Do you know how to trade with the best fractal trading strategies? This fractal trading strategy answers all your questions about fractals. You will learn how to use this strategy step by step to achieve consistent winning trades.

Today, let’s learn about strategies for trading with the Bill Williams Fractal Indicator / Bill Williams Alligator.

Before you start trading profitably using fractals, I would like to give you some background information on Bill Williams. This will help you understand the importance of these special indicators. Also read about scaling and scaling out in Forex.

Quick Overview of Bill Williams: Fractal Trading Bill Williams

Williams developed a unique theory by combining chaos theory and transactional psychology. along with their impact on market movements. Bill Williams’ vast knowledge of stocks, commodities, and forex markets has led him to develop many indicators, including fractal trading patterns.

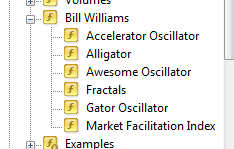

These include Accelerator/Decelerator Oscillator, Alligator, Awesome Oscillator, Fractals, Gator Oscillator, and Market Facilitation.

Each metric has a specific value. Understanding the basic concepts of each is great for trading.

His market outlook is that you need to be able to understand basic market structures in order to trade in the money. He must be aware of inside-the-market parts called dimensions.

These dimensions include:

- Fractal (phase space)

- Zone (phase energy and force combination)

- Momentum (phase energy)

- Deceleration/acceleration (phase force)

- Balance line (odd attractor)

I could go on about Bill Williams for quite some time. But the important part to note about all of this is that his analysis and perspective on the market is different. This strong metric is not as outdated as some claim. It is very effective when the right strategy is applied.

His indicator comes standard on most trading platforms. These indicators are most likely “Bill Williams” or “Williams” indicators, which are his namesake.

Indicators used in the Fractal Blaster trading strategy

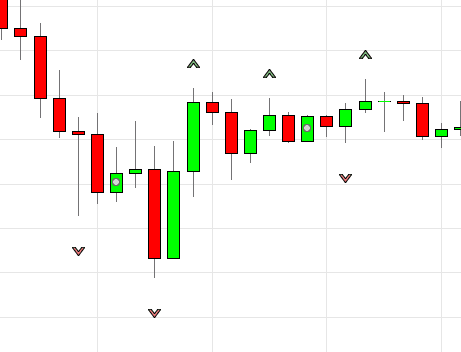

Bill Williams Fractals: How do fractal indicators work? Well, these are simply arrows above or below the candles on the chart. This fractal is formed when 5 repeating bars align in a distinct way. The fifth bar closes to find the highest high or lowest. We will explain this indicator in detail and show you how to use the alligator indicator. You can find fractal indicators on mt4 or other popular trading platforms. There is no need to run Fractal Indicator Download as it is already required.

