular cryptocurrency trading strategy. It can be used to trade over 800 cryptocurrencies available for trading today. If you are unfamiliar with cryptocurrencies, it is best to start with a brief introduction first.

How to start trading Bitcoin:

The first thing you need to do to start trading Bitcoin is to open a Bitcoin wallet. If you don’t have a bitcoin wallet, you can open one from the largest one called Coinbase. We have created a special contract for anyone who wants to start playing Bitcoin to get free $10 at Coinbase. Get $10 FREE by opening a Coinbase account here.

Bitcoin traders are actively seeking the best solutions for trading and investing in Bitcoin. In this article, we have some of the best methods described here. We’ve learned this Bitcoin wisdom through trial and error, and we’ll show you what’s happening now. The method we teach is not dependent on Bitcoin price. It can be used when Bitcoin goes up or down.

Keep in mind that you may lose money. Your capital is still at risk while trading cryptocurrencies. We always recommend demoing a trade before risking your money. Also read our trading volume guide.

This bitcoin strategy can also be used to trade bitcoin cash and other cryptocurrencies. In fact, you can use it as a trading guide for any type of trading instrument. Blockchain technology is a huge step forward in how information is accessed. Many companies are starting to develop applications that favor blockchain. When you trade digital currencies, they may look like they are not real currencies. But it’s actually a reality. This isn’t some Ponzi scheme. Before buying bitcoin, make sure you plan ahead and don’t underestimate the cryptocurrency market. You should perform technical analysis as if you were trading any other instrument. You can also read our top inter-fan trading strategies.

Major Exchanges for Bitcoin and Cryptocurrency Trading

One of the reasons Bitcoin is so popular among day traders is the variety of Bitcoin exchanges available. Finding the best Bitcoin exchange depends on many factors. This includes country of residence, preferred payment method, fees, limits, liquidity needs and other factors.

The most popular cryptocurrency exchanges on the market are:

- Coinbase is the world’s largest cryptocurrency exchange. Available in the US, Canada and most countries in Europe. We offer several payment options.

- Binance is the second largest exchange trading over 130 currencies. Transaction fees are low (0.1%).

- Bitmex is the third largest exchange and only trades BTC. Suitable for short selling and margin trading.

- Bittrex is a US-based exchange founded by former Microsoft security experts.

- Robinhood is a new transaction with 6 million users and no transaction fees

- OKEx is a Hong Kong-based exchange. Trade over 145 different cryptocurrencies.

- GDAX – a US-based exchange that allows users to trade Bitcoin, Ether, Litecoin, and other cryptocurrencies.

- itBit operates as a global over-the-counter (OTC) trading desk and global bitcoin exchange platform.

- Coinmama – easy to buy and sell. Credit cards are accepted and are widely used worldwide.

What is this free bitcoin trading strategy?

Cryptocurrency is really no different than money in your wallet. They have no intrinsic value. And while cryptocurrency is a bit of data, real money is just paper.

Unlike fiat money, Bitcoin and other cryptocurrencies do not have a central bank controlling them. This means that cryptocurrencies can be sent directly to users without a credit card or bank acting as an intermediary. The main advantage of cryptocurrencies is that they are non-printable like central banks create fiat currencies.

Printing a lot of money raises inflation, causing the value of the currency to drop. You have a limited amount of bitcoins. This is true for most other cryptocurrencies. The inability to increase the supply side makes Bitcoin less affected by inflation.

Now let’s see how you can benefit from cryptocurrency enthusiasts. We will be using the best bitcoin trading strategies. We are also trained on the best short term trading strategies.

How to trade Bitcoin

While long-term traders prefer to hold Bitcoin positions for long periods of time, day traders have found that Bitcoin is highly profitable for a number of reasons.

- Crypto trading is more volatile than stock trading.

- Bitcoins are traded 24 hours a day, 7 days a week.

- Bitcoin allows for large transactions with little overhead.

- Bitcoin is the most liquid form of cryptocurrency.

- Multiple trading opportunities within 24 hours.

Because Bitcoin is more volatile than other tradable assets, many profitable trading opportunities arise on a daily basis. As with regular currencies, technical indicators make it easy to tell when price increases are likely to occur. Volume, relative strength, oscillators and moving averages can all be applied to Bitcoin weekly trading.

It is important to pay attention to technical indicators and development trends. The following steps explain how to start trading OBV and buying and selling cryptocurrencies.

