All forex traders try to come up with their own profitable strategy. Well, today is your lucky day! We will share with you the best ADX strategies built by professional traders. Our team at Trading Strategy Guides believes that the easiest way to become a profitable trader is to emulate the behavior of professional traders.

Much has been said about trend trading strategies. You can find evidence here: Learn MACD Trend Trading Strategies – Simple Follow Strategies, Here: How to Trade Profit from Falling Stocks Here: Things Swing Trading Strategies.

However, it has not addressed how to measure the strength of trends over possible time frames. You can only measure the strength of a trend using special trading indicators. For example, ADX is an abbreviation for A verage Directive Index.

Detecting strong directional changes is the most important skill for any trader. No matter what type of trader you are, you need a strong turn after entering a position. The move must be in the direction of the trade to make a profit.

ADX indicator trading rules can help you achieve your financial goals.

Before we move on, we need to define the technical indicators required for the best ADX strategy. Define ADX indicator trading rules. Also read The Hidden Secrets of Moving Averages to learn more.

ADX indicators for futures

The principles of average-directed indices can be applied to virtually any tradable asset, including stocks, trade-traded funds, mutual funds, and futures contracts. ADX is very useful in futures markets for several reasons.

- ADX has a standard range of 14 and provides a “bigger picture” than many other technical indicators.

- ADX is time-adjusted to give superior weight to the latest data.

- ADX helps identify the strength of a trend and is useful for any contracts executing in the near future.

- ADX makes it very easy to compare mutually exclusive futures contracts in one step.

Futures traders love using ADX as an indicator because it provides a perfect blend of past and present data and future predictability. Successfully buying futures contracts requires identifying which potential contracts are mispriced in their current state. This is possible by using normal ADX readings for future contracts.

Using ADX readings on major indices (DJIA, S&P 500, etc.) can identify bearish or bullish conditions in the general market.

ADX indicator trading rules

Before moving on to ADX indicator trading rules, let’s define what the ADX indicator is and how you can profit from it.

The ADX indicator simply measures the strength of a trend and whether we are in a trading or non-trading period. In other words, ADX is a trend strength indicator. This technical analysis method is used to buy signals when a strong downtrend is occurring.

You have to be very careful how you read and interpret the ADX indicator. It is not a bullish and bearish indicator. ADX’s moving average only measures the strength of a trend.

So, if the price goes UP, and the ADX indicator also goes UP, we have a case of a strong bullish case.

The same is true if the price goes DOWN and the ADX indicator will UP . Then we have a case for a strong bearish event.

According to the first ADX indicator trading rules, a reading below 25 indicates a signal in a non-trading or range market. According to the second ADX indicator trading rule, an ADX above 25 is sufficient to indicate that a strong bullish/bearish trend is present.

Going forward, the ADX indicator does not provide any information about the direction of the market. It only provides information about the strength of the trend.

ADX indicator settings

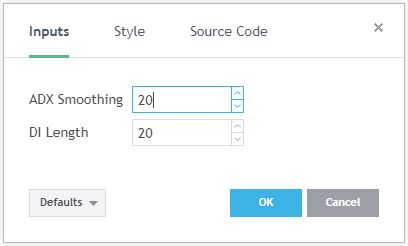

The ADX indicator uses a smoothed moving average in its calculations. The best ADX indicator setting to use is 14 periods. ADX indicator setup will give you more accurate signals and help you trade earlier.

The ADX indicator works best when used in conjunction with other technical indicators.

The best ADX strategies also incorporate the RSI indicator to time the market. The ADX indicator helps gauge the strength of a trend. I need an RSI indicator for my input signal.

The RSI uses the same 20 period setting as the ADX indicator setting.

Finally, you should have ADX and RSI indicators at the bottom of your chart settings. It should be same as picture below.

Now let’s see how you can trade effectively with the best ADX strategies. Learn how to apply ADX indicator trading rules to make money.

Best ADX Strategy

ADX indicator trading rules force you to trade only when there is a strong trend on the 5-minute chart or daily chart. In this regard, the best ADX strategies are universal strategies that perform the same regardless of the time frame used.

In the future, we will be looking for sales opportunities.

Step 1: Wait until the ADX indicator shows a reading greater than 25.

You should first wait for the ADX indicator to show a reading above 25 before checking if the market is going up or down. As per the ADX indicator trading rules, a reading above 25 indicates a strong trend and a trend is developing.

We all know that trends are our friends, but if there is no real power behind them, newly formed trends can quickly fade away.

Actual price action should also be reviewed to gauge the direction of the trend. This takes us to the next level of our best ADX strategy.

Step 2: Use the last 50 candlesticks to determine the trend. For a sell signal, look for a price that will show a bearish trend.

You need a practical way to determine the direction of a trend regardless of time period.

We use a 50 candlestick sample size to determine trends, ensuring you can trade right now. We like to keep things simple. So, if the price goes lower in the last 50 candlesticks, it becomes bearish.

Now it’s time to focus on the catalyst that will trigger the sell signal for the best ADX strategy.

Step 3: Sell when the RSI indicator breaks and mark below 30.

For the entry signal, we use the RSI indicator with the same settings as the ADX indicator setup. RSI readings below 30 usually indicate oversold markets and reversal zones. But smart trading means more than what the textbooks say.

As defined by the ADX indicator, this is the exact trend we want to see. Hopefully more sellers will come to the market.

So we want to sell when the RSI indicator breaks and shows a reading below 30.

The next important thing to set is your protection stop loss position.

See below…

Step #4: Your protection stop loss should be at your last ADX high.

To determine where to place a loss loss for the best ADX strategy, first check the ADX’s last high before entering it. Second, in ADX high, if you find the corresponding high on the price chart, you have the SL level.

Finally, the best ADX strategies also need a place to bring profits, which brings us to the final stage of this unique strategy.

Step 5: Take profit when the ADX indicator returns below 25.

The best ADX strategies only seek to capture profits made by the presence of strong trends. When the prospect of a strong trend disappears, take profits and wait for another trading opportunity.

To achieve this, we take profits when the ADX indicator drops below 25.

When the ADX returns below 25, it indicates that the general trend lacks strength.

Note ** The above is an example of a SELL trade using ADX indicator trading rules. Use the same rules for buy trades. In the picture below you can see an example of a BUY transaction in action.

watch:

Conclusion – ADX indicator

The best ADX strategies provide a lot of useful information. A lot of the time, as traders, we don’t want to get into something that’s not moving out of nowhere and doesn’t fall into a strong fad. By applying ADX indicator trading rules, you can capitalize on trend strength and quick profit cash. The bottom line is that the best returns come from catching strong trends and the best ADX strategies can help you achieve your trading goals.

You can also read our Trader Profile Quiz.

The best ADX strategies are similar to the best momentum trading strategies for quick profits. This is because both strategies take advantage of the strength of the trend.