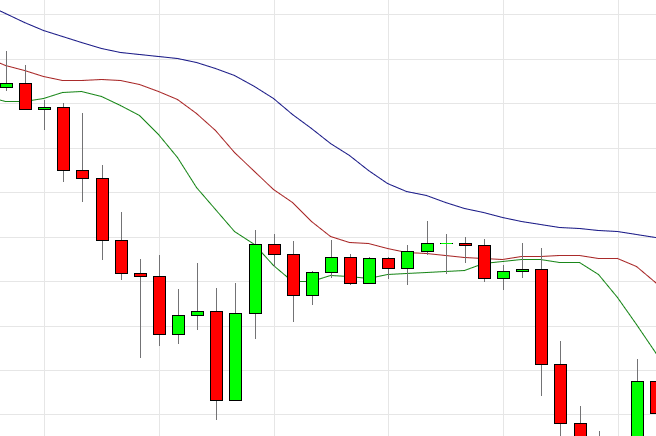

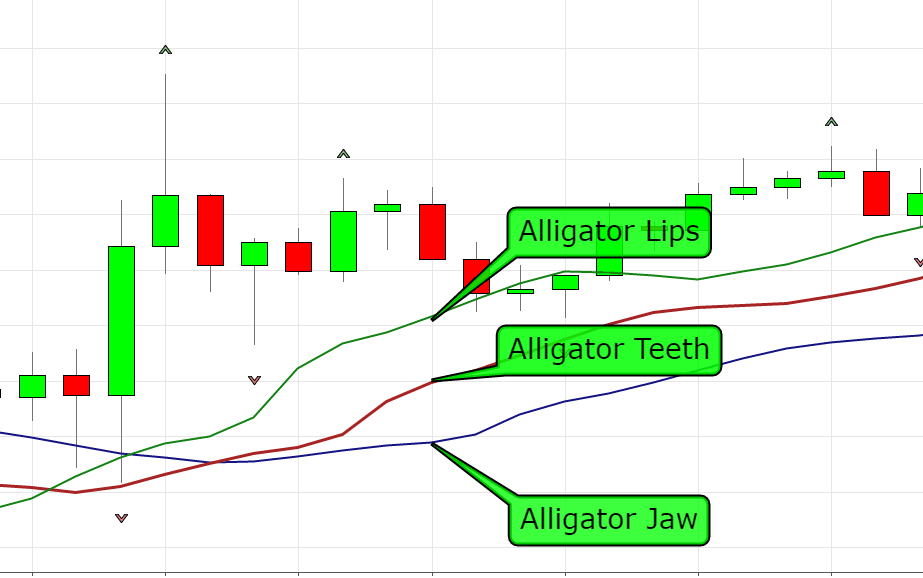

Bill Williams Alligator: How does the Bill Williams Alligator indicator work? This indicator is made up of 3 specific moving averages.

The 13th cycle line is called the chin (blue)

The 8th period line is called the tooth (red)

The 5th period line is called Lip (Green)

We’ll look at this metric a bit more. Each of these lines has a specific name. Because we will refer to it later in the strategy.

Here’s what a crocodile looks like.

We developed a strategy called the Big Three Trading Strategy which uses three specific moving averages, if you want to check it out later.

These are just two of a total of five indicators developed by Bill Williams.

As you can see above, these are the 5 Bill Williams strong indicators that come standard on our trading platform.

I love each of these 5 indicators, but after extensive research and testing, the crocodile and fractal indicators were not only the easiest way to trade with his indicator, but also very powerful with the right strategy.

Fractal Trading Strategy Steps: Fractal Trading Techniques

Step 1: Apply both Fractals and Bill Williams Alligator indicators to the chart

The first step you want to do is, of course, throw these important indicators into your charts. Like I said, they come standard on every trading platform I know of, so this should be pretty simple to do.