Best Bitcoin Trading Strategies – 5 Easy Steps to Profit

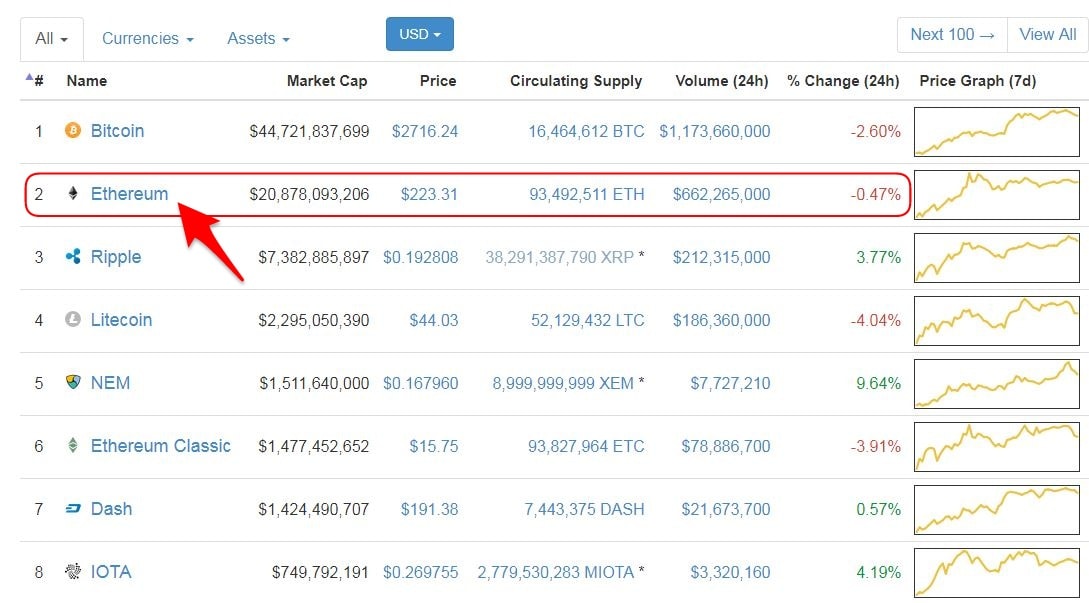

This is a cryptocurrency trading strategy that can be used for every important cryptocurrency trade. In fact, this is as much an Ethereum trading strategy as a Bitcoin trading strategy. If you don’t know Ethereum is the second most used cryptocurrency (see picture below).

The best bitcoin trading strategies are 85% price action strategies and 15% cryptocurrency trading strategies using indicators.

now…

Before moving forward, we need to define some mysterious technical indicators. For the best Bitcoin trading strategy and how to use it, you will need these:

The only indicators you need are:

On Balance Volume (OBV): One of the best indicators for daily trading Bitcoin. Basically, it is used to analyze the total money flow outside the equipment. OVB uses a combination of quantity and price action. This tells you the total amount entering and exiting the market.

OBV indicator

The OBV indicator can be found on most trading platforms such as Tradingview and MT4. Reading information from the OBV indicator is very simple. You can learn how to profit from trading.

In theory, if Bitcoin is trading and OBV is trading, it indicates that people are selling on this rally. A move upside will not be sustainable. Even if Bitcoin is being traded and OBV is being traded.

What we really want to see is OBV moving in the same direction as Bitcoin price. Later, you will learn how to apply this information along with your cryptocurrency trading strategy.

No technical indicator is 100% effective every time. In this regard, the Trading Strategy Guides team uses the OBV indicator along with other evidence to stay in the trade and gain more confirmation. The next step comes from an Ethereum trading strategy that will be used to identify Bitcoin trades.

Now, before we go any further, it is always a good idea to bring a paper and pen and write down the rules of the best Bitcoin trading strategy.

Let’s start… ..

Best Bitcoin Trading Strategies –

(Purchase Transaction Rules)