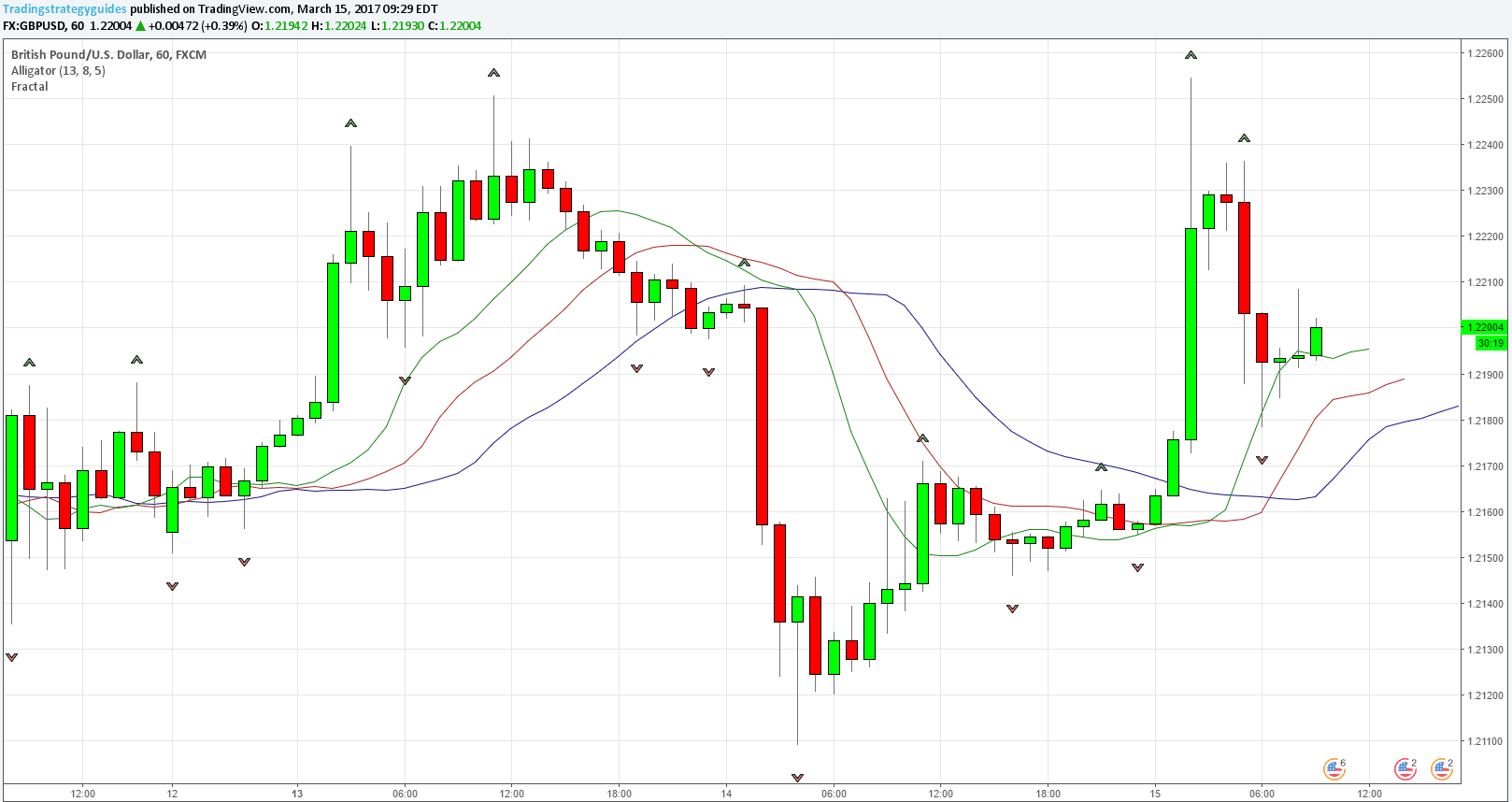

After doing this, your chart will look like this:

complete.

Step 2: Trading Fractals Bill Williams: Identifying Where Fractals Form (Above or Under Alligator Teeth)

Note **This example uses purchase transaction items, so all these rules apply to purchase items.

So, let’s figure out what a fractal is.

Fractal indicates down or up. A basic fractal indicator consists of at least 5 bars. If you see a fractal here, it may appear.

- There were at least 5 consecutive bars with the highest high in the middle and two lower peaks on either side.

- At least 5 consecutive bars are reversed when the lowest low is in the middle and on either side of the two higher lows (forming a minimal fractal).

- The fractal may appear with only one candle to the right, but we know it is an unconfirmed fractal because the price action is able to penetrate the level. So, for the fractal to appear and stay on the chart forever, traders need to wait for 2 candles to the right of the fractal.

- Fractals have high and low values. Indicated by an up or down arrow.

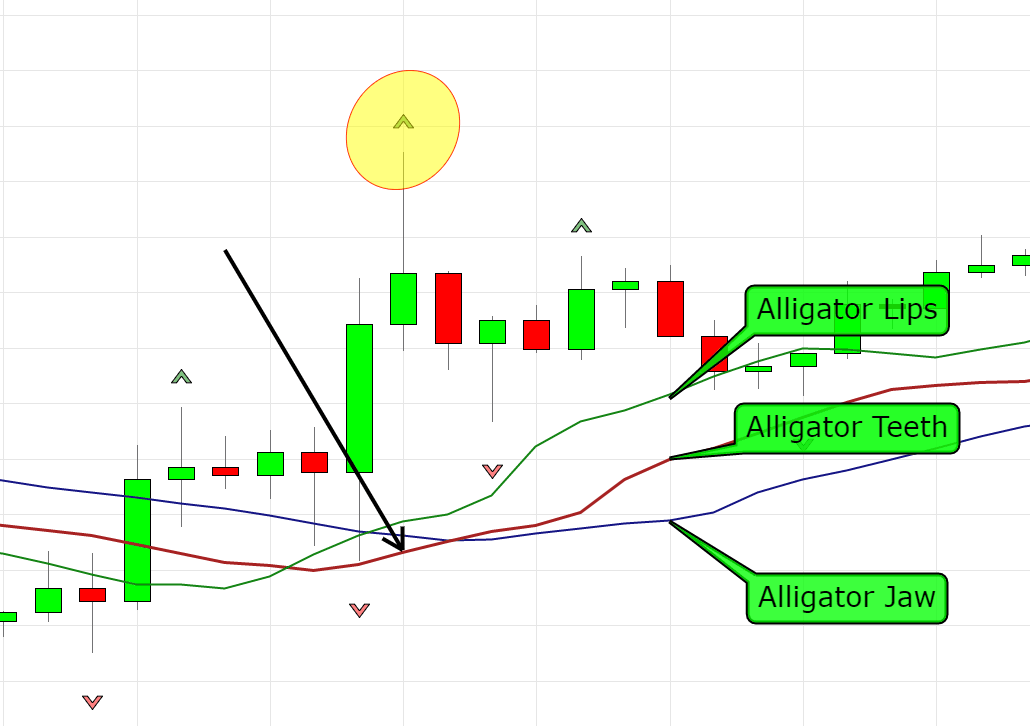

Let’s take a chart example for this fractal blaster trading strategy.

Above is the unique alligator indicator line on the chart. Now we need to know where the fractal lies in the candle for this strategy in relation to this particular indicator.

Below is a fractal we would like to pay special attention to.

I drew a yellow circle on this particular fractal. This fractal appeared over this candle. Above the red line or (crocodile teeth). This is criterion 1 of the Fractal Blaster strategy.

In a BUY trade, the fractal should appear in the candle above the red line (crocodile teeth).

What happens here is that the fractal forms a new peak over the previous fractal, so the candle shows an up fractal.

To move to step 2 (the BUY trade), the fractal must rise up and appear above the crocodile teeth.

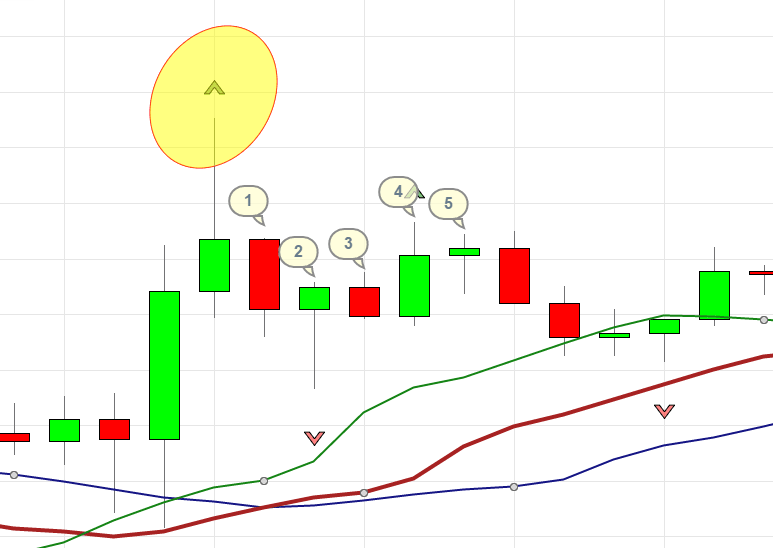

Step: The price action must be above the crocodile teeth of consecutive candles for at least 5 seconds (buy trade)

This is where all the magic happens.