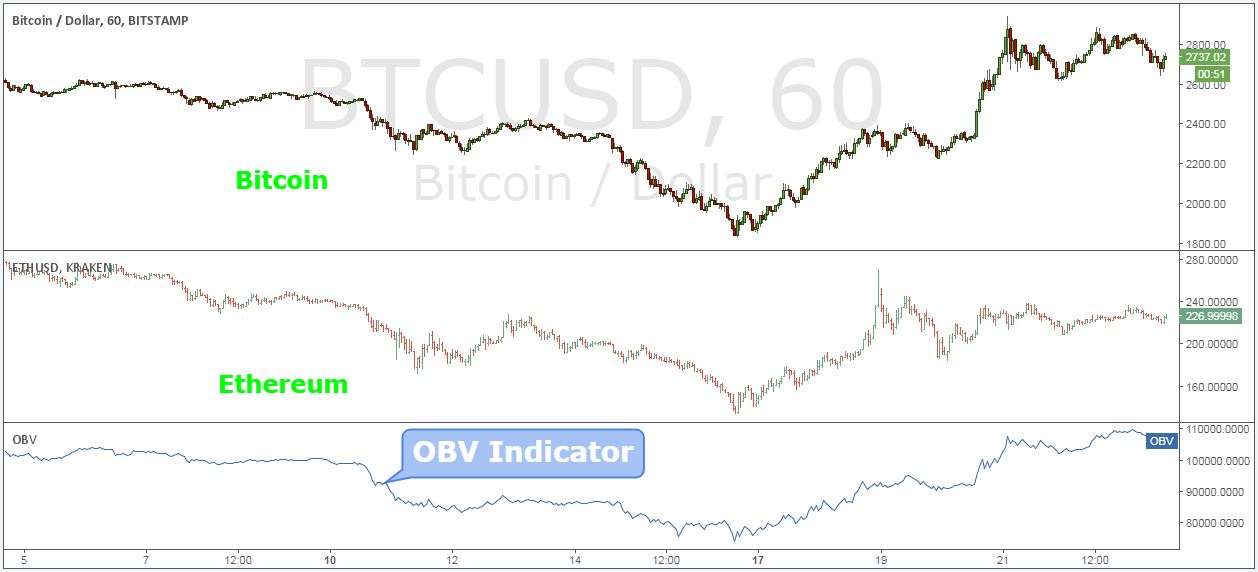

Step 1: Overlay the Bitcoin chart with the Ethereum chart and the OVB indicator.

Chart Settings basically has 3 windows. One for Bitcoin charts and one for Ethereum charts. Finally create one window for the OVB viewer.

If you follow the cryptocurrency trading strategy guidelines, your chart should look like the picture above. All will be good for now, so it’s time to move on to the next step in our best Bitcoin trading strategies.

Step 2: Find the smart money divergence between the price of Bitcoin and the price of Ethereum.

What do we mean by this?

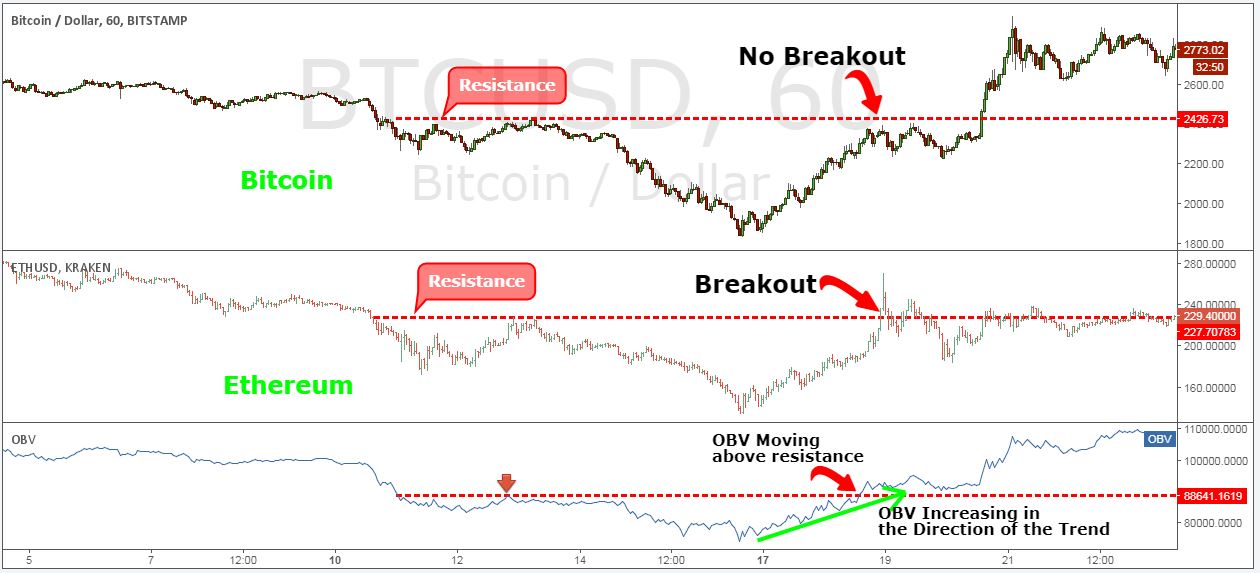

Briefly, we will look at the difference between the price of Bitcoin and the price of Ethereum. Smart money diversification occurs when one cryptocurrency fails to confirm the behavior of another.