Often when a fractal appears as above, price action is still “flat”. This means there have been no real breakouts in the recent period. You can also trade with the Breakout Triangle Strategy.

The reason this strategy needs to wait for at least 5 consecutive candles is because there is a retracement forming now, or a reversal is forming, or price action is strengthening in a market that is still flat. That doesn’t sound pleasant if you’re looking to see a big uptrend on the charts.

As you can see, the price action has remained quiet and has not significantly moved up or down these 5 candles. That is a must see when trading this strategy.

Before we dive into this strategy in more detail, here’s how to “reset” the strategy and invalidate future trade BUY entries.

- Reset when: A sell fractal appears below the crocodile tooth line before opening a position. Likewise :

As you can see, if this happened in the buy trade example, we would have told ourselves that this buy trade was invalid and we should look elsewhere. The reason is that this could trigger a long-term bearish trend.

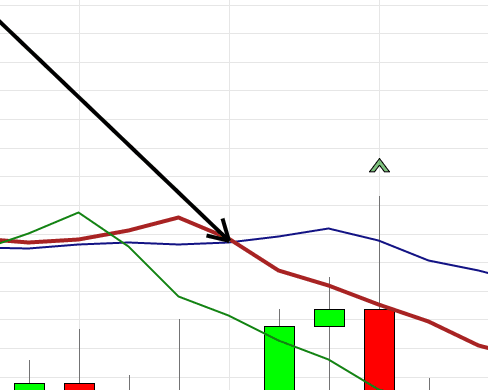

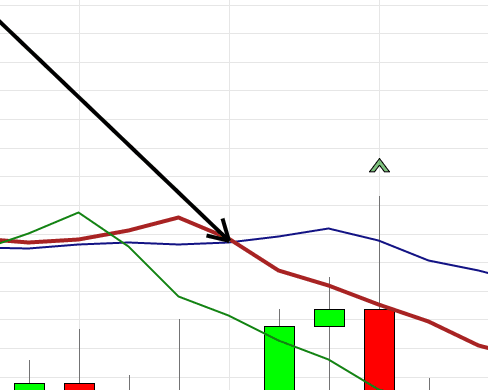

As you can see, if this happened in the buy trade example, we would have told ourselves that this buy trade was invalid and we should look elsewhere. The reason is that this could trigger a long-term bearish trend. - Reset when: One of the two lines of the alligator indicator crossed after the fractal candle identified in step 1. like this

:

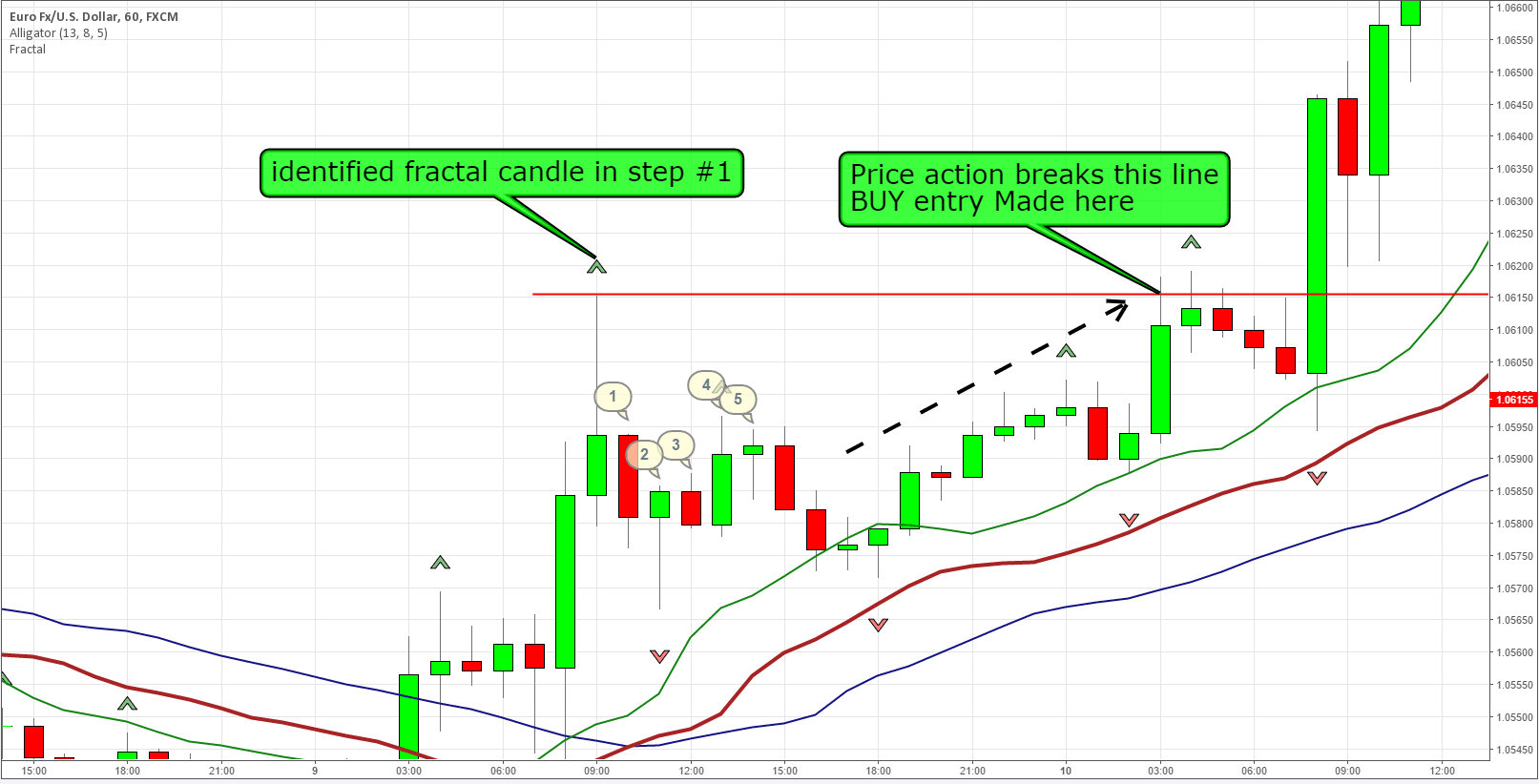

- Step: Price action should break above the fractal candle distinguished in Step 1.

After verifying that the dog’s consecutive candles do not jump sharply to the downside and stay between the fractal candle and the crocodile’s teeth, give the command to enter.

You can also make an entry this way or place a market order if you are sitting in front of a chart. Either way is fine because the same criteria are required.

Here’s what it looks like.

As you can see, I marked where the original fractal was found. What happened after that was that there were more than 5 candles that did not drift into the crocodile’s teeth, the crocodile line did not cross, and price action finally broke through the fractal candle to enter the trade.