For example, if the price of Ethereum breaks above a critical resistance or surges and Bitcoin fails to achieve it, we have smart money diversification. That means one of the two cryptocurrencies is “liar”. This is the main reason we used this cryptocurrency trading strategy. The same goes for Ethereum trading strategies.

If you’re still struggling to identify support and resistance, read our guide on this topic from Support and Resistance Areas – The Road to Successful Trading.

In the picture above, we can see that Bitcoin’s price failed to break through the resistance and Ethereum’s price rose and made a new high. This is the first sign that the best Bitcoin trading strategies are telling you to trade.

The reason the concept of smart money decentralization works is that when the entire cryptocurrency market is trending, it should move in the same direction. For decades, the same principle has been applied to every other major asset class. The same goes for cryptocurrency trading strategies.

Confirmation is required from the OBV indicator before purchase. This takes us to the next level of our best Bitcoin trading strategy.

Step 3: Find the OVB that will increase in the direction of the trend.

If Bitcoin lags behind the price of Ethereum, it means that Bitcoin will follow Ethereum and break through the resistance sooner or later.

But how do you know?

Simply put, OBV is an amazing technical indicator. It can show you whether real money is actually buying or selling Bitcoin. When Bitcoin fails to rise above the resistance level and Ethereum has already broken, what we want to see is OBV increasing in the direction of the trend. I also wanted to break above the level where Bitcoin had previously traded at this resistance level (see picture below). Here’s how to identify the right swings to increase your profits.

Now all we need to do is place a buy limit order. This leads to the next step in our best Bitcoin trading strategy.

Step #4: Place a buy limit order at the resistance level to catch a possible breakout.

When the OBV indicator shows a green signal, you are placing a buy limit order. Place a command at a resistance level in anticipation of a possible breakout.

It’s no surprise that this trade kicks off and the price of Bitcoin rises to a higher-than-expected price. After all, we said OBV is an amazing metric.

Now all we need to establish is where to place the protection stop loss and when to take profits for the best bitcoin trading strategy.

Step 5: Place SL below the breakout candle and take profit when OBV reaches 105,000.

Placing your stop loss below the breakout candle is a smart way to trade. We wrote more about why SLs hide above/below breakout candles in our most recent article, Breakout Trading Strategies Used by Professional Traders.

When taking our profits, usually an OBV reading above 105,000 is an extreme reading indicating at least a pause in the trend. This is where we want to profit.

Note ** The above is an example of a buy trade… Use the same rules for sell trades. In the picture below you can see a real SELL trading example using the best bitcoin trading strategies.

How to Strengthen This Bitcoin Day Trading Strategy

Bitcoin trading has some risks, but there are many ways to reduce these risks. Here are the best ways to improve your Bitcoin trading strategy.

remember:

- Diversify your trades. Combining Bitcoin, Ripple, Litecoin, Ethereum and other cryptocurrencies reduces the daily risk associated with a particular coin.

- Minimize transaction costs. Opening multiple positions each day will affect your daily ROI. To minimize trading costs, choose a reliable exchange with low fees.

- View trading hours. Plan trading hours that fit your schedule. Bitcoin is traded 24 hours a day. 9-5 Different from NYSE.

- Follow Bitcoin News. Stay ahead of the market by paying attention to cryptocurrency news articles. Set notifications and other types of notifications.

- Use technical analysis. Use a strong technical indicator like OBV. This will help you justify each of your trades.

- Use stop loss. Set a stop-loss order on any trade. Start with a 2:1 profit-loss ratio.

Maybe one day our fiat money system will be completely replaced by cryptocurrencies. We live in a digitized world, and the possibility that Bitcoin or other major cryptocurrencies will replace payment for goods and services is beyond the bounds of possibility.

However, as long as you are still making money from Forex currency trading, read the receipt for Forex trading success: How to Trade Money – The Key to Success 2 .

Best Bitcoin Trading Strategies – We hope you get tips on how you can trade cryptocurrencies using the same technical analysis tools you use when trading the Forex currency market.

Are you ready to start? Find out about other major investments in the best cryptocurrencies for investing in 2019.

Click here to get the e-book completely free!

Thanks for reading!

If you have any questions about this best Bitcoin trading strategy, please leave a comment below!