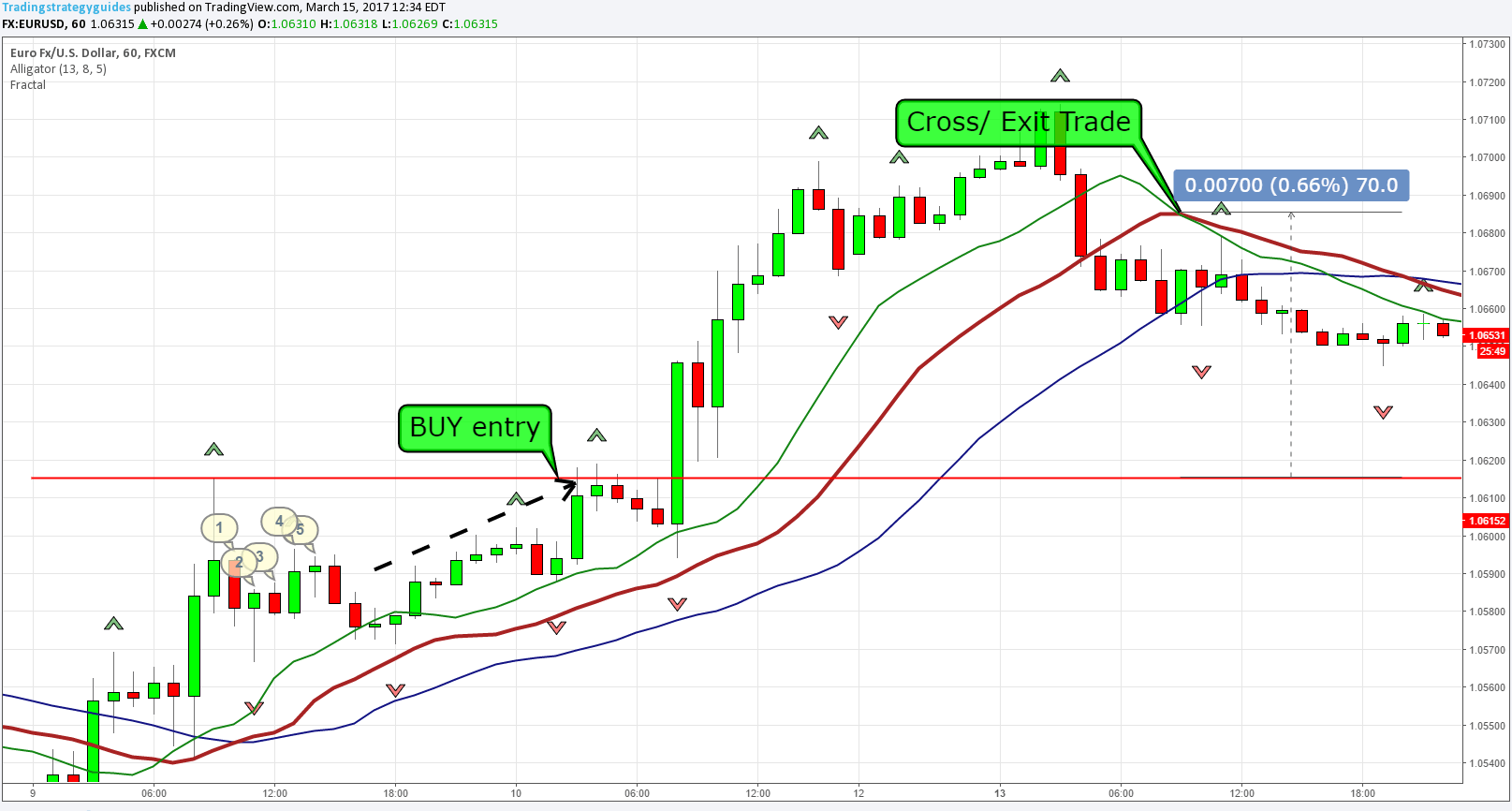

Take a Profit Target/Loss Loss.

Variations on this strategy are possible as far as take profits and stop losses are concerned.

Exit the trade when both alligator lines cross each other.

This probably means that the alligators will go back to sleep and price action will go the other way or consolidate.

This trade would have landed a 70 pip winner.

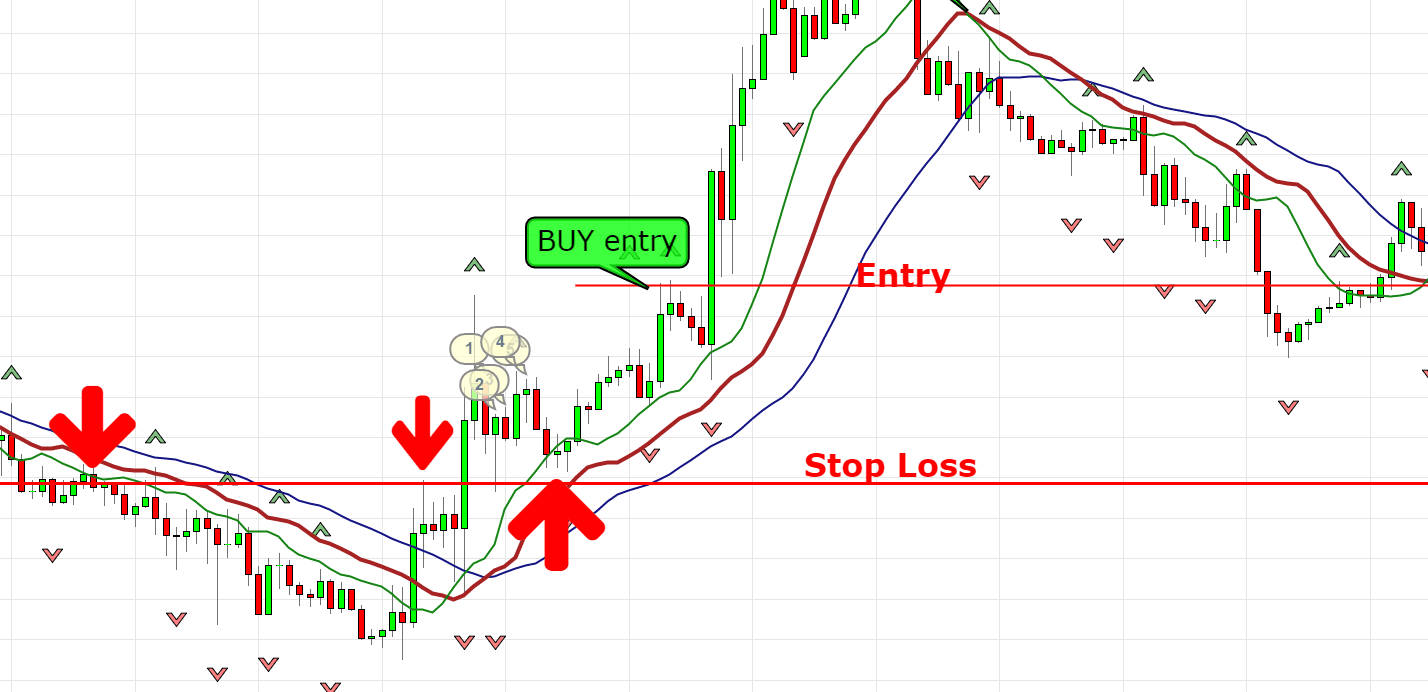

Place your stop loss below the previous support/resistance area. Check out another article here that talks about this important area.

This will give you the best chance of saving the trade if price action will turn you on and turn it into a bearish trend. You can “pop out” of this area and retrace in a bullish direction.

The above is the BUY entry criteria. Selling is the same as the opposite rule.

The steps of a fractal trading strategy are:

Trade level sale:

Applying both Fractals and Bill Williams Alligator Indicators to Tier 1 Chart

Step 2 downfragments should appear below alligator teeth and the price action should remain below alligator teeth for at least 5 seconds in a row.

Phase 3 price action must break below the fractal candle distinguished in phase 1.

Step 4 Close the trade when the two alligator lines cross each other.

Many argue that all indicators are “laging” and rarely show profitable entries. Fractal trading strategies use a combination of price action analysis that complements these great indicators. If you are one of the skeptics, try this strategy and let us know your results. We love hearing from you!

P.S. If you are not a believer in indicator-based strategies, check out our Price Action Pin Bar Strategy.